Does the Royal Commission into Aged Care = opportunity? – (KDR, EHE, JHC, REG)

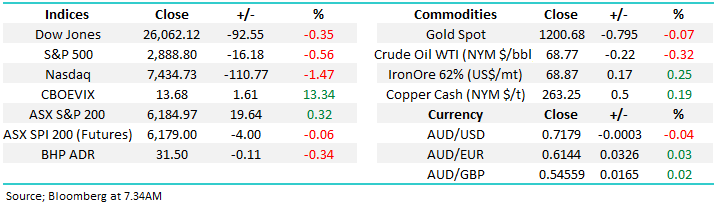

The ASX200 enjoyed another solid day after early jitters to close up +0.3% led by the banks which as a sector gained almost +0.6%. The negativity from the Hayne Royal Commission only lasts so long - as always, half the “game” is in market timing. Conversely the resources were again the main market drag led by OZ Minerals (OZL) which fell -3%, we continue to watch the sector carefully into weakness caused by the ongoing US – China trade war concerns – a theme that could well build further momentum to the downside today after Trump has upped the ante this morning by slapping a 10% impost on roughly $US200 billion ($279 billion) of imports that will rise to 25% within months unless China capitulates. US Futures have opened down, currently trading down by ~0.30%.

The brinkmanship / ego standoff is well and truly underway with Chinese equities likely to test 4-year lows today – it feels to us like the panic around global trade and emerging markets is slowly moving towards a crescendo which usually characterizes a great buying opportunity.

For the very active investors / traders out there, the futures, index and stock options basically all expire this Thursday. Over recent years it’s our experience that the market will generally be “surprisingly” strong into expiry e.g. yesterday weakness occurred early in the morning before recovering steadily throughout the day, hence around these periods any selling is often best left until after lunch. Likewise any bears out there may want to be patient for a few more days before initiating any positions.

· MM remains negative the ASX200 with an initial target sub 6000.

Today’s report is going to look at the aged care stocks which were propelled into the spotlight yesterday following our new PM’s desire to commence an inquiry into the sector + the Four Corners doco last night was very damming.

Stock markets hate uncertainty almost more than bad news so it was no surprise the sector was whacked from the opening bell but the question we ask is when will value become too compelling to ignore e.g. CBA has bounced over 10% from its June low, just when the press were in an almost anti-banking piranha like frenzy – note the 10% includes its August dividend,

ASX200 Chart

One stock that caught our eye yesterday was Kidman Resources (KDR) which tumbled over 13% following a disappointing court ruling around important tenements in WA. Another classic case of the market’s reaction to uncertainty, sell and ask questions later. The final decision by WA Mines Minister Bill Johnston will be watched carefully and volatility can be expected until markets see further progress on the issue. KDR has now fallen a huge 56% from its high in late May following Tesla’s commitment to buy from the miner – the stocks top was formed on good news as so often the case. We think there is a strong possibility of a market low being formed on this bad news.

It makes no sense to us for WA to block KDR because it benefits the state but of course you never know with politicians.

· We like the risk / reward on KDR below 90c if weakness persists prior to any announcement but note this is an aggressive play.

Kidman Resources (KDR) Chart

The Aged Care Sector

We all saw how the Banking Royal Commission unsettled the sector with market and sector heavyweight CBA falling 10% and AMP over 35% while the ASX200 rose over the corresponding period. The freshly announced launch of a royal commission into the aged care sector should be very concerning to investors as it’s a clearly a humanitarian / emotional issue, and simply one where everybody has a certain degree of exposure.

This Royal Commission will ultimately result into costly regulatory change, and unlike the banks, many of the aged care providers may not have the financial capacity to easily handle the impost.

Not surprisingly the three listed aged care providers were all whacked over 17% following PM Scott Morrison’s push to open a Royal Commission into the sector. Many investigations have already highlighted the issues facing the industry as the Australian population ages with around 1000 Australians turning 85 each week – clearly this is a big issue for Australia and the aged care companies are rightly in the vortex of the storm.

The small sliver-lining is that a de-rating has already started in the sector with many already trading at, or around, their 52-week low as the government had started looking at implementing new rules for the industry previously, while the change to the funding mechanism recently also played havoc. This can hurt the sector on number of different fronts, potential implementation of legislated staff to patient ratios which is the case in the Childcare sector, more power moving to not for profit groups and of course litigation as with the banks, the sharks will already circling.

Please note Aveo Group (AOG) has been caught up here to a lesser degree, however they are focussed primarily on Retirement Villages – although have some aged care options.

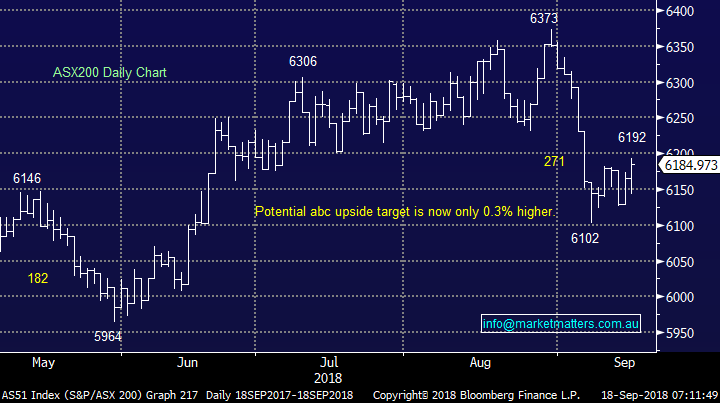

Estia Health (EHE) $2.40

EHE has fallen almost 70% from its 2015 high but it’s valuation / outlook is not exciting - I fear investors may have fallen into another classic “yield trap”. The stock may be yielding well over 6% today but this will be under pressure with costs likely to increase courtesy of the commission.

