Crude Oil leading a pullback? (STO, NHC, WHC, CVX)

I hope everyone had a great Australia Day long weekend, Sydney certainly turned on the weather for the occasion - boats, pools and obviously the beach the places to be! With Australian markets commencing trading this week on a Tuesday it means we are no longer first major market to start trading this week (sorry New Zealand).

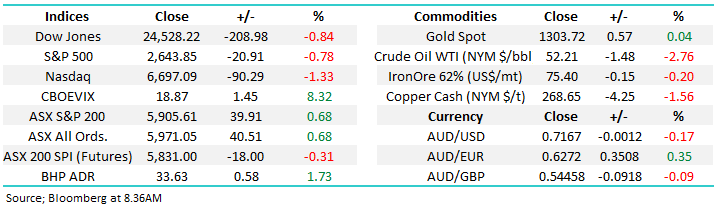

Following weakness overnight in global markets the SPI futures are calling the ASX200 to open down 20-points, a good effort when we consider Fridays strength locally and the Dows 200-point fall. However, BHP is looking to open over 50c higher helped by a strong iron ore price courtesy of the Vale disaster in Brazil where the death toll unfortunately has now hit 60, the 2015 dam disaster also in Brazil which involved BHP will still be fresh in locals minds with Vale a party in both instances.

The longer term ramifications here will be significant not only for Vale but the global mining industry as a whole. We’ve now seen two major disasters involving tailing dams where the death toll has been significant. The human element to this is clearly troubling and this will no doubt increase the scrutiny on existing facilities and you’d have to think further precautionary shutdowns are likely plus the approval channel for new mine development will increase significantly which is a negative for future global production. Higher costs and less development is supportive of price and we’re seeing this in the Iron Ore market.

We are long RIO in the Growth Portfolio and Fortescue (ASX: FMG) in our Income Portfolio, any excessive strength will be considered a selling opportunity – our current target for RIO is $87.50-$88, or 8% higher and above $5 in Fortescue.

Overall, MM remains in mild “sell mode” with our Emerging Markets IEM ETF position currently in our sights.

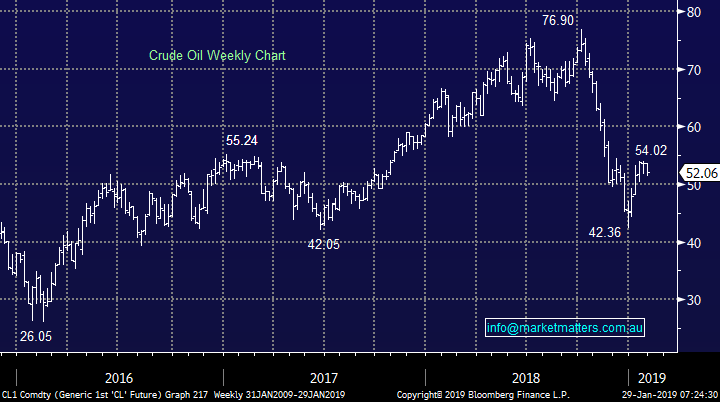

Today’s report is going to revisit the crude oil market and the Energy Sector following last night’s especially weak session i.e. crude oil fell -3% overnight.

ASX200 Chart

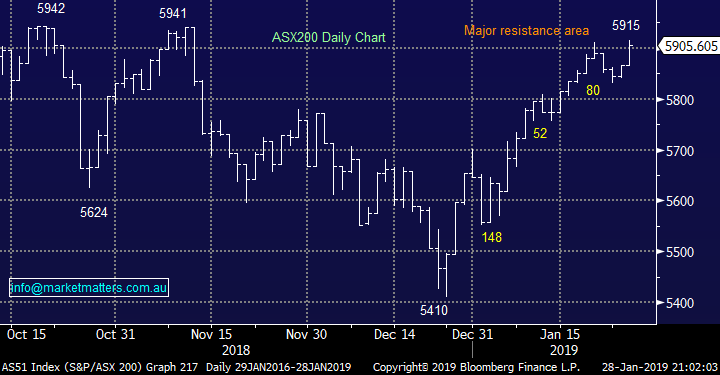

While the US market fell by ~1% last night this hardly registers as a dot on the radar when we look at the US S&P500 over recent months. The main negative influence came from Caterpillar’s (CAT) 9% plunge following its biggest earnings miss in a decade with blame being put at the foot of the slowdown in China . Caterpillar is often seen as the bell weather of global economic growth and while they missed Q4 earnings estimates, their guidance for the next 12 months was weak while their forward order book has declined.

Overnight, the Dow may have closed down 208-points but it still bounced over 200-points from the intra-day low, the price action of a market consolidating recent gains as opposed to one about to recommence its bearish decline.

MM is looking for buying opportunities into weakness over the weeks ahead.

