Equities rally on bad news, led by the consumer (WEB, FLT, JBH, HVN, NCK, Z1P, APT)

The ASX200 closed marginally higher yesterday but following last night’s 740-point turnaround by the Dow this morning we are looking to open ~20-points higher which will actually have this volatile week back in the black, at least early on.

Overnight China took the “nuclear option” in the trade war game of chicken with Donald Trump announcing $US50bn of reciprocal tariffs on 106 different products. Markets went into freefall on the news, just when many of you would have been putting your feet up after a long day at work – The Dow was down over 500-points at its worst.

However, comments later in the day by Steve Mnuchin, US Secretary of the Treasury, signalling that the US was open to talks around trade changed the landscape dramatically. Not a surprising reaction from President Trump et al with the US mid-term elections on the horizon – a plunging share market is not good for the incumbent government.

· This is still overall net negative fundamental news for stocks yet they rallied implying strongly the current weakness is exhausted i.e. a bullish sign.

In yesterday’s report we outlined our short-term bullish view and the market’s reaction to China’s latest action on tariffs leaves us even more comfortable with this opinion. Today we are going to look at our retail sector following yesterday’s local +0.6% gain in Februarys retail data, double the average economists forecast. Also, the US Consumer Discretionary sector is the strongest area of the US S&P500 over the last 6-months gaining +10% while the index advanced +3.15%.

ASX200 Chart

Probably the heavyweight move by China yesterday evening AEST was the huge 25% tariff on Soybeans imported from the US – this hits the heartland of Donald Trump’s voter base. Soybeans are primarily used in the animal feed industry as opposed to bad tasting coffee.

In a similar manner to stocks Soybeans initially plunged over 5% on the news but then recovered well over 50% of their losses.

· Markets are voting with their wallets that this Tarzan style posturing by the US and China will not escalate with an ultimate resolution / middle ground being found.

Soybeans Chart

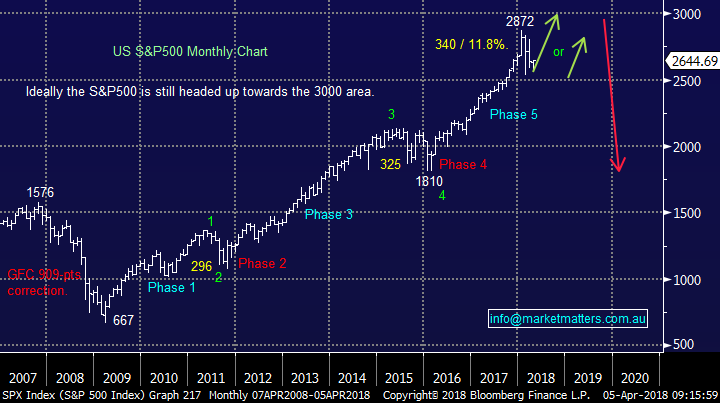

Our short-term view for US stocks remains a bullish one however if we are correct this is the last piece of the 9-year bull market puzzle so we feel it’s likely to be a very choppy advance – this certainly looks correct so far.

US S&P500 Chart

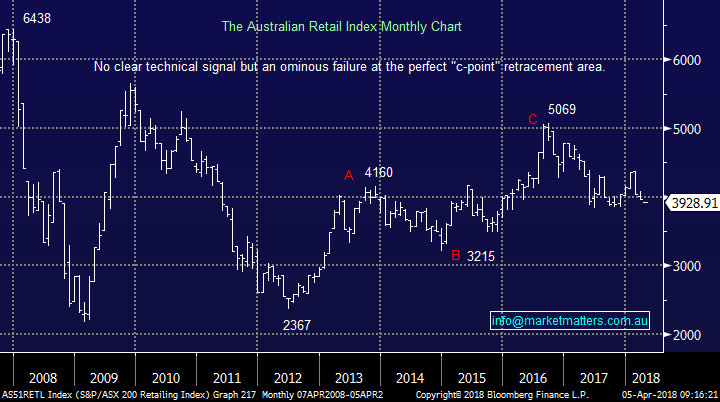

Can we find any value in the Retail / Consumer Sector?