Technically the downside momentum is intact and an eventual break of $2 feels a strong possibility. As one fundy I spoke with yesterday said, we can’t get enough stock borrow on these names! (Funds needs to borrow stock to short sell – no borrow = no short sell)

EHE trades on Est P/E for 2019 of 14x while yielding 6.6% fully franked.

· MM has no interest in EHE at current levels, we will re-evaluate the situation under $2.

Estia Health (EHE) Chart

Japara Healthcare (JHC) $1.39

Similarly JHC is now down 60% from its 2015 high and even though it’s a higher quality business than EHE, again it does not feel cheap although.

JHC trades on Est P/E for 2019 of 17.8x while yielding 7.0% fully franked.

· MM has no interest in JHC at current levels, sub $1.20 will potentially lead to re-evaluation.

Japara Healthcare (JHC) Chart

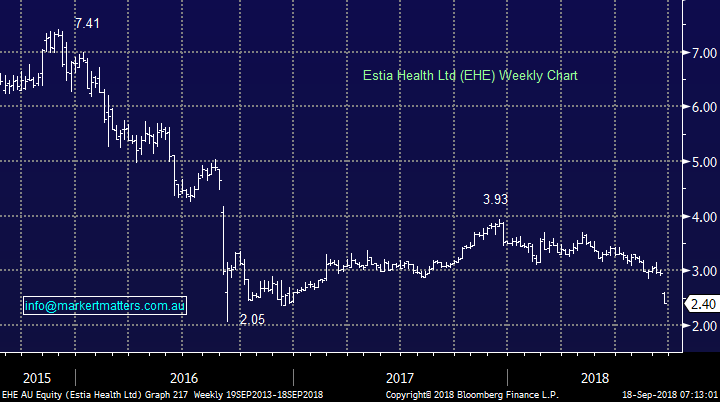

Regis Healthcare (REG) $3

The third string to the bow REG is down 54% from its 2015 high, the best performer in a bad bunch, and again it doesn’t feel cheap considering the looming headwinds.

Technically it’s hard to get a handle on a stock plumbing new depths but the $2.50-75 feels a strong possibility.

REG trades on Est P/E for 2019 of 17.9x while yielding 6.0% fully franked.

· MM has no interest in REG at current levels, the $2.50 area may lead to re-evaluation.

Regis Healthcare (REG) Chart

Conclusion

- There will likely be a re-rating in terms of the multiple paid for the Aged Care stocks on earnings that are under pressure. This could get ugly!

- MM sees no reason to catch a falling knife in the aged care sector, in all likelihood any decent risk / reward buying is many months away.

Overseas Indices

US indices fell last night led by the tech based NASDAQ which tumbled -1.5% not helped by APPLE falling -2.7% on disappointing pre-orders for the new iPhone.

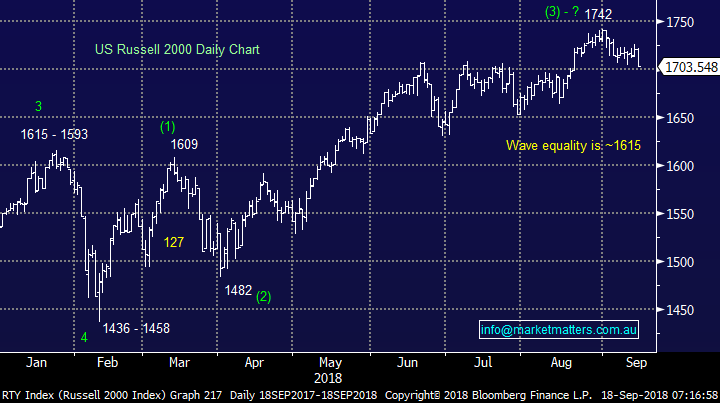

The Russell 2000 which we have been watching closely is now only 0.2% away from generating a technical sell signal with our target ~5% lower.

US Russell 2000 Chart

European indices were quiet overnight but we still have a target for the German DAX around 5% lower.

German DAX Chart

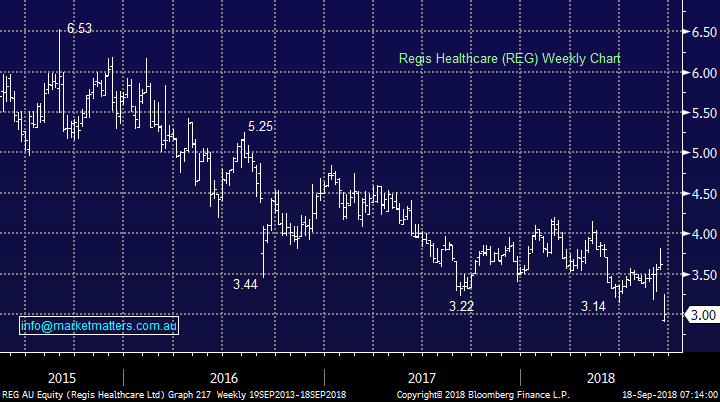

Overnight Market Matters Wrap

· The US equity markets started its week on a low note, with all major indices ending its session in negative territory.

· US-China trade fears reignited and particularly hit the tech. sector most with the Nasdaq 100 ending its session down 1.47%.

· On the commodities front, crude oil settled lower as investors anticipate a lower demand vs. its current supply. With the weakness in crude, BHP is expected to underperform the broader market, after ending its US session down an equivalent of 0.34% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open marginally lower, towards the 6180 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.