China consumer facing stocks enjoying them good times! (BKL, A2M, TWE, CWN, BAL)

The ASX200 put in an average performance yesterday closing up +0.15% in a day which had a pretty lethargic feel about it. The broad market remained solid while again the banks drifted and were this time joined by heavyweight resources BHP & RIO, hence denying the market the opportunity to close at fresh highs for June.

The Donald Trump – Kim Jong-un “show” failed to excite global markets during our time zone as investors focused on what comes next after the circus leaves town. While the outcome was predominantly back slapping photo opportunities we did notice that China was arguably the main beneficiary, definitely not South Korea and Japan – another sign that a US – China trade war will not eventuate and concerns will go exactly the same way as potential conflict between the US and North Korea.

Overnight stocks were extremely quiet just like ourselves with only the tech based NASDAQ managing to make any noticeable traction, closing up 0.6% basically at its all-time high. US inflation has continued its upward momentum reaching a 6-year high reinforcing the Fed’s outlook for gradual interest rate hikes. Inflation is now up +2.8% for the year helping US 10-year bond yields consolidate around the 3% area – the prospect of higher US rates pushed the $A lower against the $US along with most global currencies.

- Medium term MM remains mildly bullish targeting 6250 but the risk / reward is no longer compelling for the buyers – we remain in “sell mode”.

Today’s report is going to focus on the Chinese consumer facing stocks that performed strongly yesterday - Chinese economic data remains strong and the worries around a trade war seemed to have floated off into distance.

ASX200 Chart

The Chinese consumer

MM’s structurally bullish outlook for Chinese consumer facing companies remains intact but as the below ETF chart illustrates it’s been a 2 ½ year uninterrupted rally.

We can see this ETF making fresh highs above the 20-area but then we will become concerned that a rest is overdue at the very least i.e. time to consider taking some $$ off the table when euphoria is at its highest.

Today we have looked at 5 local stocks that should benefit from a strong Chinese consumer plus briefly a glance at 2 overseas goliaths.

Global X China Consumer ETF (CHIQ) Chart

1 Blackmores (BKL) $147.80

Yesterday Blackmores (BKL) rallied +4.1% as the stock continues its rollercoaster ride. The stock is up 70% this financial year after getting smashed over the previous 2-years.

BKL is now trading on a 35.9x valuation based on 2018 earnings while yielding just under 2% fully franked. The current momentum looks very capable of taking the stock at least 10% higher but at MM we’re not huge fans of the vitamins space especially as statistical / clinical trials are starting to link their usage with increased cases of cancer.

- At MM we are neutral BKL and not considering the stock for either portfolio.

Blackmores (BKL) Chart

2 A2 Milk (A2M) $10.88

Yesterday A2M advanced over 3% to its highest level in 4-weeks, a healthy 18% bounce from the recent panic sell-off. The notice that Blackrock, the world’s largest asset manager, had taken a 5% stake in the NZ dairy firm appears to have currently put a floor under the infant formula company.

The decision by the China government to encourage more children is clearly a great tailwind for earnings and arguably the only current concern for our large position is the stocks valuation of 45.4x Est 2018 earnings.

- MM likes its position in A2M but we may be tempted to take part profits if the stock enjoys an EOFY squeeze higher.

A2 Milk (A2M) Chart

3 Treasury Wines (TWE) $17.35

The global wine company Treasury Wines (TWE) has enjoyed a stellar few years but tumbled over 20% from its all-time highs last month – an opportunity we ask? The concerns are centred around a report that the company was facing a severe supply glut which has led to deep discounting across the board.

This is obviously of concern as is the companies attention switching towards the US as it considers global growth after a successful move into China. The stocks trading on a 35.4x valuation based on 2018 earnings while yielding 1.6% fully franked, the risk / reward on these metrics are not attractive to us.

- MM is neutral TWE at present and can technically see an eventual correction back below $15.

Treasury Wines (TWE) Chart

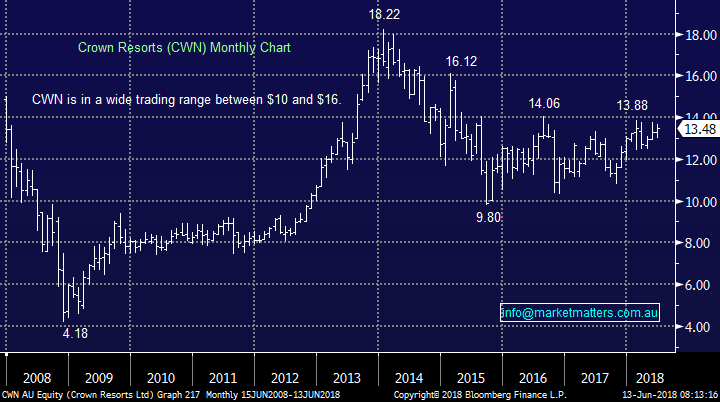

4 Crown Resorts (CWN) $13.48

At MM we not only like the Chinese consumer story but we particularly like the tourism angle. With Crown’s $2bn six star Barangaroo hotel and casino now due to open in 2021 it won’t be that long until the cash registers are getting busy.

