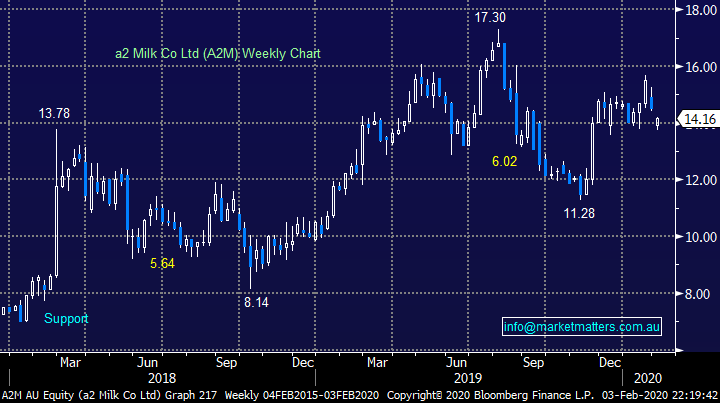

Fiscal stimulus & its implications (A2M, BKW, FMG, BGA)

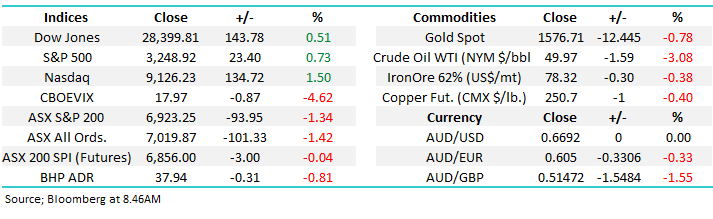

The ASX200 was hit hard yesterday as the flight away from anything China or growth facing became a stampede e.g. OZ Minerals (OZL), Sims Metal (SGM), South 32 (S32), Treasury Wines (TWE) and Beach Petroleum (BPT) fell by over -4% however there were no major surprises with the SPI futures closing well above where they finished on Saturday morning. On the global stage some of the pockets of distinct weakness paint an even clearer picture of the main areas of concern, at 10pm last night when I was reviewing this since the coronavirus outbreak we’ve seen Brent Crude -13.5%, Copper -9.6% and the BBG World Airlines index -8.5%, while US 10 year bond yields have declined by 20%, showing the markets very concerned that as China grinds to a halt so will the global economy.

Hence another day and unfortunately the story remains all about the virus epidemic potentially becoming pandemic (a worldwide issue) with global markets focusing on the potential ramifications of international growth, last night the death toll had reached 362 with almost 17,500 reported cases while arguably the most concerning statistic being only 489 people have recovered to-date. The story remains the same, things will get worse before they improve but let’s put things into perspective:

1 – This flu season in the US saw 19 million Americans catch the flu as we know it with around 10,000 related deaths – currently its fear of the unknown that’s getting the press not the actual number of human causalities.

2 – Once a vaccine is discovered assuming we see production and release with similar vigour to the current containment efforts we should see this concern to mankind rapidly move to the rear-view mirror.

Hopefully bravely and not foolhardily MM we stood up yesterday and started buying into the panic selling, we simply followed our plan laid out over the last 7-10 days. Specifically MM increased our Growth Portfolio’s market exposure by adding to our holdings in BHP Group (BHP), OZ Minerals (OZL) and Boral (BLD), we are “backing” china to get out the bazooka to reignite growth through both monetary and fiscal stimulus whereas we believe the rest of the world will lean more towards the fiscal side of the equation as they’ve largely run out of ammunition with regards to interest rates.

MM remains bullish equities into the current correction.

Overnight US stocks regained about 25% of Fridays losses and the SPI futures are pointing to an unchanged open locally, only oil maintained its downward spiral falling over 3% due to ongoing concerns around Chinese consumption – not ideal for our purchase of BHP yesterday.

Today MM has endeavoured to explain fiscal stimulus and more importantly how we feel investors should be positioned if MM’s correct and its looming in a major way into 2020 / 2021.