The Australian Retail Sector has been very out of favour since late 2016 falling over 20% while the broad market rose nicely. Investors have been understandably concerned about 2 main issues:

1. The high household debt levels by the average Australian and lack of any meaningful wage growth

2. The likely pressure on margins caused by the ever-increasing internet sales e.g. the arrival of Amazon.

The sector has a huge presence in the most shorted stocks holding 8 of the top 20 spots, a significant number for a relatively small sector. The success achieved from selling Myer would certainly have helped the hedge funds confidence when selling Australian retail / consumer stocks.

Over recent years we have generally avoided the unpopular sector for these very 2 reasons – although the Income Portfolio hold Nick Scali while we also had one profitable tilt at Harvey Norman before it fell over post it’s recent result. Due to the above we think the sector is more a place to hunt for a “diamond in the rough” as opposed to looking for some general sector exposure.

ASX200 Retailing Index Chart

1 Supermarkets

Firstly, let consider the heavyweight supermarkets Woolworths (WOW) and Wesfarmers (WES).

A simple answer: we have no interest in either with some heavyweight competition just arriving on our shores i.e. good for you and I but not supermarket shares. As a side note, the proposed spin out of Coles into its own listed entity will take some pressure off Woolies. By Coles ‘going it alone’, they’ll lose the financial support of strong businesses within the wider group like Bunnings so in a relative sense, Woolies looks the better of the two but we have no mandate to hold either, and are unlikely to going forward.

2 Travel

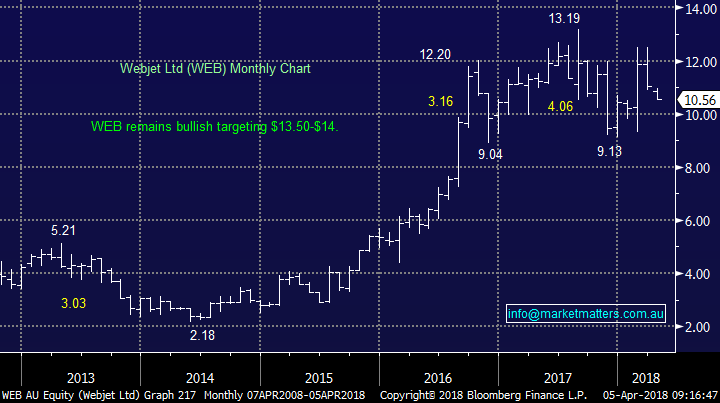

We’ve been long Webjet (WEB) for a few months and while it’s still showing us an 11% paper profit it was a lot more in March. Flight Centre (FLT) has taken the baton of performance in the specific space recently although I notice it now has almost 10% of its stock sold short so the “shorters” are not convinced.

We like both WEB and FLT but Webjet would worry us if it failed to hold the current $10.50 region.

Webjet (WEB) Chart

3 Classic Retail

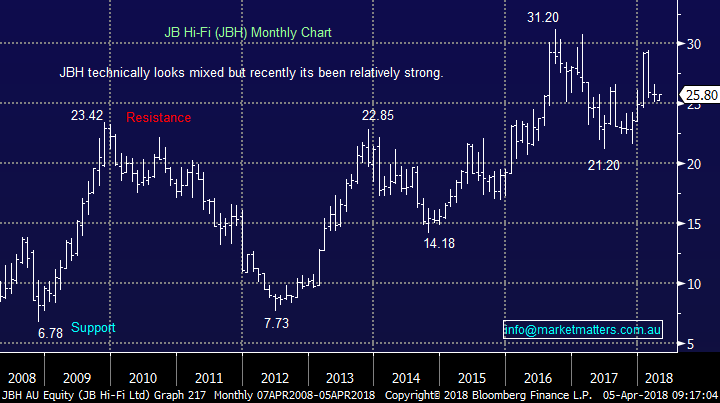

There’s been a very different level of performance from within the sector with say JB HI-FI up +5.7% over the last year while Harvey Norman is down -17.1%. Both stocks are now slowly becoming interesting again:

1. JBH $25.80 – JBH had a great rally in January following a broker upgrade although most of those gains have now been given back. We like JBH under $26 with stops under $24.50.

2. HVN $3.72 – The stocks suffering because the market doesn’t fully trust it at present and hence we still feel surprises are likely to be on the downside. We will only consider HVN in the $3.30-3.40 region.

JB HI-FI (JBH) Chart

Harvey Norman (HVN) Chart

MM has been long Nick Scali (NCK) in our Income Portfolio since mid-2017 and its currently looking after us very nicely – touch wood!

