Deep breath : 5 stocks we like today! (CBA, COH, XRO, STO, BPT, CSL, WEB)

The local stock market crashed almost -10% yesterday in one of its worst days in history, we saw 97.5% of the ASX200 close down on a day when over 100 stocks plunged by more than 10% - I had to recheck that number myself even after watching the carnage unfold. A huge plethora of news crossed our screens yesterday from a flow of worsening of the coronavirus news, massive central bank interest rate cuts, travel bans, profit warnings, flight reductions and cash injections but the ultimate dominant factor was panic which cascaded through equities leaving the local market down more than 500-points when the bell rang.

To refresh, the current sell-off is a confluence on four issues, two major black swan events and the associated fallout.

- Coronavirus spread

- Low confidence in government response

- Crashing oil prices, and

- The unknown economic impact of social measures, travel restrictions, social distancing etc

After Friday nights almost 2000-point surge by the Dow I’m sure many people anticipated a solid start by the local bourse but before we even opened the news flow had started in earnest with the interpretation at every turn simply increasing levels of panic:

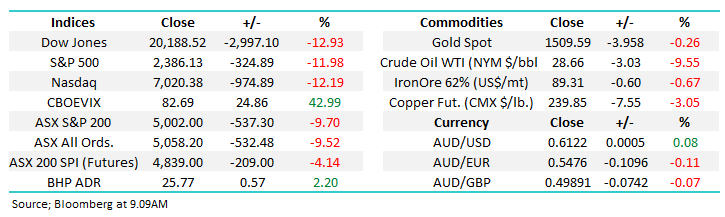

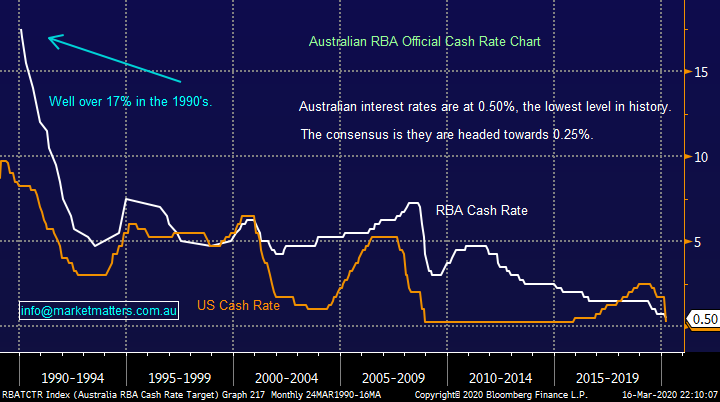

Central banks look to have hit “crisis mode” with NZ cutting rates from 0.75% to 0.25% plus the news which appeared to really unnerve investors was the US Fed drastic action of slashing their Fund Rate to almost zero while they also ruled out including the corporate bond market in QE plans. US S&P500 futures were locked limit down before our market even opened meaning any traders / investors caught long who wanted, or more importantly, needed to sell a market highly correlated to the US had to sell Australia, and boy did they ever – most of Asia which traditionally does its own thing on a comparative basis was only down between 3 and 4%.

NB Our own RBA is expected to cut rates further to 0.25% in the coming days.

Australian RBA v US Feds Cash Rates Chart

So on one hand we have central banks and governments throwing the kitchen sink at their respective economies in an attempt to arrest a prolonged recession caused by the COVID-19 pandemic while on the other hand we still have a Mexican stand-off unfolding between Saudi Arabia and Russia which has helped send the oil price down by over 50% since mid-January.

– With the oil price trading below $US30/barrel many analysts are predicting a large number of US shale producers cannot survive as they traditionally shoulder significant debt burdens which need servicing, hard to do when you’re not turning a profit! Hence the contagion like tightening in the credit markets although very few big energy companies actually have debt rolling over in 2020, only around 6% of their total exposure. However panic is the main game in town so we are seeing knock on effects in banks who will ultimately be major losers if we see huge defaults in the Energy Sector but nobodies considering the potential scenario that Saudi Arabia and Russia could patch up their differences – the glass is half empty, and some.

