Complacency is a very dangerous ingredient (CYB, RHC, BHP, CBA)

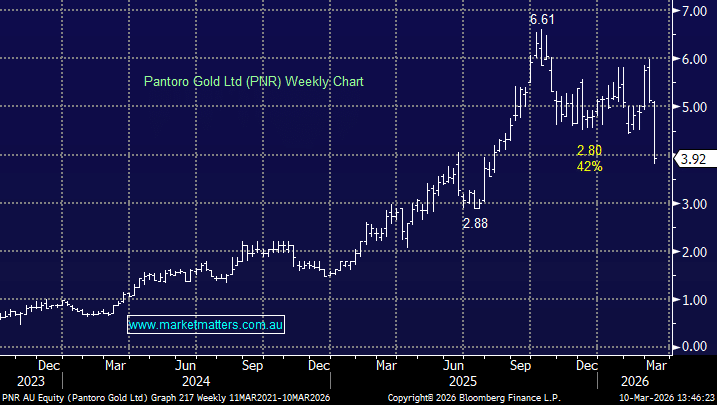

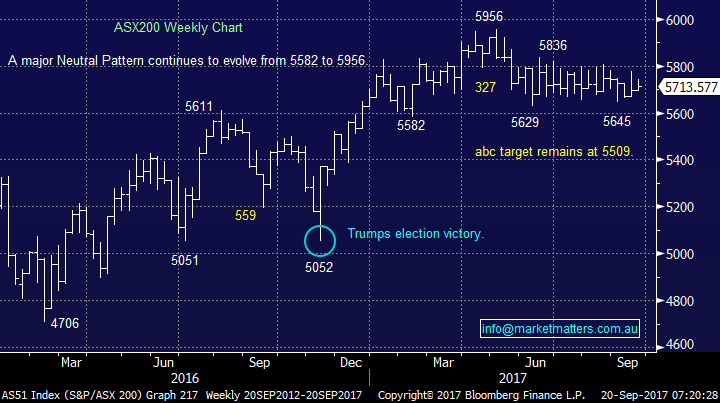

Yesterday felt like a typical recent day for the ASX200 with some early gains slowly lost with the market eventually closing down only 7-points / 0.1% - there’s as much selling of strength as there appears to be buying of weakness. As the 18th week of range trading between 5629 and 5836 unfolds we caution subscribers from believing this will continue without at least a minor hiccup – simply, I can’t recall a period of such inactivity on an index over the past 15+ years in the market! However the sector / stock rotation continues unchecked with fund managers chasing the financials yesterday, especially anything UK facing, while the real estate sector was the standout loser.

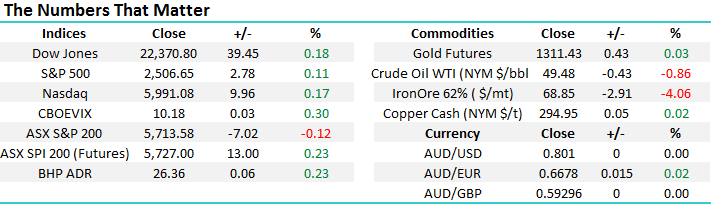

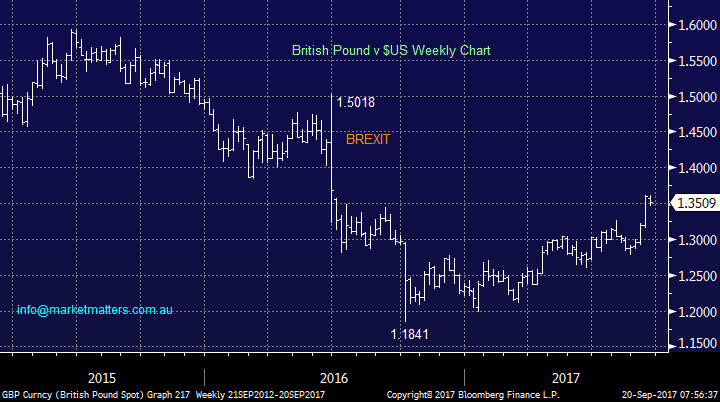

The BREXIT / British Pound scenario is a great example of a high degree of caution very often being required when you’re “following the crowd”. The majority of economists were bearish both the UK and British Pound in the months following BREXIT but suddenly here we are ~12% higher against the $US in 2017 as the UK economy remains robust with inflation picking up and interest hikes looming on the horizon. Australian stocks which were UK facing were savaged following BREXIT with CYBG (CYB) falling almost 40% in just a few weeks but the stock is now recovering strongly and looks destined to trade towards its pre-BREXIT levels. Our switch from Wesfarmers (WES) to CYB is looking great at the moment and importantly we are targeting ~$5.30 for CYB, another 6% higher which is encouraging for our substantial 10% holding in the MM Growth Portfolio.

Direct from Desk on CYB :

No change to our view for the ASX200, our preferred scenario is a test down towards the psychological 5500 area before rallying into 2018.