ASX200 Chart

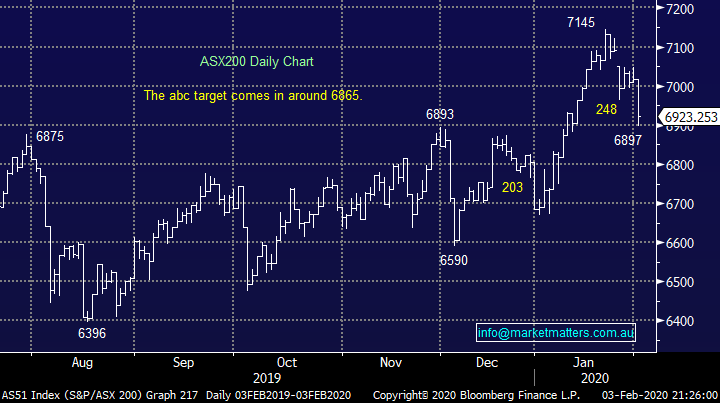

US stocks are now within striking distance of MM’s downside objective although if we were being pedantic, we would say one more attempt to search a low before it found.

Ideally MM is still looking for marginally lower levels in the US, but the risk / reward is improving rapidly after the markets almost 4% correction.

US S&P500 Index Chart

Yesterday we saw Chinas equity markets reopen under the anticipated selling pressure but ultimately the index fell less than 8%, not bad considering the risks that many believe the coronavirus may pose. Again putting things into perspective the market remains up ~25% over the last year, a very healthy return in today’s ultra-low interest rate environment.

MM still likes Asian stocks into current weakness.

China’s Shenzhen CSI 300 Index Chart

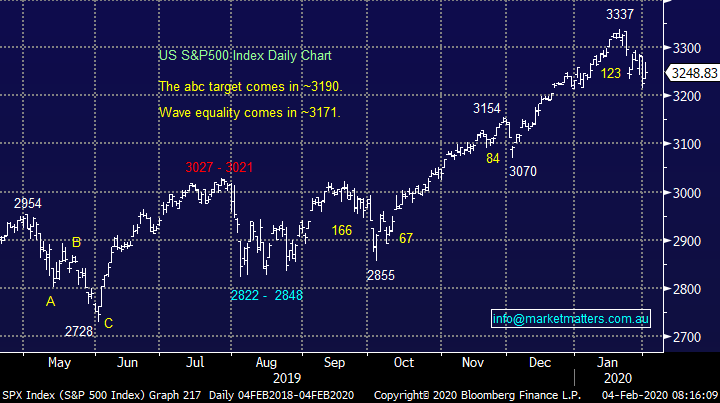

One stock on our shopping list this week where we haven’t yet pressed the buy button is a2 Milk (A2M) which fell -2.4% yesterday, closing well off its lows. The Food & Beverage sector was actually one which saw more winners than losers on Monday which is a solid performance when less than 15% of the market closed in the green, we like the sector into 2020 and we are still considering A2M in the coming days.

MM remains bullish A2M around $14.

A2 Milk (A2M) Chart

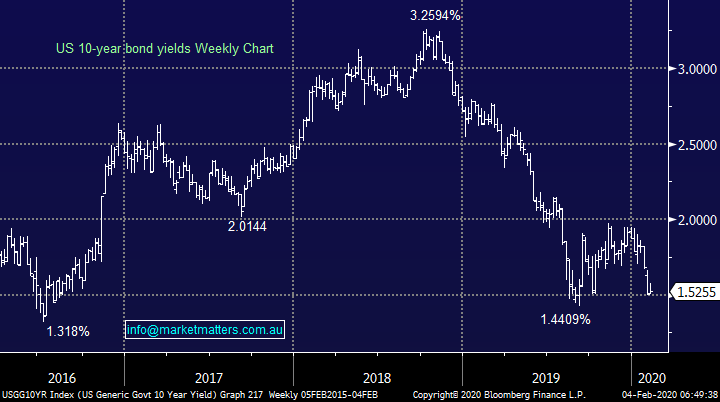

Interestingly while equities start to panic about a coronavirus led global slowdown the bond market is trading in a far more calculated manner – both the Australian and US markets haven’t seen bond yields make fresh recent lows suggesting investors still remain more upbeat on things than when the US & China trade concerns rippled through markets.

While the safety of bonds continues to attract many investors MM still believes this is a move to fade as we feel the PBOC and global central banks will throw the proverbial “kitchen sink” at their economies to get growth back on track.

MM believes the decline in bond yields is running out of steam.

