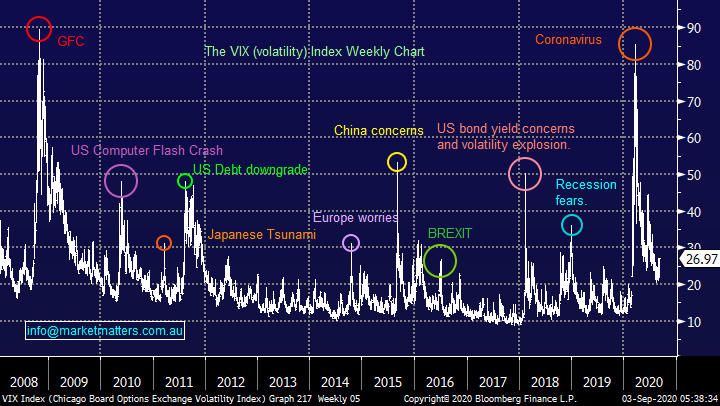

Can we find a diamond in the rough as the US “dogs” outperform (XRO, KO US, CGC, BIN, PDL, IPL, AVH)

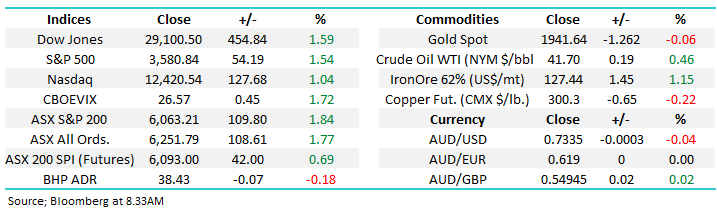

The ASX200 fell 100-points on Tuesday only to basically regain all those losses yesterday, September has certainly kicked off with some real volatility although it still remains well within Augusts tight 5% trading range. The buying was solid as you would expect with every sector closing up, if I had to pin-point an area which led the charge it would be the recovery story with stocks like Corporate Travel (CTD), Transurban (TCL) and Adbri (ABC) all trading well as the market continues to look through the pandemic, these were ably supported by a strong session by our heavyweight miners. Conversely with only 12% of the market closing down it was a tougher proposition to find standout losers but some of the IT names are “feeling” a little tired.

I’m sure we all know that Australia has finally entered its first recession in almost 30-years, inevitable after the coronavirus smashed the Australian and global economies in March. However, the lack of impact on both the $A and Australian bond market paints a very clear picture, it was no surprise to anybody! Most economists are spending their time burning the midnight oil (maybe!) trying to determine whether we will now experience a V, W or L-shaped economic recovery, an extremely tough gig when the timing of a vaccine plays such a pivotal role.

Interestingly a significant portion of the JobKeeper assistance in the June Quarter was actually put aside for a rainy day as concern for the future remains front & centre in people minds. The overall savings rate increased from 6% to almost 20% the highest level since 1974, another dark period of a global recession. There’s a definite pocket of optimism here, if the Australian economy doesn’t fall off the proverbial cliff when JobKeeper gets reigned back at the end of the month and the economy starts to turn back upward there is some extra money on hand that could rapidly find its way back into circulation.

MM remains bullish the ASX200 medium term.

ASX200 Index Chart

Yesterday, Emeco Holdings (EHL) fell through the issue price of 85c. The offer closes on the 15th September so we can decide before that time. We hold EHL in the growth portfolio and intend to take up the raise, however this will be conditional upon the price of the stock nearing the close date. In any case, we’ll update subscribers of our intentions

