Has Stockland (SGP) delivered an important message? (TWE, BAC US, SGP, GMG, BKW, BIN, CSR, BLD)

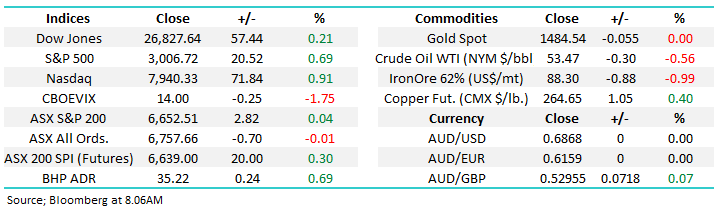

The ASX200 has continued with its last 4-months choppy price action, buyers emerge into any weakness while strength fails to follow through. Yesterday we saw the buying into early weakness taking the index up 40-points (0.6%) from its intra-day low although it felt more like there was an absence of selling as opposed to aggressive buying. The IT sector bore the brunt of the selling which did follow through dropping -2.2%, led by Wisetech (WTC) which plunged another -12.3%, while the Real Estate sector was best on ground rallying strongly with only 1 of the 20 stocks in the group closing in the red – hence today’s report.

Press around the world love to deliver us bad news as we know it “sells newspapers” but when its reversed the headlines are usually in far smaller print. Stocks were smacked back in late 2018 as the yield curve inverted convincing many that a recession was inevitable but since then its quietly un-inverted but of course that’s theoretically good news. This widely watched bond yield differential has embraced improving US – China trade talk progress plus a number of likely interest rate cuts by the US Fed suggesting that a recession in the next few years is now a lot less likely i.e. good news for stocks, this clearly improved backdrop for the market has helped the US S&P500 trade within 0.5% of its all-time high.

Interestingly the $A continues to grind higher largely unannounced and this morning its reached 68.8c, up over 2c in just 3-weeks. As subscribers know we have a bullish contrarian view towards our local currency targeting 70c in the short-term and 80c in 2020/21. We remain very cautious any stocks who are being valued / priced courtesy of strong $US earnings assisted by the previously strong greenback tailwind – its been a wonderful 8-year trend but all good things do come to an end, at least for a while, especially if it’s a “crowded trade / opinion”. For the record we believe its time for the Fed to take the baton from the RBA on rate cuts which should support the $A and probably lead to relative underperformance of the ASX.

Short-term MM remains neutral the ASX200.

Overnight global stocks rallied pretty well with the S&P500 gaining +0.7% helping the SPI futures point to an open up 20-points this morning with BHP rallying ~25c in the US.

This morning MM has looked at the local housing related stocks following Stockland’s strong quarterly trading update, the catalyst for the stocks impressive +6.5% gain and breakout of its recent range.

ASX200 Chart

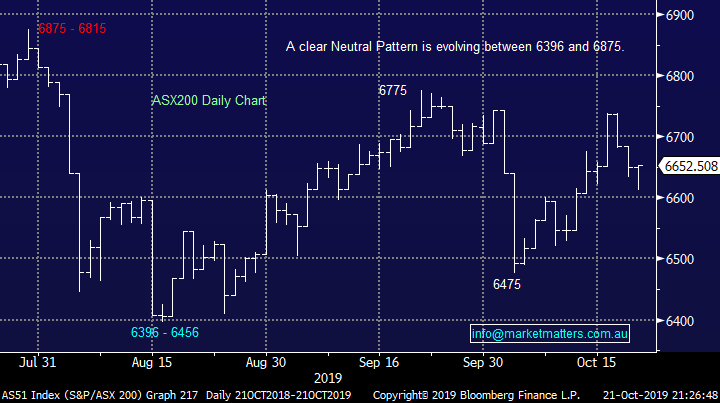

As mentioned earlier we saw Wisetech (WTC) extend its monthly loss yesterday to -27% eclipsing Afterpay (APT) -13.3% in the process. We remain committed to our bearish view towards the Australian high valuation IT stocks, the markets even given 5 of them an acronym – the WAAAX’s (Wisetech (WTC), Altium (ALU), Appen Ltd (APX), Afterpay (APT) and Xero (XRO). This style of euphoria / excitement can often herald a top, or at least a return to realistic valuations. While we like a number of the businesses, headlined by Xero & Appen, there is simply too much hot money in the sector for us to consider these stocks now.

Technically we’re initially targeting a further 10% downside for the sector but we could easily envisage this going much deeper hence MM has no interest in the group although we do expect them to bounce this morning for the traders in our midst.