Australian 3-year Bonds Chart

US 10-year Bond Yield Chart

Fiscal stimulus & it’s ramifications

For those well versed in economics please excuse the simplicity of our explanations below with regard to Australia but at MM we do like the old adage KISS (keep it simple stupid):

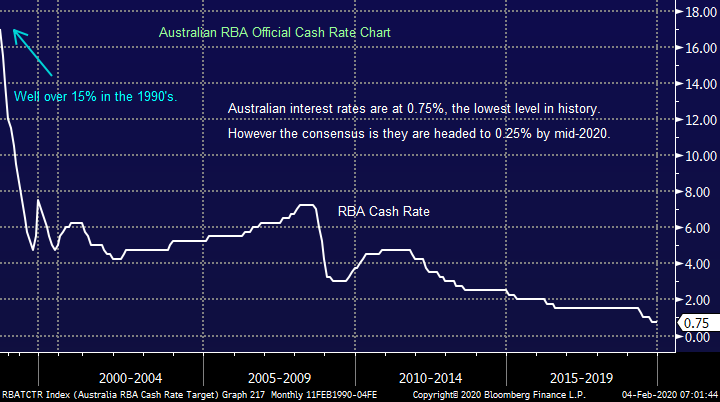

1 – Monetary stimulus is when our friends in Martin Place (the RBA) deem it necessary to cut interest rates to help activity in the Australian economy. While the current all-time low of 0.75% leaves little room for further major cuts the markets still anticipating we will see 2 cuts to 0.25% in 2020, we wouldn’t be surprised to see some economists disappointed on this front, perhaps one and done which is more of less what the futures markets are implying?

2 – Fiscal stimulus is a government action usually through tax cuts and / or increased spending, such as on infrastructure, to spur economic growth and avoid a recession and get things humming along - Scott Morrison certainly needs to do something to regain some popularity!

Both globally and in Australia we’ve experienced unprecedented low levels of interest rates post the GFC but while we’ve avoided a recession locally the economy continues to splutter along, not many people I know feel particularly well off / optimistic. However, by definition we can’t have our cake and eat it to, for interest rates to be extremely low the economy can’t be particularly strong. Remember locally we have a hugely indebted consumer whose current psychology is more aligned to paying down debt as opposed to borrowing to buy more “stuff”, not great for growth and / or retail.

Hence many people including ourselves believe the time has arrived for fiscal stimulus, the post GFC stock market rally has been fuelled by falling interest rates we believe it’s now time to hand the banner over to spending i.e. fiscal spending could become the next equities drug, one that could actually support earnings rather than simply expansion of P/E’s. We feel that the relative performance of different global bourses will largely come down to the ability / desire of the respective governments to implement fiscal stimulus e.g. there’s nobody as capable as China to press policy buttons which we believe will ultimately provide a tailwind for the Australian resources sector.

Australian RBA Official Cash Rate Chart

If we consider the common metric of net borrowing as a % of GDP then the likes of Japan, parts of Europe and the US won’t have particularly large scope to spend but as we’ve seen over the last decade current central banks & governments will do almost anything to avoid a recession on their watch – statistics tell us a weak economy is not good news for elections!

Our favoured areas for fiscal stimulus are the UK post Brexit followed now by China, hopefully we see some forward thinking locally but at this stage this is one of the reasons where are comfortable holders of UK facing Janus Henderson (JHG) and Pendal Group (PDL). Historically fiscal stimulus is felt in the likes of FX for a year or two hence stocks that benefit from such actions if / when they occur should initially enjoy a year of outperformance.

MM believes fiscal stimulus will lift inflation and growth.

Importantly if we see inflation without growth its awful for stocks hence MM will be watching out for this potential scenario very closely. The chart below illustrates how interest rates have been falling for many decades, a bounce on rising inflation would be normal from a historical perspective but it may take a year or two for it to manifest.

