Delving into the extreme volatility under the markets hood (IRE, WEB, WTC, APX, SIQ, FLT, APA)

The ASX200 extended its political induced correction yesterday falling another 21-points, bringing the decline so far from Mondays high to -1.8%. The banks have continued to lead the falls as investors consider a potential rerating of the sector courtesy of a looming Labor victory at the polls between now and May 2019, franking credits and housing remain the markets main concerns.

What a week for Bill Shorten, he’s simply sat back and watched the Liberal Party disintegrate in front of him, just as his own party did a few years ago when Kevin Rudd ousted Julia Gillard – will politicians ever learn or am I just being too optimistic. For the punters amongst you the odds this morning are Labor $1.28 and Liberals $3.4 to win the next Federal election, that’s a very high degree of confidence that we have a change of government on the horizon. For today’s ballet in the Liberal Party Room, Julie Bishop is now the favourite at $2.20 slightly ahead of Dutton at $2.30.

Enough with the politics, there is so much action happening within our market without the added complication of offshore influences thrown into the mix.

· We remain neutral / negative the ASX200 after the close below 6300 and remain in “sell mode”.

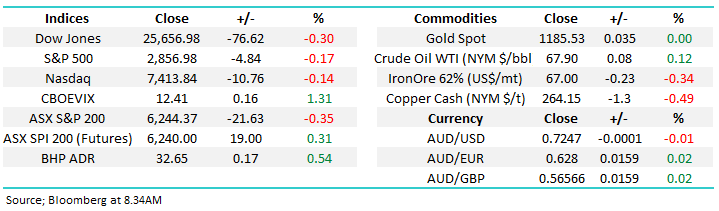

Overnight stocks were mildly weaker with our own $A the standout falling 1c against the $US during the last 24-hours to sub 72.50c. Our futures are calling the ASX200 to open up around 20-points helped by BHP being mildly firmer and some potential intra-week traders taking some $$ off the table before the weekend.

Today’s report has almost been forced to look at some of the extreme swings within our market as 16 major stocks in our index moved by over 5% while 6 rallied an astonishing +10%, and all this occurred when the index slipped just -0.34%.

A few companies out with results so far this morning;

1. Star Entertainment (SGR) – looks a strong beat to expectations

2. Brambles (BXB) – above expectations and guidance okay

3. Medibank (MPL) – looks a miss

ASX200 Chart

Continuing with the weeks theme of watching the September SPI futures for clues to at least the short-term direction for the Australian market.

· MM received a technical “sell signal” from the SPI on Tuesday, caused by the volume break below 6250.

Our initial target remains the 6150 area, or another ~1% lower but we wouldn’t be surprised to see some consolidation over next 1-2 days.

ASX200 September SPI Futures Chart

Today we were clearly spoilt for choice when it came to stocks to evaluate with significant volatility in almost every direction you look. We have not necessarily picked the days largest movers but have selected stocks where we believe MM can add some value / insight.

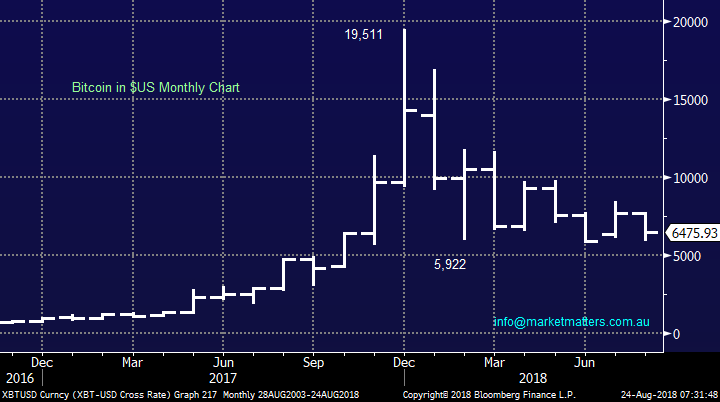

At the end of 2017 markets witnessed amazing irrational exuberance / FOMO (Fear of Missing Out) as Bitcoin surged in a move resembling the Tulip mania of the 1636-7 times.

Some of the moves we are seeing today in Australia’s few growth stocks reminds me of these moves just on a significantly toned down manner. Simple supply and demand seems to be pushing our growth stories to extreme valuations, especially when compared to their global peers – i.e. Australia has got very few true growth stories compared to say the US.

· We still believe this is not the time in the economic / stock market cycle to be chasing high growth / valuation stocks but so far the markets are not listening.

NB We are not calling the growth stocks to collapse like Bitcoin just simply come back “to the pack” a little.

