COVID-19 has accelerated the move away from cash, where are the potential winners? (NAB, CWN, APT, V US, TYR, EML, Z1P)

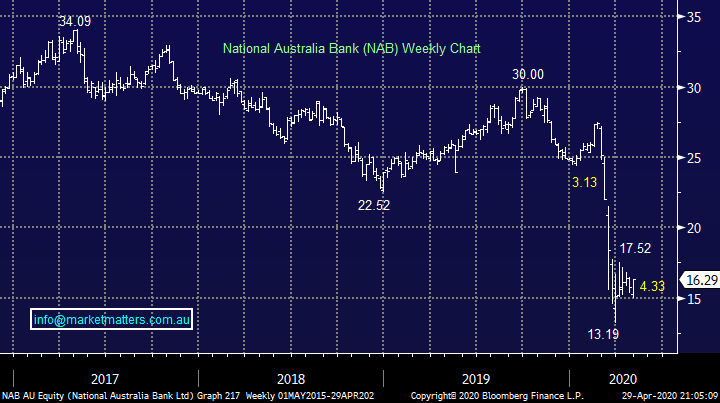

The ASX200 is enjoying a strong run into the infamous month of May, the local bourse rallied +80-points / 1.5% on Wednesday, ignoring a weak performance by the US in the process. The Banks stormed back into the winner’s circle with CBA, the worst of the “Big 4”, advancing an impressive +4.2%. The struggling Energy Sector was best on ground rallying +5.2% while the previous “safe haven” Healthcare, Utilities and Consumer Staples all retreated. Basically, the action “under the hood” is following the trend identified in the Weekend Report as investors move up the risk curve.

For subscribers who are wondering why MM hasn’t pounced on the latest market internal trend the answer is simple, were already heavily skewed towards this end of town e.g. the MM Growth Portfolio holds a ~3x index weight to energy, a position we like very much.

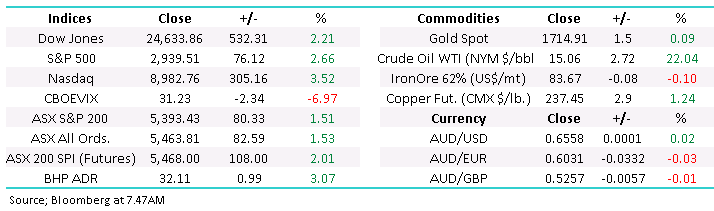

The strongest of the major banks yesterday was NAB which raised $3.5bn earlier in the week at $14.15, Wednesdays close is already showing a nice 15% paper gain, although placement stocks won’t get tomorrows 30cps dividend. More importantly the stock and sector is now looking great and while NAB can hold this weeks $15 low our first target is ~$19, around 17% higher, a potential move that made me think of one of our favourite clichés at MM – the market doesn’t fall without the banks.

If MM was a NAB shareholder, we would be taking up the stock in the SPP at $14.15.

National Australia Bank (NAB) Chart

As we said in the International Report – “there is still plenty of cash in those hills!”, it feels to us that the gains over the last 5/6 days have been primarily due to a lack of selling as opposed to across the board aggressive market buying although as we saw yesterday, with the Banks & Energy stocks, when the Fund Managers “get the bit between their teeth” they are going on the offensive in some individual areas. My “Gut Feel” is we will see more of these strong days by the underperformers as many investors are probably very underweight plus momentum traders might still be short, a bullish combination.

MM remains bullish equities medium-term and hence we are in net “buy mode”.

ASX200 Index Chart

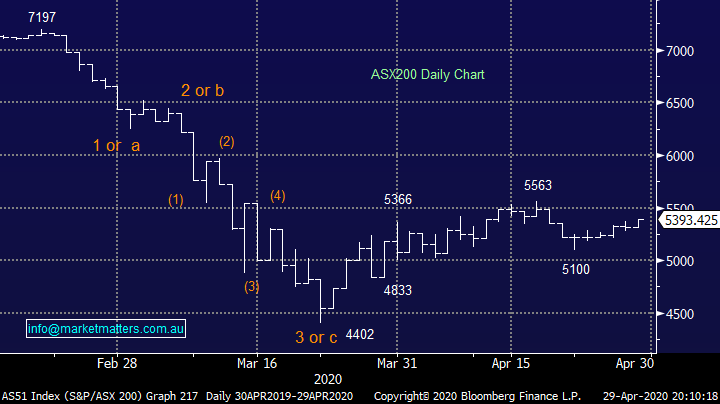

Also, on an eventful Wednesday we saw Blackstone pick up a 10% ($550m) stake in Crown Resorts (CWN) at an attractive $8.15. The discount suggests Lawrence Ho’s Melco were the more motivated of the two parties involved, CWN’s property assets will dovetail nicely for the buyer with a potential value add property spin-off an increasing possibility – US Private Equity business Blackstone usually take over whole businesses but this may have been a more opportunistic play, watch this space.

