Do we see any value “yet” in current market underperformers? (ABC, JHG, PDL, BIN, CYB, CCP)

A strong July finally left with a whimper as the ASX200 fell -0.5% weighed down by a negative start to reporting season – more on that later. The market feels scarred of what August may reveal, theoretically interest rates are falling because trading conditions are tough hence negative surprises could easily become the norm for this month. The land mines have already started and todays only the first day of August, we have to assume there are more to come. The action is now likely to be focused on the stock level as CEO’s reveal their sins, fingers crossed MM doesn’t experience another Adelaide Brighton (ABC) in the weeks to come.

Inflation numbers were slightly higher than expected yesterday courtesy of rising petrol costs but bond markets hardly cast a sideways glance as more concerning economic signs continue to flash amber, the market downgrade by ABC dragged down Boral (BLD) -8% and CSR -6.3%, as the “Scomo” bounce vanished in one fell swoop for the construction sector. Housing prices may be recovering as the RBA Cash Rate looks set to dip below 1% but the major building companies are still seeing weak levels of activity. Also just to rub salt in the wounds major Sydney property developer Ralan went into liquidation yesterday, this was a 21-year old company who had built a $1.4bn 1600 apartment complex on the Gold Coast and currently has over 3000 apartments under construction or in pre-sale stage, big numbers!

MM remains comfortable to adopt a more conservative stance than we did for the first half of 2019.

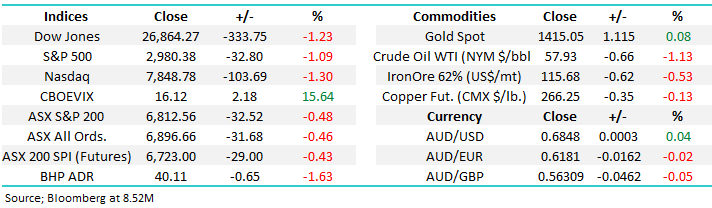

Overnight US stocks were volatile as the Fed disappointed many and only cut interest rates by 0.25% plus they didn’t signal the start of an easing cycle. The Dow initially plunged almost 500-points on the news before recovering to be down -333points / 1.2%, still a bad day at the office. The SPI is calling the ASX200 to open down ~30-points this morning which feels about right with BHP trading down -1.5% in the US. The smaller than hoped rate cut by the Fed lifted the $US which has put pressure on commodity prices implying the whole sector will follow BHP’s weak lead. The banks will need to outperform to prevent a bad day for the local bourse.

Today we are going to focus on 5 stocks that have already felt the pressure from sellers as we patiently wait for some opportunities to appear for our large cash position, reporting season is the pointy end period for investing when we focus primarily on stocks as opposed to the macro picture.

ASX200 Chart

The Fed’s 0.25% rate cut has caused the negative knee-jerk reaction we would have expected, the obvious question is are we witnessing a meaningful market turn in equities as the “free money” drip maybe coming to an end.

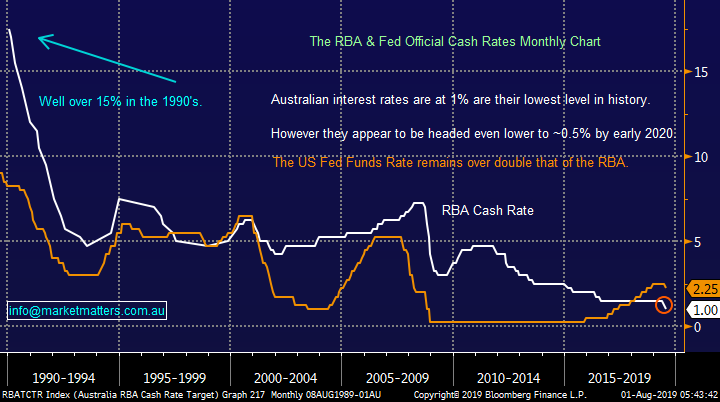

Both the Australian and US official rates are headed lower but much to the chagrin of President Trump those in the US remain relatively high, over double our own – this rate differential is pressurising the $A. The Fed cut by 0.25% was the first in a decade but importantly Chair Powell said “its not the start of a long series of moves”. The statement actually pushed the US financials up on the day and it will be interesting to see how our sector own banking sectors performs today.

MM is still considering the Bank of America for our International Portfolio.

We now feel stocks / sectors that have been pushed higher through 2019 on the prospect & hope of lower interest rates will underperform for at least a few weeks.

