Evaluating 5 Australian “deep value stocks (BHP, GMG, AAPL US, CTD, KMD, VUK, AWC, MND)

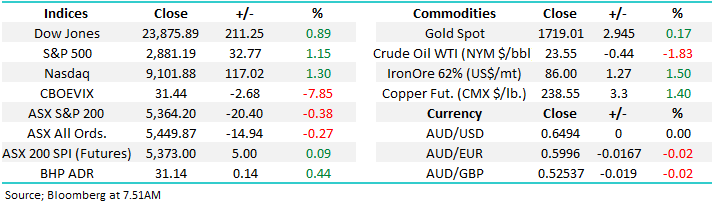

I felt the local market put in a pretty disappointing performance yesterday drifting -0.4% lower while US futures rallied strongly throughout our session, without getting too technical we simply feel tired after the 26% rally from the March panic lows. My “Gut Feel” is we will turn lower in the coming days / weeks with a test of the psychological 5000 area a possibility, around 5-6% lower. This week we’ve highlighted a few times the rich valuation by the market which is running way ahead of earnings. The risk is while stocks are pricing in a “V-shaped” recovery the room for disappointment increases as we emerge from the COVID-19 lockdown, especially as we believe the economic improvement will be very stock / sector specific.

Undoubtedly, we have a huge liquidity tailwind for stocks but as we saw back in February when markets are priced for perfection, or in today’s case very optimistically, downside surprises can prevail. Management in most companies are only guessing what comes next through no fault of their own hence more earnings downgrades feel inevitable, yet valuations are more skewed towards upgrades, a potentially dangerous scenario. Importantly we are not saying sell but we do believe general buying should be fussy at current levels. Macquarie out with earnings this morning an example of this – more on that below.

However, investors are largely cashed up / bearish hence in our opinion any declines will fall short of many investors’ expectations.

Australia and most of the developed world are “going back to work” in the coming weeks and the success of this exercise will dictate the direction of stocks in the weeks / months to come, assuming of course Trump doesn’t again go tariff mad towards China again. I am most definitely not a virologist, but my feeling is Australia will do just fine but Europe and especially the US have a reasonably high chance of major secondary breakouts – we will be watching this very carefully.

MM remains bullish equities medium-term, hence we are in net “buy mode”.

ASX200 Index Chart

Macquarie Group (MQG) have just released FY20 results and I cover the detail in a quick recording. All in all, a 4% miss to expectations at the profit line and no guidance provided. More details below. Click on the recording (no login required)

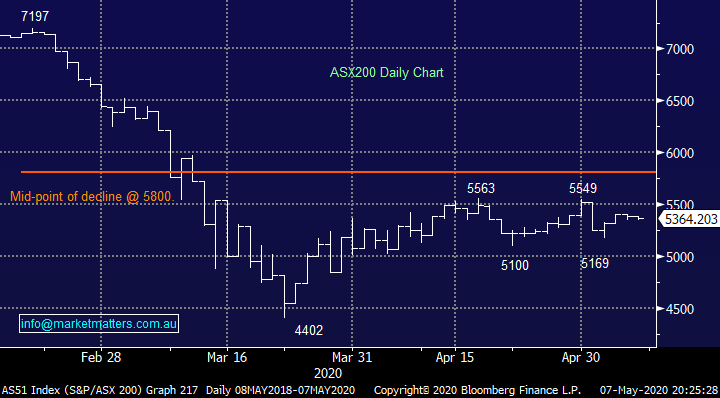

We liked what we saw and heard from BHP yesterday with the miner rallying almost 2% on a market down day. The 2 latest members added to the company’s board have technology background showing a definite skew towards the future. With China already in recovery and infrastructure spending looking poised to surge domestically BHP’s earnings should be well supported in 2020 / 2021, especially if oil recovers in line with our outlook.

MM remains comfortable with our overweight BHP position.

BHP Group (BHP) Chart

At MM we are limiting our exposure to the Australian Property Sector due to concerns around how our lifestyles will change post COVID-19 but there is one quality business which stands head and shoulders above the rest in our opinion. Goodman Group (GMG), it’s a phenomenal business, the one property stock in Australia which actually benefits from online retailing which is a great position to have engineered.

Yesterday’s 3rd quarter update reaffirmed guidance which is simply a phenomenal performance in today’s uncertain times. The company expects earnings to be up 11% from 2019 with its dividend maintained at 30c pa putting the stock on a yield of 2.1%. We are keen on GMG but with a P/E of over 24x it’s not cheap hence our ideal entry is a touch lower - but this might be a crowded thought!

MM is bullish GMG.

