Central Banks are clear winners of the latest round (WBC, MQG, SUN)

The ASX200 experienced another amazing day yesterday with the futures trading in a 161-point / 2.6% range, we’ve actually had a few months over recent years with a smaller range than yesterday! The local market managed to reclaim around 75% of its early loses but it still took the wooden spoon in the region i.e. the ASX200 finally closed down -0.77% compared to Japan +0.95%, Hong Kong +0.6% and China +3.15%. The prospect of an interest rate cut today by the RBA pressured our banking sector and as MM likes to quote “ we don’t go up without the banks”, an apt saying for the day – more on the banks later.

Under the hood 34% of the market managed to close up on the day following the Bank of Japan’s (BOJ) emergency statement flashing across our screens at midday, it included a simple assurance that they would “provide ample liquidity and ensure stability in financial markets” it appeared all that was required for now. We’ve now had Asian heavyweights China, Hong Kong and Japan flex their muscles towards the coronavirus, BOJ governor Kuroda's statement basically mirrored the Fed’s Jerome Powell's comments on Friday where he, also in an emergency statement, pledged to take action if necessary. The coordinated effort we had anticipated is slowly unfolding and in our opinion there will be much more in their tank if / when required.

COVID-19 has forced markets into panic mode with many economists believing a recession is inevitable, the poor Chinese PMI data on the weekend certainly has given some credence to this view. However with the Chinese slowly returning to work the disruptions to many businesses supply chains may improve rapidly, as we all know with their containment policy being a great example when the Chinese Government makes a decision no other country gets close to their efficiency of implementation. The country that led us into the panic might well help to drag us out economically. On the stock market front we have a battle between 2 strong opposing forces:

1 – The virus will undoubtedly slow down global growth which has clearly been bad news for stocks amplified because they were arguably “priced for perfection” or just plain expensive. However a significant amount of the froth has been removed from the equation with the ASX200 correcting -13.2% in under a fortnight

2 – Alternatively with global bond yields / interest rates at record lows the share market still offers investors a far superior yield e.g. local term deposits appearing destined to fall under 1% making CBA’s 5.36% fully franked yield hard to ignore for long.

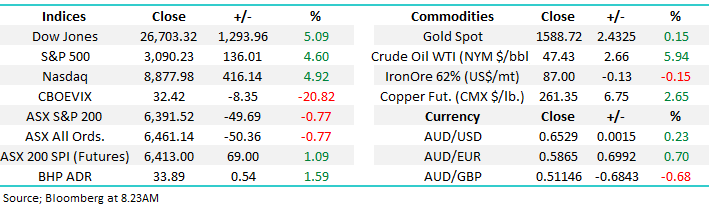

A chart we use internally from Martin Crabb at Shaw looks at the markets total shareholder return (TRS) expectations. It aggregates all analysts target prices in the market and adds in the forecasted dividends. At the grey line this equates to an expected TSR of 15% over the next 12 months. We’re yet to see earnings reductions really from analysts post the outbreak and this is a fluid calculation, however it highlights the market is now back in value territory.

Source: Shaw and Partners

MM believes investors should be looking to accumulate stocks into the current virus inspired panic.

Overnight US stocks surged with the S&P500 rallying +4.6% as it voted with both feet that the current “Financial Engineering” would be successful. The Dow closed up nearly 1300-points and the SPI is indicating the ASX200 should gap up around 1% this morning. Markets are expecting the RBA to cut interest rates today, good or bad news depending on the stock / sector, all eyes will be on the screens at 2.30 but I stress a cut is expected, or built into prices.

Today we’ve endeavoured to keep our finger on the COVID-19 pulse while evaluating market opportunities as we move through the outbreak – we have focused on the banks today with the RBA anticipated to cut at 2.30pm.

