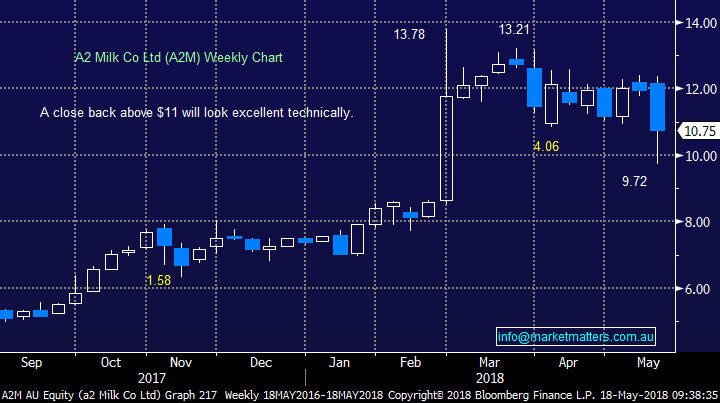

Evaluating 5 Stocks That Have Experienced a Very Eventful Week (ORE, TWE, A2M, TLS, CYB)

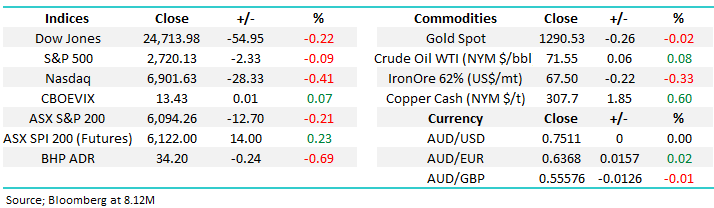

While the ASX200 fell 12-points yesterday it again found solid support at lower levels and regained over half of it’s early decline in the last hour of trade. If we simply discount the 14-points that Westpac took from the index after trading ex-dividend the market would have actually closed in the green.

The market has now been in consolidation mode for over a week, begrudgingly retracing just over 1%, it feels to us like its making a platform for another leg higher.

- MM remains bullish targeting ~6250 for the ASX200 BUT we remain in “sell mode”.

ASX200 Chart

The market has been noticeably pulled around by 2 major macro influences on a few occasions this week which we will discuss in greater detail in the weekend report. Individual stocks / sectors are being affected almost daily:

Bond yields

US bond yields continue to march higher with the most watched 10-year rate closing above 3.1% last night, a huge increase from the 2016 lows near 1.3%. Slowly but surely the local “yield play” sector is heeding the warnings from its US equivalent:

- In the US over the last 6-months the following 2 sectors have been hit hard in a rising market, Utilities -12.1% and Real Estate -9.1%.

- Locally over the last 5-days Real Estate is -1.9% and Utilities -5.2%.

US 10-year Bond yield Chart

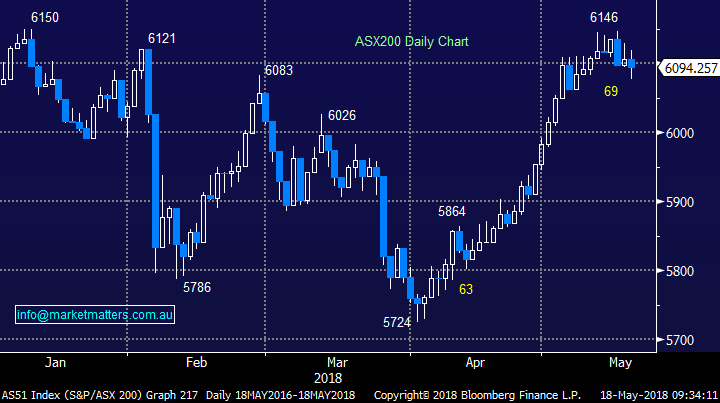

Australian Dollar

The Australian dollar is down over 6c from its 81.36 2018 high against the $US making overseas “earners” a hot spot of performance – a trend we like moving forward.

However, following the Australian unemployment data showing a small increase to 5.6%, plus importantly another 22,600 jobs being added in April, the $A rallied and we immediately saw selling in the likes of heavyweight CSL.

It feels like the market is fully positioned for ongoing depreciation in the “Aussie battler” so short-term risks of relatively sharp pullbacks feel high.

Australian Dollar Chart

Weekly Winner

One stock caught our eye in the winners circle this week and we own it.

1 Orocobre (ORE) $5.91

Lithium producer ORE took off yesterday rallying over 7% and now looks set to make fresh 7-week highs.

