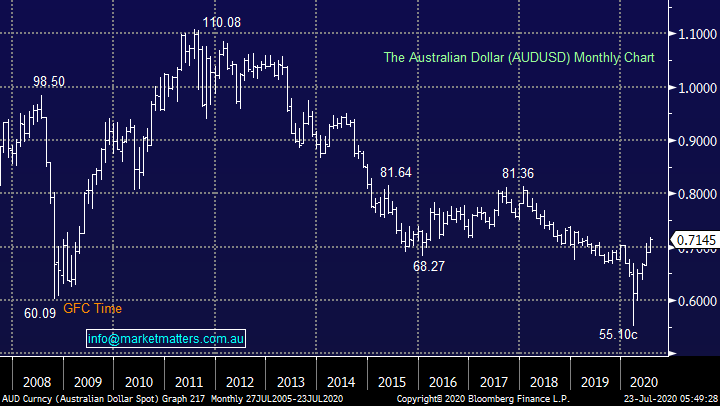

Be mindful of the $A’s impact on earnings (APT, MQG, CSL, RMD, COH, ANN, RHC)

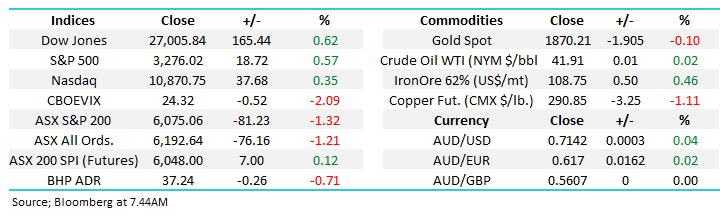

The ASX200 continues to humble anybody who believes it’s about to break free of the 6000 area, including ourselves over the last few days! Yesterday’s -1.3% pullback was relatively broad based with 75% of stocks closing lower with the Healthcare Sector coming under noticeable pressure falling well over 3% as heavyweights CSL LTD (CSL), Cochlear (COH) and ResMed (EMD) all catching my eye – remember they are all major $US earners and the $A popping to fresh 2020 highs is certainly going to pressure their revenue. The significant tailwind of the last decade is suddenly becoming a headwind, more on this later.

The news which did the damage this time was two-fold and discussing them is slowly becoming repetitive but while its influencing the markets day to day mojo we cannot push them to one side:

1 - Victoria is now into a major second lockdown and there is some concern that NSW may follow suit, although cases in our state seemed to be contained for now at least. As we mentioned in the PM note yesterday equities often hate the unknown more than the actual bad news and that’s exactly what we’re experiencing now in spades, everyone’s trying to 2nd guess the next twist in the pandemic tale but nobody really knows. The press is now sensationalising our southern friends saying they may be cut off for years, they’ve short memories, lockdown worked in March and it will again.

2 – US & China tensions are again rising after the Houston consulate was shut down which was predictably followed by China vowing to retaliate – feels like politicians diverting attention from their domestic issues with COVID-19, perhaps I’m just a cynic.

On balance the markets are still dealing with the plethora of bad news admirably but some clarity towards at least the virus feels needed for stocks to take another leg higher.

MM still remains bullish equities medium-term.

ASX200 Index Chart

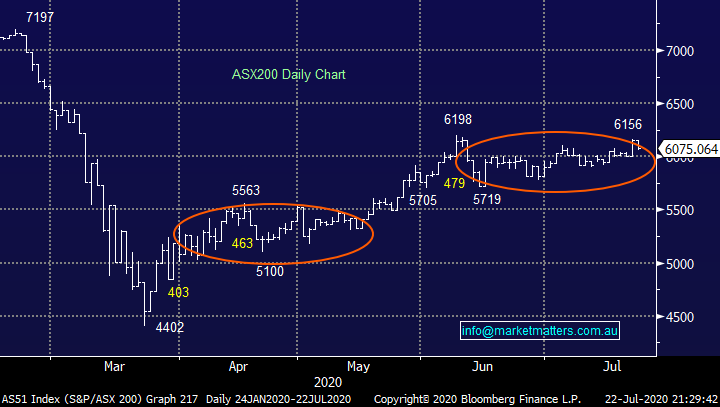

The “Buy now pay later” (BNPL) space is probably the most discussed at present, after of course the coronavirus. Hence even after a relatively quiet few days I thought I would update subscribers on our current take on Afterpay, Australia’s major player in the space. This volatile stock is one where technical analysis can often be very useful, especially as the new superstar of the index has been highly correlated to the ASX since the virus panic back in March. Our preferred scenario is another ~10% rally to fresh highs with the obvious target ~$80, but if this does unfold coinciding with the ASX200 breaking above 6200 we feel the risk / reward starts to favour some profit taking – MM may consider our position in Z1P if it rallies similarly, although I do like the longer term growth drivers of this business as they build our their US presence.

