Can the years worst performers at least finish well? (PGH, CGC, NUF, BAL, CGF)

The ASX200 soared to fresh decade highs yesterday smashing through the psychological 6600 area as if it didn’t exist, Wednesdays 6648 close is now only 3% below its pre GFC all-time high and it would be a brave person who didn’t rule out a test of the holy grail in 2019. Again the strength of the broad market was clearly evident with almost 80% of the stock’s closing up on the day, only the defensive gold shares received any notable selling. Yet again all 11 sectors of the ASX200 closed positive on the day with Energy just taking line honours but there were no real losers, or notable strugglers, on an extremely bullish day.

The market has now rallied an impressive 333 points from its June low to take the pop from its panic December sell-off to 1238-points, or 23%. The markets rich from on a value perspective on the surface but not necessarily if we consider a potential RBA cash rate at 0.75%. Last quarter the market rallied over 700-points so the statisticians amongst us must remain open-minded to a market up less than 500-points in Q2, in simple terms the markets rallying strongly and the elastic band usually gets stretched further than many anticipate, perhaps we will test the overhead trendline ~6875 in the coming weeks / months.

At MM we are in “sell mode” looking to increase our cash position and / or move the portfolios to a more defensive stance but the price action / momentum keeps telling us to be patient and we all know that grabbing profits too early leads to bad investment returns, similar to not cutting losses. At the moment many fund managers are too cashed up and the markets rallying strongly into EOFY, not good for them but nice for MM. While we have a number of stocks in our sell zone like Bingo (BIN), NIB (NHF) and BHP Group (BHP) in all cases their momentum leaves us comfortable observers as opposed to aggressive sellers, for now – we do anticipate pressing sell button (s) in the coming weeks.

MM is bullish the ASX200 while it holds above 6580 especially as we remain bullish global equities for now.

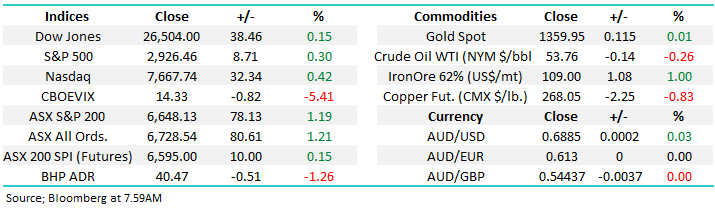

Overnight US stocks took a breather after the previous days heroics with the Dow closing up just 38-points / 0.15%. It was an unusually quiet day on Wall Street for an FOMC announcement (no interest rate change this time) plus President Trump was again tweeting away this time around currencies, perhaps the next war after trade. However the Fed didn’t cut and the Dows up close to 400-points over the last 48-hours so the ability to hold onto those gains felt positive our end. The SPI’s calling the ASX200 marginally higher although the big miners look set to be a drag early on following a ~4% iron ore production downgrade overnight by RIO.

In today’s report we are looking at 5 of the years worst performers as some buying hit the motley crew yesterday e.g. Pact Group (PGH) +4.85% Costa Group (CGC) +2.6%.

ASX200 Chart

The song remained the same wherever you look with overnight US bond yields tumbling to fresh lows for 2019 following comments by Fed Chair Jerome Powell. Mr Powell’s comments were dovish as the Fed sees rising economic uncertainties leading to the market factoring in a ~60% likelihood the Fed will cut rates 3 times by Christmas as the race to the bottom in terms of rates intensifies.

MM believes that rates are going lower with the question how far & fast.

