Australia’s pain is the share markets gain, for now (RIO, NCM, TCL, GMG, CBA, APX)

Firstly and most importantly, Happy Birthday Mum, this will test you to see if you read these notes daily!

The ASX200 reversed early losses on Thursday courtesy of disappointing Employment Data which fuelled the markets hope for another rate cut by the RBA. The market finally closed up 37-points after being in the red at the start of the day, the poor 11.30am jobs numbers were the clear bullish catalyst i.e. the Unemployment Rate rose from 5.2% to 5.3% but the composition of the report was also weaker than expected. The economic data wasn’t much better from China at 1pm with Industrial Production and Retail Sales both missing analysts’ expectations by a significant margin.

The impact of this double whammy from firstly Australia and then China was felt across domestic markets throughout the session:

1 – Australian bond yields tested their 3-week lows as the theme became when, not if, the RBA will again cut rates to a fresh all-time low – after 11.30am the odds of a February cut lifted from 44% to 64% in rapid fashion.

2 – The Australian Dollar ($A) tumbled below 68c as traders started second guessing when the RBA would cut rates from 0.75% to 0.5%, the lower our rates become compared to those in the US the more pressure the lower yielding $A will feel.

3 – The ASX rallied strongly from 11.30am with almost 70% of the market closing in the green, the growth end of town which enjoys a low interest rate environment not surprisingly caught our eye in the winner’s circle.

At MM we think the markets about right with its 64% chance of an RBA cut in February but what’s not getting the air-time we believe it deserves is the mounting pressure on the Morrison government to kickstart the flagging Australian economy – as subscribers know we believe it’s time for some meaningful fiscal stimulus, the RBA is running out of ammunition from a monetary policy perspective and the incumbent Liberal government needs to step up to the plate.

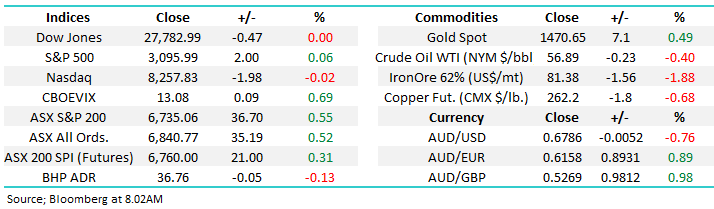

Short-term MM remains neutral the ASX200 with an upside bias.

Overnight global stocks were again quiet and choppy with the Dow down just -0.1% as I tap away at 6am, the SPI futures are calling the ASX200 to open up around 10-points, while BHP slipped slightly even with iron ore up 3% it looks likely to be another day for growth to outperform value on the sector level.

This morning MM will look at which sectors are most likely to rally and fall sharply if Australian bond yields are headed for fresh all-time lows. A slightly shorter offering this morning as I’m on the Gold Coast with some clients / subscribers, more detail on today’s subject will be covered in the coming Weekend Report.

ASX200 Chart

The markets again looking for a rate cut in February following the kick higher by the Australian unemployment rate, a few more disappointing reads and we will jump on the band wagon. The chart below illustrates 2 points very clearly:

1 – The Australian 3-year bonds are a great indictor for the RBA’s next move, to be fully onboard the rate cut train we want to see the 3’s (trade desk abbreviation) drop well under today’s 0.7444% level.

2 – Many stocks like CBA shown below are paying extremely attractive yields compared to official interest rates and subsequently term deposits, however the one biggest influence on banks will be unemployment, higher unemployment means low/no loan growth and an uptick in bad debts – a double negative for the sector.

MM is not yet convinced that the RBA will cut rates early in 2020.

The RBA Cash rate plus 3-year Bond & CBA yields Chart

One poor set of employment data doesn’t make a bad summer but the technical picture we have been flagging over the last fortnight is starting to unfold.

MM believes the Australian 10-years bonds are headed down towards 0.8%, a move that’s likely to benefit the yield play / defensives but we believe this is the final leg lower and should be faded e.g. MM will look to cut its gold position into strength and allocate the monies into value stocks.

MM expects the defensives to benefit if bond yields take another leg lower.

Australian 10-year Bond Yields Chart

Although Australia received the bad economic data yesterday the most widely followed bond yield, the US 10-years, are also triggering major sell signals from the technical perspective. This move should help gold stocks regain some of their recent losses e.g. the Gold miners ETF (GDX US) has bounced~4% this week.

MM think the pressure is mounting rapidly for US bond yields to make fresh lows for 2019.

US 10-year Bond Yields Chart

What sectors are poised to move into Christmas

Falling bond yields has a dramatic impact on which sectors are in / out of vogue e.g. last night the US S&P500 Growth Index rallied while the Value Index fell, pretty vanilla stuff in a falling bond yield environment.

At MM we believe this is the last throw of the dice for growth over value with the latter our preference in 2020. The big question is should we carry a few positions for a move to fresh lows by bond yields – in the MM Growth Portfolio only our gold exposure via Newcrest (NCM) and Evolution (EVN), 6% in total, resides in the defensive corner. As investors it’s important to remember that when trends reverse their characteristics can confuse / disappoint at times e.g. around a meaningful low for gold stocks the sector will often rally even when the precious metal falls, a catalyst we use often for “turn” identification.

We will be watching for potential inflexion points when value stocks start outperforming growth even as yields decline – this very characteristic makes us cautious jumping on the lower bond yield train because we believe this particular party is close to over.

