Do we catch any of these the falling knives? (HLS, BIN, ECX, PTM, NUF, ELD, GEM,

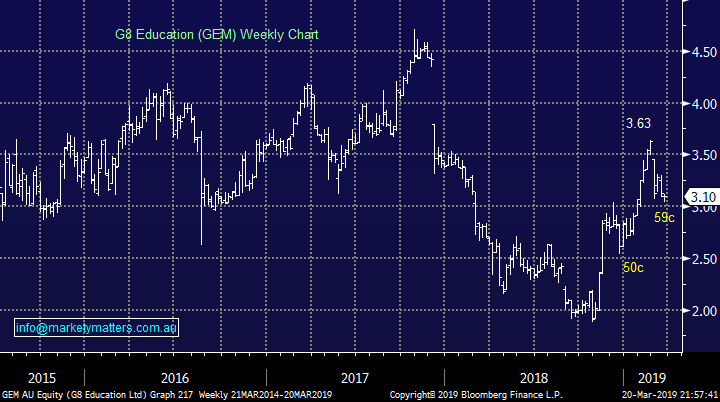

The ASX200 retreated 22-points yesterday with the main game in town avoiding “hand grenades” as we saw 4 stocks in the ASX200 fall over 10%, with an average decline for this very bad bunch remarkably over -25%. Considering we also saw our forecasted pullback by the influential iron ore names it was actually a solid performance for the bourse to fall less than -0.5% with the influential banking sector basically closing unchanged while Healthcare and Software & Services added some much needed green to the screen – interestingly on the day less than 35% of the index closed in the red showing the influence of the 4 stocks which the market so unceremoniously dumped.

Today should be an interesting session following the US Federal Reserve’s very dovish statement by the US Fed, just what markets wanted to hear with a “patient approach” the clear takeaway, however the reaction was somewhat muted. Stocks were weaker ahead of the rates decision and while no movement was expected, the commentary now calls for stability in rates for the rest of 2019. More importantly though, the Fed now plans to maintain rather than reduce its balance sheet which will obviously improve liquidity making financial conditions easier.

Locally we have our own employment data today at 11.30am Sydney time, a widely watched number given the RBA have hung their hat on strong employment as the primary reason to sit tight on interest rates, a weak number this morning will obviously open the door for the central bank to act and that may be a short term positive for the market, certainly for some sectors. However if the number is weak and the market sells off it would imply the concern around the local economy is trumping the sugar hit of lower rates - expectations are for an unemployment rate of 5.0% with 15k jobs added.

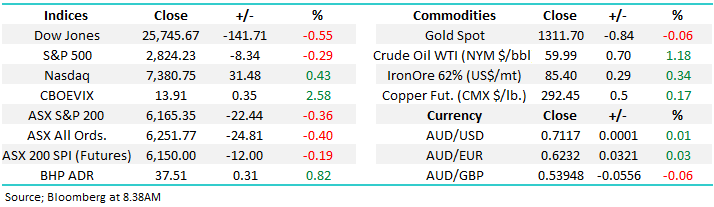

MM remains neutral the ASX200 after its strong rally from late December lows but we remain comfortable buying selective stocks.

Overnight US markets finally closed mixed with the Dow falling 141-points while the NASDAQ rallied +0.4%, the SPI is calling the ASX200 to open basically unchanged.

Today we are looking at the “dogs” of the ASX200 over the last 5 days where 9 stocks have fallen by over 5% with five of them tumbling by greater than 10% - essentially, is there a diamond sitting in this rough?

ASX200 March SPI Futures Chart

MM bought Healius (HLS) on Monday at $2.65 and it happily closed 6% higher yesterday but subscribers must remain realistic to the risks of this proposed takeover attempt by Jangho, the reason we were patient with our purchase was purely risk / reward.

As we have previously explained we purchased Healius (HLS) with one eye of the bid from their largest shareholder, however the business itself is an interestingly one. The simplest explanation I could provide is that it’s asset base could yield so much more fruit for shareholders. Good assets but returns from those assets could be so much higher, which is presumably what Jangho are also seeing.

After the stock pulled back by ~12% we added the stock to the portfolio due to our belief that the bid from Chinese suitor Jangho at A$3.25 has more credibility than the market is pricing in. Jangho currently owns ~16% of HLS and they made a bid for the company in January – which was subsequently rejected, HLS describing it as opportunistic and significantly undervaluing the business.

MM remains bullish HLS ideally targeting the $3.25-$3.50 area.

Healius (HLS) Chart

Unlike HLS, Bingo Industries (BIN) has slipped lower since we increased our position last Friday around $1.60. However we believe the waste management and recycling business which remains ~50% below its highs from 2018 is well positioned to generate strong growth in the years ahead following last month’s approval of its acquisition of Dial A Dump by the ACCC. Worth also remembering that BIN have a $75m share buy-back program in play which was due to commence on the 15th March, although from what I can see, no shares have been purchased.