Goodman Group (GMG) Chart

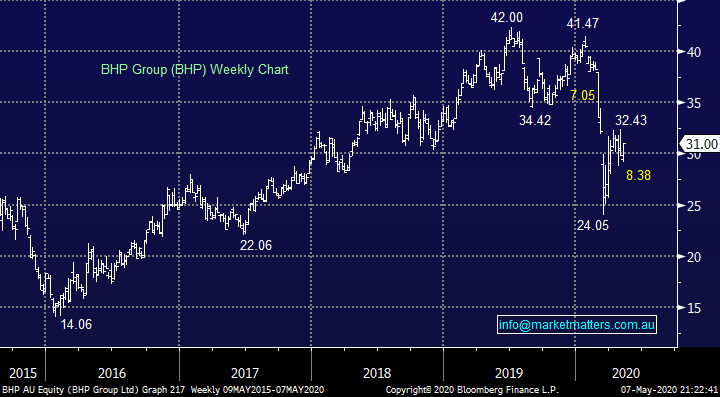

No major change here although overnight we saw the tech based NASDAQ make fresh April / May highs, this index which we often say leads the market is now only 6% below its February all-time high. In our opinion the trend that matters is up and surprises usually happen with the trend hence further gains should not be discounted, as we have said previously we are far keener on buying pullbacks as opposed to selling strength as stocks continue to rally in a choppy manner.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

A great example of the strength in the cashed-up US Tech sector comes from heavyweight Apple (AAPL US), one of our favourite positions in the MM International Portfolio. AAPL continues to rally stoically, it’s now only 7% below its all-time high, a landmark we remain confident will be surpassed in 2020, the stock impressively already broke its March high last night.

MM remains bullish Apple (AAPL US) medium-term.

US Apple (AAPL US) Chart

Evaluating 5 local “deep value” stocks

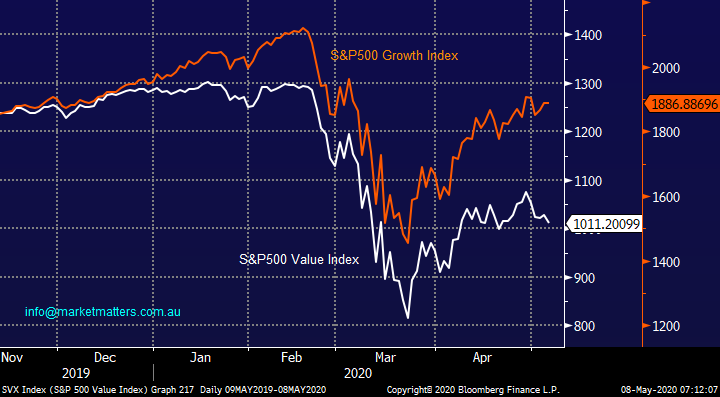

While US equity markets are largely pricing in a “V-shaped” recovery its clearly far more in the extremely liquid growth sector as we touched on earlier, fund managers appear comfortable to still chase the quality stocks while largely ignoring areas of perceived danger. This trend is understandable but when it reverses we are likely to see dramatic outperformance from Value Stocks – overnight while the NASDAQ rallied +1.3% the S&P500 Value Index actually turned lower. At this stage we are sticking with our comment from Wednesdays International Report – “if we are correct some of the best gains will be seen in the currently less popular Value Sector but it still feels a touch too early to flock towards the view.” However, be definition the time to skew portfolios more towards Value is getting closer by the day.

Interestingly on a pure index level the Value Index appears to be correcting its multi-week rally from March’s low, a potential precursor for the broader indices.

Today I have looked at 5 local stocks that appear to be offering “deep value” however they’re cheap for reason and some of them will be traps hence we need to evaluate both a company’s value and future after the coronavirus.

US Value v Growth Indices Chart

1 Corporate Travel (CTD) $12.08

CTD operates a fee for service model hence when nobody’s travelling the revenue dries up. While many from the likes of mining, government and healthcare are still travelling the company is still burning cash at $5-10m per month but a relatively small uptick in domestic travel should see the business return to profitability. Importantly CTD has avoided any loans being called hence they didn’t require a capital raise when their stock price is depressed, unlike others in the sector like Webjet (WEB) and Flight Centre (FLT).

The big question is now the stocks down over 60% is it cheap when we try to evaluate how the future will look in aviation moving forward, we have no doubt that like today people will still fly for business but how much will the traffic be decreased by the evolution of Zoom & Microsoft Team meetings for example. At current levels we aren’t excited by the risk / reward but back under $10 the picture would improve and be tempting.

MM is neutral CTD at current levels.

