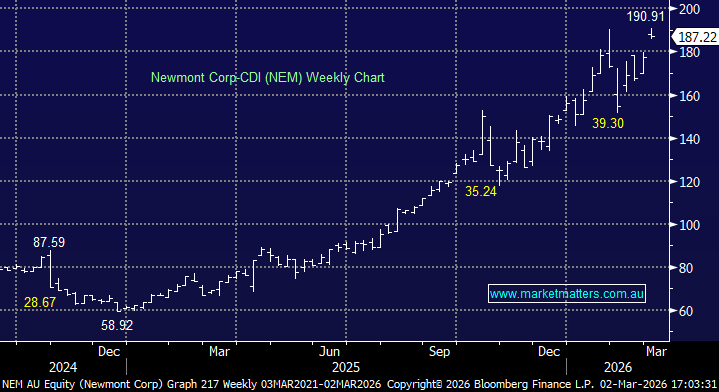

How to play the Telcos from here (TLS, TPM, VOC)

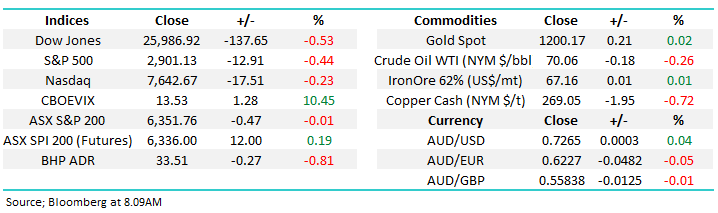

The ASX200 struggled all day after a solid opening and finally closed marginally in the red after making fresh decade highs early in the morning. The banks gave back some of Wednesdays gains while the telco sector surged another +10.5% during the day to make it a stunning +39.4% advance over the last month – arguably the best illustration to remain open-minded provided by the market in 2018.

Interestingly following hard on the heels of yesterday morning’s report when we covered property, banks and retailers, Australia’s Building Approval data was announced for July in the morning and it came in at -5.2% month on month compared to the estimated -2%, as you know we believe things will get worse before they get better.

· We are neutral the ASX200 while the index holds above 6240 but we remain in “sell mode” albeit in a patient manner.

Overseas markets were overall negative with the US indices closing down -0.44% and Europe -0.7%, but the SPI futures are indicating the ASX200 will actually open mildly positive, a good result with BHP down -0.8% in the US.

Donald Trump is again banging hard on the “trade” drum threatening to pull out of the World Trade Organisation (WTO) and to slap another $200bn of tariffs on China next week – the extremely muted reaction by US stocks illustrates how optimistic things have become as markets “price in” the US President ultimately getting his way at every twist in the road. We question whether China will roll over like Mexico.

Today’s report will focus on the suddenly in vogue telco sector.

ASX200 Chart

A few subscribers have wondered why we didn’t “pull the trigger” on our buy emerging markets ETF (IEM) against short US indices ETF (BBUS) view especially as we are already long the BBUS I.e. short the S&P500.

The answer is we think following the sharp 6% rally by the IEM over the last 2 weeks a better entry point is likely to present itself.

· MM remains keen on the IEM with an ideal entry ~59.

iShares Emerging Markets (IEM) Index Chart

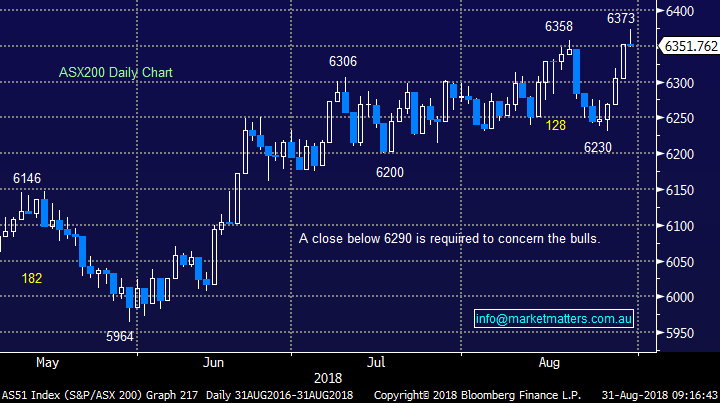

The Australian Telco Sector

The Australian telco sector has surged since David Teoh again showcased his talents by orchestrating the merger of Vodafone and TPG Telecom (TPM) to create a $15bn giant – Telstra’s current market cap is $38.4bn. The market has liked the synergy for TPM and especially the perceived end to a potential mobile phone pricing war which was likely if TPM went it alone i.e. good news for Telstra.

1 Telstra (TLS) $3.23

Yesterday TLS rallied another +3% to sit 24% above its June $2.60 low plus its paid an 11c fully franked dividend.

Following the strong run up in the share price TLS is trading on a Est. P/E of 15.4x for 2019 while yielding 6.81% fully franked.

We like the new direction for TLS under CEO Any Penn but while we felt the stock was extremely cheap under $2.70 its closer to fair value at today’s levels and we will potentially trim our large position, if the opportunity presents itself, closer to the $3.50 area.

There remains a lot of twists and turns ahead for this sector.

· MM is still positive TLS but we consider trimming our position ~$3.50.

Telstra (TLS) Chart

2 TPG Telecom (TPM) $9.31

TPM surged another +18.2% yesterday to see it up an impressive +60% over the last month!