Either way it shows buyers remain for quality assets at the correct price.

About CWN we are not too excited at this stage after the pop higher, but we will watch with definite interest.

Crown Resorts (CWN) Chart

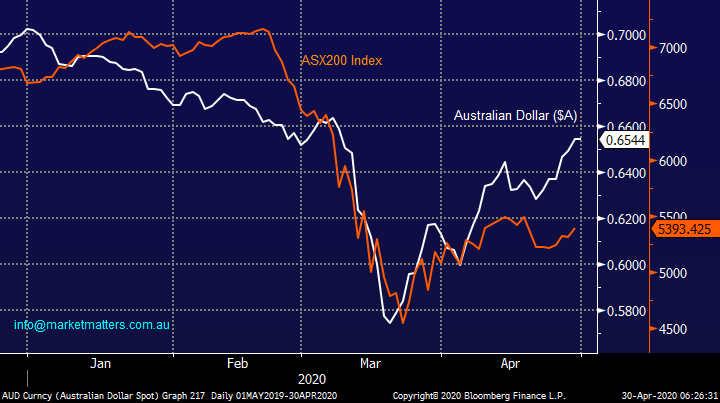

Please excuse the repetition but when a leading indicators on song we should definitely pay attention : The $A continues to rally testing 7-week highs overnight, until the local currency experiences a pullback there’s no technical reason to suspect that the ASX200 won’t break its April 5563 high. However we do note the $A looks likely to encounter some technical resistance around the psychological 66c area.

Medium-term MM remains bullish both equities and the $A.

Australian Dollar ($A) & ASX200 Chart

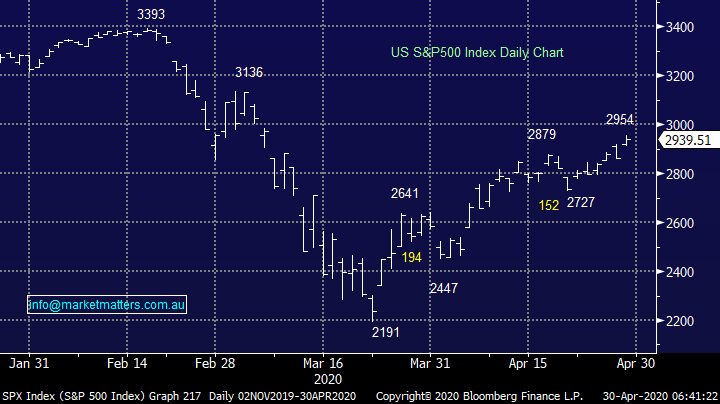

Overnight US stocks were significantly stronger than we expected demonstrating the underlying bullish strength after March’s panic low, 2 important points to add clarity to our outlook for US and Global stocks:

1 – We are bullish US stocks into 2021 targeting fresh all-time highs, huge government stimulus combined with incredibly low interest rates for the foreseeable future are likely to be the main drivers

2 – We still feel equities are a bit stretched / overly optimistic towards the post COVID-19 economic recovery and although we anticipate an ongoing choppy staircase style advance our core belief is investors should be more focused on buying pullbacks as opposed to selling strength.

Stocks are climbing the proverbial wall of worry and slowly but surely, we’re getting an underlying feel of FOMO percolating through the market i.e. “Fear of missing out” towards the already impressive stock market recovery. The massive liquidity being added to markets by central banks combined with an unprecedented tsunami of fiscal stimulus about to wash through countries is creating an enormous market tailwind i.e. there is simply too much cash and too many buyers hence pullbacks continue to be shallower than anticipated.

MM is bullish US stocks medium-term.

US S&P500 Index Chart

COVID-19 has pushed us towards a cashless society

I hear the tradies are having a shocking time of late with not only their work drying up but also they’re bastion of “cash deals” dwindling in significance – I currently can’t use cash at my local butcher, grocery store or even garage, not that I need much fuel these days!

In previous reports we’ve discussed how COVID-19 has accelerated the WFH (work from home), on-line meetings (Zoom), e-commerce & education trends it appears to also have had a similar impact on our move away from cash, a move which big brother will love. MM has no doubt that the world is going to emerge from this pandemic an even more digital place which will assist many businesses that can adapt appropriately.

Usually when we see markets experience exogenous shocks like the current oil crisis a boom usually follows but with this pandemic we believe it’s going to be more of a rapid, almost instant, structural change to our lifestyle and underlying economy as we continue to embrace digital expansion. Hence MM believes this recovery will be different and probably take more time to percolate through to traditional growth.

