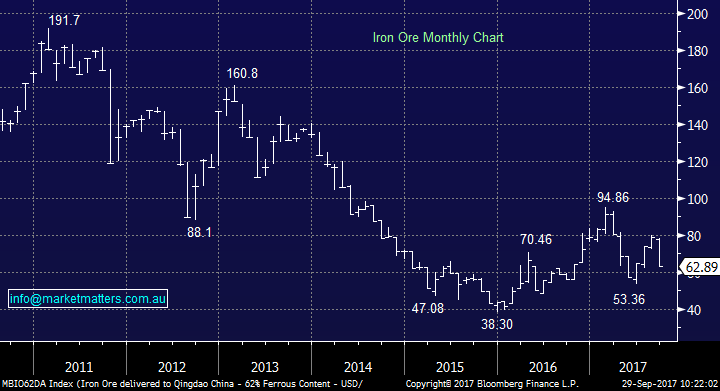

Has the Iron Ore Bear Market just the begun?

Please note there will be no Weekend Report over the coming long weekend, reports will resume as normal on Tuesday the 3rd of October.

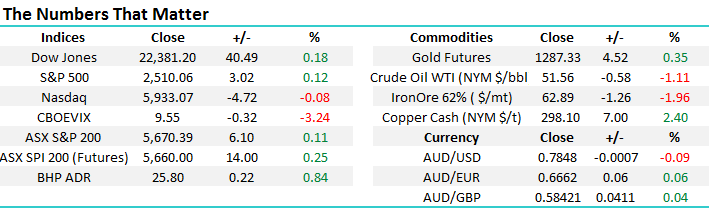

As the Australian market finishes the 3rd quarter of 2017, the lack of index movement continues to amaze us. Assuming we get no strange end of month / quarter shenanigans today as people head off for their long weekend, the ASX200 will have remained range bound between 5629 and 5836 for astonishing 19-weeks.

With the ASX200 unchanged over the last month, September has clearly been about one major theme within the Australian market, sector rotation:

1 Buy banks which have rallied 2.9% led by CYB +11.7% and National Australia Bank (NAB) +4.6%.

2 Sell resources, with large caps Fortescue Metals (FMG) -15.4%, BHP Billiton (BHP) -4.8% and OZ Minerals (OZL) -12% all suffering.

While we’ve stated a few times that MM believes this relative outperformance by the banks has further to unfold today we wanted to focus closely on iron ore which witnessed almost panic selling yesterday on the Chinese Dalian Commodity Exchange where the bulk metal has now tumbled 27% since late August.

Following our switch from Healthscope (HSO) to Aristocrat Leisure (ALL) yesterday, we are sitting on 17.5% cash and are looking to buy stocks into weakness, while there are no signs that opportunities will abound today, you can never say never at the end of a quarter when fund managers often “rejig” their portfolio’s.

ASX200 Weekly Chart

Global Indices

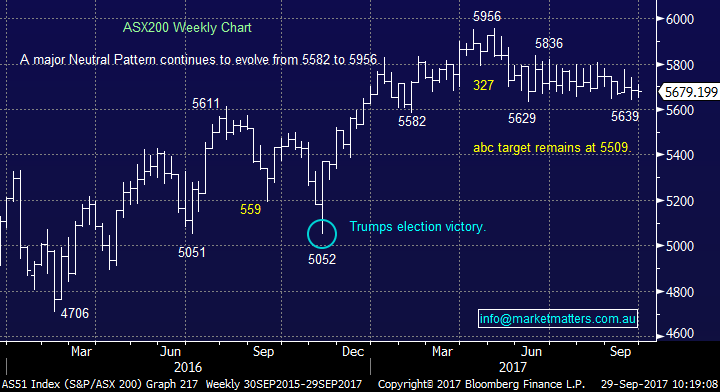

US Stocks

US equities were mixed last night with the broad S&P500 gaining 0.1%, while the tech NASDAQ slipped 0.1%, basically very quiet and boring stuff.

Overall there is no change to our short-term outlook for US stocks where we are still targeting a ~5% correction for the S&P500.

