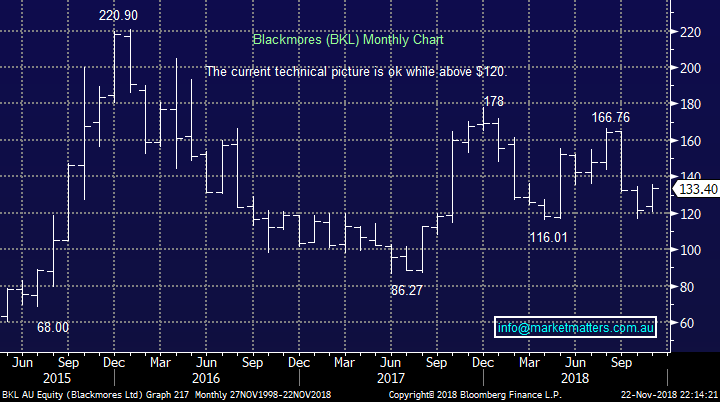

China increases its citizens CBEC overseas e-commerce spending cap by 30% (A2M, BAL, BKL, TWE)

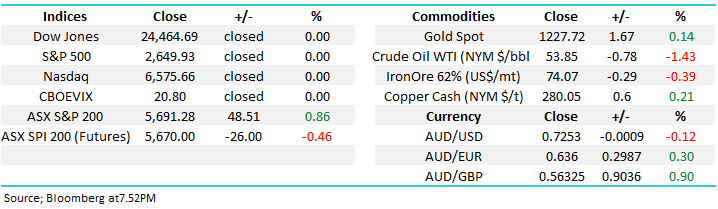

The ASX200 enjoyed an excellent Thursday closing up 48-points / 0.86% and suddenly we commence the last day of a tough week only down 39-points from last Fridays close, and importantly in our opinion the markets are now well positioned for a Christmas rally. The recently battered Healthcare Sector led the gains rallying +2.7% but all sectors closed in the black except the Telcos which slipped -0.35% as Telstra (ASX: TLS) seemed to lose its safe haven allure. The important banking sector remains firm with Westpac (ASX: WBC) the worst of the “big 4” still closing up +0.35% but considering WBC remains down –18.4% for the last year an ongoing squeeze higher by the influential banks feels a strong possibility to MM.

Its important to bear in mind that if we are correct and the ASX200 can reach say 5950 during a Christmas rally that’s only an average of 10-points gain per day from yesterday’s close i.e. we expect a slow staircase style “climb up the wall of worry” into 2019 with different sectors probably taking it in turns to perform the heavy lifting – the usual characteristic of a December rally is no selling as opposed to aggressive buying.

MM remains bullish the ASX200 short-term targeting a “Christmas rally” to the 5900-6000 area.

Overnight US stocks were closed for Thanksgiving Day but the S&P futures were weaker in line with European equities. SPI futures are pointing to an open down around -0.5% for the ASX200, the market will face a minor test today of whether recent buyers have the confidence to hold their positions over the weekend.

Today’s report is going to look at 4 major China facing stocks following the news that the world’s second largest economy have allowed its citizens to spend more on “Cross border e-Commerce” (CBEC).

ASX200 Chart

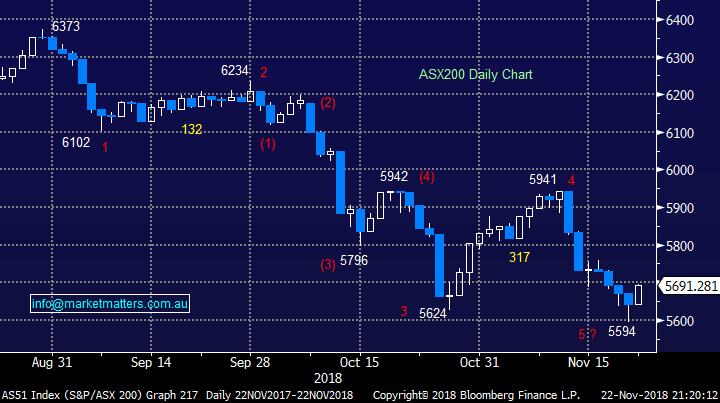

We will look into the characteristics of a typical Christmas rally in more detail when we are fully convinced one is unfolding i.e. we don’t want to tempt fate after our recent aggressive foray into domestic equities. However an interesting set of characteristics only comes to light when we delve into the statistics with a pen and calculator - a quick snapshot since the GFC:

