Can the “risk” sector manage a leg higher? (XRO, APX, ALU, APT)

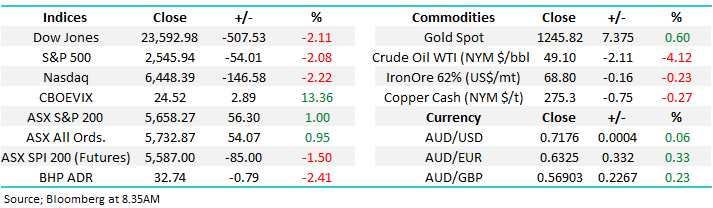

Yesterday the ASX200 enjoyed a corker of a session rallying 1% and totally ignoring an almost 500-point drop by the Dow in the process. The resources led the gains but the market demonstrated strength across almost all sectors as it rallied up 80-points / 1.4% from the anticipated nervous opening. This morning is clearly going to require a similar effort to avoid a very bad day at the office following another 500-point drop by the Dow.

The market appeared to garner support from the prospect of some vote enticing “bribes” by both parties before next May’s election, rumours of future Chinese economic stimulus plus confirmation of a major special dividend by BHP.

This week is likely to remain very choppy, especially in the US with the key event likely to be the US Feds decision on interest rates this Wednesday - the odds of a hike are now sitting ~68% however worth noting that we’ve only seen the US Fed hike rates twice out of the last 70 times when stock markets are down on a 3 month, 6 month and 1 year time frame and that was when inflation was an issue in the 1970’s – our “Gut Feel” is there will be a hike however commentary about the outlook into 2019 will have a big bearing on how the market interprets it. US stocks are certainly building “bad news” into the crunch Fed meeting perhaps we are seeing “buy on rumour sell on fact” in reverse, or perhaps I am just being an optimist!

MM remains mildly bullish the ASX200 short-term targeting a “Christmas rally” but we really need to see a close above 5700 to reignite any major degree of confidence.

Overnight US markets were again weak with the selling focused in the Healthcare Sector following a ruling by a Texas judge that Obamacare was unconstitutional. This illustrates perfectly the current mood in equity land as this ruling is highly likely to be repealed in 2019 but any bad news is embraced by stocks with sheer gusto.

The Dow finally closed down over 500-points and the tech based NASDAQ -2.2% as US stocks again traded around their 2018 lows. The SPI is calling the ASX200 to open down around 70-points, back below the recent 5600 pivot point.

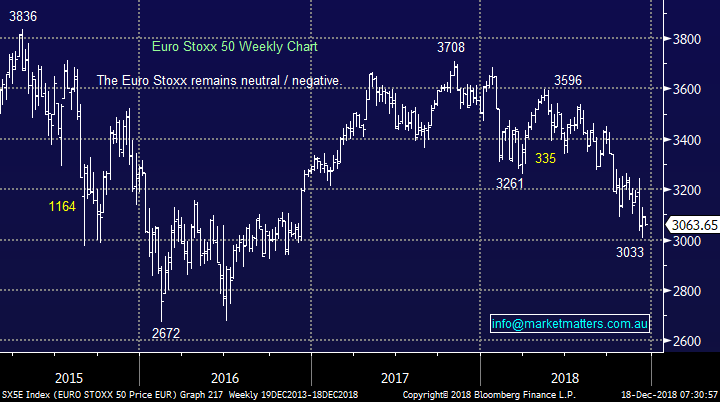

Following the NASDAQ’s unwind today’s report is going to look at the “risk” end of town which recently has been reflected almost perfectly by the Software & Services Sector.

