How do the online classified stocks look as IT booms? (BHP, HVN, SEK, REA, CAR)

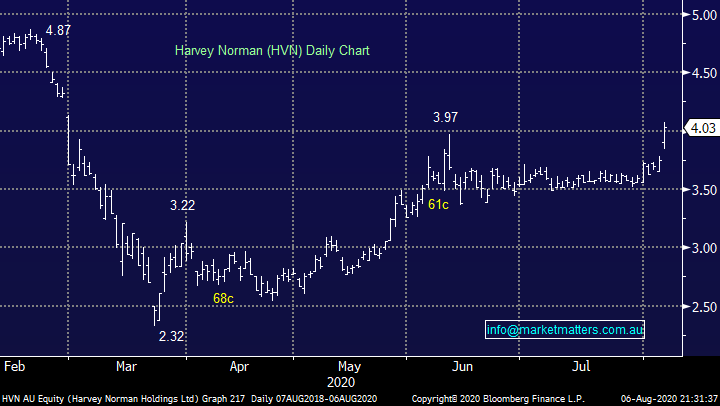

The ASX200 put on a solid performance on the pen-ultimate day of the week and while over 67% of the market closed up it was the major resources that caught my attention with 4 of our significant overweight position all rallying well over 4% i.e. BHP Group (BHP), Western Areas (WSA), RIO Tinto (RIO) and Alumina (AWC). Conversely healthcare stocks remained under pressure following a disappointing result from ResMed (RMD), the sleep disorder stock fell -7.4%. While ventilator sales have been very strong highlighting the benefit of a diversified business, sales here seem to have peaked, while for the company’s core sleep apnoea business to pick back up, they require hospitals to be open and operating “business as usual”.

We remain bullish the “reflation trade” for the next 12-18 months hence we believe the quality resources will be market outperformers plus for good measure they’re paying some healthy dividends in today’s almost zero interest rate environment e.g. BHP is forecast to yield 4% fully franked over the next 12-months, significantly better than a term deposit. With the likes of copper and iron ore continuing to rally despite the weak economic backdrop, I can see why some of the “Bears” sitting on large cash piles appear to have decided to bite the bullet towards the sector. Investors should never underestimate the Chinese government when they make a plan hence while we are very overweight the sector MM is not planning on taking profits yet, our initial target for BHP is over 10-15% higher.

MM remains bullish BHP et al.

BHP Group (BHP) Chart

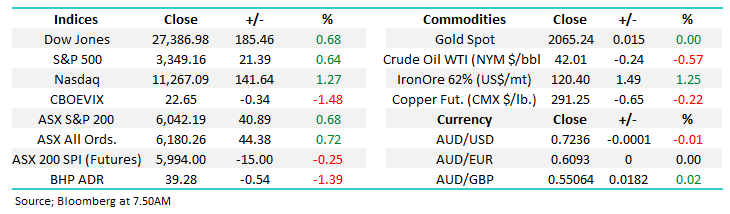

This morning should see the local market open in lacklustre fashion as people start thinking of their coming weekend, unfortunately we’re not set to embrace the positive sentiment on Wall Street early in the session but if some investors are prepared to risk the COVID-19 statistics over the weekend we might be able to add to yesterdays gains. As we’ve outlined previously the ASX is far more correlated to European stocks than the US and they fell overnight as the short-term day to day movements continue to resemble a game of two-up.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

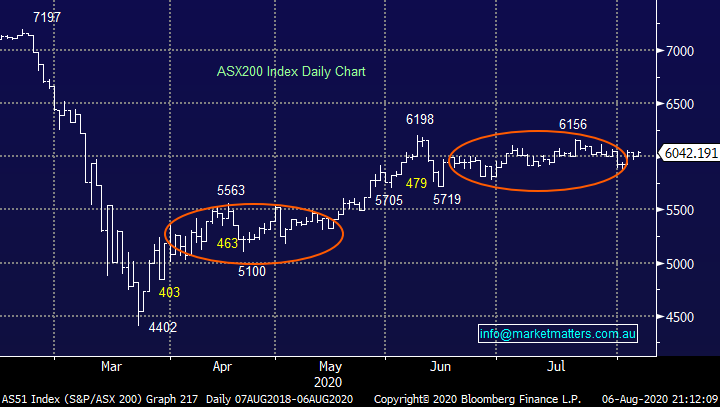

Yesterday Harvey Norman who we covered on Thursday soared +7.5% on the coattails of fellow retailer Nick Scali (NCK) following a positive outlook from the furniture business. In Thursdays reports we said “This discretionary retailer looks on track to break above $4 in the coming months but I’m not convinced it will be a sustainable rally with discretionary spending in question after September plus the company maintains a large footprint outside of electronics.” The later part appears to have been appeased by NCK and with Scott Morrison now set to pay more JobKeeper for longer due to the virus issues in Victoria perhaps HVN can maintain its upwards momentum, we would now advocate stops on longs under $3.90.

MM is now neutral / bullish HVN.