1 – The Christmas rally starts in November over 50% of the time and when it does the Nov / Dec high is usually in the last 48-hours of December but it then usually kicks a little higher into mid-January, or even early Feb.

2 – When the swing low before the Christmas rally is in December the high is again in the last 48-hours of December but the market does not have the momentum to push higher into January / February.

Time will tell if we have seen a meaningful swing low this week (November) at 5594 but if we have 2 points are clear:

Firstly, be patient with general selling as the market usually rallies into the last 48-hours of December and secondly don’t be surprised if the market has a little “gas left in the tank” for Q1 2019.

ASX200 Seasonality Chart

Is it time to buy China facing stocks?

Yesterday China facing stocks greeted the news from the economic goliath of no changes to current CBEC regulations plus they increased the amount people can spend each year. China’s actions albeit relatively small do feel conciliatory at a glance with regard to trade.

1 – China increased the personal limit on purchases through CBEC to 26,000 yuan p.a. from a previous cap of 20,000 yuan.

2 – Obviously the increase in the personal annual purchase limit means that consumers can buy more products from overseas through CBEC i.e. on-line.

The health supplements market in China is currently in the top 3 categories for Chinese consumers buying through CBEC and it appears to present strong opportunities for growth into 2019.

1 A2 Milk (ASX: A2M) $9.90

A2M rallied almost 6% yesterday largely fuelled by the positive news out of China. The stock recently reported a strong start to the financial year with net profit growing almost 65% to NZ$86m although they did warn the result was helped by strong foreign exchange movements.

China remains A2M’s growth market with its market share up to 5.6% from 5.1% also while the is US still in its early days its moving ahead nicely. All sounds good under the hood with management expecting strong growth for the full year but at a slightly lower rate than the first 4-months.

Technically A2M looks good targeting ~15% upside although the reaction to its recent profit update has been muted i.e. there appears to be plenty of sellers into strength. A2M has a relatively high but justifiable valuation with a current Est P/E for 2019 of 29.1x.

MM is now neutral, to slightly bullish A2M.

A2 Milk (A2M) Chart

2 Bellamy’s (ASX: BAL) $7.55.

BAL has experienced a major correction since late March with the stock correcting a huge 70%. Yesterday BAL managed to bounce +4.7% but it still closed near the lows of the day as sellers took advantage of the “pop” higher to unload stock. Obviously the reported changes to the official Chinese “cross border e-commerce channel (CBEC)” are good news for the stock but not enough to quickly change an entrenched bearish trend.

BAL’s has a lower valuation than A2 Milk which makes sense to us, it’s currently trading on an Est P/E for 2019 of 19.3x.

Technically BAL is neutral although a strong bounce would not surprise – traders could consider buying a move back above $8.10 i.e. jump on board a bounce as opposed to catching the falling knife.

MM is currently neutral BAL.