ASX200 Index Chart

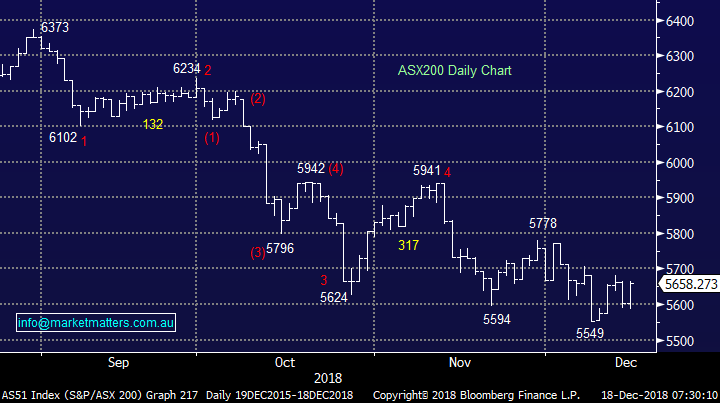

Yesterday we touched on a possible second referendum in the UK which in our opinion is the only solution to the BREXIT debacle but when politicians are driving the bus anything is possible.

However, what we didn’t mention was the rest of Europe which is disintegrating before our eyes.

This month alone we’ve seen horrendous riots in both France and Belgium and in our opinion you don’t need to be Nostradamus to predict that the EU is headed towards a very messy conclusion.

We can see a short-term bounce in European stocks but it’s definitely not a region we anticipate holding long-term exposure to i.e. European stocks closed down -16% from their 2018 highs on Friday compared to the Dow -10.6% and the ASX200 -10.9%.

MM anticipates further underperformance from Europe in 2019 / 2020.

Euro Stoxx 50 Index Chart

Looking at the Software & Services Index

The Software & Services Sector has had a volatile 2017/18 although it still remains up nicely, even after the last few months ~17% correction. Optimism had taken many stocks within the sector to almost crazy valuations leading to the new market phrase – “We want GARP (growth at a reasonable price) not GAAP (growth at any price).

Momentum traders appeared to keep buying the sector as it made fresh highs in the first half of 2018 without any apparent concern to valuation, MM felt this was always going to end in tears which was the simple reason we avoided these stocks as their valuations became way too elevated.

We eventually put our hand up into the aggressive sell off in late November and our 3 positions are showing paper profits, but considering the recent moves by overseas indices we felt it was time to review the sector – if US stocks and especially the NASDAQ behave the local growth stocks largely feel solid but if they keep declining aggressively it’s unlikely the likes of Appen, Altium and Xero (our purchases) will not follow to the downside.

Software & Services Sector Index Chart

1 Xero Ltd (ASX: XRO) $39.96

Online accounting software business XRO has grown strongly in recent times as many small businesses move to their user friendly solution. As an excellent software / service business XRO has attractive scalability and should be cash flow positive by 2020.

MM likes XRO after its 31% correction but it’s likely to struggle this morning following overnight weakness in the NASDAQ.

MM remains cautiously bullish XRO targeting an initial advance of at least 10%.

Xero Ltd (ASX: XRO) Chart

2 Appen Ltd (ASX: APX) $13.27

APX is a world leader in artificial intelligence (AI) space and as such we expect the demand for its services to grow significantly in the years to come as AI takes a foothold in so many industries.

The chart pattern for APX is a touch messy but a break to fresh all-time highs would not surprise if / when we get a stable market.

Appen Ltd (ASX: APX) Chart

3 Altium (ASX: ALU) $21.93

ALU is an electronic design software business, its award winning software has led many to forecast it to achieve market leadership in PCB design in the coming years.

The companies revenue in 2018 was $US140m illustrating this business is far from all about hope for the future although a P/E of 40x in today’s environment does leave little room for error.

At todays level ALU looks neutral but we would considering increasing our position below $20.