US S&P500 Index Chart

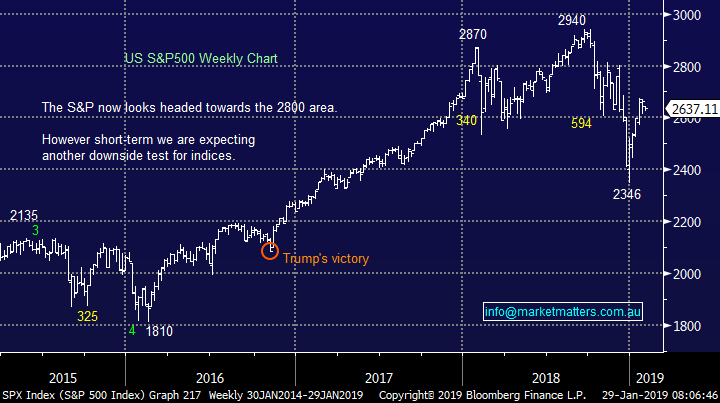

Crude Oil & the Energy Sector

Crude Oil has an uncanny knack of following moves in global equities which makes sense as a correlation with the demand for oil / energy is an obvious indication of the strength of the underlying global economy, and individual countries for that matter.

The price of crude oil has plummeted 45% since its October high although it’s now having a rest bouncing 25% from its late December low.

MM’s outlook for crude oil, implies some good opportunities in the weeks / year ahead:

1 – Crude should continue a choppy recovery up towards $US60/barrel.

2 – However a pullback towards $US48-50/barrel looks likely first.

3 – In the next few years we can see a test of the major $US26-30/barrel area implying any buying of oil/energy stocks should be more short-term in nature – a likely theme in 2019.

Crude Oil Chart

The correlation between crude oil and US stocks is indisputable when you look at the chart below e.g. they actually both bottomed on the 24/25th of December.

Interestingly our view on crude oil coincides with how we see stocks in 2019 i.e. an ongoing choppy correction higher before another leg lower. Hence any reasonable correction in energy stocks over the next few weeks should present a good short-term buying opportunity.

Crude Oil v S&P500 Chart

We have 3 stocks in our sights as buying opportunities moving forward, it’s important to note we are looking at the slightly more volatile end of town because we only anticipate the purchase being short-term in nature.

What surprise many is that we have 2 coal stocks amongst the small list but it’s a theme we’ve had over recent months without yet pulling the buy trigger due to surprisingly quick rallies in both stocks.

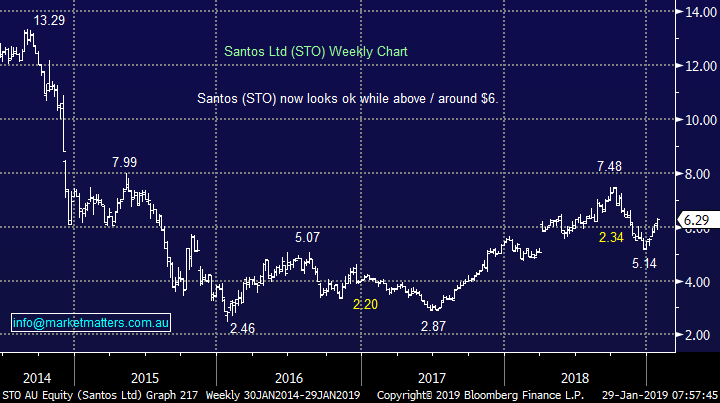

Santos (ASX: STO) $6.29

Santos has been a tale of woe over the last 5-years but the stock’s regained at least some “mojo” since 2017.

The 22% bounce by STO over the last 5/6 weeks shows it’s an ideal vehicle to invest in for our anticipated choppy recovery in oil up towards $US60/barrel.

MM likes STO into weakness, ideally around or below $6, looking for a strong few months ahead and potentially a test above $7.

Santos (ASX: STO) Chart

New Hope Coal (NHC) $3.86

We remain bullish NHC although from a risk / reward basis the ship may have sailed.

MM are keen buyers of NHC around $3.50 targeting fresh highs above $4.

New Hope Coal (ASX: NHC) Chart

Whitehaven Coal (WHC) $4.86

We remain positive WHC targeting an eventual break above $6.

MM likes WHC back towards $4.70 in the next few weeks.

NB We have a preference for NHC in the Growth Portfolio and Whitehaven Coal in the Income Portfolio.

Whitehaven Coal (ASX: WHC) Chart

Chevron (US: CVX)

Interestingly enough, looking overseas at US energy giant Chevron, this has generated has generated a technical buy signal targeting a 20% rally.

The ideal area for CVX is $US108-110 – only a few % lower.

It’s encouraging to our outlook for the local energy sector to have a positive look / feel around this large Dow stock.

Chevron (US: CVX) Chart

Conclusion

MM likes Santos (STO), New Hope Coal (NHC) and Whitehaven Coal (WHC) into weakness over the weeks ahead.

Overnight Market Matters Wrap

· Growth concerns in the US returned to investors’ eyes overnight, following disappointing earnings from Caterpillar (CAT.US) which brought the major 3 indices to close in the red.

· Iron ore rose ~5% overnight as one of Vale’s tailings dams in Brazil burst killing at least 60 people, with many hundreds still missing.

· Most metals on the LME were weaker, led by aluminium which fell nearly 3% as the US lifted sanctions on Rusal. Crude oil fell 2.76% despite the Saudi’s pledge to pump less oil than expected under the most recent OPEC agreement.

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 1.73% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 15 points lower, towards the 5890 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.