US 30-year Bond Yields Chart

So, MM believes fiscal stimulus is coming which will lead to inflation through rising commodity prices, the million-dollar question is what stocks to buy if we are correct. Our thoughts below clearly mirror how we’ve been positioning the MM Growth Portfolio over recent weeks:

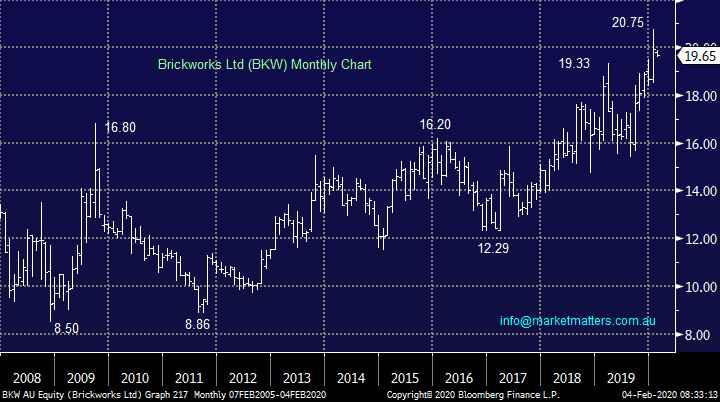

1 – Building stocks: Infrastructure spending is clearly good news for Australian building companies like Boral (BLD), Brickworks (BKW), Adelaide Brighton (ABC) and James Hardie (JHX) who have all risen over the last month – just the beginning in our opinion.

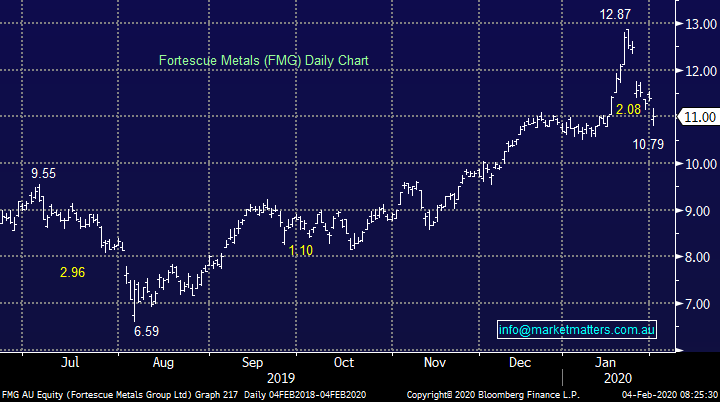

2 – Resources: If / when China presses the stimulus button we expect the likes of copper and iron ore to rally strong taking the associated miners along for the ride.

3 – Foods: If we’re right inflation will rise plus people will distrust food stuffs out of China, good news for our producers.

MM has been positioning ourselves for this major change from interest led gains to spending, investors should recognise the results will not be instantaneous whether we are right or wrong, stocks have rallied for over 10-years on falling interest rates / bond yields, we don’t expect to simply witness a handing over of the baton to spending and change the markets characteristics overnight.

MM will remain patient with this outlook; we don’t expect instant success.

BBG Agricultural Index Chart

Today I have briefly looked at one stock from each of these sectors that MM doesn’t own but likes, remember never say never!

1 Brickworks (BKW) $19.65

BKW is not just a building products company it also holds a major shareholding in Soul Patts (SOL) plus a joint venture with Goodman Group (GMG) which gives the business some nice diversification while its 3% fully franked yield is the attractive icing on the cake.

MM likes BKW below $20.

Brickworks (BKW) Chart

2 Fortescue Metals (FMG) $11

Iron ore producer FMG has followed the anti-China sentiment lower as the coronavirus panic takes hold, as subscribers know we feel things are probably reaching the summit of market / sector panic.

MM likes FMG after its 15% correction.

Fortescue Metals (FMG) Chart

Iron Ore Chart

3 Bega Cheese (BGA) $4.45

BGA has had a tough time over the last few years but we feel a significant portion of the bad news is built into this cake and value is presenting itself under $5.

MM is bullish BGA with an initial target ~15% higher.

Bega Cheese (BGA) Chart

Conclusion

MM expects fiscal stimulus to create outperformance in the resources, building and food stuffs sectors.

Overnight Market Matters Wrap

- The US equity majors started February with positive sentiment, following a disastrous end in January led by the tech. heavy Nasdaq 100.

· All metals on the LME fell overnight after large losses in China yesterday as they played catch-up after the Lunar Holiday break. Copper is trading at multi-year lows while iron ore tumbled and crude oil sliding 3.08% into bear market territory as Chinese consumption collapsed.

- BHP is expected to underperform the broader market yet again, after ending its US session off an equivalent of 0.81% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open with little change, around the 6925 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.