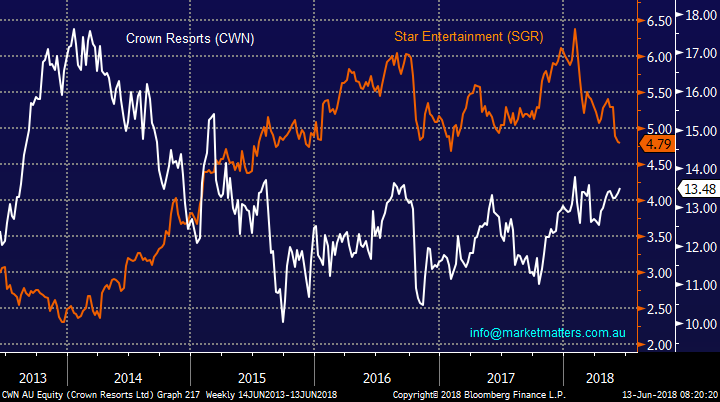

Asian tourists love to visit casino’s and when this world class facility opens its likely to be the focal point of many visits to Sydney pushing Star city (SGR) into the inevitable shade, however ultimately, more gamblers into the Sydney will also give SGR are boost longer term once the fanfare of Crown wears off. One certainly to watch.

CWN is trading on a valuation of 25.3x 2018 earnings while yielding 4.45% part franked – not cheap but importantly not scary as some

- We like CWN at current levels but especially under $13.

Crown Resorts (CWN) Chart

Crown Resorts (CWN) v Star Entertainment (SGR) Chart

5 Bellamy’s (BAL) $17.50

The organic infant food company Bellamy’s (BAL) failed to join in the China party yesterday and its clearly had a tough 2018, tumbling ~32%. While short-term we can see a 5-10% bounce in the stock it’s not exciting given its 40.9x valuation based on 2018 earnings and technical picture.

In the bigger picture the stock should benefit from the Chinese looming population “pop” on the other hand the inevitable increase of competition will present a challenge.

- MM is currently neutral on BAL having more interest below $15.

Bellamy’s (BAL) Chart

6 Tencent Holdings HK417.60

Tencent is a huge Hong Kong based holding company which provides internet value added services. They have Social Networks (WeChat for instance), payments, entertainment (Tencent games in the largest games community in China) – essentially its tentacles span lots of markets but a growing Chinese consumer is arguably its largest tailwind. Tencent is trading on a valuation of 38.3x Est 2018 earnings hence risk / reward is important as we’ve seen the pain experienced by high valuation stocks in recent times, however this is a true global platform with true exposure to the westernisation of the Chinese consumer.

- Following its 21% correction we see value in Tencent while the cautious can use stops below $400.

Tencent Holdings (HK) Chart

7 Alibaba $US209.08

The e-commerce business Alibaba is a goliath ($535bn market cap) and the company has followed / assisted the NASDAQ on its charge to all-time highs. This is a great business and the 31.9x valuation is not too demanding especially when compared to some of the local stocks above.

- We like Alibaba but believe the opportunity will present itself to buy closer to $US170 in 2018/9.

Alibaba $US Chart

Conclusion

We like the Chinese consumer facing space moving forward although some consolidation in the growth feels likely.

We particularly like Crown and A2 Milk at current levels, while international we could be buyers of Tencent into recent weakness

Overseas Indices

The tech-based NASDAQ basically closed at all-time highs last night with the broader S&P500 now only 3.0% below its same milestone. We remain net bullish US equities targeting a further ~5% upside in the short-term.In Europe the German DAX remains 6% below its 2018 high, again our preferred scenario is European indices follow the NASDAQ to fresh all-time highs creating a degree of euphoria for global equity investors.

No change, we are on alert for a decent market correction and are still looking to increase our cash position into strength.

US NASDAQ Chart

German DAX Chart

Overnight Market Matters Wrap

· A quiet session overnight in the US as investors look past the US-North Korea meet yesterday and are now focusing in on the Fed’s two day meeting with a 0.25% hike priced in. Comments and language will be closely scrutinized to work out whether the dot plot will move from 3 to 4 rate rises this year. US 10 year bond yields rose slightly to 2.96%.

· On the commodities front, copper, nickel and zinc were weaker on the LME, alongside with oil and gold.

· BHP is expected to outperform the broader market after ending its US session up and equivalent of 0.19% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 10 points lower towards the 6045 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/06/2018.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here