The RBA Cash Rate & Fed Funds Target Rate Chart

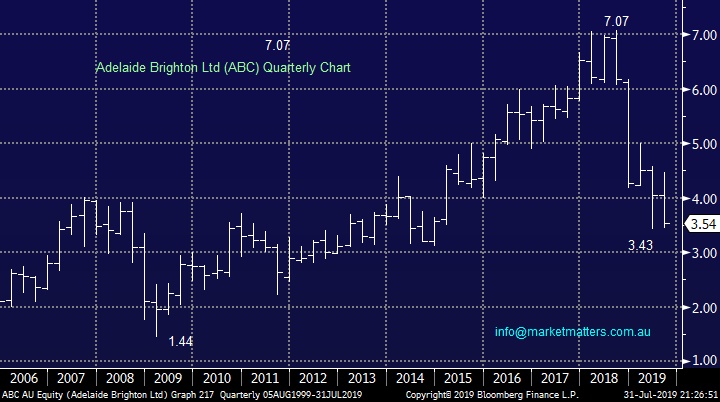

Today I have looked at a 5 stocks which have been pressured over the last week as reporting season kicks into gear. Yesterday was an uncomfortable one for MM as we saw one of our stocks in the MM Growth portfolio, Adelaide Brighton (ABC), tumble by 18%, a stark reminder that this can be a tough game at times. My thinking on ABC over the last 24-hours has 2-points coming to the fore:

1 – The reasons we took a small position in ABC still make sense even though they have proved wrong / premature. We were / are cautious in picking a bottom in the construction sector, dipping our toe in initially.

2 – The 3% holding ensured our Growth Portfolio only underperformed the ASX200 by 0.4% yesterday although when you’re holding 26% in cash you expect to be a winner when the market falls. Spreading risk is very important, especially around reporting season.

MM’s 26% cash holding means we are looking for opportunities to increase our market exposure into any undue weakness hence the nature of todays report and probably a few more similar ones to follow in the weeks ahead.

1 Adelaide Brighton (ABC) $3.54

Adelaide Brighton (ABC) gave MM our first, and hopefully last, major kick in the guts this reporting season, the building materials company downgraded full year profit expectations by around 23% relative to market expectations – only back in May they downgraded the current financial year by 10-15%, we wrongly thought they had already cleared the decks, not unreasonable given it was less than 3-months ago!

Management said this was a consequence of a softening residential housing market along with competitive pressures in QLD and SA. They also said no dividend will be paid for the first half which appears prudent. Interestingly when big cement producer Heidelberg Cement reported ~24-hours earlier they did call out weakness in Australian cement demand due to delayed infrastructure projects and softness in residential construction – one of our fundamental reasons to buy ABC was the anticipation of a pick up in infrastructure spending as the government looks for new weapons to stimulate our economy, interest rates cannot do much more heavy lifting!

At MM we still like the logic of increased government infrastructure spending but we see no reason to average ABC at present, it’s a wait and see for now, especially as ~30% of its cement sales go to the residential market which remains subdued. However we feel the new CEO Nick Miller is now getting his head around earnings / costs plus the $100m “balance sheet” review feels like a clearing of the debris before they move ahead , our concerns are more around the economy than the company.

MM is now neutral ABC, retaining our small 3% position for now but we’re not planning to average at this point.

Adelaide Brighton (ABC) Chart

3 Janus Henderson (JHG) $31.81

Overnight fund manager JHG reported and unfortunately it was another miss although not in the same league as ABC - the stock looks poised to fall between 5-10% today – a night when the Dow plunges over 300-points is not a great day for an earnings miss. Their second quarter update showed revenue of $US525m, down 9.5% on the same time last year. Assets under management were up 1% but net outflows grew by almost $US10bn, they are lucky the market rallied – the CEO described these outflows as challenging.

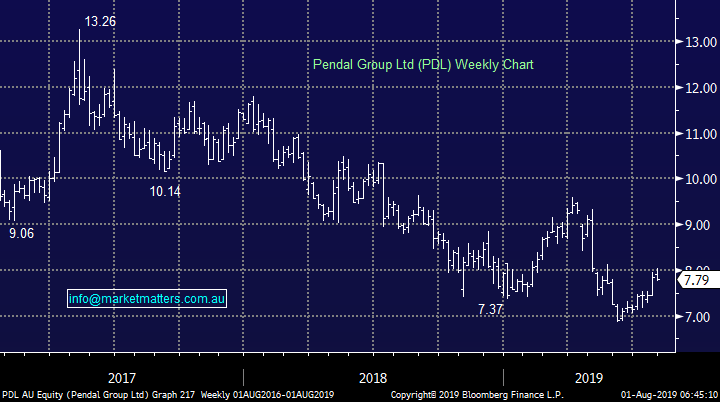

This is an example of a “cheap stock” remaining cheap for a while, we now prefer Pendal Group (PDL) for similar market exposure / risk, PDL is likely to be dragged lower if JHG does get smacked today – it opened down only 3.7% in the US but then slipped lower all night with the weak market. Hence the price differential for the switch is unlikely to be too painful.