MM remains bearish the ASX200 IT sector.

ASX200 IT Sector Chart

Treasury Wines (TWE) was the worst performing stock yesterday, after WTC, falling -11.8% after their CEO announced his plans to retire in 2021. Not great news for the stock but a solid looking succession plan plus plenty of notice appears to have been totally overlooked i.e. an overreaction on the day. However the winemaker is still trading on a Est P/E for 2020 of 22.6x which feels about right hence MM currently only has interest in TWE into ongoing weakness around $13.

MM is neutral to slightly negative TWE.

Treasury Wines (TWE) Chart

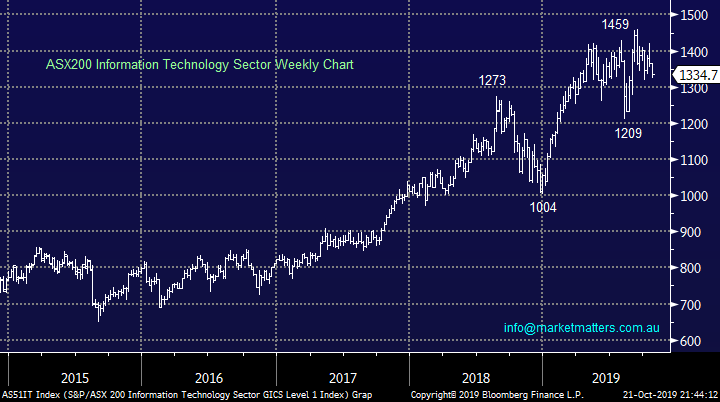

For subscribers who missed the alert in our PM report, overnight MM took on 3 positions for our International Portfolio: Bank of America (BAC US), Janus Henderson (JHG US) and UnitedHealth Group (UNH US) - https://www.marketmatters.com.au/new-international-portfolio/.

Bank of America (BAC) Chart

Stockland’s (SGP) update and its ramifications

Yesterday as we discussed in the PM report diversified property group Stockland (SGP) delivered an optimistic quarterly update propelling the stock up +6.5%. For the quarter to 30th September sales came in above expectations suggesting that the bottom in the property market is behind us. An good day for our MM Income Portfolio which owns SGP but not for the property bears – click here to view the income portfolio.

The stock is conservatively priced trading on a P/E of 14.3x for 2020 while it yields 5.6% unfranked – a nice fit for a yield focused portfolio.

MM is bullish SGP initially looking for another 10% upside.

Today I have looked at 5 other stocks which should be well positioned if we see a steady pick up in the Australian property sector.

Stockland Group (SGP) Chart

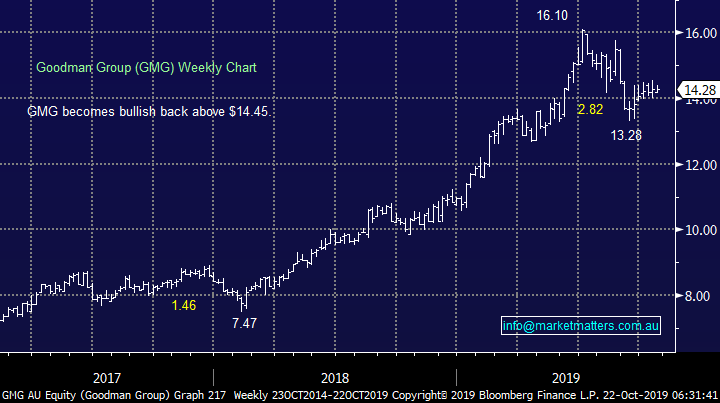

1 Goodman Group (GMG) $14.28

GMG has been a hugely successful property group over the last 2-years and any pick up in the Australian property market is a clear plus for the assets it owns. In August they delivered solid FY19 results showing 38% growth during uncertain times for property – a clear sign of a quality business. However the stocks not particularly cheap as is often the case with a quality business trading on a Est P/E of 25x for 2020, while it only yields 2.1% unfranked.

Technically we need a rally of 1.5% to trigger technical buy signals but our “Gut Feel” is this will unfold shortly.

MM is bullish GMG targeting over 10% upside.