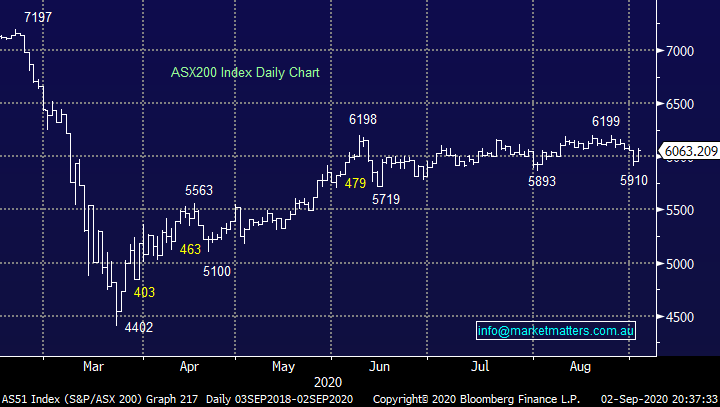

Overnight Xero (XRO) founder Rod Drury was part of a $200m sell down of shares at a relatively small 3.9% discount to Wednesdays close. Ironically, the stock had just made a fresh all-time high after hearing that Chairman David Thodey had bought $405k worth of stock. The cloud computing software giant is already up 30% for the year, it’s no great surprise some people are taking some money from the table, we’ve been considering it ourselves!

MM remains bullish XRO but will be watching the impact of this selldown carefully.

Xero (XRO) Chart

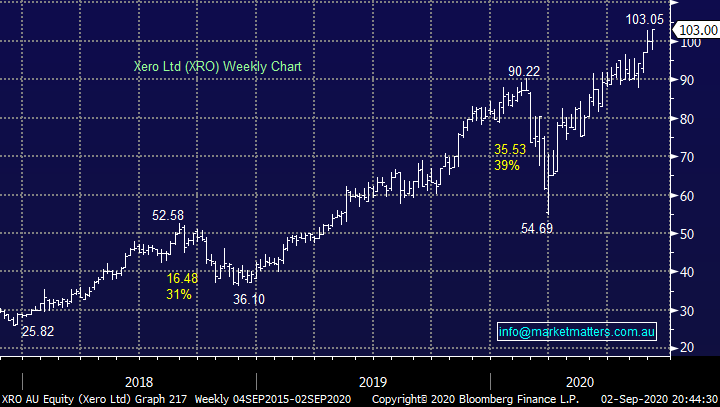

Beware the US election as professional investors are getting nervous – they’re hedging positions against a sharp spike in volatility around November’s US election, it’s now the most expensive event risk on record. The odds at the bookmakers has narrowed recently with President Trump apparently now back in with a big shot. The only thing that doesn’t appear to care is equities, they continue to rally whatever the news week to week.

Often “worry” can be self-fulfilling and uncertainty around the looming US election might indeed cause the rocky start to Q4 of this year that we flagged yesterday but for the moment it’s a case of don’t fight the tape, especially in the US.

MM believes the US election is still a coin toss.

The VIX volatility Index Chart

Overseas Indices & markets

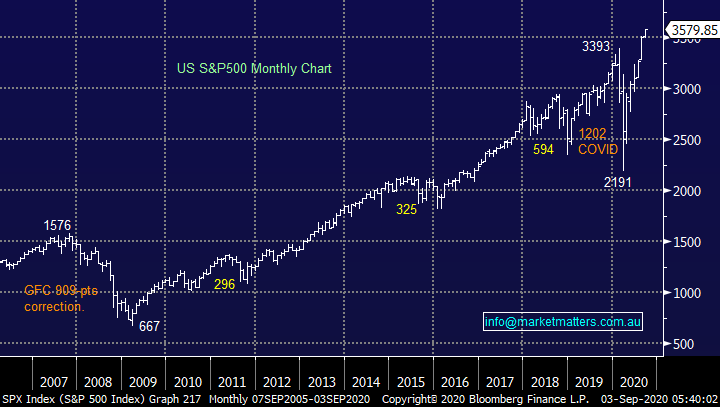

Overnight US stocks continued to power ahead with some of the more unloved stocks leading from the front e.g. the Dow was up 450-points yet high-flying Apple (AAPL US) was down -2% whereas Coca Cola rallied over 4%. The S&P is feeling stretched towards the 3600 area but when we glance at the monthly chart below its only just started breaking out to fresh highs, the trends up and so far its far stronger than any blip in bad news - as we’ve said previously its probably going to need the Fed turning off the “free money” tap to properly slow this freight train.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