Harvey Norman (HVN) Chart

Overseas Indices & markets

US stocks enjoyed another strong night on Wall Street with the S&P500 now only one decent session away from new all-time highs, when you look at the US markets I cant help but keep thinking “what virus”. The glass remains 100% half-full in America with regard to financial markets – last night’s gains were attributed to optimism towards further stimulus while some news sources cited the good US Jobless Claims offering hope to their battered economy, arguably contradictory statements but when the path of least resistance is up it doesn’t matter, its all just an excuse to keep buying!

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

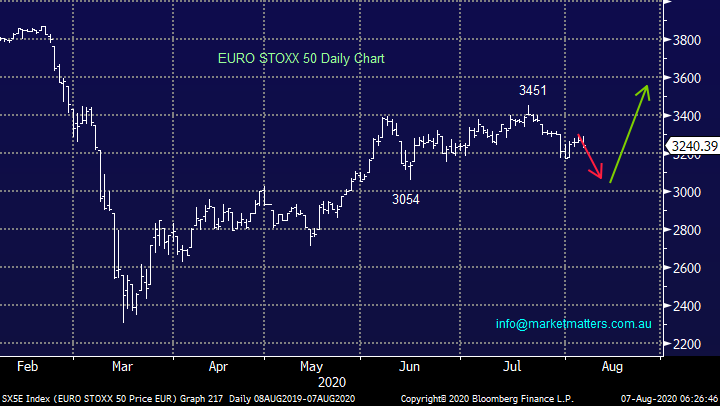

European stocks continue to run their own race which has pretty much followed our roadmap illustrated below, if this proves correct one more look lower should provide the springboard to regain their upside momentum which potentially / hopefully the ASX will follow.

MM is a buyer of Europe ~5% lower.

EUROSTOXX Index Chart

How do the online classified stocks look as IT booms?

Overnight we saw the US tech-based NASDAQ again rally strongly making fresh all-time highs with household names like Apple (AAPL US) and Amazon (AMZN US) continuing their upward surge. Locally we’ve seen some amazing performances from a number of the new kids on the block like Xero (XRO), Appen (APX) and of course the BNPL sector (buy now pay later). However it’s not all been big gains under the hood of the Australian IT sector, over the last 12-months 43% of the sector is actually down, Afterpay (APT) has been the top performer but WiseTech Global (WTC) and Nearmap (NEA) have both fallen by over 20% - stock selection is every bit as important as sector selection.

Hence today we have looked at 3 of the more mature stocks in the Australian IT space, these almost forgotten online classified companies were top performers into ~2018. However they became relatively pedestrian since the quick / sharp correction in Q4 of 2018 which was caused by concerns around increasing bond yields - the NASDAQ has almost doubled since the start of 2019 although to be fair its left almost all stocks in its wake. The question today is are any of the 3 poised for some relative performance catch up or should investors simply move on to pastures new.

MM remains bullish US tech although we do believe the “Value” end of town may shine into Christmas.

US NASDAQ Index Chart

The 3 stocks covered today have no shop front costs operating on-line which theoretically should be excellent to help maintain low costs levels but since the coronavirus arrived Webjet (WEB) has underperformed Flight Centre (FLT) illustrating things aren’t always as obvious as they seem.

1 Seek Ltd (SEK) $21.48.

On-line job seeker platform / business Seek has rallied strongly since the GFC, I’m sure virtually all subscribers have looked at the site in some capacity. Undoubtedly conditions are challenging, and competition is intensifying from the likes of LinkedIn but management is striving to maintain growth through investments in new business / international expansion - the low hanging fruit appear to be gone and growth will undoubtedly become harder. We like SEK and can see fresh all-time highs moving forward but we wouldn’t be married to the stock’s performance medium-term.

MM is bullish SEK short-term looking for ~20% upside.

Seek Ltd (SEK) Chart

2 REA Group (REA) $111.34

The Real Estate goliath continues to perform strongly and today they report full year results which look strong on first glance. I’m pressed for time this morning and will cover in more detail this afternoon however top line revenue came in slightly ahead of expectations while EBITDA is a decent beat coming in at $492.1m v $471.8m expected, although that number is down 4.5% yoy.

In Australia REA continues to dominate an improving Domain (DHG) while it might surprise many to know it also achieved this status in parts of Asia like Malaysia and Hong Kong i.e. a good product sells! From a technical perspective a pop above $120 could be bought with stops under $109, or for those particularly keen on the business the buying could be pre-empted.

MM is bullish REA short-term initially targeting over 10% upside.

REA Group (REA) Chart

3 Carsales.com (CAR) $18.79.

Yet another carbon copy of SEK, these 3 stocks appear to move almost as one illustrating the overlapping nature of the on-line classified market. CAR is actually the cheapest of the 3 from a traditional P/E perspective trading on ~31x, although when you enter this space these metrics should always be anchored to the level of growth being achieved.

While growth is hard to come by in FY20 pretty much across the board, the market is looking forward with one eye on the +20% expected in FY21 which is solid, the majority of the growth coming from its Asian operations which is very encouraging moving forward and makes its PE feel reasonable.

MM is bullish CAR short-term with an initial target ~10% higher.

Carsales.com (CAR) Chart

Conclusion

We like the 3 stock touched on today who benefit from being an online business model, our order of preference is REA, CAR and SEK – at this stage I don’t envisage any transactions in the 3 just yet

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.