MM remains bullish APT targeting ~$80.

Afterpay Ltd (APT) Chart

Over recent weeks we have been touching on MM’s plan to lighten our market exposure if / when the ASX200 can finally breakout above the psychological 6200 area although the way things are going this maybe months away! One stock under consideration which is steadily climbing into our “sell zone” is quintessential diversified Australian bank Macquarie Group (MQG) which has bounced over 80% from its March low looking after MM in the process. However, all stocks have a fair value and MQG is on our radar above $130 with a couple of our core fundamental views supporting the thought process.

1 – MM is very bullish the $A through 2020 / 2021 but under 40% of MQG’s income comes from Australia hence a strong local currency becomes a headwind.

2 – MM believes the ASX will outperform US indices over the next 12-18 months and MQG is highly correlated to the US.

MM is considering reducing our large ~7.5% MQG position into strength further.

Macquarie Bank (MQG) Chart

Global Markets.

US stocks continue to climb a wall of worry, they’ve become almost immune to 60,000+ fresh daily cases of COVID-19, the underlying huge Fed stimulus is enabling investors to look forward to an economy which is virus free sometime in the next 1-2 years, the WHO suggesting a vaccine will be ready by early 2021, which is not that far off, fingers crossed on that one.

Overnight the broad based S&P500 climbed another +0.6% to fresh post-March highs, it’s now rallied 50% from its march low and is incredibly poised just 3.4% below its all-time high, an impressive performance even for the most bullish amongst us – its easy to see how many retail investors & fund managers have been caught out by the recovery.

MM remains bullish US stocks.

US S&P500 Index Chart

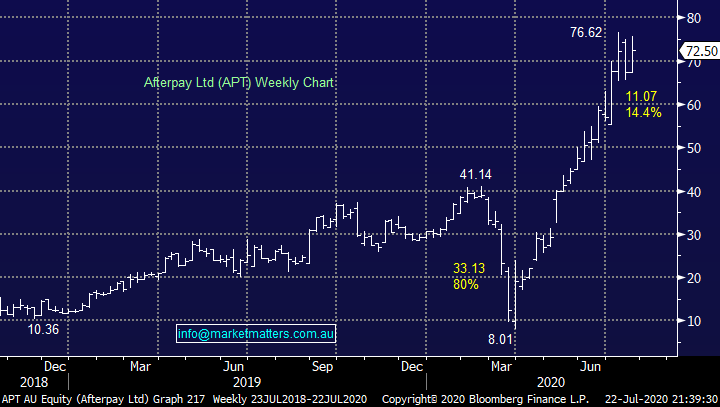

Is the strengthening $A gaining supporters?

I wouldn’t be surprised that with all the volatility and uncertainty created by COVID-19 if many investors haven’t even realised the $A is starting to challenge levels last posted in mid-2019, before any of us has even considered a global pandemic. At MM we have made no secret of our contrarian bullish outlook for the Aussie believing 80c will be achieved in 2020 / 2021, frustrating for some that we can’t use the stronger $A for overseas holidays. From our point of view we simply believe the $A’s 50% depreciation had stretched too far, a common trait for financial markets, especially as the $US currency struggles on many fronts. The important underlying theme for the ASX is many investors appear to have chased “the offshore earners” over recent years, potentially creating a complacent / crowded position in the process.

Hence, we believe there’s a very real underlying risk under the hood of the ASX for some stocks with decent $US earnings, as a relatively short / sharp re-rating would not surprise MM.

MM remains bullish the $A initially targeting the 80c area.