US 10-year Bond yield Chart

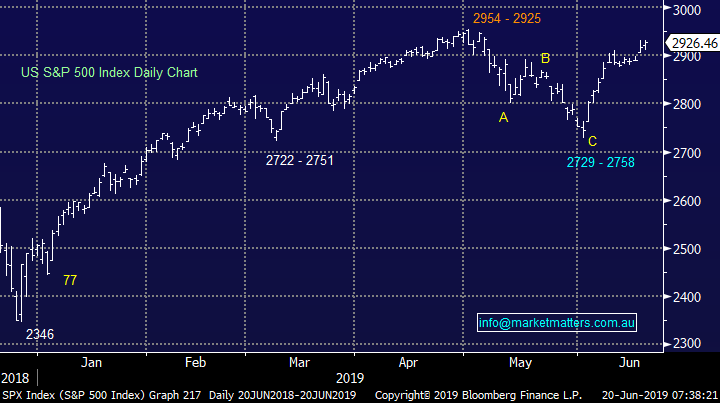

With markets rallying towards fresh all-time highs I continually hear questions around where should I sell as opposed to “is this a good time to buy” – unfortunately human emotion makes a very average investor. In the case of US indices, which we still feel will push higher, the answer is straightforward – if the S&P500 breaks out to fresh all-time highs and subsequently fails we will become negative US stocks and probably the ASX200.

MM will turn negative on the US S&P500 on a false breakout above 2955.

US S&P500 Chart

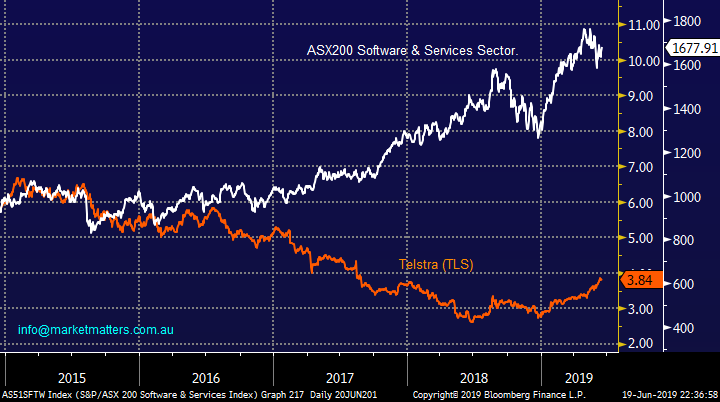

Since the markets major swing low in 2015 / 2016 its been all about risk on as the likes of Appen (APX) and Xero (XRO) have boomed at the relative expense of recently perceived safer areas of the index. The markets optimism towards the areas of growth within the Australian market has taken valuations to extreme levels while the momentum bandwagon has kept on rolling, pushing the WAAAX named group ever higher.

If we look at the profitability of the freshly named Australian WAAAX stocks (WiseTech, Appen, Afterpay, Altium and Xero) they are trading at extremely high multiples, trading ~25% above their US peers.

When we look at the ASX200 Software & Services sector against Telstra (TLS), which has obviously had its own issues, the jaws of comparative performance look poised to close.

MM believes the “risk off” trade is close to a period of outperformance.

ASX200 IT sector v Telstra (TLS) Chart

Assessing the “wrong” end of town.

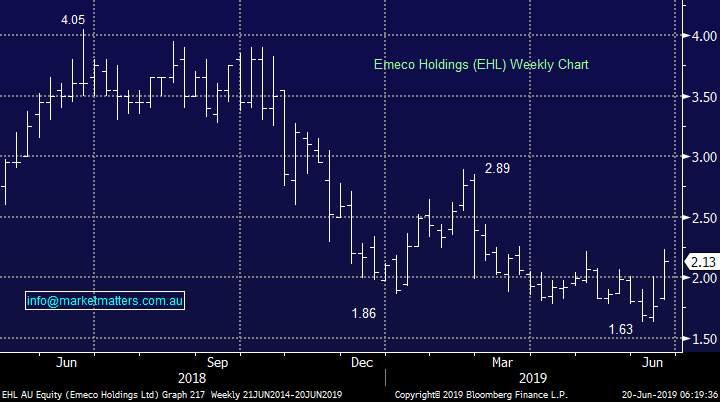

Many fund managers appear to have been caught too cashed up as local stocks have soared to fresh decade highs, in 2019 alone the ASX has rallied over 1000-points, or 17.8%. However at the bad end of town we have 7 stocks that have halved over the same period and 10 that have dropped by over 40% creating plenty of candidates for brave bargain hunters. So far this month Emeco (EHL) has rallied 37% from its low illustrating perfectly that there can be gold in the abandoned hills. We are long EHL in our Growth Portfolio with a target ~$2.50.

