How MM wants to position portfolios into Christmas & beyond (JHG, CYB, CGC, FMG, ALL, TCL)

The ASX200 threatened to explode towards the psychological 6700 area yesterday morning only for the market to come off the boil throughout the remainder of day finally closing up 35-points, after giving back half of its early gains. Under the hood the Energy and Resource stocks (ex-gold) spearheaded the gains while some major beneficiaries of low bond yields fell i.e. Healthcare, Utilities and Telco’s. As we’ve said previously one day most certainly does not change a multi-year trend but MM continues to believe that stocks that have revelled in plunging bond yields are becoming increasingly vulnerable to an aggressive pullback, hence MM has no exposure to the 3 above mentioned sectors in the MM Growth Portfolio.

A major talking point in today’s financial press remains “is it time to switch from growth to cyclicals?” – at MM were not convinced it’s today or this week, especially as we believe the gold stocks still look ok in Q4, but we do believe the time is definitely nigh. Hence yesterday in our Growth Portfolio we took profit from our Tabcorp (TAH) position and switched to OZ Minerals (OZL)– the plan is to increase our exposure to cyclical stocks if we see another spike lower in that area of the market courtesy of further squabbling between the US & China. At 10pm last night the US S&P500 futures had reversed down 1% after China said it wants more talks before signing Trumps “Phase 1” deal – it still feels there’s more twists in this tale before 2020.

We remain cautious local stocks but no technical sell signals will be generated for MM until the ASX200 closes sub 6600.

Short-term MM remains comfortable adopting a more conservative stance towards equities.

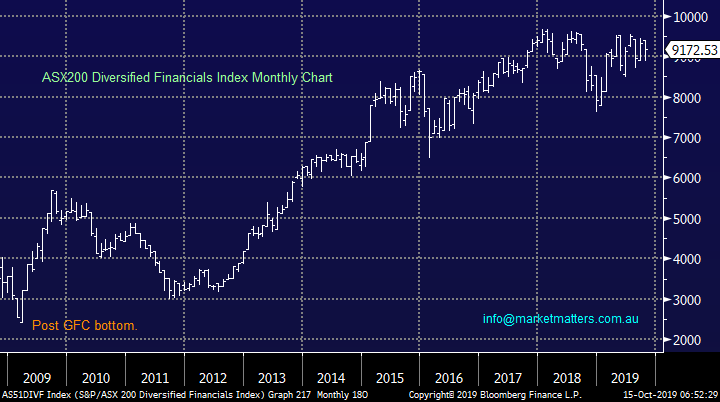

Overnight global stocks churned around finally closing close to unchanged but the ASX200 is set to open down ~0.5% due to weak overnight crude oil and iron ore prices – BHP fell 60c in the US implying an open locally of ~$35.87

This morning MM has looked at an additional 5 sectors within the ASX200 as a follow on from last Fridays sector focussed report: CLICK HERE

Over the last 3 to 4 trading sessions the UK facing stocks have soared as the belief that Boris Johnson can successfully and relatively harmoniously lead Britain out of the EU has gathered momentum. We’ve seen CYBG (CYB) rally +30% and Janus Henderson (JHG) +8.5%, the question I can imagine subscribers are now asking is what now? Firstly we would add that MM believes while a resolution is on the horizon more volatility is likely, if we were active traders we would considering buying dips in such positioned companies.

1 Janus Henderson (JHG) $32.09 – we remain bullish JHG initially targeting $37.

2 CYBG Plc (CYB) $2.41 – we are not a fan of CYB as a business but we cannot deny its short-term momentum and another 40c upside would not surprise, but it’s not for us at this stage.

Janus Henderson (JHG) Chart

CYBG Plc (CYB) Chart

Costa group (CGC) is a decent holding in the MM Growth Portfolio and it enjoyed a corking Monday rallying almost 7% on double its usual daily volume with a block of 1.58m shares changing hands at $3.61 just after the open - it feels like a major buyer is about under $4.

MM remains bullish CGC at current levels initially looking for ~15% further upside – we will only look to reduce size into further strength.

Costa Group (CGC) Chart

Two totally unrelated stocks we watch very closely at MM currently have remarkably similar chart patterns which coincides with a planned sale in the MM Growth Portfolio in the weeks ahead:

1 Fortescue Metals (FMG) $8.95 – we remain bullish FMG targeting a break towards / above the $9.50 area.

MM is looking to take profit on our FMG position into fresh recent highs.

2 Aristocrat Leisure (ALL) $31.68 – we have used ALL as our “Chart of the Week” in the Weekend Report a few times in 2019 with the pattern remaining on course i.e. we expect a break above $32 but then a correction back towards $28 remains our preferred option.

Both these stocks might be telling us something around the underlying ASX200 – a little more continued choppy action higher before a reasonable pullback, this is one of the many reasons MM doesn’t believe today’s market is one where chasing strength makes sense.

Fortescue Metal (FMG) Chart

Aristocrat Leisure (ALL) Chart

Running the ruler over 5 more ASX200 sectors.