MM is considering switching JHG to PDL and reducing market exposure – although it depends on relative performance today.

Janus Henderson (JHG) Chart

Pendal Group Ltd (PDL) Chart

3 Bingo Industries (BIN) $2.41

High flying Bingo (BIN) experienced some decent selling recently courtesy of a downgrade to neutral by Goldman Sachs and further proof that the construction picture looks tough moving forward. About a month ago MM took a nice 55% profit on BIN around $2.25 obviously premature in hindsight but the current 11.7% correction looks likely to offer the opportunity to re-enter BIN.

As we have said previously we are not too proud to buy back into a stock around, or higher, than where we sold previously – it’s just about trying to add value with solid risk / reward. We like the waste & recycling space into tough economic times as do Goldman’s whose rating change was only a function of price appreciation by BIN, not anything to do with the company’s outlook.

MM likes BIN back around the $2.20-30 area.

Bingo Industries (BIN) Chart

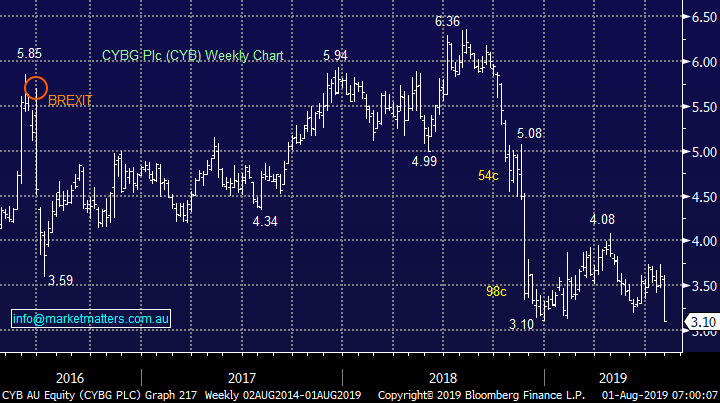

4 CYBG Plc (CYB) $3.10

UK based CYB has now fallen 14% this week after delivering a simply awful result. Their net interest margin continues to fall with no end in sight, especially with Virgin who they bought in mid-2018 now offering new mortgagees 0.8% under that of CYB – strange strategy.

The stock still feels overvalued at current levels without the attractive yield offered by the local banks to support any share price weakness.

We reiterate MM is not keen on CYB until well under $3.

CYBG Plc (CYB) Chart

5 Credit Corp (CCP) $25.15

The “debt collectors” CCP have enjoyed a stellar few years but they have slipped almost 9% this week following a disappointing full year result – stocks that have rallied need to perform. They increased net profit after tax by 9% and guided for FY2019 to be ~8% higher.

The 2 important matrix for CCP’s profitability is how much discount it can buy bad debts for in the first place and then its subsequent success rate in chasing up this bad debt. I ponder in today’s new local regulatory environment, where lending / credit requirements are being increasingly scrutinised, whether they will find the same volume of “low hanging fruit” bad debts to buy & chase. However the companies push into the US may help offset Australia’s evolving credit criteria.

The stocks valuation is not scary if it can grow by 8% plus a yield of 2.9% fully franked is not unattractive in today’s environment.

MM is currently neutral CCP.

Credit Corp (CCP) Chart

Conclusion (s)

We may switch from JHG to PDL and reduce exposure however this will dependant on relative pricing.

Otherwise we have found no compelling investment ideas at this early stage of reporting season.

Global Indices

No major change with US stocks still feeling vulnerable to us at this stage, a break back below 2950 by the S&P500, now only ~1% lower, will be a definite technical concern to MM.

We reiterate that while US stocks have reached our target area they have “not yet” generated any technical sell signals.

US S&P500 Index Chart

No change again with European indices, we remain very cautious European stocks as their tone has becoming more bearish over the last 2-weeks, we are actually targeting a correction of at least 5% for the broad European indices.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· The US equity markets lost over 1% overnight as the expected 0.25% rate cut was announced by the Fed. The decision was based on global developments and “muted” inflation, however selling in was seen after the Fed will also end the balance sheet drawdown as of today.

· Fed Chair Powell said the cut was not the beginning of a long series of rate cuts but did say “I didn’t say it was just one” cut. While the US economy remains strong, the rate cut was designed to boost inflation and sustain growth.

· Crude oil maintained its rise, testing he US$58/bbl. while iron ore sold off, with BHP expected to underperform the broader market after ending its US session off an equivalent of 1.63% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 17 points lower, towards the 6795 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.