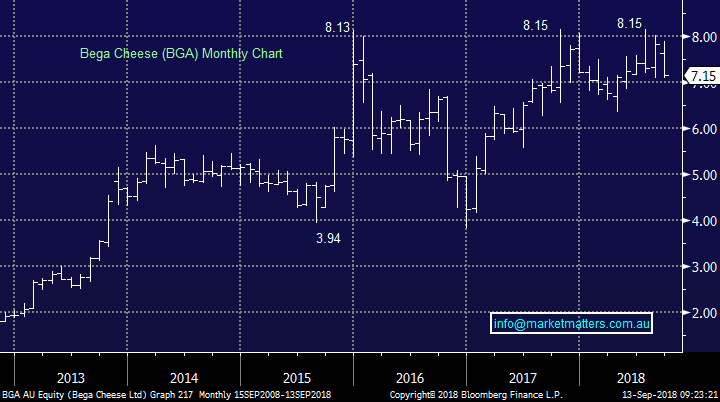

Are there Opportunities in 5 Stocks on the Move? – (WSA, API, MYX, MND, BGA, CZZ, CGC)

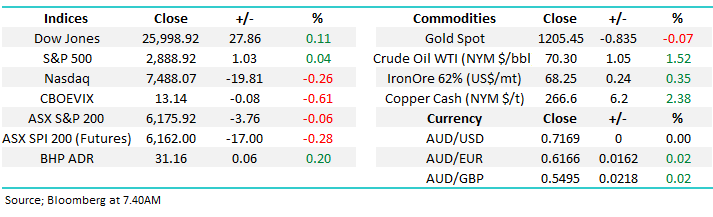

The ASX200 fought hard all day to close in the black but finally fell short by under 4-points. Overall it was a pretty quiet day with only the energy sectors +1.8% gain and Fortescue (FMG) making fresh 14-month lows standing out.

The ASX200 has now consolidated for 3-days below 6200 which is no surprise following the sharp -4.2% fall, remember we said previously “the more time the market spends under the psychological 6200 area the more likely the next leg will again be down”.

• We remain mildly negative the ASX200 targeting the 5800 region, another ~6% lower.

Overseas markets were pretty active overnight, especially outside of equities land:

• US stocks were flat while European bourses managed small gains.

• The $US slipped lower following average economic data plus the news that the US had reached out to China to commence fresh trade talks.

• The Indian government signalled they are considering propping up their battered currency which added to the negative $US sentiment.

• The weaker $US sent metal prices / oil higher and the $A rallied to 71.7c, after trading below 71c yesterday.

Considering the above mix, we were surprised to see the SPI futures call the ASX200 to open down ~15-points, it feels like the $US earners like CSL, ANN, MQG, ALL etc are going to be the target of some selling.

• MM may even pull our buying level for Aristocrat (ALL) back towards $28 if this selling of $US earners does unfold.

Today’s report will focus on 5 of the stocks which moved by over 3% yesterday as we wait for the market to show its hand.

ASX200 Chart

The Nickel price keeps falling

This week, the nickel price has made fresh 2018 lows, down well over 20% from its June high as both base metals and currencies suggest that the risks of a US – China trade war are continuing to rise, although overnight there was some loosening of that pressure valve.

Nickel producer Western Areas (WSA) has fallen by over 40% from its euphoric high, double the nickel correction, illustrating the elastic band of optimism v pessimism regularly gets stretched too far in both directions.

We are negative WSA targeting ~$2 but we like the stock for a sharp ~15% rally on a risk / reward basis from below $2.15.

Western Areas (WSA) Chart

Five stocks which caught our eye yesterday

Hopefully subscribers have a decent handle on our current market views with 4 of our main thoughts summarised below:

1. We believe equities are in the late stages of this bull market hence it’s time to shy away from the high growth / valuation stocks that have “shot the lights out” in 2017/8.