Australian Dollar ($A) Chart

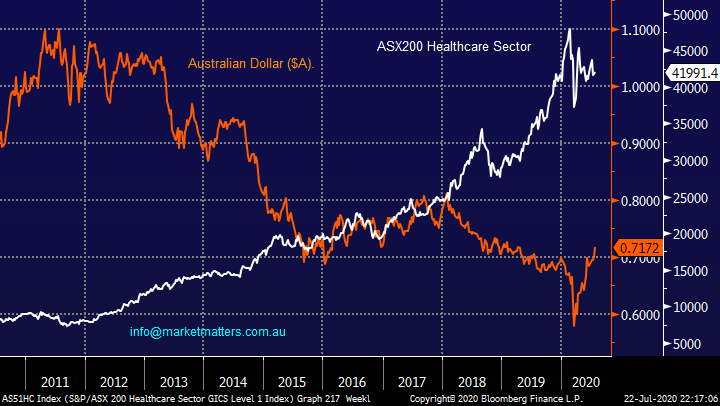

Over the last decade the best performing sector of the ASX has been healthcare although over the last couple of years the IT stocks have grabbed most of the headlines. We have touched on this previously but as we can see below even while the ASX has recovered strongly following its March sell-off the initial strong outperformance by healthcare stocks which was totally understandable at the time has steadily been losing momentum and we’ve pondered if the $A is slowly but surely becoming a major contributing factor.

Obviously under the hood not all stocks are equal especially as CSL has become such a dominant influence hence we’ve delved a little deeper today as we especially consider where some of these quality stocks will present value – MM currently has no exposure to the Healthcare Sector which now makes up over 12% of the ASX200 hence by definition we are in ”buy mode” for the group but at what level is the question, especially as we know from experience how aggressively markets can unwind crowded trades.

The $A and Healthcare Sector have been inversely correlated over the last decade.

ASX200 Healthcare Sector v Australian Dollar ($A) Chart

Today I have briefly looked at 5 well known Australian healthcare stocks with $US / overseas exposure to see if cracks are emerging and where value would present itself:

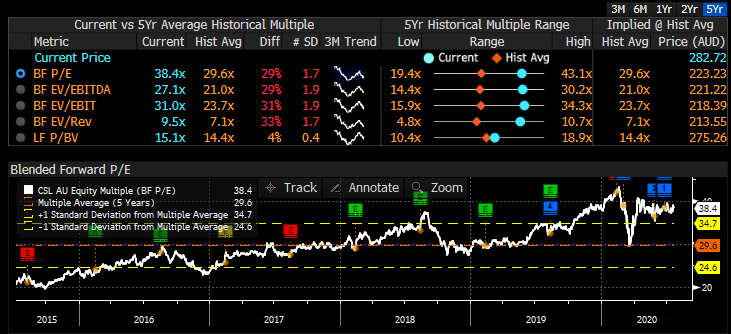

1 CSL Ltd (CSL) $282.72

CSL has become Australia’s largest listed company with a market cap of almost $130bn, a phenomenal performance by this quality company but we remain convinced its led to a dangerous number of complacent investors as its became the “go to stock” of recent years, similar to the banks in 2015/6. While I’m not suggesting for one moment that it will fall from grace like the “Big Four”, the first chart below shows that over the past 5 years investors have been willing to pay a higher and higher multiple for this quality stock. Out simply, its valuation remains rich compared to much of the market although it has clearly moved more into line over the last few months.

Overall, we feel CSL’s revenue growth of 11% last financial year while solid doesn’t warrant a P/E near 40x, 29% / 1.7 standard deviations above its 5-year average. While we continue to believe this is a quality business it won’t interest us until it’s at least ~10% lower, and this is before we even consider the increasing headwind of a strengthening $A. On its 5-year average P/E, CSL is worth $223.

MM is considering CSL under $250, over 25% below its 2020 high.