Yesterday we saw a couple of these chronic underperformers gain a bid tone as it felt like investors were scanning the market for bargains hence we thought today was an ideal opportunity to look for the next EHL. We have considered 5 of the worse 8 for the year, 2 of which we hold but readers may not.

Emeco Holdings (EHL) Chart

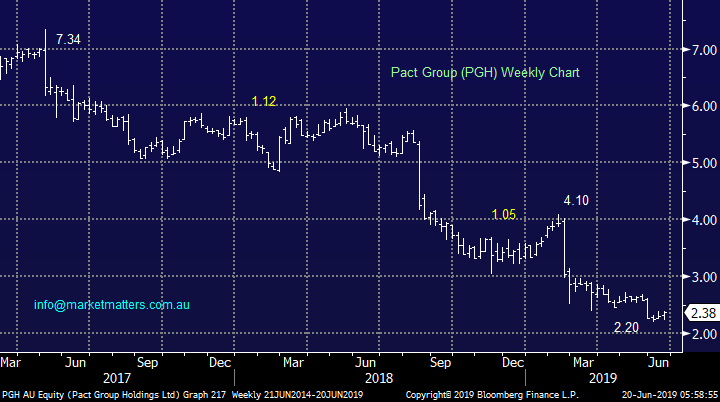

1 Pact Group (PGH) $2.38

Packaging business PGH bounced almost 5% bounce yesterday but unfortunately this pales into insignificance compared to the stocks +55% decline over the last year, the markets 4th worse performing stock. Other packaging stocks Orora (ORA) and Amcor (AMC) have fared far better in recent times which we find encouraging as its not a sector issue but a company one which can be rectified.

The last few years has seen a succession of downgrades for PGH while debt concerns remain as issue, but we feel the new CEO / Managing Director Sanjay Dayal could be just the tonic the business requires, he’s only been in the role since April hence remember Rome wasn’t built in a day!

MM is long PGH in our Growth Portfolio following the stocks plunge below $3 and we still believe the stocks a turnaround story that can emulate EHL.

MM is net bullish PGH initially targeting ~$3.

Pact Group (PGH) Chart

2 Costa Group (CGC) $3.98

CGC is also down close to 55% this financial year so yesterdays +2.6% needs to be repeated for a significant number of days before the stock will look exciting. Just like PGH the below chart illustrates the 3 major downgrades since early 2018 but the market often says don’t buy until the 3rd downgrade.

The latest downgrade was put down to a number of cyclical factors that arose in 2019, they are largely weather related and / or certain conditions in two of their product lines, raspberries and citrus. There’s no sugar coating the downgrade, it’s the second since January highlighting the significant number of moving parts and complexities in an agricultural business like this. Of course, this makes predicting earnings in the short term challenging, however despite these near term headwinds we continue to see medium term opportunity as the business grows, diversifies both in terms of product and geography. CGC remains the largest grower, packer and marketer of fruit and veg in Australia.

MM is long CGC in our Growth Portfolio having averaged following the stocks plunge below $4 and we still believe the stocks a turnaround story but it’s likely to require a little time to regain the markets confidence. We are currently sitting on a paper loss of ~20% in Costa.

MM likes CGC below $4 as a turnaround story.

Costa Group (CGC) Chart

3 Nufarm (NUF) $4.09

NUF is down over 52% this year with the manufacture of agricultural chemicals suffering on 2 fronts – extreme Australian weather conditions and risks around litigation from its links to glyphosate. We wrote about NUF in a recent note on the 7th June (click here) and that note prompted a reply from one subscriber who knows the sector well. While we have no interest in NUF as an investment, I think it’s important to balance our view (we are external looking from a markets perspective) with feedback from the industry and for that reason we’ve re-printed the response below.

GDay James - I have emailed you about NUF before. You are right, don’t go near them.