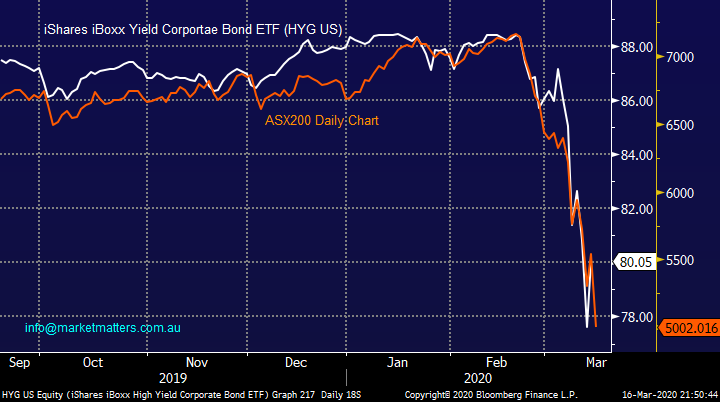

The big canary in the coal mine for equities are corporate / junk bonds and the chart below illustrates perfectly how closely the ASX200 has followed the US Corporate Bond ETF (HYG US). Let’s move on down the timeline from today’s action by central banks cutting interest rates and beefing up QE, the markets clearly worried they‘ve run out of bullets, it makes sense as they essentially have!

However I think back to the GFC, what if Donald Trump whose desperately trying to get his election campaign back on the front foot guaranteed the Energy Sectors debt for say the next 2-years, not a bad punt going long oil ~$US30/barrel after its just halved, I reckon this course of action would return stability to financial markets almost overnight. An extension of this would be including corporate debt in the Fed’s QE measures, something they ruled out at yesterdays meeting, but something they should be reconsidering to restore confidence.

Markets will as always find a level to bottom out, the million dollar question is how low will the current panic take us, we feel the time is very close at hand for the brave.

ASX200 v Junk Bonds Chart

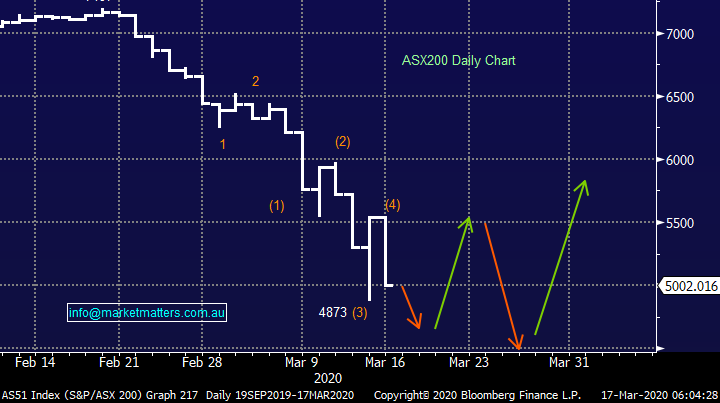

When we look at the savage 32% decline by the ASX200 its easy to get caught up in the short term angst gripping markets, however from a technical perspective at least its current volatile rhythm may slowly be showing its hand, albeit in an extremely unsettling manner. The technical picture has now become clearer, implying that in the short-term we should be buyers around 4800 and sellers back toward Fridays 5500 high level, a week or two rotation between these levels would not surprise moving forward - we are often asked how we see things unfolding, our “best guess” in todays crazy market is shown below, it’s a very similar “picture” to how many major declines have unfolded over history, we feel it’s time to accumulate stocks – certainly feels uncomfortable enough!

Hence we consider tweaking our portfolio mix MM are buyers ~4% lower and sellers 10% higher.

NB These ranges would normally be regarded as crazy ranges for a week but certainly become the norm this month.

ASX200 Chart

An updated snapshot of Global Markets

US stocks were again smashed overnight, with the Dow closing down almost 3000-points / 13%, the chart below illustrates the current aggressive decline by the broad based US S&P500, Fridays strong bounce was clearly a correction to the COVID-19 plunge but we believe another rally of this magnitude, or even more is very close at hand.

At MM we have refrained from aggressively pushing the buy button for our International Portfolio, it just “felt wrong” previously but we started last night with Microsoft (MSFT US), watch for additional alerts.