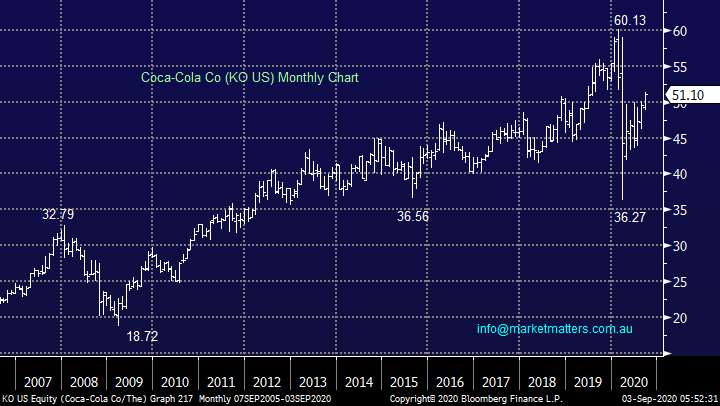

The above mentioned Coca-Cola rallied to fresh post March highs overnight but a quick comparison between it and the broader S&P500 illustrates it has plenty of catch up potential as its sits 15% below its all-time high posted earlier in the year. There are way too many bears out there but a glimmer of hope for them in the weeks ahead might come from the fact the markets rarely pullback until after the underperformers have enjoyed a decent period in the sun.

MM likes KO with stops under $US49, or ~5% risk.

Coca-Cola (KO US) Chart.

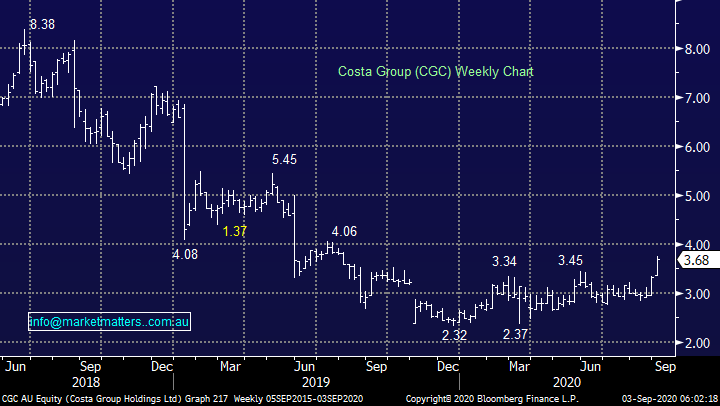

Is there another Costa Group (CGC) lurking?

As we said earlier it was the less glamourous stocks which caught a bid in the US overnight, this morning I’m wondering if we’re about see the same cycle unfold in Australia – over the last week Costa Group (CGC) is up ~25% and AMP Ltd (AMP) +10%. Both of these stocks have received reasonable news with CGC reporting well and AMP being identified as a potential takeover target following an asset review but when the markets underweight, or short a stock, moves can be dramatic as CGC illustrates – MM is long and bullish CGC looking for another 10% upside before we envisage a period of consolidation. Bingo (BIN) is another stock that caught my eye yesterday that seems very likely to rally in the short term.

Following on from Wednesdays Income Report today I have looked at 3 other stocks who’ve underperformed in 2020 to see if we can find another potential 25% “quick pop” where the risk / reward is compelling. Obviously with reporting season behind us any such rally is unlikely to be company news driven but with investors sitting on cash looking for anything that might be cheap the “pop” as we call it might be more in the vicinity of 15-20% but if it unfolds fairly fast with good risk / reward its not to be sniffed at – in my experience these are moves to cash in, not nurtured, hence I would call them active positions and not for subscribers who like to hold stocks long term.

MM is bullish CGC initially targeting ~$4.

Costa Group (CGC) Chart

Bingo (BIN) Chart

Today I have deliberately had a quick look at 3 stocks we haven’t considered of late as we look for another diamond in the rough.