Buy now / pay later (BNPL) goliath Afterpay Touch (APT) has illustrated perfectly how a business can boom if they nail a trend around e-commerce and payment platforms. APT is now a $7.5bn business which has seen its shares appreciate by around 15x fold since it listed, amazingly less than 3-years ago. Undoubtedly people increasingly shopping on-line lends itself as an ideal backdrop for APT although appetite for debt and the ability to repay such liability is the uncertainty which sent the stock down almost 80% during the COVID-19 panic.

Year to-date APT has increased underlying sales by over 100% to $73bn, huge numbers even as March understandably saw a dip – a strong global recovery should be great news for APT. With active customers growing over 120% to 8.4million last year there is clearly plenty of room in related sectors for successful competition, today we will look at a few potential local candidates.

Afterpay Touch (APT) Chart

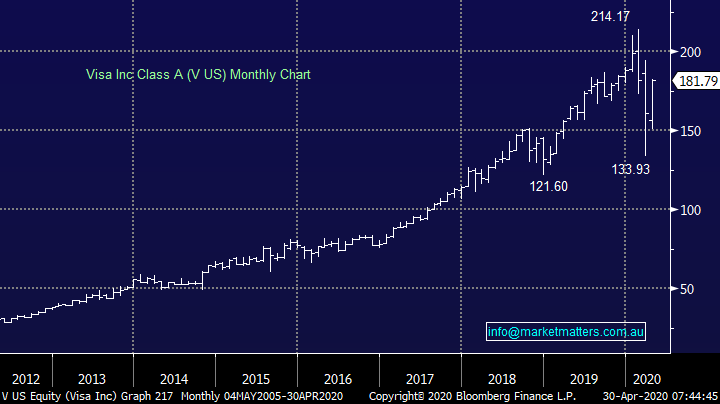

On the international front I am sure we’re all familiar with Visa / Mastercard, we hold Visa in our International Portfolio. This credit card business now has a market cap of ~$55b, it was flying to fresh all-time highs before the coronavirus hit town making it a prime candidate for an economic recovery. Mastercard (MA US) reported overnight and the numbers were very encouraging as they beat estimates on both earnings and revenue while contactless payments jumped 40% for the quarter, there is the trend were looking at! Both heavyweights surged more than 6% overnight which bodes well for local payment solutions today.

MM remains bullish Visa (V US) targeting fresh all-time highs.

Visa (V US) Chart

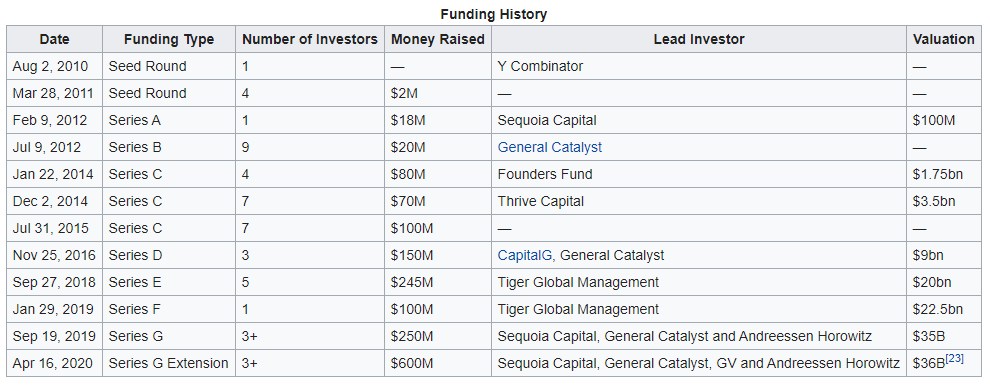

Another excellent illustration of growth within the on-line payment sector comes from payment platform Stripe which we use at MM, they have grown from zero to a $36bn monster in just 10-years. Below shows how they have raised capital and the company’s subsequent valuation each time, a phenomenal kick over the last couple of years.

Today I have looked at 3 local stocks within this growing space to see if we can see an opportunity following the coronavirus sell off.