US S&P500 Index Chart

The traditional safe havens have also been struggling over the last few days, overnight gold was weaker while US 10-year bonds failed to reach their dizzy heights of last week, in fact even after rates were slashed in the US yields on the closely followed 10-year Notes are double where they were – investors just want cash, a stampede to “risk assets” will ultimately follow when the dust settles on this panic.

MM believes US bond yields have bottomed in 2020.

US 10-year Bond yield Chart

A fresh look at 5 stocks we like at current levels.

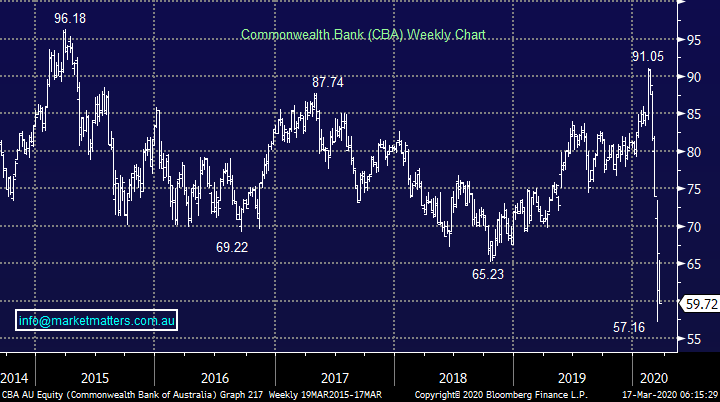

When a goliath like CBA can be unceremoniously dumped 37% in just a few weeks it’s obvious there’s both alarm and confusion roiling through equities – panic, irrationality and fear are the dominate emotions that ae gripping equities. As we’ve said previously I know it’s hard when we are all about to have our lifestyles dramatically changed for the next 1-2 months but we need to look further ahead - think of Wuhan / China, after 6-weeks of aggressive lockdown and too much TV they have recommenced they’re normal daily lives. Hence we feel strongly subscribers should consider how things were at the end of 2019 because in most cases that’s how we will be when Christmas rolls around in 2020, it will have just been an extremely /unprecedented rocky journey to get there.

“Keep it simple stupid (KISS)” – and consider what businesses should be operating solidly in late 2020 that have been potentially oversold (obviously a judgement call) in todays panic.

This morning we’ve served up a report for the brave and mindful investor who is prepared to look longer term and invest for the future when the majority are panicking, not an easy trait but historically a smart course of action – some of the 5 stocks below have previously been considered but some ideas are new for both you and ourselves to ponder.

We have been talking at length at moving “up the quality curve” but we also feel that 1 or 2 stocks are close to phenomenal bounces eclipsing from a % perspective those witnessed by Fridays stellar turnaround by the markets hence the below 5 list is a mixed bag of quality and heavily oversold candidates which we feel are poised for both solid steady recoveries and / or aggressive bounces.

NB This is not the time to reinvent the wheel, just look to buy quality stocks that have been oversold.

Commonwealth Bank (CBA) Chart

1 Cochlear (COH) $174.51

Cochlear has understandably scrapped earnings guidance because of COVID-19, I find it hard to comprehend this would be a surprise for any stock within our market but any sniff of bad news is weighing heavily on individual names. Because this situation is highly uncertain, companies have very little read through on what the earnings impact will be in the short term, so they are simply stepping back from their projected numbers.

Dumbing things down, we simply need to assess whether or not Cochlear has the balance sheet to get through short term issues and whether or not the demand into the future for their products will rebound, in both instances, we believe this will be the case.

People will need hearing implants once we’ve moved on from this pandemic and COH’s technical / market advantages will remain in place, while their balance sheet is robust.

MM likes COH below $170.

Cochlear (COH) Chart

2 Xero (XRO) $68.16

A stock we have mentioned previously, XRO is a quality online accounting business with a strong balance sheet and no “shopfront” presence, perfect in both today’s environment and moving forward. When business is disrupted as is the case now it often prompts change, the need to improve systems, the need to get better data and insight, and this is exactly what Xero delivers.

While this is a traditional high P/E growth business, it has a very solid and predictable annuity style earnings base.

MM likes XRO into fresh 2020 lows.