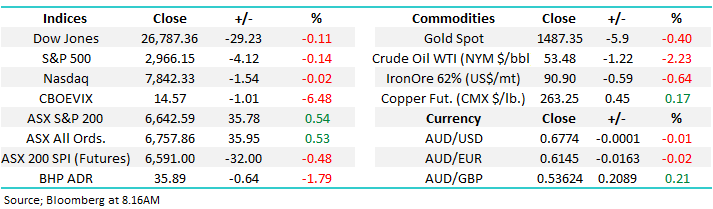

When we look at the relative performance of 2 major indices it doesn’t look too different in 2019 but when we consider the whole post GFC bull market the variance is substantial – the “yield play” Transurban (TCL) has significantly outperformed cyclical BHP Group (BHP). Both last Friday and todays reports are aimed at identifying which sectors we want to own / avoid in 2020 and beyond, as the below chart illustrates it will make an enormous difference to our investors portfolio performance.

To recap last Friday our conclusion was as follows:

1 – The Healthcare Index looks set to make fresh all-time highs implying it’s too early to switch from growth to cyclical value.

2 – The Consumer Discretionary Index is extremely close to generating a major technical sell signal which coincides with simple logic at this point in time.

BHP Group (BHP) v Transurban (TCL) Chart

Today we have looked at 5 different market sectors for signs we should be buying or avoiding stocks under their umbrella moving forward – we again plan to look at another 5 sectors in the week (s) ahead.

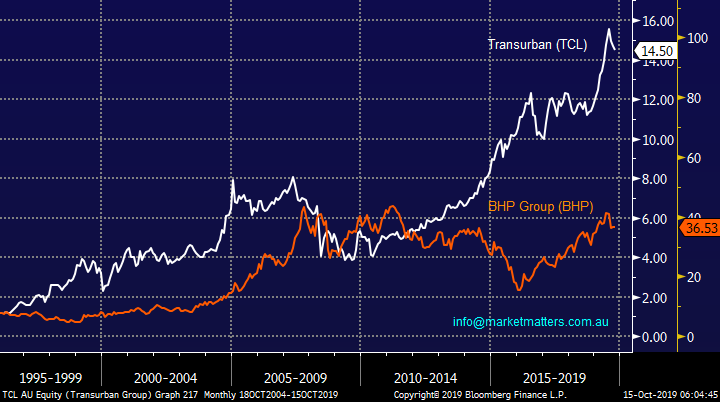

1 ASX200 Transportation Index

The Transportation Index is a “yield play” sector containing the likes of Sydney Airports (SYD) and Transurban (TCL) which not surprisingly has enjoyed a stellar run over recent years as bond yields / interest rates have tumbled globally. In the bigger picture we feel this indices post GFC bull market is very mature but in the short-term fresh 2019 highs still feel likely, entrenched long-term trends usually take longer than many expect to give up the ghost – sounds like the stock market itself, as the indices have climbed a global wall of worry pundits have been picking a top for years!

We hold Transurban (TCL) in the MM Income Portfolio however this is tagged as a shorter term position.

MM can see the Australian Transport Index making fresh highs in 2019.

ASX200 Transportation index Chart

2 ASX200 Banking Index

The heavyweight Australian Banking Index has endured a tough few years being hit with the left-right of falling interest rates, which damage their margins, and a Banking Royal Commission but this phoenix appears to be rising from the ashes and we’re bullish medium term – it helps that not many analysts are excited by their prospects but while CBA is paying an almost 5.5% fully franked yield compared to term deposits around / under 1.5% we like them into any pullback.

We hold the big 4 banks in the MM Growth Portfolio.

MM is bullish the Australian Banking sector.

ASX200 Banking Index Chart

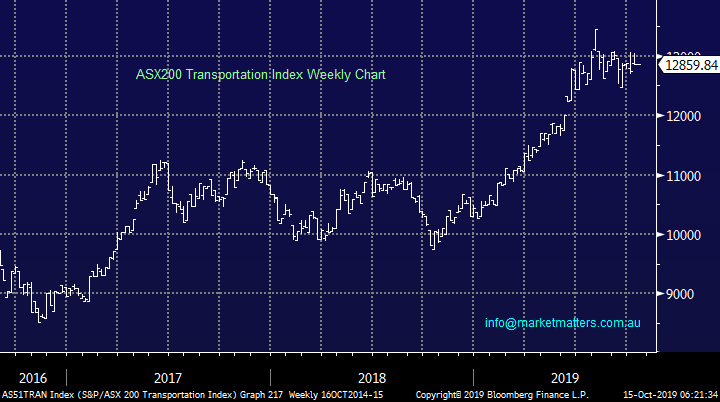

3 ASX200 Diversified Financials Index

The Australian Diversified Financials have experienced a huge variance of performance beneath the hood, just over the last year we’ve seen Magellan (MFG) rally 85% while AMP (AMP) fell 45%. As an index we are neutral however the stocks within the sector present opportunity on an individual basis given the large cross section of exposures and underlying valuations.

