Four stocks MM is watching carefully in today’s market (CIM, HSO, NUF, IFL)

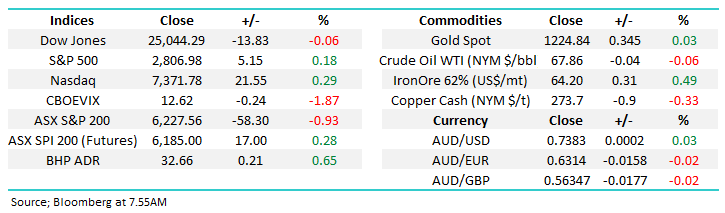

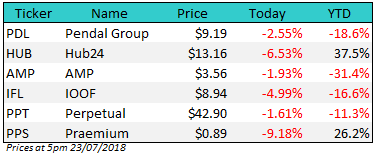

The ASX200 was whacked 0.93% yesterday with weakness basically across the board as an average opening was met with continued selling throughout the day. While none of the sectors managed to close in the black a -2% fall in the diversified financials caught our eye on the downside and we will look at one of the hardest hit in the sector in today’s report.

The markets becoming harder to predict on a day to day basis as unpredictable news flow is on the increase, yesterday it was more Trump inspired trade war concerns and the resurgence of worries around Labor’s proposed changes to franking credits which would significantly reduce the appeal of Australian stocks to local investors, especially on a comparative basis. Perhaps a Labor win will be yet another reason to invest internationally, something MM is currently working on.

- Short-term MM is neutral the ASX200 with a close below 6140 required to switch us to a more bearish stance, however we remain in “sell but patient mode”.

Overnight stocks were pretty quiet with Europe slightly lower while the US etched out small gains, however the main game in town was bond yields which surged higher, the 10-years are now back in striking distance of the psychological 3% mark – the move sent US banks higher while the “yield play” stocks fell. At this stage markets are embracing comments from finance ministers that global growth remains robust while discounting a future damaging US-China trade war – the new “Trump Trade” of fading the bluster because nothing eventuates!

Today’s report is going to focus on 4 stocks that have fallen / drifted onto our radar over recent trading sessions.

ASX200 Chart

The move overnight in bond yields was impulsive but the “yield curve” watchers would have liked seeing the 10-years rallying harder – the differential has now increased to 0.3254%.

US 2 & 10-year bond yields Chart

One for the very active market player / trader - at MM we find the SPI premium / discount is a great indicator of market sentiment and its lost its bullish tone over recent days.

- Recently the September SPI futures have been trading at a 60-point discount to the ASX200 whereas during the strong rallies in June, late July it was around -50-points.

Fund managers often use the SPI futures to reduce / increase their exposure to the Australian market, the discount increasing strongly implies the “professionals” are selling our market, probably as they switch to a perceived cheaper alternatives likes the emerging markets which have been smacked almost 20% in 2018.

ASX200 v September (SPI) Futures Chart

Now moving onto 4 stocks that have caught our eye over recent trading sessions with 3 of them potential buying opportunities as they exhibit attractive risk / reward.

1 CIMIC Group (CIM) $47.56

The global mining services & infrastructure company CIM is enjoying an excellent month following its market update on the 19th when it reported a 12% growth in net profit after tax (NPAT).

The shares are currently trading on 19.2x forward earnings while yielding 2.84% fully franked – it’s a reasonable premium to its global peers however the infrastructure boom in Australia is big. My brother runs a business in this area and we were discussing the numbers / growth in his business last night. The last 12 months have been incredible strong, however it’s a cyclical sector(looking at the companies numbers 3 years ago highlights it), however the next few years should see a strong earnings tailwinds. This is a stocks to buy after the initial heat comes out of its post last week’s profit report spike higher - we’ve already seen it come back 5%.

We have an eventual target of ~$54 but would be concerned if the stock gives back most of last week’s gains and retreats back below $44.50.

- MM likes CIM from a risk / reward basis around $47.

CIMIC Group (CIM) Chart

2 Healthscope (HSO) $2.21

We discussed HSO in our Weekend Report and MM has been considering the stock as a buy below $2.25. As covered in Mondays afternoon report the CEO Gordon Ballantyne joined HSO in May last year, and used the FY17 result to rebase earnings and expectations which saw the stock fall from around $2.20 to ~$1.70.

- Shares did recover most of the losses over the following six months, only to be hurt again at the half year result in February through weakening private hospital earnings. This softness saw corporate activity circle, and a private equity group BGH along with Australian Super launched a bid in April at $2.36/share.