Xero (XRO) Chart

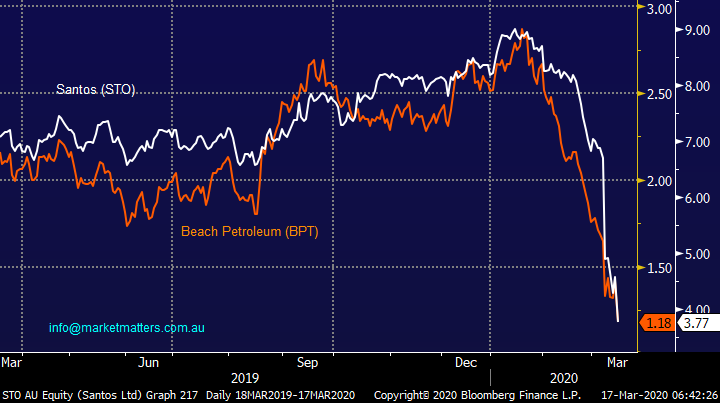

3 Beach Petroleum (BPT) & Santos (STO) $3.77

The one-two of COVID-19 and the new “Oil Price War” has seen the Energy Sector simply battered, over the last 5-days alone Santos (STO) has fallen 23% and Beach (BPT) 11.3%, the reason being that BPT carries no debt while Santos does, plus BPT has more exposure to the domestic gas markets. Santos on the other hand is the lowest cost producer of oil in Australia, with most leverage to any improvement in the Oil price.

To gain best exposure to an improvement in the Oil price, we believe there is an opportunity to switch from BPT to STO, and increase our weighting slightly.

MM likes Santos (STO) after its recent savage decline.

Santos (STO) v Beach Petroleum (BPT) Chart

4 CSL Ltd (CSL) $281.34

No introductions required here, CSL is world class company which has corrected 25% making it an excellent medium / long-term investment in our opinion.

MM likes CSL below $280.

CSL Ltd (CSL) Chart

5 Webjet (WEB) $4.32

Webjet is in the vortex of the current storm and its share price is showing that loud and clear. In February they retracted their guidance (understandable) and there is considerable uncertainty about what the overall impact on the business will be. As a consequence, this is a high risk play and certainly not for the faint hearted.

Again, looking through the noise, the Webjet business model is one we like, capital lite, low fixed cost base and fairly well diversified across the broader travel industry (corporate, leisure etc) . People will be going on holiday in a years’ time and this on-line booking platform will used by many – the 70% collapse in 2020 we feel is overdone and a ~50% bounce, back towards $6, once the dust settled is a very strong possibility.

MM likes WEB down towards $4 as an aggressive short to medium-term play.

Webjet (WEB) Chart

Conclusion

MM is keen on the following 5 stocks on different timeframes, we like them all but from a subscribers perspective it obviously depends on objectives and risk profile.

1 – Aggressive short-term bounce / rally – Webjet (WEB)

2 – Excellent medium-term prospects from current levels – Santos (STO)

3 – Excellent long-term prospects from current levels - CSL Ltd (CSL), Cochlear (COH) and Xero (XRO).

Overnight Market Matters Wrap

- There was no relief in sight from the global coronavirus pandemic overnight as Wall St was sold off aggressively, wiping out Friday’s 9% gains, with the Dow tumbling the most since the 1987 crash - nearly 3000 pts (-13%) - after President Trump admitted the worst of the virus effects could last until August and that the US could be heading for a recession. The moves came despite the Federal Reserve’s massive monetary policy stimulus, including cutting interest rates to zero, to help offset any US economic slowdown.

- European markets had earlier dropped 5% as the Euro economy went into lockdown with further borders closed and Spain banning all non-essential travel for the next 15 days. Airline and tourism stocks in particular were smashed as travel was further restricted, and the oil price fell another 12%, with Brent below US$30/bbl, on the expected demand slump.

- Investors once again sought the safety of the bond market with US ten years rallying strongly to around 0.75%. Gold however failed to find support, dropping back below US$1500/oz along with the other commodities as fears grew of a global recession. Locally the futures are currently down over 4% to 4840. The A$ is trading at a post GFC of around US61c.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.