Bitcoin $US Chart

Winners

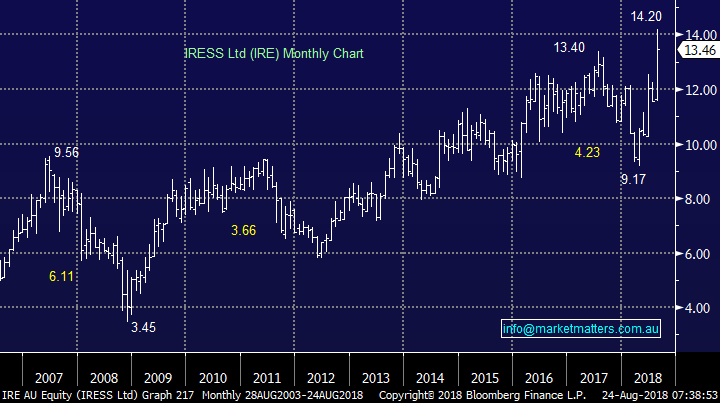

1 Iress (IRE) $13.46

IRE rallied +11.1% yesterday following its report showing both the net profit of $32m and revenue beating market estimates, coming up 8% on the year.

The rally allowed MM to realise a nice 17% profit from a position held for only around ~1-month i.e. we simply followed our laid out plan.

The stock is at the expensive end of the scale trading on an Est P/E of 30x while yielding 3.3% fully franked.

· MM is now neutral IRE seeing no attractive risk / reward.

NB IRE is not the most liquid of stocks and hence one that MM will always choose to sell into strength when possible.

Iress (IRE) Chart

2 Wisetech Global Ltd (WTC) $23.73

Wisetech (WTC) was the largest winner on the market yesterday rallying another +19.3%, continuing its sensational week.

The logistic cloud-based platform provider’s shares are now trading on a scary P/E of 110x Est 2019 earnings – however that seems irrelevant at the moment as long as they can continue to grow the top line, which they are doing. Ultimately though, businesses mature and valuations become important, usually when growth slows and that leads to a big PE re-rate. Obviously that’s not happening with WTC now, however it will at some point.

· MM is neutral WTC on a pure risk / reward basis.

Wisetech (WTC) Chart

3 Webjet (WEB) $17.12

WEB surged 17.1% yesterday after reporting an excellent full year result. Revenue increased by over 50% and NPAT (net profit after tax) over 60% to $55.7m.

Importantly the board reiterated its growth forecasts for the coming year. On the day some of the buying felt like funds being switched from Flight Centre (FLT) which had a very different experience.

WEB is trading on a reasonable P/E for a growth stock of 26.7x Est 2019 earnings while yielding 1% fully franked.

· MM is currently neutral / positive WEB after realising a nice ~38% profit earlier in the year but unfortunately now clearly too soon.

Webjet (WEB) Chart

4 Appen Ltd (APX) $14.44

Leading provider of data for the artificial intelligence market APX shares gained 12.3% yesterday on no news adding weight to our “feeling” that at least one fund manager has been forced to press the buy button on the high growth sector of the Australian market.

After market yesterday APX stated they know of no reason for the gains in their stock, while reiterating that they expect their half year results to be in line with expectations again – this morning will be interesting.

· MM feels APX looks vulnerable above $14.

Appen Ltd (APX) Chart

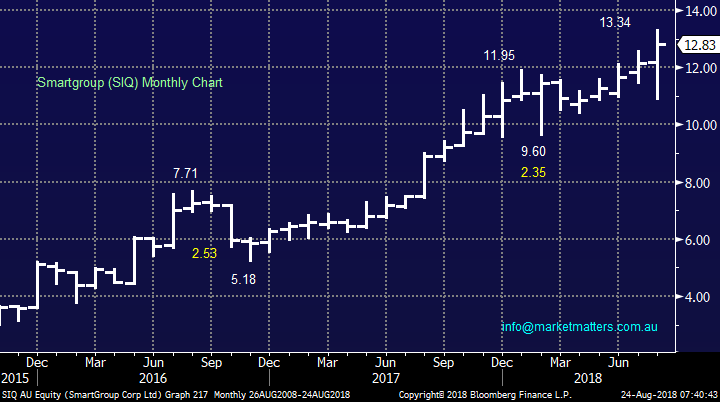

5 Smart Group (SIQ) $12.83

SIQ rallied +12.9% yesterday following the release of its first-half results on Wednesday. The outsource salary packaging company reported a NPAT of $38.5m for the half year with revenue increasing by 26%.

SIQ is trading on a conservative P/E of 20.8x for Est 2018 while yielding 2.7% fully franked.

· MM is currently neutral SIQ and technically would not be surprised to see a retest of $10.

Smart Group (SIQ) Chart

Losers

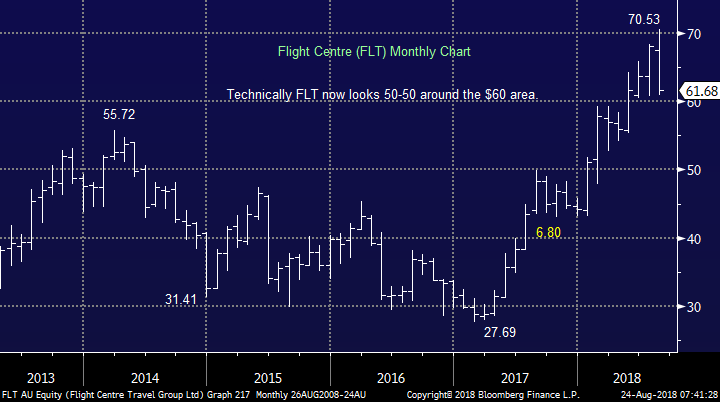

1 Flight Centre (FLT) $61.68

FLT shares plunged -8.1% yesterday after the store front travel agents profit missed market expectations plus as we said earlier it felt like “sell FLT and buy WEB” was the trade of the day for a number of players.

