Can the budget reignite local stocks? (WEB, CIM, BIN, JHC, CBA, CCL)

Yesterday the ASX200 had another ok session closing up 7-points but it gave up most of its mornings gains as unease crept into investors’ minds ahead of the 2018 Federal Budget. The market is simply consolidating the recent strong gains having spent the last 4 trading days in the relatively tight band between 6050 and 6111. While we can see this continuing for the next few days our bullish stance remains intact with another leg to the upside feeling not too far away – remember if May has an equal range to the average of last 3-months the upside target for the ASX200 over the next few weeks is ~6270 / 2.9% higher.

- Market Matters remains bullish the ASX200, initially targeting the 6250 area, or ~2.6% higher.

Last night’s voter friendly pre-election budget has few major surprises as the new norm continues to be “leak” the bulk of the content beforehand, keeping the papers in content for days! A strange approach for sometimes price sensitive economic data that can move stock prices but I’ve given up trying to understand politics!

A few standouts catching our eye on top of the obvious tax cuts for 10 million Australians:

Winners – Older Australians, commuters via infrastructure spending, lower / middle income earners, family’s energy bills, the Great Barrier Reef, the sick and importantly the “future” if they can deliver on a budget surplus by 2019/20.

Losers – Welfare / visa cheats and IT giants (e.g. APPLE & Google)

Let’s hope the very ‘bullish’ forecasted increase in GDP to 4.25% comes to fruition otherwise we may run out of money to pay for it all. Overall, we see little impact to the broad local share market but the removal of uncertainty is usually positive for stocks. Overnight leads are giving very little away with the Dow up 2-points and the futures pointing to a another test of 6100 by the ASX200 early this morning.

Hence rather than bore readers with a granular look at last night’s budget we have picked out a few titbits that may be useful while keeping our finger on the overall market pulse.

PS Yesterday we sent out a MM survey as we embark on major upgrade to the MM website and service, thanks for the huge response to-date and for those who have not yet completed the survey please spend the 5-minutes to help all the MM community benefit.

ASX200 Chart

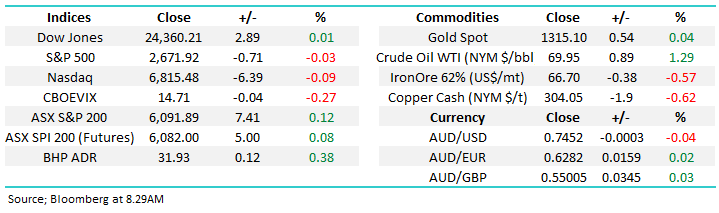

Overseas Indices & markets

US Stocks remain in an ever decreasing trading range following Februarys sharp sell-off. We remain mildly bullish the US targeting one final pop to fresh all-time highs in 2018:

- We are bullish the broad based Russell 3000 targeting 1700, or 7% higher.

US Russell 3000 Chart

Our position in the $US Index is nicely on track as the “greenback” made fresh multi week highs again last night but alas the usual inverse correlation with commodity prices is still not unfolding as expected i.e. It appears we took profit on some of our resources holdings too soon.

- We remain bullish the $US which is being assisted by rising interest rates.

Hence we continue to be bearish the “yield play” sector – US utilities are the worst performing S&P500 sector over the last 6-months, falling almost 8%. However it remains good news for Australian companies earning substantial revenue overseas with the $A down over 8% from its January high.

The $US Index Chart

European stocks remain extremely constructive targeting fresh all-time highs in the relatively near future.

- We remain bullish the UK FTSE targeting ~7900, or ~4% higher.

UK FTSE Chart

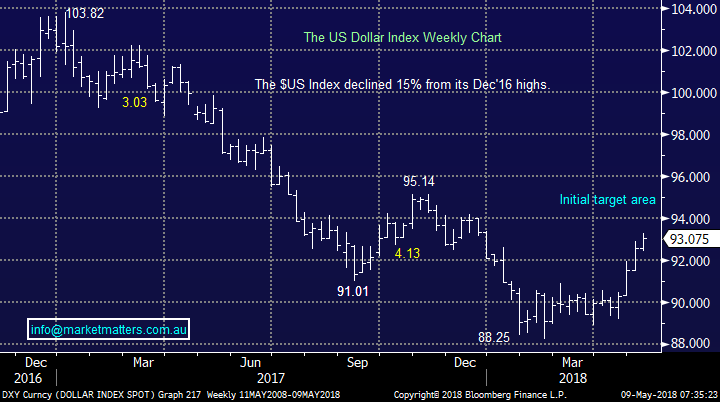

1 Tax on overseas hotel accommodation websites

Australians have been increasingly booking hotel rooms through offshore companies - but these businesses will no longer be exempt from GST i.e. a 10% price hike decreasing their competitive edge.