Corporate Travel (CTD) Chart

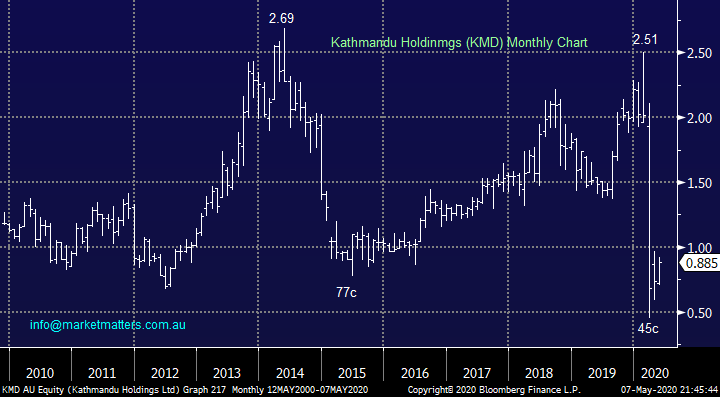

2 Kathmandu Holdings (KMD) 88c

Outdoor clothing business KMD raised capital on the back of extreme pressure from their banks, the raise at 50c was a big one but it’s currently looking good for the buyers. KMD have been given covenant relief from their lenders after the equity injection. On forward numbers, the stock trades on 14x however we would take that number with a grain of salt.

The big question here is how the foot traffic will be for KMD now their Australian stores have reopened for business. Also, can they evolve on-line sales still further, I like their site and have used it, I’m a “Summit Club member!”. I think KMD will survive the current pandemic and eventually again thrive but their risk / reward around current levels is not yet exciting.

MM likes KMD but is neutral at present.

Kathmandu Holdings (KMD) Chart

3 Virgin Money-CDA (VUK) $1.44

Virgin Money (VUK) 1H20 result showed income up 3% but this was largely due to a one-off sale, the important net interest margin was unchanged. While the bank is a profitless business that’s endured a 2-year downgrade cycle we feel its now basically treading water. Some analysts who have been aggressive sellers of the stock are moving to a hold position which is clearly a step in the right direction. We see no reason to chase the current bounce in VUK but another test of 2020 lows would look very interesting from a risk / reward perspective. This is another ‘deep value’ turnaround style stock that trades on a price to book around 0.3%, about a 3rd the level of the local banks.

MM likes the risk / reward on VUK towards $1.

Virgin Money-CDA (VUK) Chart

4 Alumina (AWC) $1.58

Alumina (AWC) is probably the largest underperformer in the Australian Resources Sector but with the Aluminium price looking close to a bottom as the Chinese economy picks up things are looking interesting. AWC owns 40% of the world’s largest alumina business so if / when the commodity turns expect the stock to follow. The companies operating ok with cash margin edging higher, it simply just needs alumina to follow.

The downtrend is entrenched so a test of $1.20 would not surprise but we would be looking to accumulate into such weakness.

MM is bullish AWC into fresh 2020 lows.

Alumina (AWC) Chart

LME Aluminium Chart

5 Monadelphous (MND) $10.09

Mining services business MND has been hit on the back of reduced capex guidance from mining companies, while on historical numbers it might look cheap trading on just 6.3x, the world has moved on and more difficult times are ahead for the contractor – the question being, has the stock price factored this in already?

MM has exposure to the correlated mix of Emeco (EHL) and Lend Lease (LLC), otherwise we would be considering MND seriously.

MM likes MND around current levels.

Monadelphous (MND) Chart

Conclusion

Of the 5 stocks we looked at today MM our favourite play is AWC into fresh 2020 lows.

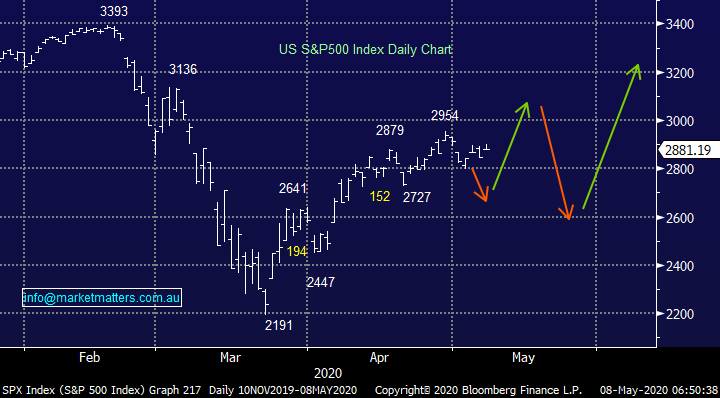

Overnight Market Matters Wrap

- The key US equity indices closed in positive territory ahead of its US employment data for April due to be announced tonight and to show how severe the coronavirus has impacted its economy – its is expected to report a ~21m fall in payrolls.

- ETF treasury yields were off overnight, this could be a possible sign in shift to ‘riskier assets’, while gold gained little, currently at US$1,719.01/oz.

- Locally, investors will digest the RBA minutes, Macquarie Group (MQG) will release its earnings, while the UK is closed this afternoon for a holiday.

- The June SPI Futures is indicating the ASX 200 open marginally higher, testing the 5380 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.