TPM has sprung out of the unloved corner, probably assisted by a ~5% short position who are clearly hurting and probably in many cases covering at painful losses. Potentially optimism for TPM has now gone too far in the positive direction as Telstra and Optus remain solid adversaries.

We feel the value in the TPM-Vodafone merger has been more than built into the recent share price gains.

· MM is now neutral TPM

TPG Telecom (TPM) Chart

3 Vocus Group Ltd (VOC) $2.89

VOC actually fell 2c yesterday and clearly remains the ugly sister within the telco sector, especially over the last 2-weeks.

Over recent months we felt both VOC and TPM looked good value as a trade but VOC has now rallied from sub $2.50 to closer to $3 removing the attractive risk/reward.

VOC is now trading on an Est P/E for 2019 of 16.4x, not particularly cheap.

· MM is neutral VOC.

Vocus Group Ltd (VOC) Chart

Conclusion (s)

We feel the “easy money” from buying the depressed telco sector in mid-2018 is well and truly behind us with our view on the 3 stocks covered today below:

1. Telstra (TLS) – MM is are mildly positive from here but we need to see results from Andy Penn to expect strength above $3.50 and towards the next large psychological hurdle at $4.

2. TPG Telecom (TPM) – MM is now neutral after its impressive rally.

3. Vocus (VOC) – MM is neutral VOC.

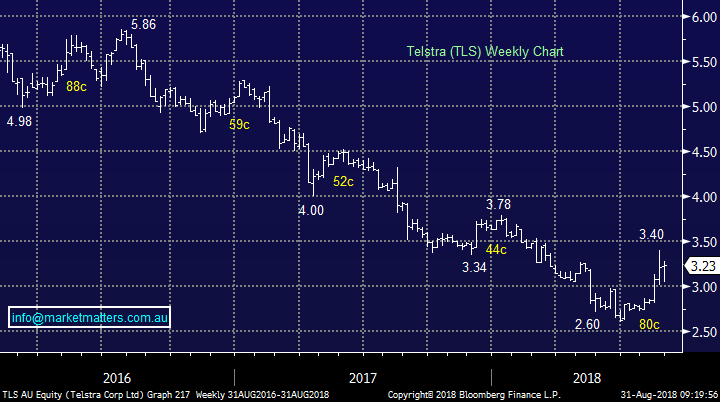

Overseas Indices

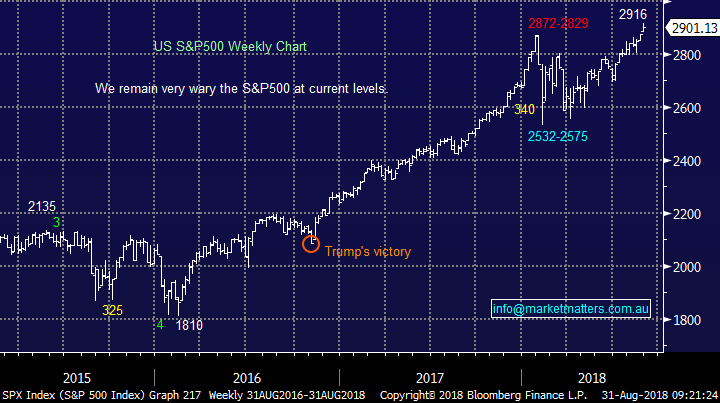

Last nights relatively small decline by US indices can almost be taken positively considering the aggressive rhetoric from President Trump around trade.

· MM needs a weekly close below 2880 to generate warning signs technically.

US S&P500 Chart

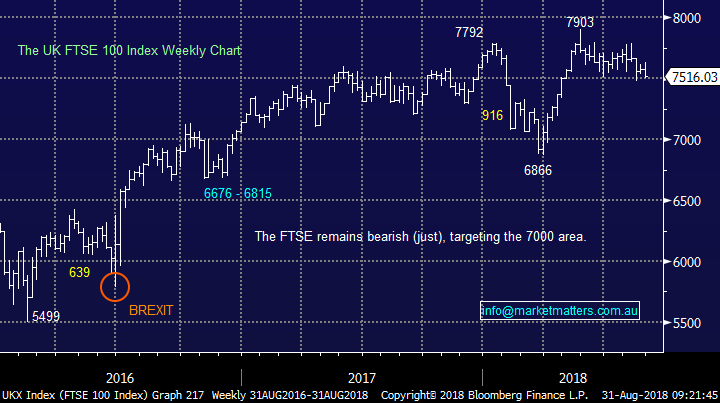

European indices were weaker overnight, a weekly close below 7450 will look very poor for the UK FTSE.

UK FTSE Chart

Overnight Market Matters Wrap

· The US major indices broke its four day winning streak overnight on reports that President Trump supported additional tariffs on US$200bn of Chinese imports and also threatened to withdraw from the World Trade Organisation which he said “doesn’t shape up.”

· Base metals and iron ore prices slumped on the tariff reports leading to both BHP and Rio reversing their recent gains, slumping 2% and 1.5% respectively.

· The A$ also lost further ground, easing back 0.6%, hovering at recent lows of around US72.65c following yesterday’s slump in Aussie building approvals – is this the downturn in the property market?

· BHP is expected to underperform the broader market, after ending its US session down an equivalent of -0.81% to $33.51 from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 9 points higher, doing its best to break its 10-year high!

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here