US S&P500 Weekly Chart

Emerging Markets

The Emerging Markets Index has been on a stellar run since 2016, very similar to our highly correlated resources sector. However, an 8-10% correction now feels underway following the 4% fall over the last 2-weeks. The correlation implies our resource stocks have further to fall before optimum buying.

Emerging Markets (EEM) Weekly Chart

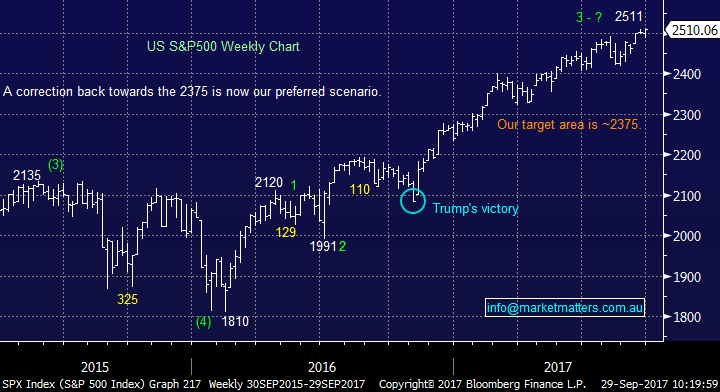

Iron Ore

Iron Ore has now tumbled well over 20% in just a few weeks and when we stand back and look at the bigger picture over the last 6-7 years, further losses would not surprise. Undoubtedly this bulk commodity can be very volatile and MM would be very keen buyers of any weakness back towards the 2016 lows ~$US40/tonne, this potential move should not be ruled out by investors.

Iron Ore in $US Monthly Chart

Compared to the fall in iron ore, RIO has been fairly resilient, falling only 6.5%, following some very well received capital management announcements. We remain keen to buy RIO into weakness with an ideal target back under $60, however that level feels miles away at present and we may use the Emerging Markets Index as a trigger to at least buy a certain % at higher levels.

RIO Tinto (RIO) Weekly Chart

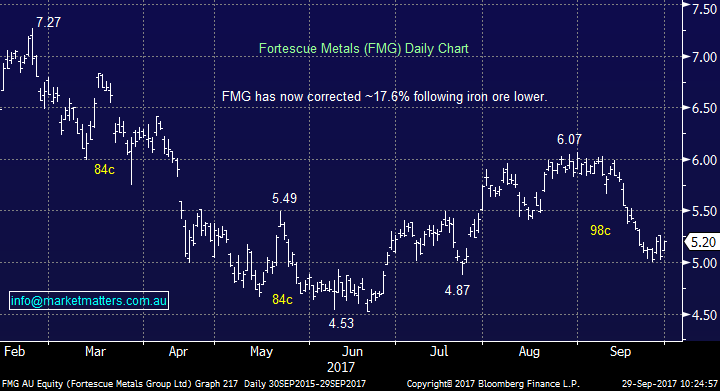

Fortescue Metals (FMG) being the pure iron ore play has, as would be expected, fallen hard on the coat-tails of iron ore i.e. correcting almost 18%, pretty much in-line with the iron ore price. While we could be aggressive / trading buyers under $5, we would only be looking for ~6% bounce hence options may be the best vehicle.

Fortescue Metals (FMG) Daily Chart

So far BHP has slipped over 7% since we took some nice profits a few weeks ago, we are buyers of weakness and similar to RIO may use the emerging markets index as a catalyst to commence buying with our current medium-term optimum entry under $24 still 6% lower.

BHP Billiton (BHP) Weekly Chart

Conclusion (s)

At MM, we are believers in the “reflation trade”, hence are keen to buy the current weakness in our resources stocks. However, on balance we feel the recent correction is probably only 50% complete, hence we will remain patient for now on the investment level monitoring the emerging markets index closely for a trigger to commence buying.

*Watch for alerts.

Overnight Market Matters Wrap

· The US majors ex-Nasdaq closed higher overnight, particularly with in the small cap sector as the market focussed on Trump’s proposed tax cuts and the implications of potential larger deficits.

· Base metals on the LME were mostly better, gold improved while oil and iron ore fell.

· The December SPI Futures is indicating the ASX 200 to open 16 points higher towards the 5675 area this morning. A quiet session however is expected on the last trading day of the month, as Melbourne is on public holidays.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here