Are warning lights flashing in healthcare stocks? (COH, RHC, PRY, RMD, SHL)

The ASX200 only closed down -0.1% yesterday but there certainly was some volatility under the hood in both directions and interestingly we saw a very different picture unfold to recent years with Telstra (TLS) rally +5.1% while market darling Cochlear (COH) fell -4.2%.

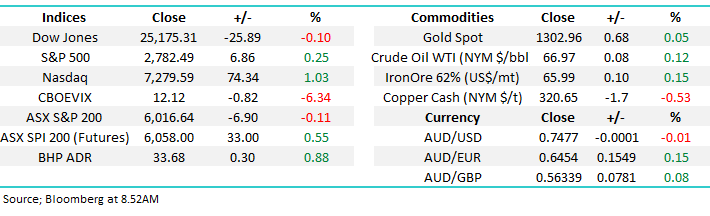

We should remember the timely statistics / seasonality with regard to US stocks:

1. Over the last 20-years the average return for the US S&P500 over June is -0.5% but so far this year it’s up over +2.8%.

2. Historically following early June gains just as we’ve witnessed in 2018, the average return for the balance of June is a meaningfully poor -3%.

This is the “sweet spot” for a monthly top in June for US indices, considering the above numbers plus how the local market has performed recently, a degree of caution is clearly warranted.

· MM remains neutral with a close above 6050 required to rekindle any short-term buy signals for the ASX200 BUT we remain in “sell mode”.

Overnight, right on the heels of the Fed’s interest rate hike, Mario Draghi signalled that the euro-area is finally strong enough to end QE by the end of 2018 while also pledging to maintain record low interest rates until of their summer next year. Currency markets reacted strongly by sending the $US up ~1.5% sending the “Aussie” down to 7470, its lowest level in 4-weeks.

European equities embraced the news sending the EuroStoxx up +1.4% while the US S&P500 was up only +0.25% - remember the ASX200 is far more closely correlated to Europe, hence a strong session to end the week would not surprise.

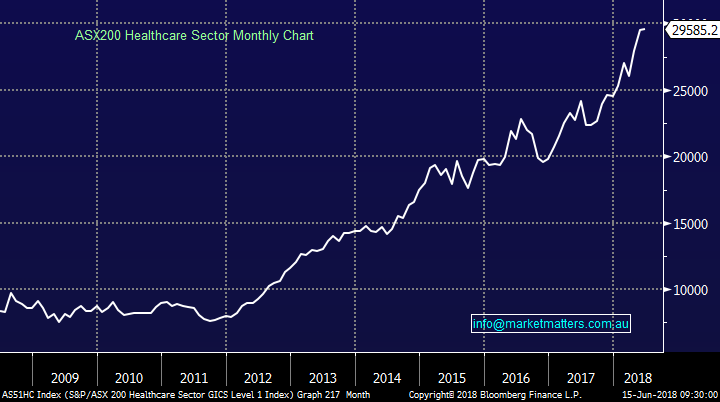

Today’s report is going to look at the healthcare sector which is down ~4% over the last month – it’s extremely rare that we’ve seen underperformance from this sector since the GFC.

ASX200 Chart

As we rapidly approach the EOFY fund managers clearly appear to be busy as individual stocks are experiencing large random moves – clearly some portfolio rebalancing. Today we’ve looked at 5 healthcare stocks that have been fairly active in both directions.

We haven’t covered CSL because we touched on it in Thursdays report i.e. “Short-term we can see CSL dipping back under $180, or around a 5% pullback, but the bull trend remains intact for now.”

- MM likes CSL into weakness with ideal buy levels sub $180 and preferably sub $170 if a major market correction unfolds.

NB yesterday CSL closed down -1.3% at $186.79.

ASX200 healthcare sector chart

Our interest in healthcare stocks this morning was sparked by the drop in Cochlear (COH) yesterday plus US and European central banks signalling interest rates will rise further, usually a poor economic backdrop for the healthcare sector. However, we must also remember our bearish view on the $A which certainly feels correct this morning – a substantial tailwind for the majority of the Australian healthcare names.