· NCK $6.51 - We have an eventual target up towards $8 although technically we would not want to see the stock much lower than $6.10.

Nick Scali (NCK) Chart

4 Disruptors

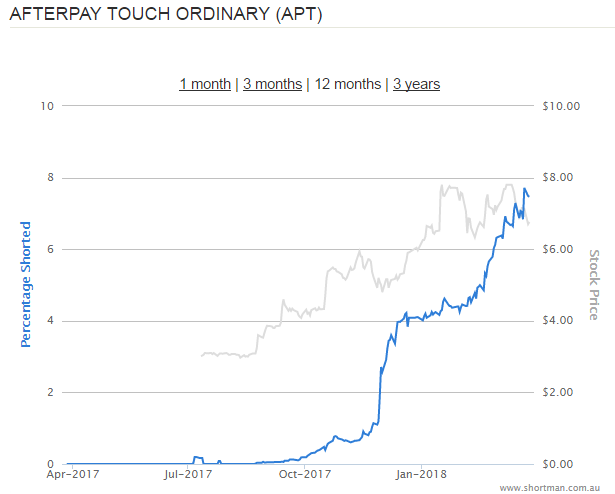

I’m not sure if disruptors are the correct term here – but I’ll run with it anyway. The 2 we have discussed over the last 6-months both provide payment services – Z1P and APT.

Both stocks have enjoyed excellent returns over the last 12-months but the last few weeks have been extremely tough as potential regulatory concerns have emerged and a number of ‘commentators’ have sent bearish notes around on some aspects of both businesses. Shorts have increased, particularly in the larger of the two, Afterpay Touch.

In simple terms , both companies offer credit for shoppers to buy now and pay later, with Afterpay focussing on smaller purchases while Z1P focusses on larger transactions. There retail penetration has been strong, and their platforms are good. Z1P is the smaller of the two and in our view offers most growth potential from current levels. That said, we’ve all witnessed the impact of regulators on our banks recently and it seems to me, that although both companies ‘seem’ to have robust internal practices in place, regulators have given them a wide berth to date, however ultimately we know regulators like to regulate and this is a sector ripe for it. Our inclination is to pass for now given these uncertainties may take a while to be resolved and neither stock pays a dividend in the interim.

ZIP Co (Z1P) Chart

After Pay Touch (APT) Chart

Conclusion (s)

1. In general, we are not keen on local retail / consumer stocks although a bounce feels close at hand

2. We do like JBH below $26 with stops beneath $24.50 i.e. a 6% risk.

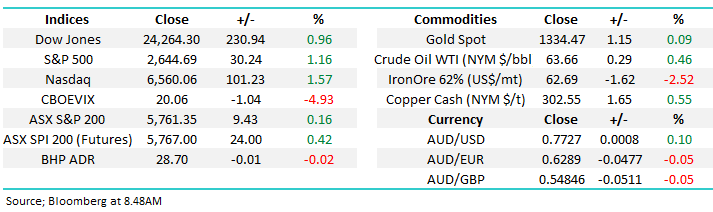

Overnight Market Matters Wrap

· The threat of an escalating trade war between the US and China saw Wall St open considerably lower, only to rally strongly on increasing expectations that both parties would enter talks to head off the tariff threat to global trade.

· The Dow rallied nearly 800 pts from its early morning lows of around 23,500 to close up 0.96% at 24,264 as hopes rose that the Trump administration would be prepared to negotiate with China to reduce the tit-for-tat tariff threat. Overnight China threatened a further range of 25% tariffs on key US imported goods.

· The tech heavy Nasdaq 100 rallied 1.57%, back above 6,500 (from an intra-day low of 6,326) and the S&P 500 up 1.1% at 2,644 (intra-day low of 2570). Facebook was in the news again with disclosure of extended number of data breaches. It now appears the data on as many as 87m people (up from 50m) was shared with research firm Cambridge Analytica during the 2016 US election. The stock closed another 1% weaker at US$150/ share, having lost nearly 20% since the data scandal erupted early last month.

· Despite the more positive tone, commodities were mixed with oil and gold steady, copper and iron ore slightly weaker.

· The A$ is back above US$0.77 while the June SPI Futures is indicating the ASX 200 to open 21 points higher, towards the 5780 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/04/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here