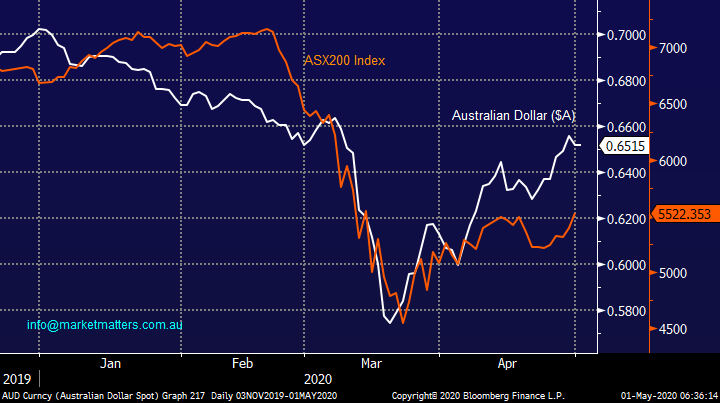

How to position ourselves for the next phase of economic stimulus (LLC, DOW, MND, CWY, BIN)

Happy Friday and the 1st of May to all of our subscribers, if the infamous “May” is half as good as April we will all be happy, amazingly following the horror of March last month was the best month in over 30-years. Unfortunately putting the euphoria around last month into perspective the local bourse has only recovered 40% of its panic coronavirus losses, a disappointing effort compared to the US S&P500 which has retraced well over 60% of its comparative decline – unfortunately we lack the influential FANG stocks.

Yesterday’s +2.4% surge was broad-based with over 80% of the ASX200 closing up on the day which was led by 17 stocks surging by over 10% in another clear “risk on” day. On the sector level we again saw strong outperformance by the Energy names whereas defences names like ASX Ltd (ASX), a2 Milk (A2M), ResMed (RMD), Fisher & Paykel (FPH), CSL Ltd (CSL), Woolworths (WOW) plus the Gold Sector all closed down as investors continued to move up the risk curve.

Currently it feels like fund managers are taking some profits from their top performers as they look for more “kick” from their investments but markets are evolving so fast at present that before we know it will be worth reversing back into the markets quality names, especially when fresh monies are deployed into risk assets.

The below table which we showed yesterday illustrates perfectly the appetite for risk in April as investors piled into the IT / Energy names while deserting or ignoring Consumer Staples and Healthcare stocks.

Source: Bloomberg

On Thursday the market has continued to ignore theoretically negative news with 3 more capital raisings led by Newcrest (NCM) for $1bn and a very average result by ANZ Bank (ANZ) not denting investors’ appetite for stocks, I must admit at current levels I’m becoming a little nervous by some of the rhetoric I’m reading / hearing but until we actually see buyers take a backward step the trend is your friend and for now it’s clearly up.

Considering we believe that cyclicals are set to outperform growth for the remainder of 2020 we will be watching carefully the potential to go long the ASX against the S&P for our Global Macro ETF Portfolio but the timing still feels a touch early.

MM remains bullish equities medium-term and hence we are in net “buy mode”.

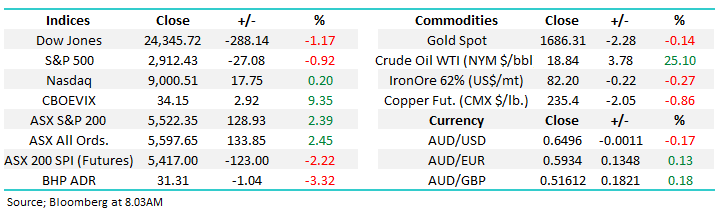

ASX200 Index Chart

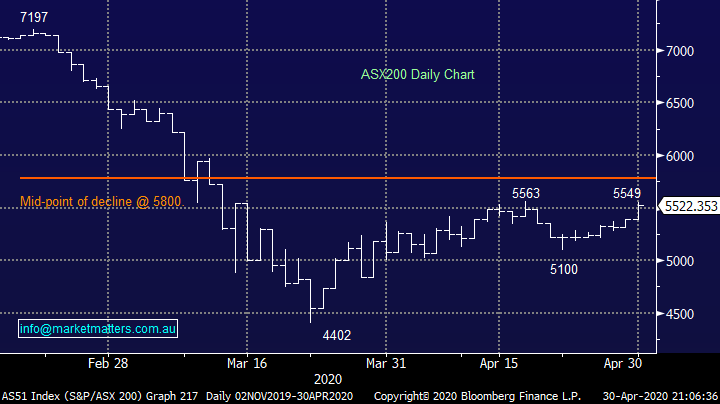

The post GFC relative performance saw the Healthcare Sector boom while the Energy Stocks sunk into the abyss, even over the last year Energy is down 35% while Healthcare has rallied 37%. The point I’m making here is if we are correct and the likes of Woodside (WPL) and Santos (STO) are finally going to reward their loyal shareholders the elastic band is so stretched that the degree of catch up might surprise many. Most in the market remain bearish energy obviously sighting weak demand, which is true, but also the impact of negligible storage capacity for Crude Oil. If demand remains weak, and storage capacity fills up, that would likely be the catalyst for a sharp cut to production, which is bullish for price.