2. We believe that the more old-fashioned blue chips with reliable earnings and yield will come back into favour moving forward, while an active bias at this late stage of the cycle remains key

3. From a risk / reward perspective we are keen short-term buyers of equities ~5% lower - cash levels across the market remain high hence the call for weakness rather than a major correction (at this stage)

4. We believe that the outperformance of US stocks over the emerging markets is close to complete.

While we wait to see if we are correct with our above macro outlook it’s a logical time to look under the hood for potential opportunities on the stock specific level.

1 Australian Pharmaceutical Industries (API) $1.85

The health and beauty company API enjoyed a +4.8% rally yesterday and the stocks now only a few cents below its 2018 high at $1.87. Earlier in the year API purchased Clearskincare Clinics and we like the synergies this brings to the business with its Priceline outlets.

This is not a stock we have discussed often in 2018 but we do like the defensive qualities of this business. From a technical perspective it looks strong, while its valuation / yield are reasonably appealing.

API is trading on an Est P/E for 2018 of 17.2x while yielding 3.8% fully franked.

• MM likes API while it can hold above $1.70.

Australian Pharma Industries (API) Chart

2 Mayne Pharma Group (MYX) $1.25

Shares in MYX rallied +4.2% yesterday and we feel the falls in generic drug prices look to have run their course which again has the stock worth considering. Plus of course new product launches can help get the business back on track.

Technically MYX looks ok while it can hold above $1.19 but the stocks volatility cannot be discounted.

MYX is trading on an Est P/E for 2019 of 24.9x.

• MM likes MYX while it can hold above $1.19 but this would be an aggressive investment

Mayne Pharma Group (MYX) Chart

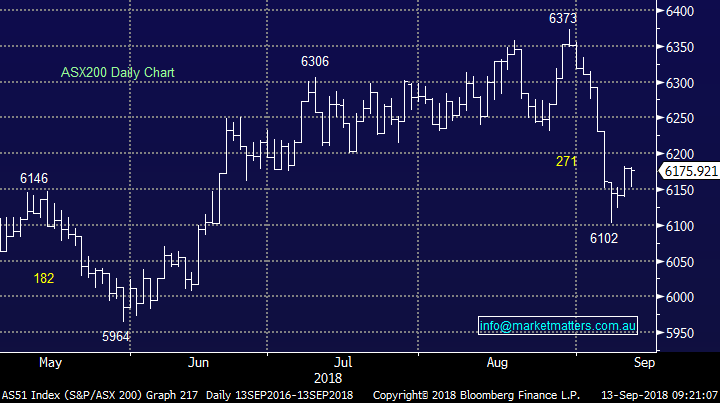

3 Monadelphous (MND) $14.88

Mining services business MND rallied just under 4% yesterday with the oil price probably a positive contributing factor.

Both fundamentally and technically we are neutral MND.

MND is trading on an Est P/E for 2019 of 22x while yielding 4.17% fully franked.

• MM is neutral MND.

Monadelphous (MND) Chart

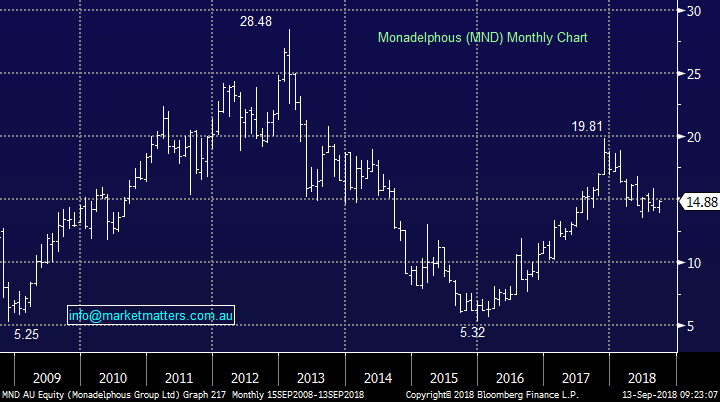

4 Bega Cheese Ltd (BGA) $7.15

One of the market darlings of the last 5-years BGA fell well over 5% yesterday following the $200m capital raising with institutions at $7.20. The company is also attempting to raise another $50m through a share purchase plan for retail investors priced at $7.10 - which we believe will be short-term negative for the stock.