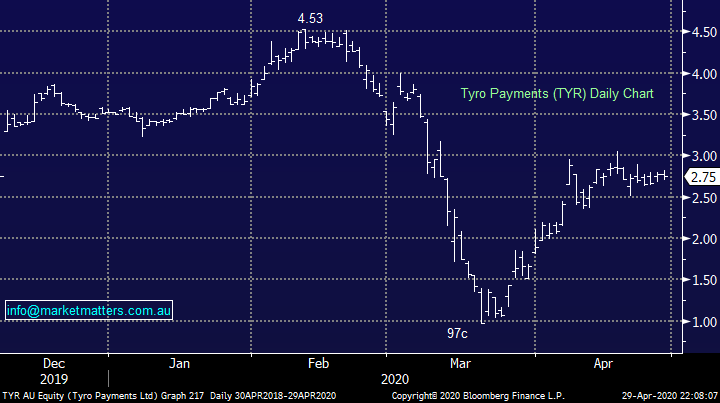

1 Tyro Payments (TYR) $2.75

TYR was a hot IPO last year, the business provides payment and banking services to 32,000 small and medium enterprises a number of which have been impacted by COVID-19 hence the stock came down to earth during March’s panic, similar to many stocks exposed to economic strength. We believe this is a structural growth stock which is taking market share away from the “Big 4” banks but like most of the sector, as the coronavirus has demonstrated, its cyclically tied to the economy.

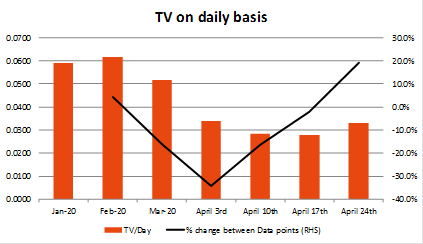

TYR rolled out a good initiative during this crisis reporting transaction volumes on a weekly basis. This is obviously insightful for TYR itself, but it also provides a good indicator on broader trends, particularly within retail and hospitality which make up 77% of their transaction value. While they are current doing just $33.1m worth of payments a day versus 62m in February, TV looks to have bottomed 2 weeks ago implying people are opening their wallets.

Source: Shaw and Partners

MM likes TYR with an ideal entry ~$2.50.

Tyro Payments (TYR) Chart

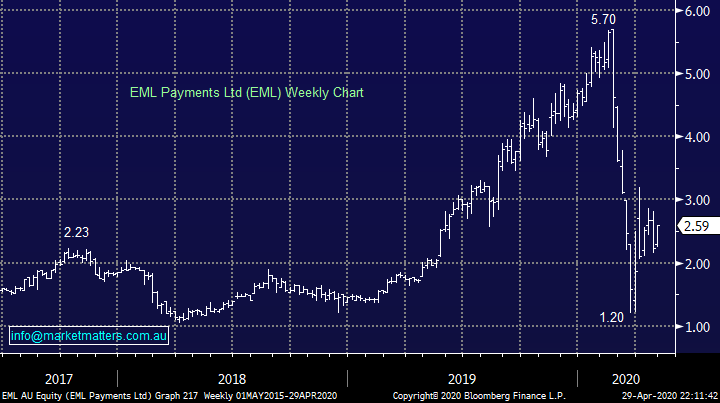

2 EML Payments (EML) $2.59

EML is a payment solution provider whose stock started tumbling back in February even after announcing profits had grown by 70% on revenue of almost $60m. Back in December of 2019, EML raised capital at $3.55 per share to help fund the purchase of an Irish payments business for $423m, the terms of the deal subsequently got revised lower which was beneficial for EML – a rare CV-19 induced win.

EML focuses in areas like gift cards, payouts, incentives, rewards and prepaid gaming not particularly exciting growth areas in our opinion even if they do offer both virtual and physical card solutions.

MM is neutral EML.

EML Payments (EML) Chart

3 ZIP Co (Z1P) $2.19

ZIP is another major “Buy now pay later “ company, it has arguably struggled to break out of the shadow of APT, it’s amazing how damaging an extra required click can be with regard to on-line shopping – some feedback from our “shopaholic” General Manager Vanessa. This BNPL company has seen its stock suffer in a similar manner to APT, however revenue in January and February was ~$30m almost double that of 2019 showing the company’s growth and potential moving forward.

Z1P has a market cap of $855m making it almost 90% smaller than Afterpay. Like APT this is a very volatile stock which should be taken into consideration when investing.

MM likes Z1P into weakness.

ZIP Co (Z1P) Chart

There is a broad cross section of other payment providers, mostly at the smaller end of town. Money 3 (MNY) & Wisr (WZR) are two that are worth a further look.

Conclusion:

MM likes TYR and Z1P in Australia while remaining long and bullish Visa in the US.

Overnight Market Matters Wrap

- The US equity markets surged overnight as hopes of an antiviral treatment for the coronavirus was resurrected.

- Crude oil gained over 20%, breaking its 2-day losing streak, after a reported lower than expected build in US inventories.

- BHP is expected to outperform the broader market after ending its US session up over an equivalent of 3% to $32.11.

- The June SPI Futures is indicating the ASX 200 to open 100 points higher, testing the 5500 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.