ASX200 Chart

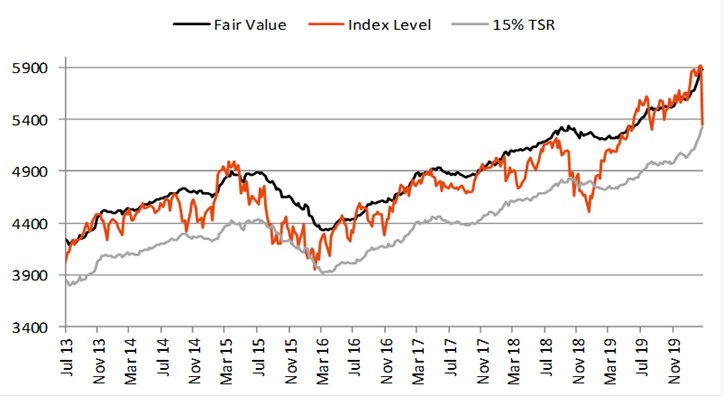

The virus has now claimed over 3000 lives but the below chart illustrates perfectly that the China situation is improving rapidly after the explosive outbreak in February – we could argue that if most countries manage to contain the virus in as effective a manner as China the economic impact should only be one major Quarterly hit to global growth however we feel the markets have priced in a far worse outcome – a reason for optimism towards stocks at current levels.

Confirmed COVID-19 Cases in China Chart

Global Markets

US equities have enjoyed a huge rally this morning following the Fed’s line in the sand at the end of last week. Unless the virus breaks out significantly worse than anticipated we may have seen the worse of the scaremonger style selling. I think we will now see at least a few days consolidation but it’s a brave person who bets against volatility in todays market.

MM believes US equities have now found, or are looking for a low.

US S&P500 Index Chart

Bond yields remain a vital key to equities, the lower they go the more attractive equities become as fund managers crave returns on the monies they’re managing. US bond yields made fresh all-time lows last night with some economists now predicting the Fed will slash rates down to zero in the next 6-months, clearly a worst case call for the virus outbreak in the US.

In Europe German Bunds are still yielding negative although not quite at their lowest (most inverted levels) just yet; I still find it hard to comprehend the concept of negative yields.

MM is still expecting bond yields to bottom during this COVID-19 outbreak.

German 10-year Bund yields Chart

US 10-year Bond yields Chart

The flight away from risk assets (shares) into safe havens such as gold, bonds has failed to flowthrough to the $US, the Greenback has encountered some major selling over the last fortnight - this is another market which MM has been targeting for a major change in trend and its already started to fail. Theoretically the $A should ultimately bounce against the weakening US currency but a pick up in bond yields / global growth appears a required catalyst.

MM maintains its contrarian bearish view on the $US, the reason why the AUD stayed stable yesterday even with a rate cut being priced in

The $US Index Chart

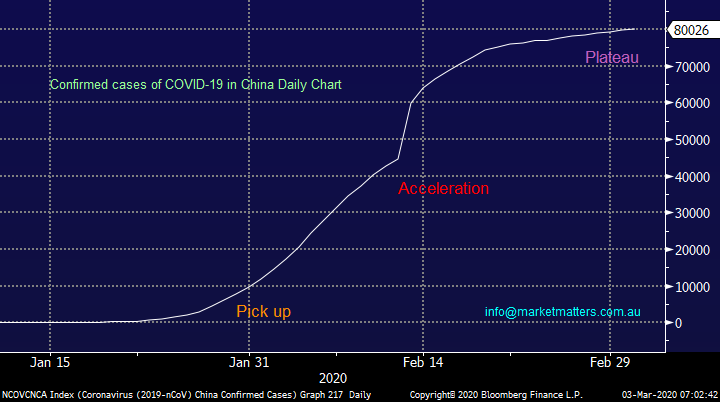

Will the RBA create opportunity in the Banks?

Yesterday the market moved to more than 90% belief that the RBA will cut interest rates today, personally I believe they should hold fire to see exactly what is required, a 0.5% cut in a few months’ time would potentially have more impact than 0.25% today or more targeted stimulus measures. However on this one I wont fight the crowd hence my mindset this morning is interest rates will be cut in Australia, the impact on an already buoyant property market will be fascinating.

The ”Big 4” Australian banks struggled yesterday under the prospect of lower rates which generally pressures their margins, CBA was best on ground and it still fell -1.6%. At MM we have accurately forecast this final washout style spike down in interest rates / bond yields but assuming we are also correct that we are in the process of forming a meaningful high in bonds (low in yields) then the banks might actually be about to receive a tailwind in the years ahead, just when the markets pricing in the opposite. At their last updates they actually showed margin expansion as more money moved from Term Deposits to cheaper at call accounts given only a slight differential in rates.

MM believes the Banking Sector is showing excellent value at current levels.

ASX200 Banking Sector Chart

Currently we have Australian 3-year bonds yielding more than one rate cut below the RBA Cash Rate, looks good for those with floating mortgages – when this has happened in the past rates have usually been cut. At MM we are confident we will see 1 or 2 rate cuts by the RBA in 2020 but they have very little ammunition with a cash rate already down at 0.75%, any further stimulus style heavy lifting we feel is going to be required by the government in the form of fiscal stimulus, hopefully Scott Morrison will step up.