The Australian Dollar ($A) Chart

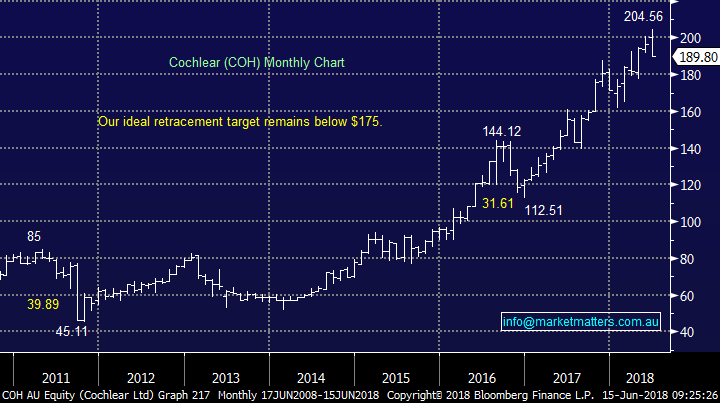

1 Cochlear (COH) $189.80

We must not get carried away by one bad day but likewise they should not be ignored. The Sydney based hearing implant company has undoubtedly enjoyed a great few years but is it worth paying 43.9x Est 2018 earnings?

We feel while the valuation is rich it’s not unreasonable when we consider the company’s growth prospects. However, the stock can be fairly volatile correcting ~13% twice in the last year and over 20% twice in the last 7-years.

Hence due to its high valuation this is a stock we prefer into further weakness.

· We are neutral COH at current levels but are potential buyers of a further ~10% correction back towards $170.

Cochlear (COH) Chart

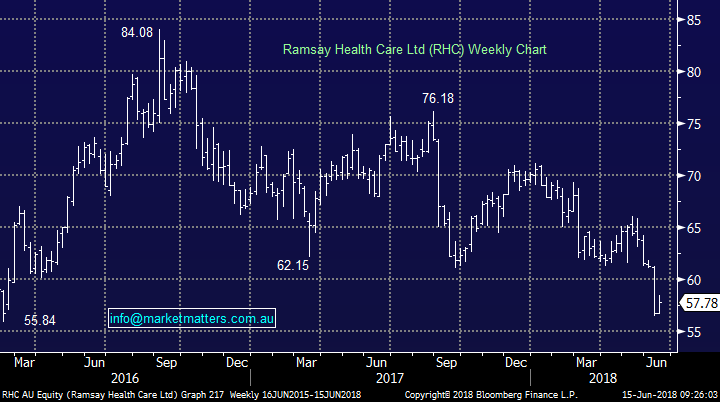

2 Ramsay Healthcare (RHC) $57.78

We’ve discussed RHC a fair bit recently so I do apologise for the repetition but the stocks slowly becoming interesting and if tax loss selling accelerates its -12% fall over this year, MM is likely to start accumulating.

· MM remains a buyer / accumulator of RHC below $55.

Ramsay Healthcare (RHC) Chart

3 Primary Health (PRY) $3.54

PRY was smacked -8.3% yesterday following a major downgrade from influential broker UBS – they went straight from a buy to a sell targeting of $3.50, almost where it closed yesterday following a change of analyst, or as Harry suggested yesterday – an internal power struggle! A bit dramatic a description for me!

The company appears to have some challenges moving forward and doesn’t excite us when compared to other alternatives within the sector.

· We are neutral PRY just here, sitting happily on the fence.

Primary Health (PRY) Chart

4 ResMed (RMD) $14.06

RMD made fresh all-time highs this month making it hard to jump on board the sleep disorder company from a risk / reward perspective.

The stocks trading on a valuation of 30.5x Est 2018 earnings, certainly not too expensive compared to its peers and considering its growth/ track record.