MM prefers value over growth stocks in 2020.

US S&P500 Value & Growth indexes Chart

1 Gold & Resources

Interestingly the reaction from both Newcrest and RIO Tinto to bond yield bouncing / rallying since September has been dramatic:

1 – Newcrest (NCM), like the whole gold sector, has been hammered as fund managers rapidly repositioned portfolios around interest rates bottoming but as we all know entrenched trends take time to let go and our current view is we will get a more opportune area to exit gold exposure: MM is a definite seller of our gold exposure ideally when bond yields challenge their 2019 lows.

2 – RIO Tinto (RIO) rallied as bond yields bounced and similarly its corrected this week as bond yields fell away it declined, we recently exited our Fortescue (FMG) position which feels good but MM is still looking to beef up our resources position into weakness.

MM’s perfect scenario is to switch from gold to industrial metals when bond yields test their 2019 lows.

RIO Tinto (RIO) & Newcrest (NCM) v US 10-years Chart

2 The “yield play” & defensives

This large group of stocks which also obviously includes the influential Healthcare favourites has simply loved falling bond yields but they have come off the boil since the critical yields bounced from late August.

With our preferred scenario “bond yields will fail to make / test fresh lows for 2019” MM must revert to a bullish stance to the likes of Transurban (TCL), Goodman Group (GMG) and CSL Ltd (CSL) but if we are correct this should provide some decent selling opportunities.

MM is bullish the defensives / “yield play” stocks short-term.

Transurban (TCL) & Goodman Group (GMG) v US 10-years Chart

3 The “Big 4” Banks

The picture has been slightly distorted recently as the banks have reported with mixed outcomes but their yields remain very supportive in today’s environment as we showed earlier.

The banks sit in a relatively solid position as they benefit from rising rates from a margin perspective while their yield is extremely compelling when compared to term deposits however at this stage we are steering clear of the regionals i.e. Bank of Queensland (BOQ) and Bendigo Bank (BEN).

MM remains comfortable being long the banks.

Commonwealth Bank (CBA) v US 10-Years Chart

4 IT Growth Stocks

The most dramatic reaction to the last few months kick up in bond yields came from the IT growth sector which was hammered, a number of big names fell ~30% hence this is the space where a snap back on declining bond yields is most likely.

MM is considering a quick foray into the growth space to “play” falling bond yields.

Appen (APX) v US 10-years Chart

Conclusion (s)

MM is happy to continue to structure our portfolio towards value over growth into 2020.

Any quick “play” to benefit from falling bond yields is most likely to be positioned in the IT sector e.g. Appen (APX).

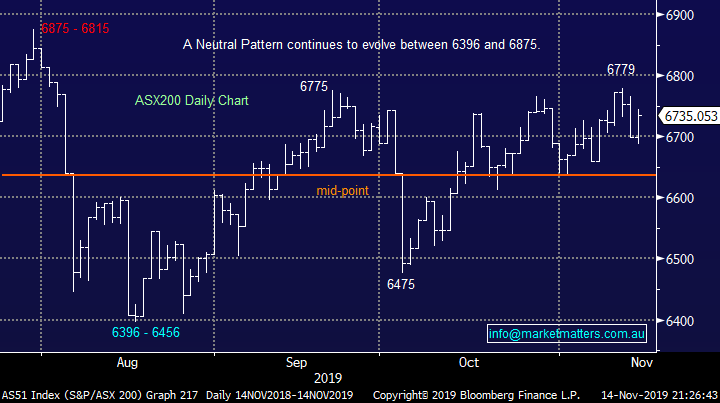

Global Indices

No major change, we had given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated, a close well under 3020 for the S&P500 is required to switch us to a bearish short-term stance.

MM is now neutral / positive US stocks.

US S&P500 Index Chart

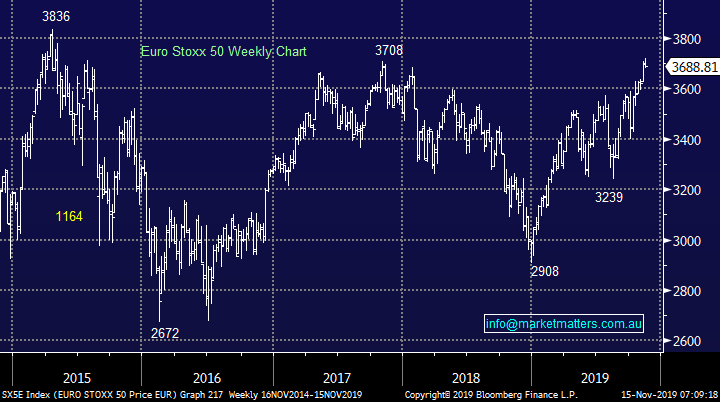

European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias with a target ~10% higher looking realistic.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

- The US equity markets closed mixed after recently hitting all-time highs this week following mixed economic data and growing concerns over the exhausted US-China trade deal.

- Crude oil slid a tad, while gold rose as investors’ risk appetite is slowly being taken off the table as the waiting game resumes.

- Locally the Aussie Battler has slipped back below US68c to US67.86c as investors will be watching for commentary on the mortgage risks to the housing market from the deputy governor of the RBA, Guy Debelle, who is presenting at a business conference at lunchtime.

- The December SPI Futures is indicating the ASX 200 to open 22 points higher, around the 6760 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.