MM believes the RBA will cut once, or twice, in 2020 but bond yields are close to a low.

RBA Cash Rate v Australian 3-year Bonds Chart

Hence we ask the question today how should we play the banks as the coronavirus scares global investors.

1 The “Big Four”

The “Big 4” move largely as one although CBA has been the clear winner over the last year. At current levels WBC is forecast to pay an almost 7% fully franked yield, even if margins remain under some pressure due to falling rates we believe this is too compelling a story to be ignored. Technically WBC appears to have finished its drop from $30, it will likely surprise many doubters on the upside.

MM is bullish WBC seeing over 20% upside from current levels.

Westpac (WBC) Chart

2 Macquarie Bank (MQG) $134.00

MM remains keen on MQG which we bought early last week, too early in hindsight but we still believe this quality business will deliver to loyal shareholders. MM likes MQG below $140 but alas I can see it gapping above this level this morning.

MM remains bullish MQG.

Macquarie Bank (MQG) Chart

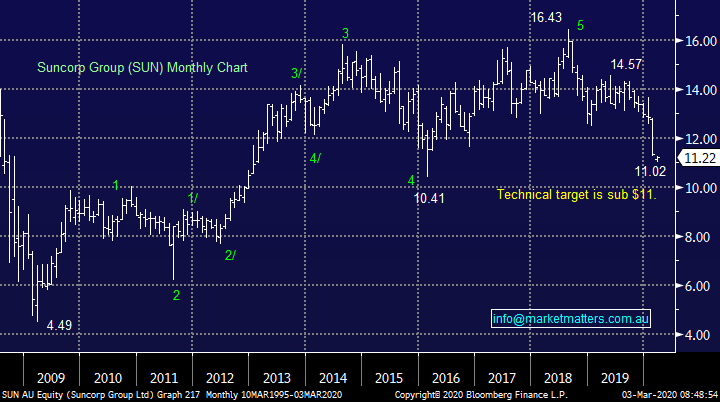

3 Suncorp (SUN) $11.22

MM has been bearish Suncorp (SUN) for a number of reasons since we sold our position in 2018 and avoiding insurance / banks in the current environment has proven a good call. However SUN has now reached our target which has been in place for almost 2-years. While we prefer the “Big 4” banks to SUN, still not being a fan of insurance, this does improve our confidence with regards to the Australian Banking Sector.

MM is now neutral / bullish SUN.

Suncorp (SUN) Chart

Conclusion

MM is bullish both the “Big 4” banks and Macquarie Bank (MQG) over the medium-term.

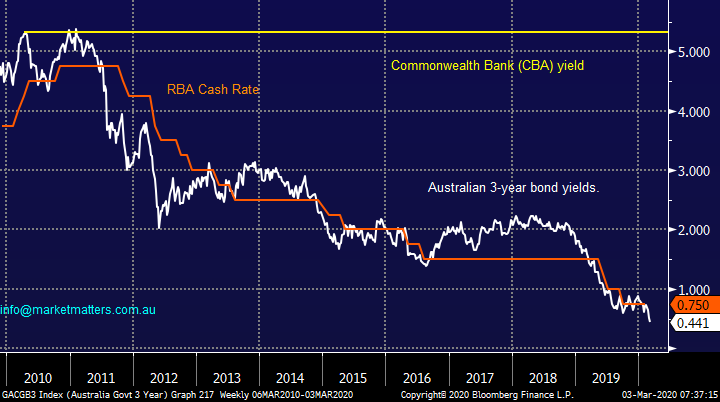

Overnight Market Matters Wrap

- The US equities had a snap rally towards the end of session, its biggest rally ever (after having its biggest selloff ever, of course!) as investors start to place risk back on the table on global co-ordinated stimulus.

- Crude oil rallied 5.94%, while commodities did ok last night with no real standouts. In the base metals, Zinc was the only detractor while gold climbed to US$1588.72/oz.

- BHP is expected to outperform the broader market after ending its US session up an equivalent of 1.59% from Australia’s previous close.

- The March SPI Futures are indicating the ASX 200 rally 1.09% higher towards the 6445 level, and expect it to go further should the RBA cut its key interest rates (with the majority in favour of one) this afternoon at 2.30pm.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.