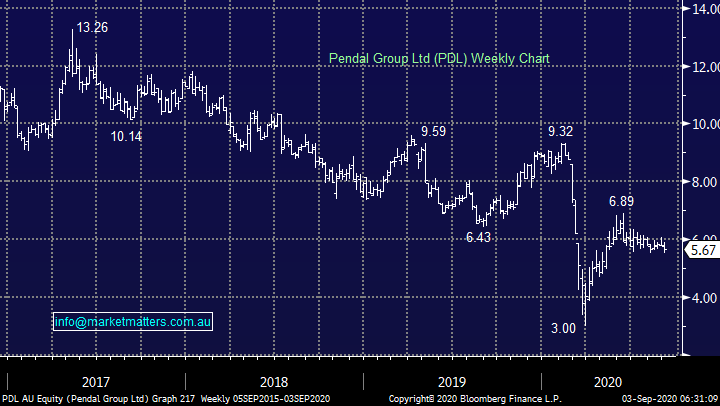

1 Pendal Group (PDL) $5.67

Investment management company (PDL) is down -20% over the last 6-months, the previously called BT Investment management has struggled since BREXIT and disappointing performance on the company level has compounded issues but financial markets are being kind to money managers as we covered recently, the stocks cheap and we feel an estimated yield above 5% should start to garner some attention in today’s zero interest rate environment. The company doesn’t report until November, so the risks of bad news is reduced short-term, we like the potential for PDL to kick higher, but we advocate stops under $5.40.

MM is now neutral / bullish PDL.

Pendal Group (PDL) Chart

2 Incitec Pivot (IPL) $2.10

Explosives, chemicals and fertiliser business IPL is down -23% over the last 6-months, failing to regain most of its March sell-off in the process. The company reported a strong trading update in August sending the stock up +15% in a week, an estimated dividend moving forward over 3% is also a decent bonus. As we’ll likely discuss in the Resources Roundtable today, miners are likely to spend more in the coming year after a relatively benign period in terms of capex – this trend should help demand for industrial explosives.

We feel this is a great candidate for a 20% rally with a stop only 7% lower, excellent risk reward in anyone’s books.

MM likes IPL with stops under $1.95.

Incitec Pivot (IPL) Chart

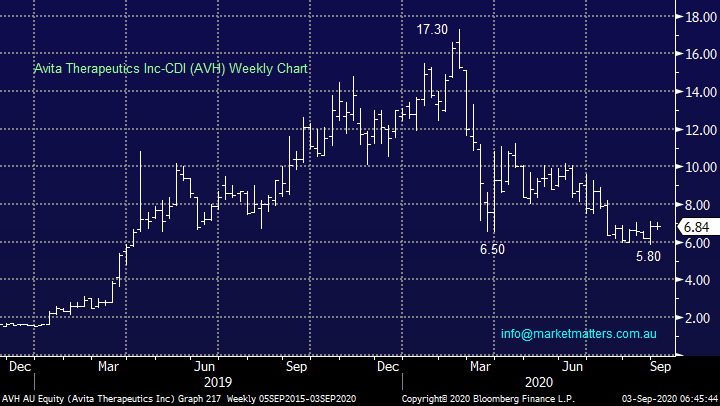

3 Avita Therapeutics (AVH) $6.84

Burns specialist AVH is down well over -40% during the last 6-months after being one of the hottest stocks through 2019. Similar to IPL the stock bounced 15% following its August report which showed revenue grew strongly to just over $US16m but therein lies the issue, does the company deserve a $734m valuation so early in its evolution, especially with many uncertainties ahead of it in the medical field. We like its flagship Recell system but believe this is a stock that needs to have a technical stop in place to minimise risks i.e. we can be buyers with stops under $6.50, around 5% risk.

MM is neutral / bullish AVH.

Avita Therapeutics Inc (AVH) Chart

Conclusion

Of the stocks looked at today and the 3 covered in today’s report IPL was my favourite with a 7% risk (stop).

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.