The result saw NPAT of $264m compared to expectations around $275m but the miss was accompanied by the news that ~200 employees had contacted the ABC with complaints around their experience with the company – bad timing for the share price.

· MM is neutral around the $60 area.

Flight Centre (FLT) Chart

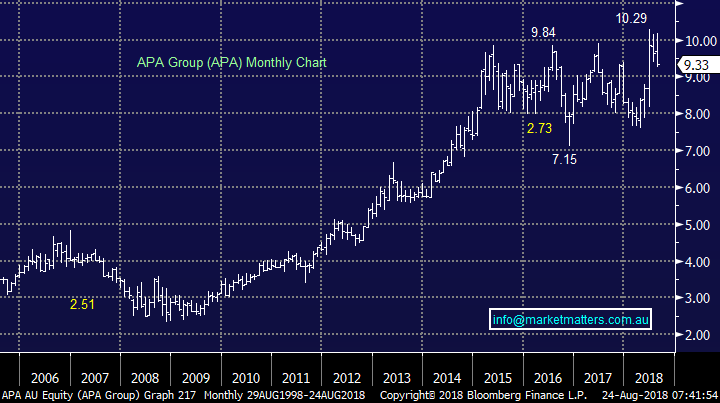

2 APA Group (APA) $9.33

APA fell 8% yesterday given the current takeover bid in play from CK Infrastructure Holdings may hit a snag if Labor win in an early election + we also had one broker downgrade the stock to a hold. The natural gas infrastructure company is trading on a rich P/E of 37.8x for 2019 while yielding 4.8% part-franked.

· MM is bearish APA targeting under $8.

APA Group (APA) Chart

Conclusion

We obviously have a number of different opinions of the 7 stocks covered this morning, a simple summary is below:

Bullish – Webjet.

Neutral – Flight Centre (FLT), Appen Ltd, Iress and Wisetech.

Neutral / Bearish – Smart Group.

Bearish – APA group.

Overseas Indices

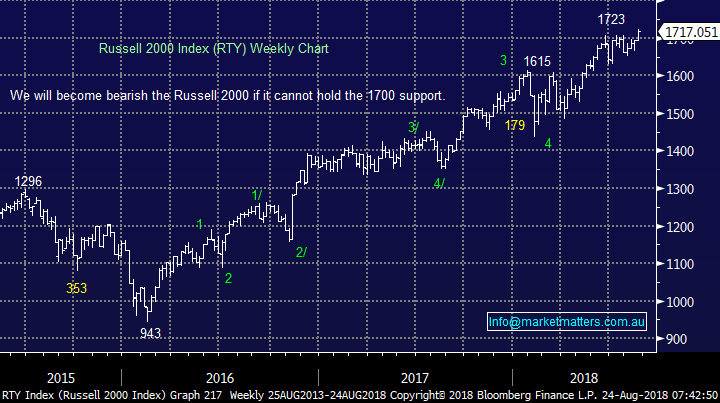

US indices had a quiet night and we continue to watch the Russell 2000 closely for a potential sell trigger under 1700 i.e. 1% lower.

US Russell 2000 Chart

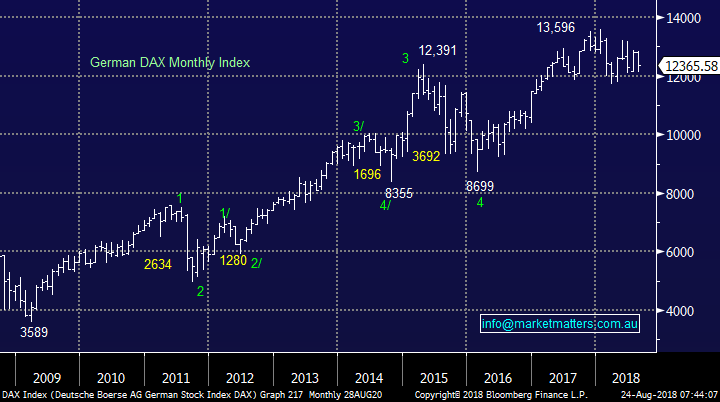

European indices remain quiet and devoid of signals.

German DAX Chart

Overnight Market Matters Wrap

· The US markets closed marginally lower overnight, as investors wait to digest further information on Jackson Hole, where US central bankers will meet and Chairman Jerome Powell will speak.

· Domestically, all eyes will be on the Liberal Party at midday to determine who will be our next Prime Minister.

· On the LME, nickel and copper fell, while aluminium rose. Oil was flat while iron ore fell 0.5%.

· Companies expected to report today are BXB, CHC, MPL, MYX, SCG, SGM, SGR & WPP.

· The September SPI Futures is indicating the ASX 200 to open 30 points higher, testing the 6275 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here