Bad news for the likes of Booking.com, Trivago and Expedia but this should assist local stock Webjet (WEB) which happily MM is long in its Growth Portfolio – let’s hope the 8% short position gets squeezed today!

- We remain long and bullish WEB targeting the $13.50-$14 area.

Webjet (WEB) Chart

2 $24.5bn infrastructure spend.

Everybody anticipated a large infrastructure package but this is probably larger than anticipated as the government push to reduce travel / commuting time.

Unsurprisingly most Australian infrastructure stocks have run pretty hard of late e.g. CIMIC group (CIM), Downer (DOW) and Lend Lease (LLC).

One company in the mid cap space primed to benefit is waste management provider Bingo Industries (BIN). Building infrastructure creates waste and of the 16 recent infrastructure projects dished out in NSW, BIN has won 15 of them + they have a facility next door to Badgerys’s Creek!

- We like CIMIC Group (CIM) targeting $55 with stops below $39 – solid 3-1 risk / reward.

- We like Bingo Industries (BIN) however liquidity can be an issue - the company only listed on the ASX in May so we have limited technical data

CIMIC (CIM) Chart

Bingo Industries (BIN) Chart

3 Assistance to the “Baby boomers”.

The government will also fund 20,000 new home care places to help older Australians stay at home for longer.

Not a great outcome / precedent for the likes of Japara Healthcare (JHC) and Estia Health (EHE) – we are neutral both of these stocks.

Japara Healthcare (JHC) Chart

4 Major bank levy to continue.

Morrison said the government would continue to “roll out our stronger penalties, powers and enforcement to take action on misconduct.” The bank levy will continue, the new Australian Financial Complaints Authority will start on November 1st and the previously announced regime to hold bank executives to account will start on July 1. I feel this has all been built into the bank share prices over recent months.

- We believe banks represent good value at current levels, especially on a comparative basis.

Commonwealth Bank (CBA) Chart

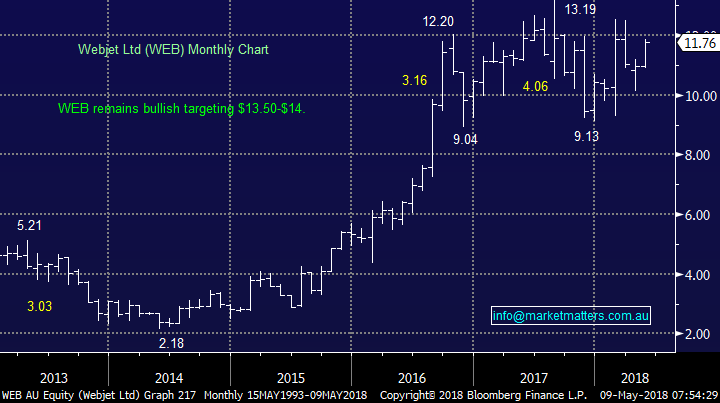

5 Obesity / activity spend.

The government has pledged $150m to get Australians more active as it stares down the barrel of huge costs associated with obesity and subsequently diabetes – already a greater cost to the nation than smoking.

Unfortunately this is growing problem for Australia and the western world more generally. Hence we have no interest in stocks like CCL that magnify the problems and will be on the lookout for market opportunities that deal with the issues both prior and after obesity.

Coca-Cola Amatil (CCL) Chart

Conclusion

1 Our holding in Webjet (WEB) should be a beneficiary of the budget.

2 Avoid stocks like CCL that are detrimental to the weight problem in Australia.

3 We like BIN and CIM in the infrastructure space

4 We believe the bad news for our banking sector is primarily behind us.

Overnight Market Matters Wrap

· The US ended their session with little change overnight, with investors sit on the sideline with another potential geopolitical tension on the cards – this time President Trump’s decision to abandon a nuclear deal with Iran.

· The Energy sector gained following the strength of Crude Oil, while the defensives - Health Care, Telcos & Utilities lagged.

· Clydesdale Bank (CYB) is expected to recover yesterday’s losses and gain after ending its London session higher to an equivalent of $5.85 from Australia’s previous close of $5.51 while BHP is also set to outperform the broader market after ending its US session up an equivalent of 0.38% to $31.93 from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 14 points higher, testing the 6110 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/05/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here