Goodman Group (GMG) Chart

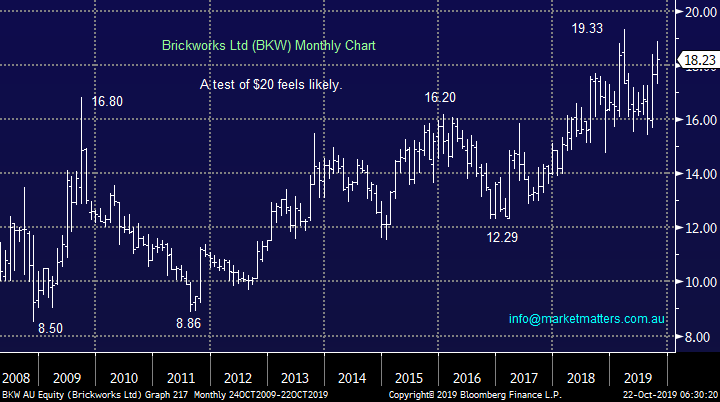

2 Brickworks (BKW) $18.23

Last month BKW delivered a FY 4% increase in net profit to $234m, an excellent result in our opinion during a cyclical building sector downturn for the brick maker / property business. The stock is still conservatively priced trading on an Est P/E for 2020 of 16x while it yields 3.18% fully franked.

The board understandably gave no specific guidance for next year in these uncertain macro-economic times but they do “feel” optimistic moving forward. Technically we can be long with stops below $17.

MM is mildly bullish BKW targeting 8-10% upside.

Brickworks (BKW) Chart

3 Bingo (BIN) $2.33

Waste management business BIN enjoys a strong construction market simply because it produces lots of waste. We’ve been concerned with their margins as they try and push through price rises plus the recent major acquisition, overall we feel it’s prudent to wait for guidance to be delivered at thir November AGM before dipping our toe back into Bingo – a stocks we make 50+% from near the lows. We discussed the stock in a recent MM video around reporting season for those who want to revisit https://www.youtube.com/watch?v=j6YaJJsUEl0&t=121s

BIN is not particularly cheap trading on a P/E for 2020 of 23.8x while yielding 1.6% fully franked but investors feel there’s a degree of stability in waste which makes sense to MM. For the traders, technically BIN looks good with stops below $2.20, a 6% risk.

MM is mildly bullish BIN with stops below $2.20.

Bingo (BIN) Chart

4 CSR Ltd (CSR) $4.21

Building products business CSR has recovered well in 2019 which we’ve enjoyed owning it in our Income Portfolio where its showing us a healthy 22% paper profit – the stock is still trading on a conservative P/E for 2020 of 15x while yielding 6.,2% part franked, a great fit for us. The stocks actually been climbing a wall of worry from an average report in May to a broker downgrade in September but remember stocks that rally on bad news are generally bullish.

We remain bullish CSR initially targeting fresh 2019 highs around 10% higher

MM is bullish CSR.

CSR Ltd (CSR) Chart

5 Boral (BLD) $4.72

Global building business BLD is a stock we’ve been watching carefully over recent weeks looking for an ideal risk / reward opportunity, they are cheap compared to most stocks covered today trading on a P/E for 2020 of 13x while yielding an attractive 5.8%, part franked. The company delivered average earnings for the 2019 FY courtesy of a weak Australian housing market but the business still produced 4% sales growth.

Technically the short-term price action has been average but we do see a rally towards or over $5.50 into Christmas - this feels like an under-owned stock that could rally hard and fast – we like the stock after its halved since early 2018, at least for a short-term pop higher.

MM is bullish BLD into 2020.

Boral (BLD) Chart

Conclusion (s)

We like the cyclical building stocks moving forward and are likely to increase our market exposure in the coming weeks.

*Watch for alerts.

Global Indices

No change, we are now giving the benefit of the doubt to the post GFC bull market with fresh all-time highs ultimately looking likely.

MM is now mildly bullish US stocks.

US S&P500 Index Chart

European indices are mixed technically but with no commitment in either direction at this point in time but we maintain our slight positive bias.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

· The major global equity markets closed in positive territory overnight, ignoring the lingering global growth concerns as US-China trade negotiations were positively parlayed by President Trump, while it was mentioned by a US trade official that planned December tariffs could be delayed or withdrawn if negotiations are going well.

· Across in the Euro region however, Britain’s PM Boris Johnson’s Brexit plan received another setback with Speaker John Bercow rejecting the chance of a vote, saying that the same motion can’t be voted on twice. Johnson will instead seek another extension from the EU.

· The resource sector is expected to outperform the broader market yet again, despite crude oil being weaker due to the global growth concerns. BHP ended its US session up an equivalent of 0.69% higher from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 14 points higher, towards the 6665 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.