Bellamy’s (BAL) Chart

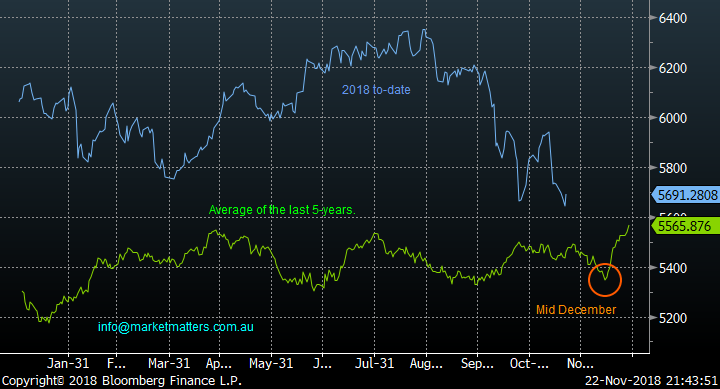

3 Blackmores Ltd (ASX: BKL) $133.40.

BKL bounced 5.9% yesterday but like BAL it’s been a tough year with the stock still 20% below the years high. The vitamins business trades on a similar valuation to A2 Milk (A2M) which on the surface may feel a touch optimistic. BKL reported a net profit after tax (NPAT) of $70m in August with earnings up 19% on the year with growth again into China while Australia / New Zealand numbers were soft.

However the 22% growth last year in China was primarily across e-commerce platforms highlighting the positive influence of yesterday’s news.

MM is neutral BKL.

Blackmores Ltd (BKL) Chart

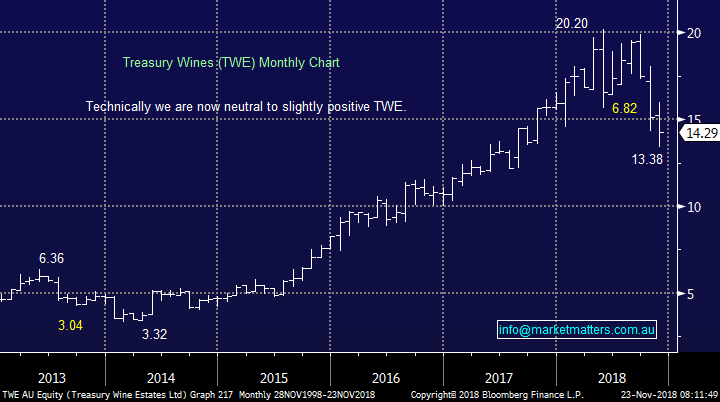

4 Treasury Wine (ASX: TWE) $14.29.

Similar to the other China facing stocks TWE bounced 5.7% yesterday but it still remains almost 30% below the years high. The wine business has an average valuation within the group as investors juggle with its potential growth outlook moving forward – the stocks trading on an Est P/E for 2019 of 22.7x.

TWE had a bad October, like many growth names, but the weakness has continued into November due to poor export data from Wine Australia which showed poor traction into the US, just where TWE is focusing its new efforts for growth.

MM is neutral with a slight short-term positive bias on TWE

Treasury Wines (TWE) Chart

Conclusion

The savage corrections these 4 stocks have suffered is a perfect illustration of optimism – pessimism regularly being stretched way too far – in this case stocks facing China were bought by investors at crazy valuations with no sensible concern for risk.

Unfortunately none of these 4 stocks are currently exciting to us although a bounce in most would not surprise – if you forced my hand I would buy A2 Milk (A2M).

Overseas Indices

The S&P500 was closed for Thanksgiving.

We are still bullish US stocks into Christmas / 2019, especially if the S&P500 can close above 2675, only 1% higher.

US S&P500 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January. To turn us bullish we still need to see strength above 11,800.

German DAX Chart

Overnight Market Matters Wrap

· The European markets fell overnight in quiet trading while US markets were closed for Thanksgiving. The FTSE 100 closed ~1.3% in the red while the Euro Stoxx 50 was 0.86% lower.

· Slowing economic growth and concerns around Brexit are keeping traders bearish. British and European leaders are due to meet on Sunday with some details still to be thrashed out. The pound rose as confidence grew that a crash landing can be avoided.

· US Fed watchers are starting to become more dovish in their commentary. Future rate hikes are likely to be accompanied by a more conservative approach.

· Metals on the LME were mixed, while both iron ore and crude oil fell. The Saudi energy minister said they see January oil demand to be weak and that they will adjust supply to avoid a glut.

· The December SPI Futures is indicating the ASX 200 to open 26 points lower towards the 5665 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.