The whole sector embraced the news that rival Kidman Resources (KDR) had entered into an exciting off-take agreement with US heavyweight Tesla. Ironically as is often the case investors sold into the news and KDR only closed up +2.8%, whereas ORE gained +7.1%. Perhaps the financial side of the agreement being confidential led to some selling.

We continue to be large believers in the electric vehicle revolution and both hence lithium and cobalt.

At these levels we see better value in ORE and would not be surprised to see Toyota consider increasing its exposure following the stock’s recent correction.However, we believe investors must acknowledge that the sectors had a huge run since early 2016, along with most of the resources names, and hence at MM we will have no hesitation locking in decent gains if / when the present themselves – just as we have in KDR / ORE in the last few months.

NB This morning we see that Chinese company Tianqi has agreed to buy a $4.1bn stake in lithium giant SQM – the sectors clearly “hot” and ripe for further M&A.

Orocobre (ORE) Chart

Weekly Losers

We’ve picked on 4 companies in the “losers” corner today, 2 of which MM unfortunately owned at the start of the week. Fortunately at this stage we’ve added value to the portfolios via one very timely purchase which illustrates how a week can be a long time in the market.

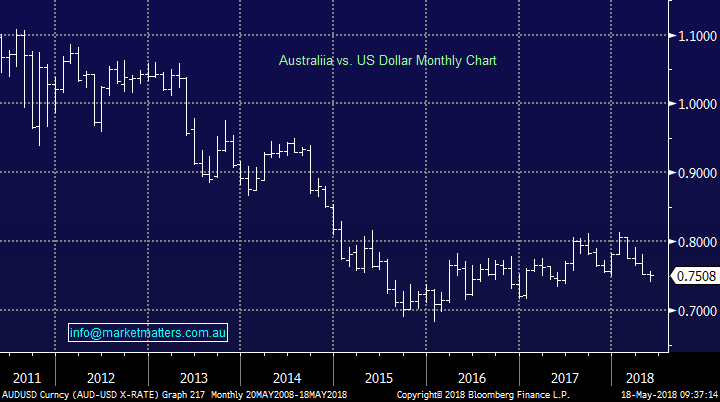

2 A2 Milk (A2M) $10.75

Market favourite A2 Milk (A2M) came back to earth with a thud on Wednesday and its now corrected 29.4% from the dizzy heights of February.

A2M was smashed following the announcement of its quarterly trading update.

- A2M reported ~70% growth in revenue for the first 9 months to NZ$660m and it anticipates total revenue of NZ$900-920m – slightly lower than anticipated.

- Importantly to us gross margins have not decreased.

- However, it warned the marketing spend in China would be higher than many expected ~NZ$85m – it’s an expanding business!

- The stock was “priced for perfection” hence the 20% drop on the opening bell mid week.

At MM we bought the “gap lower” taking our holding to 6% of the MM Growth Portfolio with an average entry of $10.53.

We expect the results influence will take a while to fade away, especially as the stock has now corrected almost 30% leaving a lot of investors losing money but we remain upbeat.

· MM anticipates an eventual rally by A2M towards $14 - we are especially keen on its exposure to China’s growing internal economy.

A2 Milk (A2M) Chart

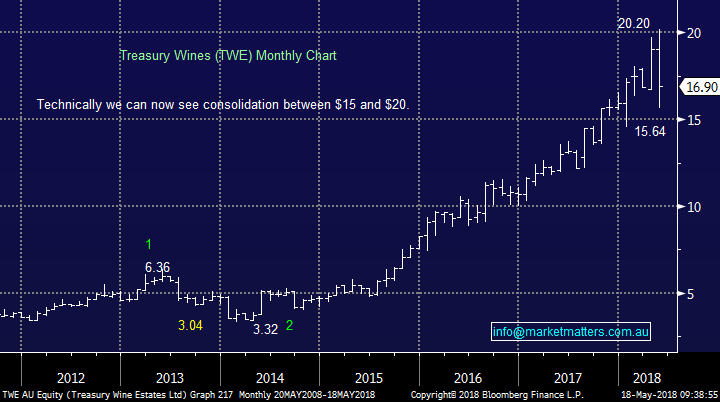

3 Treasury Wine Estates (TWE) $16.90

TWE was smacked on the opening yesterday, falling -13.2% early on before recovering to close down -6.2%.

The fall was created by are report in the AFR that TWE is facing a supply glut, created by itself, in China. The report suggested that distributors in China are sitting on upwards of 3 years’ worth of primarily low-end stock e.g. brands such as Rawson’s Retreat, Wolf Blass, and a selection of cheaper Berringer products. This is rumoured to have led to deep discounting by wholesalers and retailers in China.