We like RMD as the market place expands while its patents look to get more protection as China evolves. The companies enjoyed strong positive earnings growth in 2017 / 8 which is reflected by its share price and of course it doesn’t hurt that most of its business is conducted o/s.

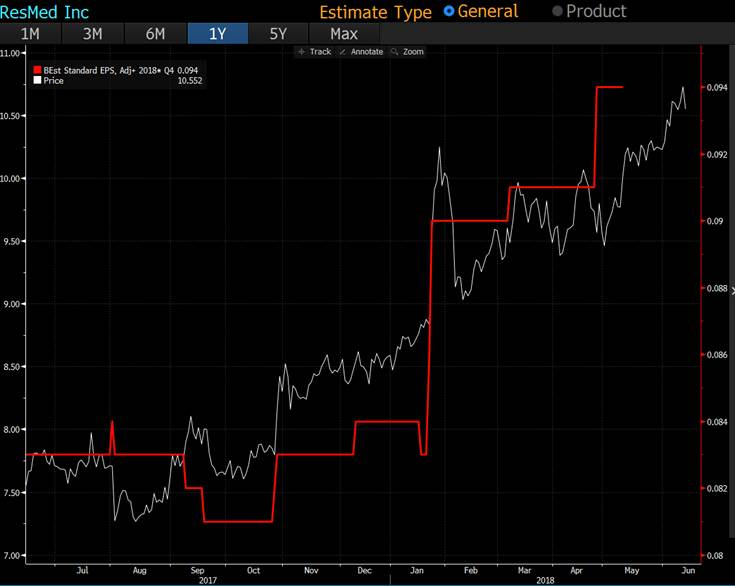

Resmed Earnings (red) v share price (white) – clearly a very good trend

Technically RMD has experienced two $1.50 corrections over the last year providing a potential pivot to jump on this runaway train as risk / reward should always be considered.

· MM likes RMD with an ideal entry between $12 and $12.50.

ResMed (RMD) Chart

5 Sonic Healthcare (SHL) $23.90

The medical diagnostics company has ground higher over the last 2-years with perhaps its lack of presence in the US leading to some of its relative underperformance within the sector.

SHL is not an expensive healthcare stock trading on a valuation of 21.5x while it also yields over 3% part franked. Technically the stock feels heavy as it failed to make any serious gains for ~3-years and our “gut feel” is to stay away.

· We are neutral SHL preferring other stocks in the sector.

Sonic Healthcare (SHL) Chart

Conclusion (s)

The Australian healthcare sector does feel ripe for a reasonable correction but if / when it eventuates MM will be looking for selective buying opportunities.

The 5 healthcare stocks we looked at can be split into 2 groups, those that we are considering buying into weakness and those we will avoid for now:

A. Buyers into weakness – CSL, COH, RMD and RHC.

B. Neutral and currently no interest – PRY and SHL.

Global markets

The tech-based NASDAQ continues to drag the broader based S&P500 higher, almost kicking and screaming, towards its all-time high.

Ideally, we will see the S&P500 rally a further ~4-6% and make the fresh all-time highs we’ve been targeting all year but remember we are looking to fade this move if it eventuates.

US S&P500 Chart

European stocks embraced Mario Draghi’s backing of the EU economy last night sending the German DAX up almost +1.7%.

We continue to target a further ~4% advance for an excellent risk / reward selling opportunity.

German DAX Chart

Overnight Market Matters Wrap

· A mixed session was experienced overnight in the US following the recent rate hike, with both the Dow and broader S&P 500 ending their day with little change, while the tech. heavy Nasdaq 100 outperformed and rallied 1.03% higher.

· With investors now positioned for an expected further 2 rate hikes this year, investors now sit on the sideline waiting for President Trump’s release of particular tariffs against Chinese products.

· BHP is expected to outperform the broader market today after ending its US session up an equivalent of 0.88% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 40 points higher towards the 6050 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/06/2018.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here