ASX200 Weekly Chart

British Pound v $US Weekly Chart

CYBG (CYB) Weekly Chart

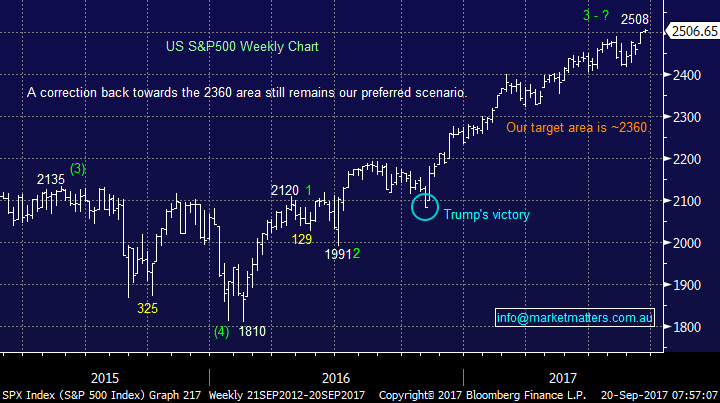

US Stocks

US equities were again quiet last night managing to advance just under 0.2%, again ignoring aggressive rhetoric from Donald Trump around North Korea – it’s become like an old fashion statement “so passé”.

There is no change to our short-term outlook for US stocks, we are targeting a ~5% correction i.e. a around 130-points by the S&P500.

US S&P500 Weekly Chart

Not only is “following the crowd” often a dangerous path to take for investors, so is complacency and we feel this phenomenon is slowly and worryingly increasing within global equity markets. Both a great and amazing example of complacency over the last 24 hours has been with Toys “R” Us who has just filed for bankruptcy which will certainly concern all the regular Christmas shoppers like myself who use there 1600 stores across 38 countries. Who will be the new go to Christmas kids store, Amazon perhaps but will that still “feel” like Christmas? Moving back to the market, holders of debt in Toys “R” Us have seen their investment plunge ~80% over the last 3 weeks, there was undoubted comfort from holders of their debt at the start of the month but major wealth destruction has followed. This also illustrates the dangers of holding debt securities, they are only as secure as the company itself.

Toys “R” Us Debt Weekly Chart

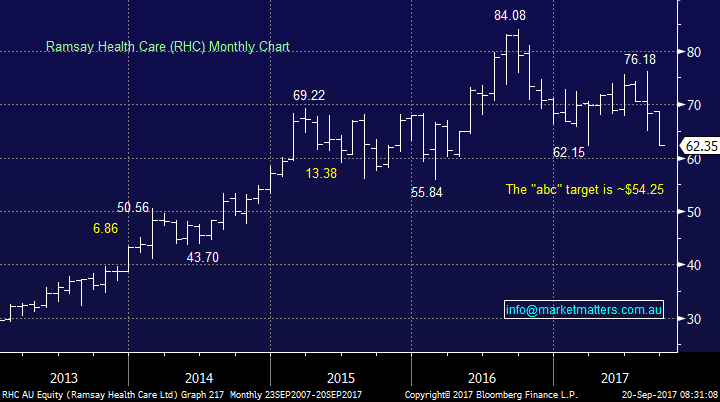

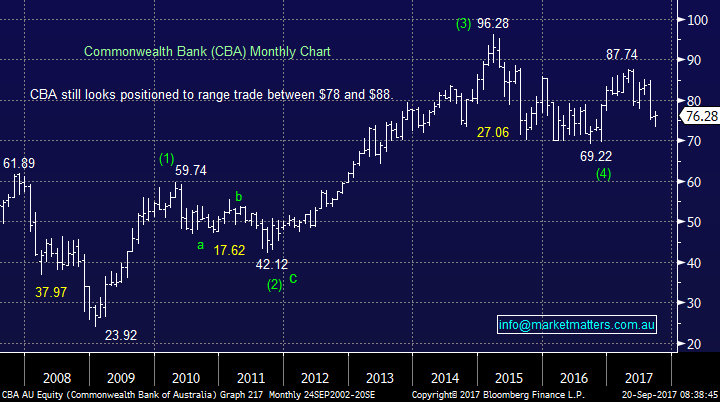

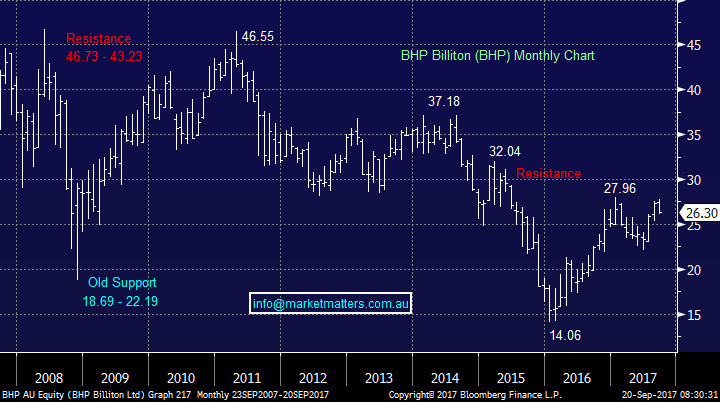

Let’s consider 3 examples within the Australian market, without considering the extremes like say Telstra (TLS), Bellamy’s (BAL) and Domino’s Pizza (DMP), where complacency looks to be hurting investors performance:

- Ramsay Healthcare (RHC) – RHC is a very popular and highly “owned” stock by local retail investors with probably only its relatively small yield preventing it being in the top 3 most popular stocks - but suddenly its down 25% and has become one of the most common stocks in questions we are receiving at MM as investors understandably become concerned.

- Commonwealth Bank (CBA) – CBA has been in the press a lot recently but months before that it had corrected 28% from the highs of 2015.

- BHP Billiton (BHP) – The big Australian is the most inherited asset in this country but its shares, even after a stellar run since early 2016, are still trading 43% below their post-GFC high.

The message is an extension of the important one we have been preaching through 2017:

“Keep open minded, complacency is a very dangerous emotion. We are in a world of very fluid change with huge companies like Amazon and Apple relatively new, for optimum returns investors must be flexible and more active / dynamic than over past decades, buying and holding is no longer the answer, especially as the current mature bull market is already the second longest in history”.

Ramsay Healthcare (RHC) Monthly Chart

Commonwealth Bank (CBA) Monthly Chart

BHP Billiton (BHP) Monthly Chart

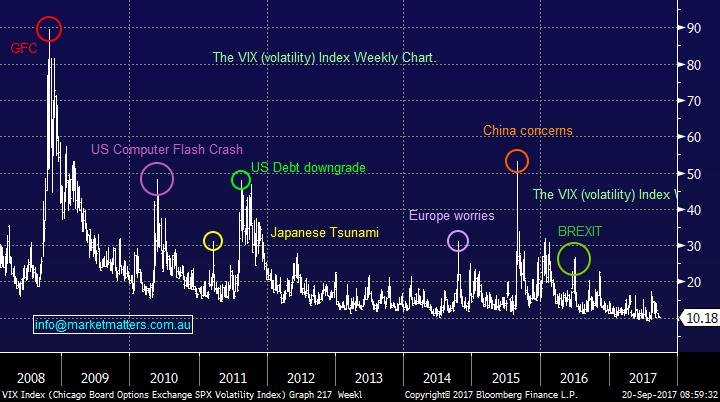

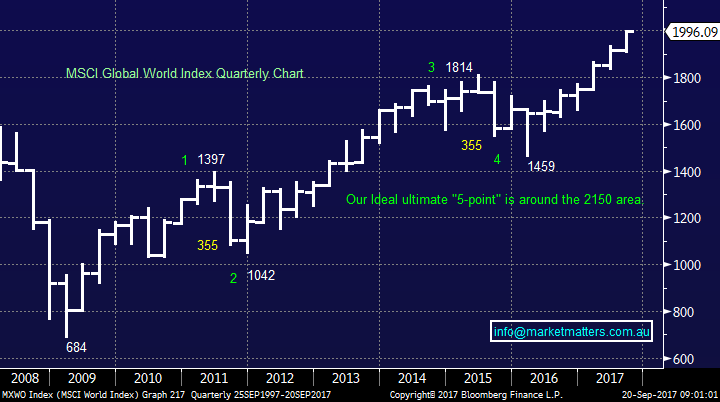

Some warning signals are slowly emerging for us in the bigger picture for global stocks as the “Fear Index” (VIX) trades around all-time lows yet the geo-political landscape is a concern. Perhaps more importantly global stocks are statistically overdue a correction but markets remain convinced that Central Banks will stop any major correction in asset prices.

Fear Index (VIX) Weekly Chart

MSCI Global World Stock Market Index Quarterly Chart

Conclusion (s)

No change, we believe our message is gaining in importance weekly:

“Keep open minded, complacency is a very dangerous emotion. We are in a world of very fluid change with huge companies like Amazon and Apple relatively new, for optimum returns investors must be flexible and more active / dynamic than over past decades, buying and holding is no longer the answer, especially as the current mature bull market is already the second longest in history”.

Overnight Market Matters Wrap

· The US share markets gained some grounds overnight, ahead of the FOMC rate decision where most expect US rates to be left unchanged, however it is the content of the meet is what most investors are keen to digest prior to major decision.

· Volatility is very low ahead of the Fed’s policy announcement. Rates are likely to be unchanged and many believe the Fed will start to unwind its US$4.5T balance sheet.

· The normalisation of the Fed’s balance sheet is expected to be at the rate of US$10B per month, not enough to have any meaningful market impact.

· The ASX 200 is expected to open 14 points higher towards the 5728 level as indicated by the September SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here