Altium (ASX: ALU) Chart

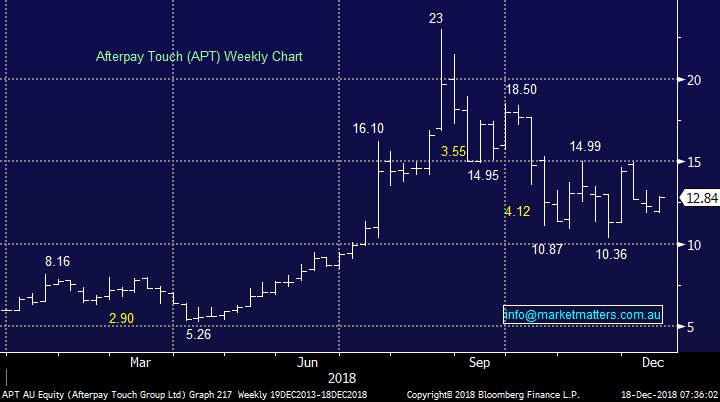

4 Afterpay Touch (ASX: APT) $12.84

APT has become a talking point of late as regulatory issues have pressured the stock.

A bounce up towards $16 would not surprise but MM is unlikely to consider the “buy now pay later” lender.

Technically APT is now neutral having hit our $15 target area.

Afterpay Touch (ASX: APT) Chart

Conclusion

We still like XRO, ALU and APX but obviously the influential US tech sector needs to hold together for any meaningful headway is likely to unfold.

MM intends to give our 3 purchases some more room / time, for now.

Overseas Indices

The US NASDAQ needs to hold together around current levels otherwise something far more sinister will appear to be unfolding.

US NASDAQ Chart

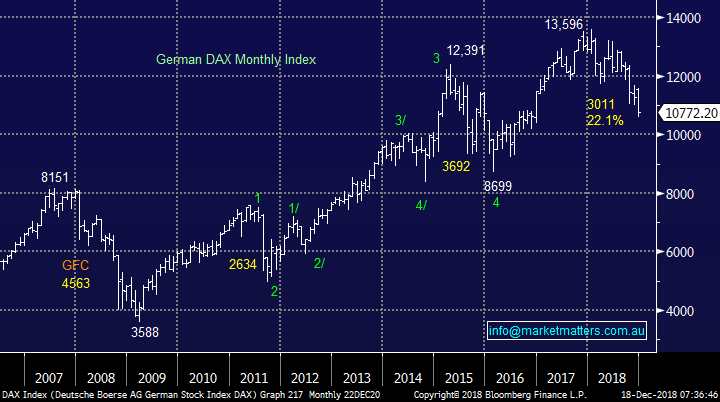

European indices are now neutral short-term but the bigger picture is average with the German DAX on track to decline at least another 10%.

German DAX Chart

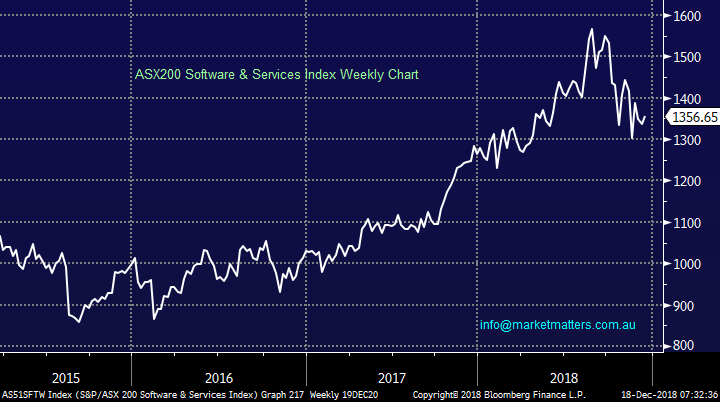

Overnight Market Matters Wrap

· The US equities remained on its downward slope overnight, with all 3 majors ending their session over 2% lower, with investors bracing for the US Fed to hike rates for the final time this year.

· The current year to date performance for the major 3 US indices are – Dow -4.56%, S&P 500 -4.78% while the Nasdaq 100 is currently sitting in positive territory, up 0.81%. Australia however is underperforming significantly, down -6.71%, while our comrades New Zealand Index is outperforming, up 3.46%.

· BHP is expected to underperform the broader market, after ending its US session down an equivalent of -2.41% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to give back yesterday’s gains and more, down 73 points towards the 5585 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.