MM remains bullish BIN from around current levels.

Bingo Industries (BIN) Chart

Big movers during the last 5-days.

Today we have covered five of the stocks which have fallen by over 5% in the same amount of days leaving just 4 uncovered from the 9 companies who have fallen by over 5%, below is a quick snapshot of our thoughts with these 4 :

1 - MM is still net bearish New Hope (NHC) targeting ~$3 but after yesterday’s -14% decline, and -24% over the last 5-days, we are dusting off our neutral hat – not buyers hat!

2 – We are neutral on HUB24 (HUB) which has fallen almost 9% over the last 5-days, it feels like the “forced” buying as HUB entered the ASX200 has gone and shorts are now getting the upper hand here. In January there were 2.2m share held short while today there are 4.8m shares short representing nearly ~8% of the company.

3 – Perpetual (PPT) enjoyed a strong rally this year as Blackrock bought ~12% of the company, however they have now slipped -5.3% from recent highs. We remain short term negative targeting another 5% lower in the weeks ahead, however we are maintaining exposure in the MM Income portfolio

4 – Whitehaven Coal (WHC) has not been helped by sector friend NHC, we are neutral WHC around this $4 area.

1 Eclipx (ECX) $0.83

Eclipx (ECX) was totally repriced yesterday with the vehicle leasing and financial business collapsing by over 55% in a move that would pressure any portfolio exposed to the stock. ECX said profit for the first 5-months of the current financial year was 42% lower than a year earlier and that has scuttled the proposed deal with rival McMillan Shakespeare (MMS).

Digging into the detail of the decline tells an interesting story about corporate Australia, and where we are in the economic cycle. ECX’s corporate fleet business struggled as companies extend existing fleets rather than buy new ones. They also own Gray’s online which is a business that does well in tougher economic times – it sells equipment coming out of insolvency and that’s also dragged.

That really sums up the Australian economy, corporates and consumers are cautious and focussed on cost cutting however we’re not yet seeing any real signs of stress through higher levels of insolvency.

Expect ECX to sell Gray’s & Right2Drive which provides car loans for those not at fault in a car accident

At this stage MM sees no value in ECX

Eclipx (ECX) Chart

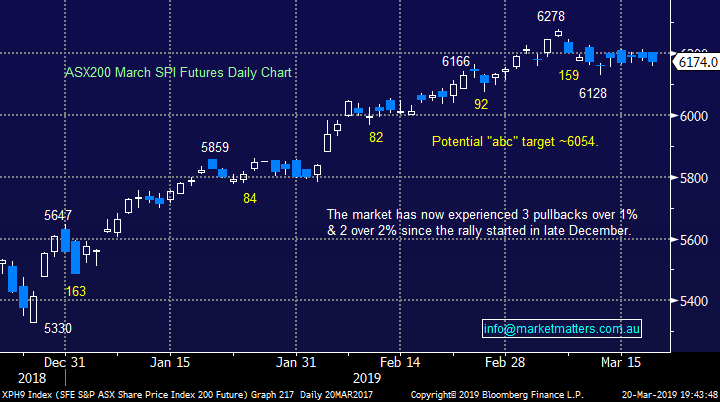

2 Platinum Asset Mgt (PTM) $4.89

Platinum (PLT) fell over 11% yesterday after Kerr Neilson and his wife Judith sold 60m shares in the asset manager he co-founded many moons ago at a 9.10% discount to the last traded price – the trade valued at $300m. It looked like there were two buyers in the transaction however he’s far from bailing out on PTM – he still owns more than $1.2bn worth of stock in PTM.

However we feel the company’s founder will continue to drip feed the market with their 43% holding which creates 2 concerns:

1 – There is a clear overhang / headwind to the share price from the couples 43% stake hence when the stock has a strong move, like in 2019, don’t be surprised to see a repeat performance.

2 - New management is untested when compared to Kerr Neilson’s excellent track record.

MM is neutral PTM and will only consider the stock into decent weakness when its cheap compared to its peers e.g. under $4.25.

Platinum Asset Mgt (PTM) Chart

3 Nufarm Ltd (NUF) $4.23

NUF was smashed almost 24% yesterday after downgrading FY19 EBITDA expectation to $440 million-$470 million down more than 11% from previous guidance of $500 million-$530 million plus they have temporarily suspended their dividend as they prepare for a tough second half.

Obviously at MM we are very glad to have avoided NUF and it was largely a result of the MM community being on the ground operating in various industries around the country.

MM is now watching NUF but our finger is not yet inching towards the buy button.

Nufarm Ltd (NUF) Chart

4 Elders (ELD) $5.73

Elders closed down -7% for the last 5-trading days at $5.73 making fresh multi-month lows as the stock continues to grind lower.

