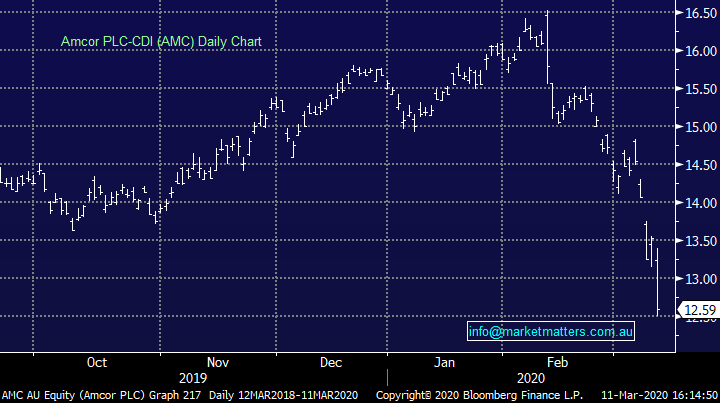

Biden firms as Democratic favourite, US Futures drag our market into the red (AMC, NCM)

WHAT MATTERED TODAY

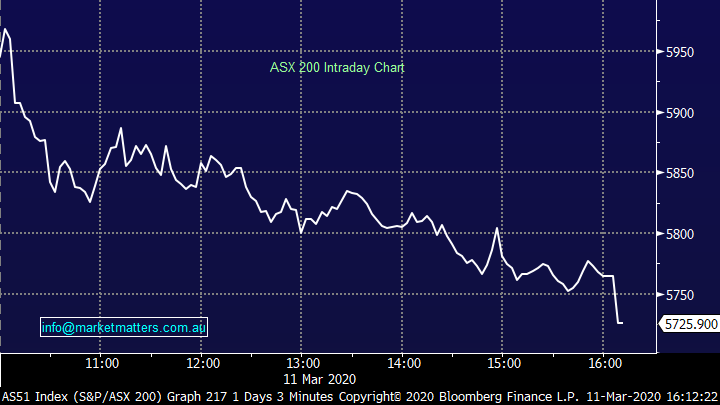

US stocks traded higher overnight, the Dow Jones up by more than 1,000pts however that optimism failed to filter through locally today, the ASX officially hitting bear territory as defined by a 20% decline, although the swings have been bigger than that already. A bear market is a meaningless term that will capture the headlines tonight, however ultimately, it’s here nor there for markets, as Mike on our insto desk just exclaimed…the best thing about bear markets is they turn into bull markets…at some point!

After a reasonable open today (mkt +32pts early), the selling was consistent from around 11am onwards, with the market closing on the session lows. S&P saying we would go into recession, bank stocks sold after confirming they would be supportive of small business through this difficult period, which is obviously a negative for bank earnings while the focus on a looming stimulus package from Canberra failed to ignite the bulls. The AFR leading with headlines that stimulus should be at least $10bn – we’ll find out tomorrow how many $$$ they’ll pack into the helicopter.

We’ve also had hints coming from the RBA about unconventional policies mainly targeting the front end of the yield curve, but all this is now a known known to some degree.

I think more importantly today was the decline in US Futures (Dow off -640pts) during our time zone as Joe Biden firmed as the likely Democratic candidate, he’s a real contender against Trump and that’s being reflected in the betting / market positioning, Trump blown out to $1.80 vs Biden at $2.25 to win Novembers election. The market likes Trump and while Biden is no extreme like Sanders or Warren, he’s still a democrat. 1,000 Americans now with Coronavirus also not helping things today.

Asian markets were also soft today, Japan down 2% the worst of them while China trickled down -0.28%.

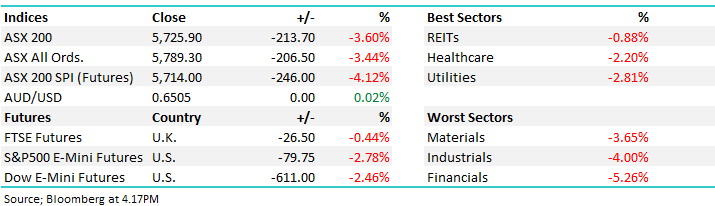

Overall, the ASX 200 fell -213pts / -3.60% today to close at 5725 - Dow Futures are trading down -640pts/-2.75%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Banks: Banks the major drag today thanks to 1. S&P saying that We believe Australia's economy will move into recession by June 2020, and grow just 1.2% in 2020 before rebounding.

They went on to day that its ratings on Australia (AAA/Stable/A-1+) are not under immediate threat from the now likely technical recession and the fiscal cost of the government's imminent stimulus package following the outbreak of COVID-19. The ongoing coronavirus outbreak comes on the back of climate-related events such as major bushfires and storms on the east coast of Australia.

2. The banks also hit after saying they’ll be supportive during these difficult times, banks being supportive = negative for earnings.