- A few weeks later, Canadian asset manager Brookfield offered $2.50 a share and the bidding war looked on.

- A week later however, Healthscope poured cold water on the proposals deciding not to grant due diligence to either party but launching a review into the company’s hospital portfolio.

- Since the announcement, HSO has fallen to $2.22, over 10% below the higher Brookfield’s bid.

- This is a fascinating corporate play especially as we think the downside is fairly low. MM likes HSO around this $2.20 level.

Healthscope (HSO) Chart

3 Nufarm (NUF) $7.48

Yesterday NUF was walloped well over 10% on an earnings downgrade by the agrochemical company due to the ongoing dry weather both in here and in NZ – this has been one of our local farmers driest periods in a decade.

The company expects these headwinds to continue into the next financial year as crop protection products remain in storage. NUF appears to have entered a downgrade cycle however buying agricultural stocks into weather related issues does traditionally have solid merit. After reassessing we are targeting a further 4-5% downside in the short-term.

In the bigger picture we like NUF’s $500m acquisition of European interests earlier in the year giving the company more of a global footprint to navigate the seasonal cycles that are common / expected within the industry.

- MM likes NUF around $7.15 but would leave some ammunition to average further weakness considering the recent news flow.

Nufarm (NUF) Chart

4 IOOF Ltd (IFL) $8.94

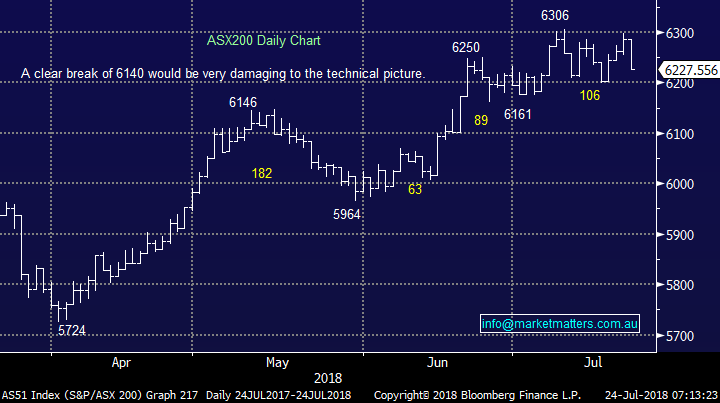

IFL was in the firing line yesterday courtesy of a major strategic change of pricing by BT which led to the platform providers getting sold off hard, some parts of yesterday’s afternoon report:

“This morning BT announced a large reduction in platform pricing to an admin fee of 0.15% and an account fee of $540 p.a. It also announced a new online services hub which provides advisers with governance, advice tools, investment research etc. While the reduction in earnings is not material for Westpac (who own BT) at the moment, the implications for others are from the change - AMP for instance could be very significant for both their platform fees and their distribution. We recently sold our position in IOOF (IFL) for a loss given the challenges facing the advice / platform / planning space.

Looking at the performances today tells the story. The new players have had very strong runs over the past year or so, while the more traditional names have clearly suffered – yet today was across the board, just on different scales. All this ahead of the Royal Commission which focusses on superannuation and is kicking off on Aug 6. It’s a hard sector to be in at the moment! “

- Technically and fundamentally we are bearish IFL targeting well under $8, a concern for the whole group of stocks.

IOOF Ltd (IFL) Chart

Conclusion

We are considering buying CIM and NUF into a little further weakness while HSO looks good around yesterdays close – note these stocks tend “do their own thing” as opposed to following the ASX200 index closely.

We are bearish IFL which fell 5% yesterday but our target is now over 10% lower.

Overseas Indices

The tech-based NASDAQ continues to trade around its all-time high while the UK FTSE is threatening to fail after achieving its same milestone in May.

No change, we remain on alert for a decent market correction and are still looking to increase our cash position moving forward.

US NASDAQ Chart

UK FTSE Chart

Market Matters Overnight Wrap

· The SPI is up 17 points as the DJIA closed down 0.1%. The S&P 500 and NASDAQ closed up 0.2% and 0.3% respectively.

· US bonds fell amid concerns that international demand for US debt could fall. Bond yields rose as did the prices of financial stocks. US Treasury Secretary Mnuchin said he wouldn’t downplay the possibility that President Trump will follow through on threats to impose tariffs on US$500B of Chinese goods.

· Alphabet shares are trading higher in after hours trading on the back of a strong result. Metals on the LME were lower, iron ore rose ~1%, while oil and gold fell.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here