The stock is trading on an Est P/E for 2019 of 11.1x while yielding ~2% making it attractive but not “super cheap” in a very tough time for the agricultural sector. At this stage we would rather buy the stock when it was potentially bottoming as opposed to catching the falling knife – we saw with ECX when sectors struggle it can unravel worse than many anticipate.

MM is neutral ELD at this stage but we are watching carefully.

Elders (ELD) Chart

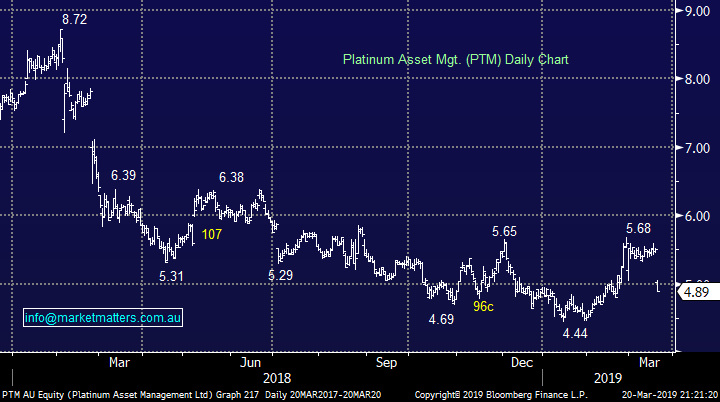

5 G8 Education (GEM) $3.10

GEM has fallen 5.2% recently but it’s not “felt right” hence we haven’t gone long as we have previously contemplated.

The stock had rallied as a turnaround story after struggling with the oversupply of child care centres and subsequent dilution of occupancy rates with the market clearly not convinced at this point in time plus the stocks not overly cheap trading on an Est. P/E for 2019 of 15.9x. Aggressive players can buy around $3.10 with stops below $2.90 – although this feels a little like the false rally of optimism that we saw in 2017.

MM is now neutral GEM just here.

G8 Education (GEM) Chart

Conclusion

Of the stocks looked at today, MM is unlikely to be a buyer short-term.

Global Indices

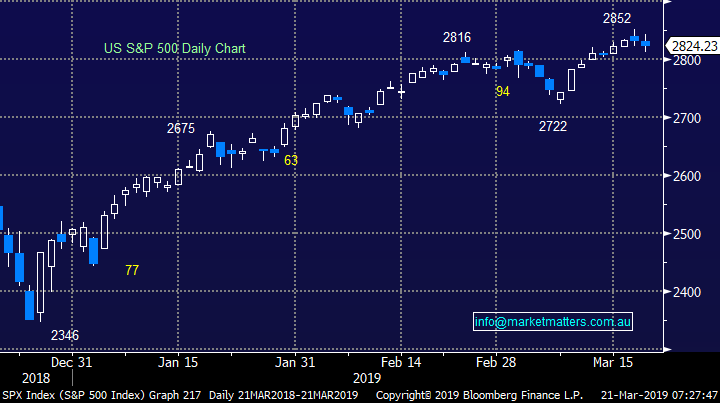

No major change with US stocks which like our own are proving very resilient to any meaningful pullback. We cannot be negative the US S&P500 Index short-term while it holds above 2810 which is now very close.

However we will continue to avoid stocks that are highly correlated to the US at this point in time e.g. Macquarie Bank (MQG).

US S&P500 Chart

Also no change, European indices are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage.

Any significant Increase in our equities exposure moving forward may be accompanied by purchasing a negative facing ETF.

German DAX Chart

Overnight Market Matters Wrap

• A rough ride for the US equity majors overnight with the Dow losing 141 points, while bonds hit their lowest levels in a year towards 2.5% after the Federal Reserve cut US growth outlook for 2019 from 2.3% to 2.1% and said there would be no more rate rises this year.

• The US Fed Chair, Jerome Powell cited headwinds from a “substantial slowing “in growth from both the European and Chinese economies. He also added that the Fed would end its balance sheet unwind in September. His comments, which contrast with previous expectations of two hikes in 2019 and growth of 2.3% from the December update, saw the US$ weaken, with the A$ back up to US71.1c.

• Gold rallied to over US$1310/oz. while crude oil settled 1.18% higher its highest level since November 2018.

• On the European front, markets also sold off, in particular the German market (-1.5%) as the UK Prime Minister Theresa May officially asked the EU for an extension on the Brexit deadline, currently due on March 29th, to June 30th. The EU president, Donald Tusk, said the extension would likely be supported, but interestingly only on the condition the UK parliament backs the current exit proposal, which has already been knocked back twice.

• The March SPI Futures is indicating the ASX 200 to open with little change, yet a volatile opening is expected due to March Index Expiry this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.