Commonwealth Bank (CBA) Chart

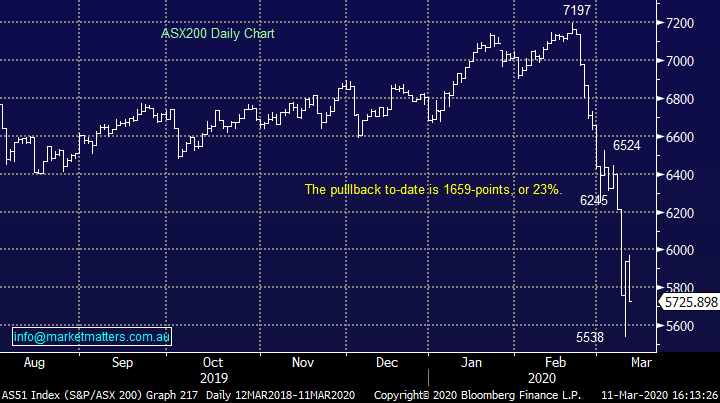

Amcor (AMC) –6.95%: Hit record lows today on the back of a Short Report. Have not read it howeverSpruce Point Management have targeted AMC as a short, projecting 40%-60% in downside for the packaging company. Shares were hit today as a consequence trading down 6.95%

Amcor (AMC) Chart

Newcrest (NCM) -8.61%: updated their production guidance today, lowering expectations by 10% for the financial year. Within the downgrade there was added production out of Ecuador as the Fruta del Norte mine came on earlier than expected. Recently divested Gosowong mine production was removed from guidance, but the big hit came from difficult operating conditions at Lihir, one of Newcrest’s key assets. The mine struggled in the first half with Newcrest pushing guidance to the lower end of the range and now the problems have extended through the third quarter forcing the hand of management to downgrade expectations.

The range was lowered 180koz for the year, down 18% for the mine or around 9% of the group’s production. Newcrest has had a number of operating issues hit lately causing higher costs and lower production run rates. Despite all of this, they are a tier 1 producer and have A grade assets, often talked up as an M&A target. It’s problem for the short term is gold which has failed to rally substantially despite the risks around the global economy of late. Hard to be bullish gold stocks, hence we are not interested in NCM here.

Newcrest (NCM) Chart

BROKER MOVES: Qantas in the cross hairs today from Macquarie as analysts have taken “a more cautious view” on Qantas amid lack of clarity over the prolonged impact of the coronavirus, high operating leverage and uncertain timing for earnings stabilization or recovery.

Qantas (QAN) Chart

…Elsewhere

- Nanosonics Raised to Hold at Bell Potter; PT A$5.52

- Southern Cross Media Raised to Neutral at Macquarie

- Qantas Cut to Neutral at Macquarie; PT A$4.80

- REA Group Raised to Neutral at Macquarie; PT A$110

- Altium Raised to Outperform at Macquarie; PT A$37.50

- Dexus Raised to Overweight at Morgan Stanley; PT A$13

- Blackmores Cut to Hold at Morningstar

- South32 Raised to Buy at Goldman

- Bendigo & Adelaide Raised to Neutral at JPMorgan; PT A$8.30

- Sydney Airport Raised to Neutral at JPMorgan; PT A$7.50

- AGL Energy Raised to Equal-Weight at Morgan Stanley; PT A$18.68

- Coca-Cola Amatil Raised to Neutral at Credit Suisse; PT A$11.40

- Tabcorp Raised to Outperform at Credit Suisse; PT A$4.50

- Fortescue Raised to Overweight at JPMorgan; PT A$11

- IDP Education Raised to Buy at Blue Ocean; PT A$21

- Insurance Australia Raised to Buy at Bell Potter; PT A$7.20

OUR CALLS

No changes today

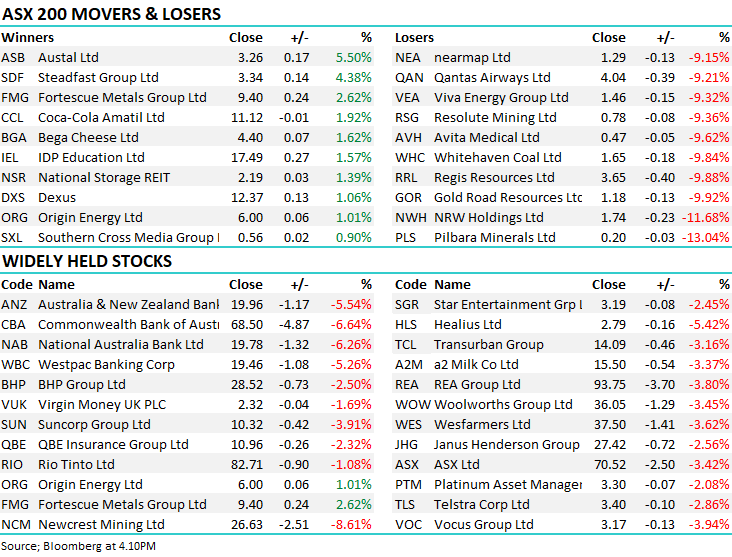

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.