ASX200 Healthcare & Energy Sectors Chart

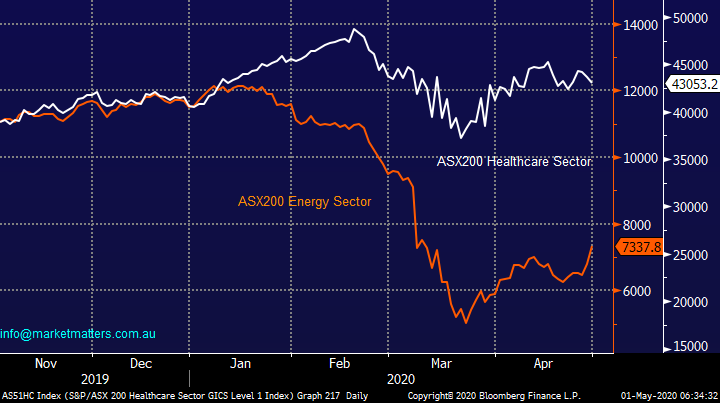

All good things come to an end, especially with financial markets and that may now be the case with the $A acting as a leading indicator for local stocks. Overnight the $A and ASX200 SPI Futures both declined fairly aggressively, where was our heads up!

Medium-term MM remains bullish both equities and the $A.

Australian Dollar ($A) & ASX200 Chart

Overnight US stocks gave back some of their recent gains but they still recorded the best month since 1987. We are now in May where nervous investors often need no excuse to start selling stocks, March could easily pop back into investors’ minds. It’s certainly easy to imagine short-term players who bought well taking some profits after the markets sharp +34% rally – we remain keen buyers into weakness but at this stage our ideal buy area is ~5% lower.

On a bright note Microsoft (MSFT US) which we own in our International Portfolio rallied 1% after beating even pre-coronavirus expectations when it reported, the company topping $10bn in earnings with growth in the cloud business leading the way.

MM is bullish US stocks medium-term.

US S&P500 Index Chart

How to be positioned for the next phase of economic stimulus.

Traditionally there are 2 forms of economic stimulus with both appearing to be currently required at extreme levels to avoid COVID-19 crippling the global economy for the foreseeable future. The main glimmer of hope is things weren’t too bad before the pandemic spread from China:

1 Monetary Stimulus: Cutting interest rates, quantitative easing and other ways of stimulating the economy through increasing the amount of available money / credit, this is instigated by central banks.

2 Fiscal Stimulus: This is usually delivered in the form of increased government activity / spending and / or tax cuts in an attempt to spur growth while increasing public debt in the process i.e. the government borrows & spends money.

At this stage we feel that central banks have shot most of their bullets and it’s up to governments to take up the reins although Scott Morrison & Co have hardly been slack through the coronavirus pandemic – we already have the huge Jobkeeper payments due to hit companies accounts for the first time next week. However with interest rates close to zero and the Australian 10-year bond yield sub 1% the greatest economic impact is likely to come from fiscal action – who would have ever comprehended back in the decadent 80’s that the cost of money for 10-years could tumble to 0.89%. My father in law often tells the story of borrowing $1m at 17% to start a business with no initial revenue. He did it, and it worked out, but a massive call, nonetheless.

The Federal and State governments have been extremely proactive to try and stop the Australian economy from falling off a cliff but unfortunately lots of people and businesses are still doing it extremely tough - small businesses often at the centre of the pain. I’ve come to the office this morning, first time in a few weeks and the city remains a ghost town. The guys / girls in the coffee shop downstairs are clearly doing it very tough – the economy needs to re-open.

We’re getting closer to this point and as we go back to work as a nation this is arguably the optimum time to give the economy a huge shot in the arm through the likes of infrastructure spending i.e. Fiscal Stimulus.

Australian 10-year bond yields Chart

In the last 48-hours we’ve seen infrastructure heavyweight Lend lease (LLC) raise capital and talk intensify around tax cuts to lift us out of the current economic downturn, these events triggered my thought that today would be an ideal time to follow up on our recent Building Report with a look at stocks that could benefit from a significant ramp up in infrastructure spending. I expect traditional red tape to be cut big time in the months ahead with the likes of the rail line to Badgerys Creek and an extension to the Pacific Highway to be fast tracked.