Later in the day Treasury Wine Estates (TWE) stated that it is “comfortable with the sustainability of its operating model in China, to build a portfolio of brands, and of its disciplined approach to managing inventory levels with its customers.” However, it stated “that investors should be careful about listening to feedback from selected customers in China.” – in other words there is some truth out there in our opinion!

- Unlike with A2M we would rather let the dust settle with this one and are neutral TWE just here.

Treasury Wine (TWE) Chart

4 Telstra (TLS) $2.87

Telstra’s continued demise garnered significant publicity this week and has been the standout stock for questions being directed to the MM team hence I thought this was an ideal opportunity to reiterate our view:

- MM sold part of our holding in January over 20% higher with the plan to increase our holding under $3.20.

- We have refrained from this buying because the stock “didn’t” feel right.

- If we had no position we would be currently accumulating into weakness but as MM does we are simply holding and awaiting further developments.

Telstra (TLS) Chart

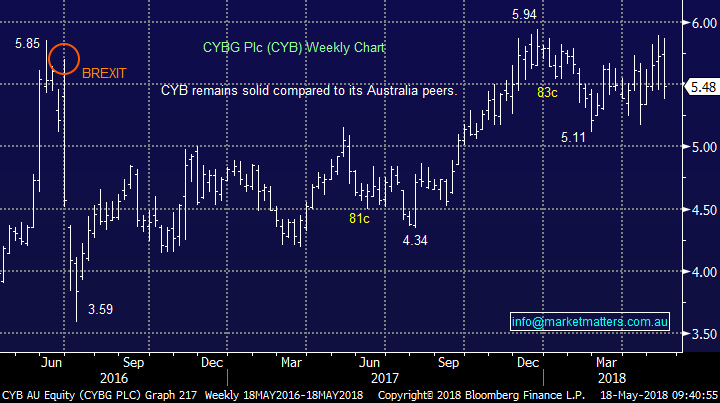

5 CYBG (CYB) $5.48

CYB frustratingly has endured a tough week falling 29c / 5% on Wednesday following its half-year report.

The bank reported a statutory loss of GBP76b but an underlying pre-tax profit of GBP158. The loss was driven by an increase in compensation claims from the UK’s insurance scandal.

BREXIT continues to cloud the business but with clarity slowly emerging and the insurance scandal apparently now behind us the future should improve.

- We are sticking with CYB for now, still targeting over $6.

CYBG (CYB) Chart

Conclusion (s)

We like ORE and A2M at current levels while being more neutral TWE, CYB and TLS.

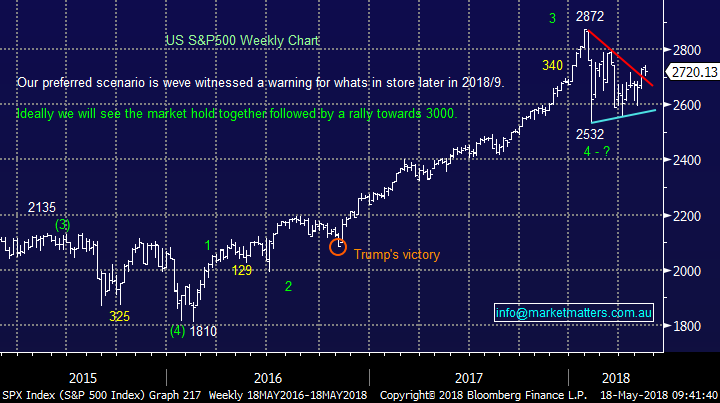

Global indices

Overnight markets were quiet with the US Russell 2000 again making fresh all-time highs.

We are short-term bullish US stocks targeting ~6% upside for the S&P500.

US S&P500 Chart

European stocks remain strong with the UK FTSE now basically at its all-time high.

UK FTSE Chart

Overnight Market Matters Wrap

· Despite solid economic data the US market finished lower after concerns emerged over the US and China trade talks. Stocks battled back to erase those losses before fading into the close to finish down overall.

· New US sanctions that will hit Iran’s energy industry and the fallout of Venezuela’s economic collapse have raised fears of significantly tighter global oil supplies, sending prices above $80 a barrel for the first time in nearly four years. Energy producers rallied on merger activity and strong oil prices, while Cisco’s weak earnings took down technology shares.

· The US 10 year yield continues to firm and finished at 3.11% on the back of continued inflationary expectations, leading a stronger USD overnight.

· The June SPI Futures is indicating the ASX 200 to open 20 points higher this morning, towards the 6115 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/05/2018. 8.31AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here