The problem with NUF is not around glyphosate per se. The issue is that it is a badly run company that has very little to offer the market other than generic chemicals that have very low margin, this will not change because they have no proper R and D division. They are riding on their good name which is rapidly eroding.

Interesting, your comments about Glyphosate. You are an influencer, and I think some of your comments may be misguided or ill-informed. This is a major problem for our industry, our social license to farm food and fibre is being undermined by comments such as yours. There is no link between Glyphosate and Cancer. Jurys are ruling on cases not science and the sharks/lawyers are circling. If we were to ban Glyphosate here is a list of things that will happen:

- the cost of food will more than double

- Agriculture is worth $60b to the economy, most of that will be gone.

- Half of the people in our industry will be out of a job

- More droughts- Glyphosate means better water use efficiency.

- Increased cultivation and erosion of soils, means more dust in the cities (more cancer!)

I have a great deal of respect for you. Choose your words carefully, people listen to what you say. Have a good day.

MM has no current interest in NUF.

Nufarm (NUF) Chart

4 Bellamys (BAL) $8

Organic food producer BAL is down just over 50% this year with concerns around US – China trade one of the obvious reasons, however regulatory approvals have also been a factor and more recently, China has announced an action plan to promote domestic production of infant formula setting an optimistic 60% target but without a time frame. Clearly the sector is influenced by many external factors and when we also consider that Nestle has lined their sights up on the lucrative market – the regulatory & competitive landscape is clearly a complicated one.

This stock is simply a great example of optimism getting way too far ahead of itself - when its baby formula initially took off in China all sorts of crazily optimistic extrapolations of earnings did the rounds but as is usually the case reality disappoints many.

Technically we want to see BAL at fresh multi-year lows before its attractive plus its not cheap with an Est 2019 P/E of 26x.

MM has no interest in BAL at current levels.

Bellamys (BAL) Chart

5 Challenger (CGF) $6.43

CGF is down almost 48% this year as downgrades continue, its latest is for normalized net profit to now be $545m to $565m. Although the stocks getting cheaper now trading on an Est P/E of 12x it’s not a place we want to be at the moment, and it won’t be helped by lower interest rates and higher costs within the business. This is a business very leveraged to external factors and those external factors have been a headwind in recent times. I still remember when CGF traded below $1 during the GFC.

CGF are now in a process of de-risking the investment side of their business, the side that delivers the returns to underpin their sold annuities. In the past, they had a riskier book and that risk hurt them in times of volatility. The company is now reducing risk but as a consequence, returns will be reduced leading to CGF becoming a more vanilla annuities provider, which ultimately should trade on lower multiples. .

CGF shares have more than halved over the last 18-months and it’s now clearly a candidate for “tax loss” selling, we see short-term value emerging around 5% lower as a trade but CGF is not investment grade through this period of transition.

MM may be tempted as an aggressive trade below $6 but we are not investors here!

Challenger (CGF) Chart

Conclusion (s)

Of the 5 stocks we looked at today the only 2 that interest us at todays prices are Costa Group (CGC) and Pact Group(PGH) and we own both!

Global Indices

Again nothing new with our preferred scenario - the recent pullback was a buying opportunity although we are initially only looking for a test of / slight new 2019 highs from US indices.

The current dovish stance by the Fed has helped the S&P500 get within 2% of its all-time high, perhaps some positive news from this week’s G20 meeting between on trade between the US & China will create the market optimism for a test of the large psychological 3000 area.

US S&P500 Index Chart

No change again with European indices, we remain cautious European stocks but the tone has improved recently and fresh highs in 2019 look a strong possibility.

German DAX Chart

Overnight Market Matters Wrap

· US equities pushed higher for its third consecutive session, while the short term yields lost following the US Fed holding its current interest rate but noting it has turned dovish and has opened its door for future rate cut/s.

· On the commodities side, plenty of action on the Iron Ore names, with Rio cutting its supply, while Vale restarted some tonnes.

· BHP is expected to underperform the broader market after ending its US session down 1.26% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 23 points higher, towards the 6670 level this morning. Note we expect a volatile open due to June Index expiry.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.