CSL Ltd (CSL) Chart

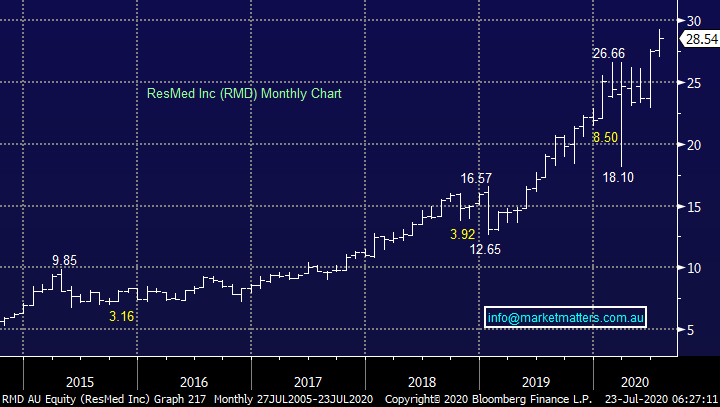

2 ResMed (RMD) $28.54

Sleep and breathing disorder business RMD has gone from strength to strength in 2020 and this is dropping down to strong profit growth to the tune of +20% in FY20. Importantly we can see exciting growth for the companies products over the next decade as the Chinese and Indian economies evolve.

A period of anti-$US earners may provide an opportune risk / reward chance to buy RMD.

Medium / longer-term MM likes RMD here and into any weakness.

ResMed (RMD) Chart

3 Cochlear (COH) $196.57

Cochlear has performed far more in-line with CSL and the hearing device company did its share price no favours by raising $880m during March’s panic at $140. This is another healthcare stock trading on a very elevated valuation which to be justified needs the global economy to re-open, elective surgeries are not a top priority during lockdown.

With the ongoing virus risks and a strong $A impacting the companies earnings MM is not excited by COH at current levels.

MM is neutral COH.

Cochlear (COH) Chart

4 Ansell (ANN) $38.48

ANN’s business has revelled in the new virus world as we all become far more health conscious, similar to working from home we believe this is now a trend which is here to stay although it might taper slightly over the coming years there has clearly been a structural shift. Chasing a stock at all-time highs is not exciting in today’s environment but if it’s going to continue the advance why not. Similar to RMD, any period of anti-$US earners may provide an opportune risk / reward chance to buy ANN.

Medium-term MM likes ANN here and into any weakness.

Ansell (ANN) Chart

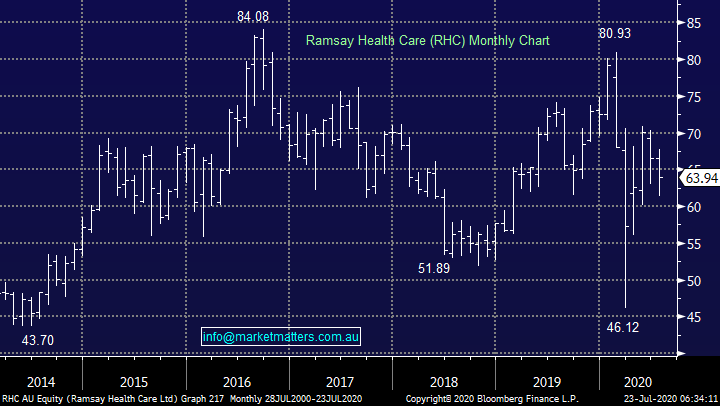

5 Ramsay Healthcare (RHC) $63.94

MM recently took a very small profit on private hospital operator RHC with the following note on the alert : “Ramsay Healthcare (RHC) is exposed to lockdowns in Victoria and while we like the longer term thematic of the hospital operator, we are cutting for a small profit in the short term to reduce risk.”

There’s no real change, we like the stock but with the Victorian lockdown escalating and NSW at potential risk of following suit, I simply feel comfortable with both our move to take a small profit and the potential to re-enter at lower levels.

MM likes RHC into weakness below $60.

Ramsay Healthcare (RHC) Chart

Conclusion

We don’t feel stocks are being sold off indiscriminately because of the stronger $A, they are currently following the more orthodox route of following each individual company’s fundamentals - perhaps we’re wrong and this isn’t a crowded position.

We like ANN and RMD into mild weakness while CSL and RHC will appeal ~5-10% lower as outlined above.

Overnight Market Matters Wrap

· The US equity markets rallied overnight, with the tech. heavy Nasdaq 100 resuming its lead following Tesla and Microsoft reporting better than expected numbers.

· Tensions are at its high between the US and China following the US shutting the China consulate.

· On the energy front, crude oil settled marginally lower held by the tensions stated above. We do expect this commodity to rise further in the short term.

· The September SPI Futures is indicating the ASX 200 to open marginally higher, testing the 6100 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.