Today I have looked at 5 prominent stocks in the Australian market that are theoretically positioned nicely for such an aggressive pick up in infrastructure spending, after all these are cyclical businesses.

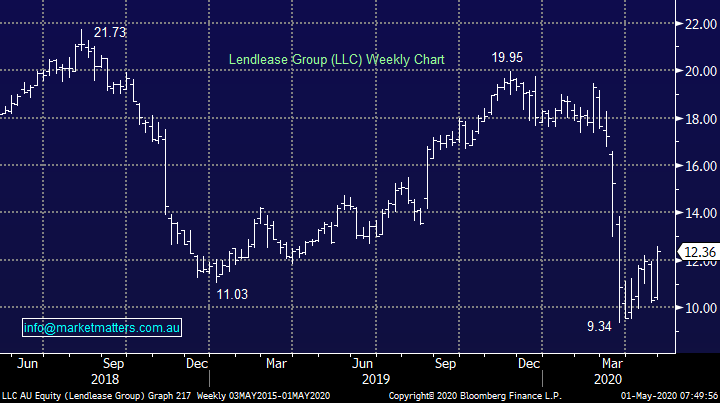

1 Lend Lease (LLC) $12.36

LLC successfully raised capital this week only a few weeks after delivering a solid half year report in late February, with its bolstered war chest we believe LLC is excellently positioned to benefit from a major pick up in infrastructure spending.

MM likes LLC at current levels.

Lend Lease (LLC) Chart

2 Downer EDI (DOW) $4.17

Engineering and infrastructure business DOW looks similarly positioned to LLC although importantly to us the company was not performing strongly as LLC before COVID-19.

MM is neutral to bullish DOW.

Downer EDI (DOW) Chart

3 Monadelphous Group (MND) $11.30

MND provides engineering and construction services primarily to then resources and petrochemical industries, not traditional areas to benefit from government spending but the stock looks good, like LLC the company was delivering before the pandemic – we are bullish targeting $13 or 15% upside.

MM is bullish MND.

Monadelphous Group (MND) Chart

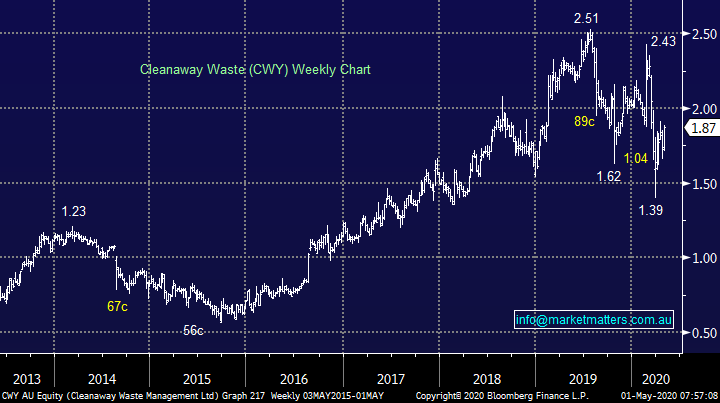

4 Cleanaway Waste (CWY) $1.87

CWY is a stock we have monitored carefully due to our holding in Bingo (BIN), if we weren’t already long BIN we’d be stalking this one very closely.

MM remains bullish CWY.

Cleanaway Waste (CWY) Chart

5 Bingo Industries (BIN) $2.35

MM is long BIN and although the stocks well down from its highs, like most of the ASX we remain bullish, if our holding was smaller, we would be considering averaging. The company rallied ~9% yesterday after gaining approval to modify their Eastern Creek landfill facility to increase its capacity by more than 40% and extend the hours it can operate. This is a smart move from BIN and an example of how they can optimise their current facilities.

MM is bullish BIN.

Bingo Industries (BIN) Chart

Conclusion:

MM likes Australian stocks exposed to the likely large uptick in infrastructure spending with our order of preference LLC, BIN, MND, CWY and DOW.

Overnight Market Matters Wrap

- The US equity markets ended its last day of April on a weaker note, stemmed by weak economic data and mixed earnings reports, leading investors to take risk off the table.

- Unemployment in the US hit the 30 million mark, while consumer spending declined by 7.5%.

- BHP is expected to underperform the broader market after ending its US session off over an equivalent of 3% from Australia's previous close.

- The June SPI Futures is indicating the ASX 200 to start the month of May 80 points lower, towards the 5445 level this morning

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.