Of the 14 stocks in the sector 7 are down by more than 10% and 5 up by the same degree over the last 12-months.

We hold Janus Henderson (JHG) in the MM Growth Portfolio & Genworth (GMA) & Perpetual (PPT) in the MM Income Portfolio

MM feels the Financials are a sell 10% higher and a buy 20% lower but neutral right here at a sector level

ASX200 Diversified Financials Index Chart

4 ASX200 Capital Goods Index

The rarely discussed Capital Goods Index contains the likes of CIMIC Group (CIM), Reliance Worldwide (RWC) and GWA Group (GWA). As we can see for the chart below post the GFC it’s been a chronic underperformer but technically it looks poised for a ~60% rally – perhaps cashed up fund managers are going to start chasing these stocks looking for turnaround potential.

We hold Emeco (EHL) in the MM Growth Portfolio.

MM is bullish the Capital Goods Index.

NB We plan to look at the 8 stocks within the sector closely in a morning report in the next week – this is an interesting part of the market.

ASX200 Capital Goods Index Chart

5 ASX200 Commercial & Professional Services Index

The Australian Commercial & Professional Services Index comprises stocks like Downer EDI (DOW), Seek (SEK), Bingo (BIN) and IPH (IPH) – the 9 stocks in the sector have enjoyed the last year with only BIN currently down and 5 of the members up by well over 10%. This is another group of stocks that look set to make fresh 2019 highs but we would not be chasing strength at these levels as a group, although clearly there is a lot of variance amongst the sector constituents.

We have no current exposure to this group across our portfolios.

MM is cautiously bullish the Commercial & Professional Services sector.

ASX200 Commercial & Professional Services Chart

Conclusion (s)

A few interesting finds this morning which will require follow up over the next 1-2 weeks:

1 – MM is particularly bullish the Capital Goods Index on a risk / reward basis.

2 – MM remains bullish the banks.

3 – The Transport, Commercial & Professional Services Index and Diversified Financial remain net positive but the risk / reward is diminishing fast.

Global Indices

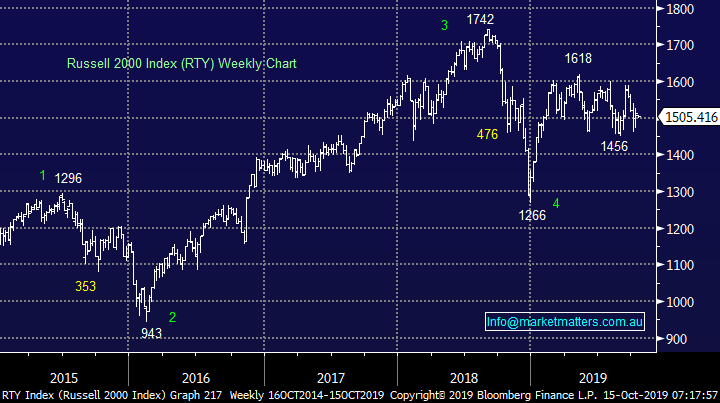

No real change, we are looking for a move to the downside but recent weakness has failed to follow through with any meaningful momentum.

US stocks look vulnerable to the downside but the trend remains sideways.

US Russell 2000 Index Chart

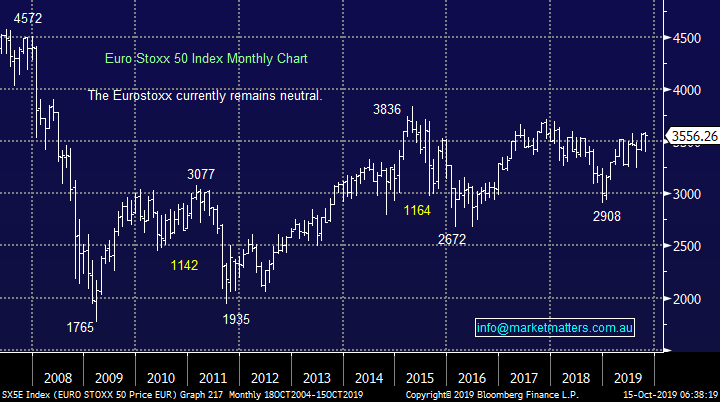

Similar to US indices European indices are mixed technically but with no commitment in either direction at this point in time.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

- The US equity markets closed marginally lower on the back of Chinese rhetoric questioning some of the details behind Trumps claims in phase 1 of the deal.

- Crude oil slid back sub US$53.50/bbl. alongside with iron ore, leading BHP in the US to end an equivalent of -1.79% from Australia’s previous close.

- US 3rd quarter earnings begin tonight, with consensus expectations for a 4.6% drop in earnings compared with the same period last year, starting with key financial stocks including Citigroup, JP Morgan, Goldman Sachs and Wells Fargo.

- The December SPI Futures is indicating the ASX 200 to open 25 points lower, testing the 6620 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.