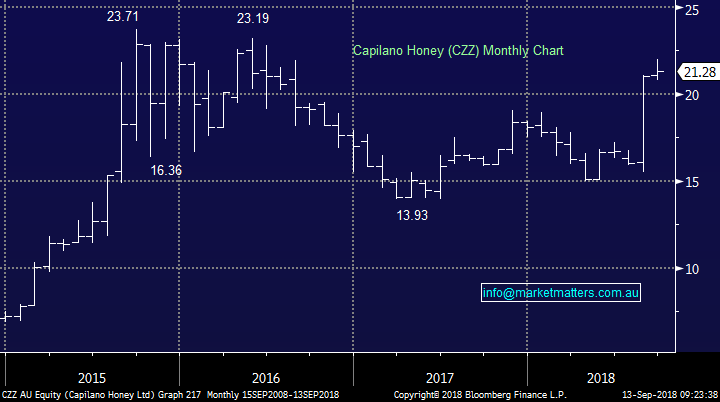

Rumours have been circulating about a potential takeover of Capilano Honey (CZZ) following BGA’s foray into the honey producer but at this stage the company have said the money is to “shore up its balance sheet” - we are sceptical.

• We like CZZ between $20 and $21 with stops under $19 – a takeover feels likely.

Conversely now BGA is looking at acquisitions for growth we believe caution moving forward is warranted. BGA is trading on an Est P/E for 2019 of 27.7x while yielding 1.54% fully franked.

• MM is neutral to slightly negative BGA at current levels.

Bega Cheese Ltd (BGA) Chart

Capilano Honey (CZZ) Chart

5 Costa Group (CGC) $6.61

CGC is now one of Australia’s largest food businesses growing produce like avocados, berries, mushrooms and citrus fruit but their shares slipped just over 3% yesterday.

The company is growing into both China and Africa which is exciting but of course they can be at the mercy of the weather at all times. Competition is always around when it comes to food and we believe this is a stock to consider into weakness, not strength.

Weakness is what we’re witnessing at present with the stock now over 25% below its June high. This financial year we have been bearish initially targeting ~$7.50 but the downside momentum continues. Technically we now only have interest below $6, another 10% lower.

CGC is trading on an Est P/E for 2019 of 24.2x while yielding 2% fully franked.

• MM is interested in CGC below $6, or over 10% lower.

Costa Group (CGC) Chart

Conclusion (s)

MM is unfortunately not too excited by any of the stocks looked at today but we have listed them in order of preference basis yesterday’s price:

1. We like API with stops below $1.70.

2. MYX is ok as an aggressive play while it can hold above $1.19.

3. We are not keen on BGA but think related CZZ is worth a thought below $21.

4. We are neutral MND.

5. CGC, we only have interest below $6.

Overseas Indices

Last night US stocks were again very quiet hence our thoughts have not changed.

• MM is ideally targeting a drop of ~6% by the US Russell 2000 – small cap index.

US Russell 2000 Chart

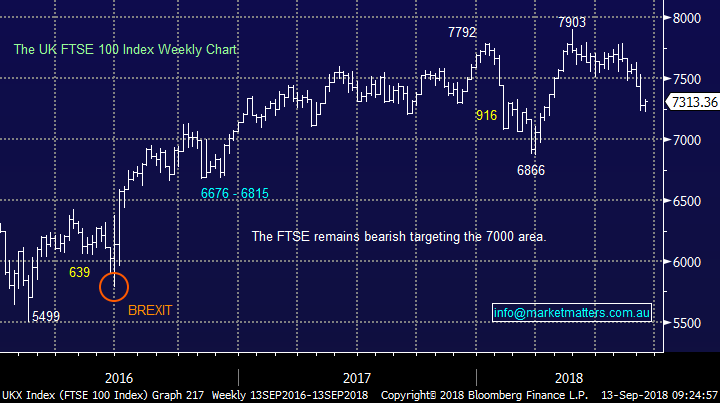

European indices were slightly firmer overnight, The UK FTSE continues to feel heavy as expected with our target of ~7000 now only 4% away.

UK FTSE Chart

Overnight Market Matters Wrap

• The US closed with little change overnight, with the Dow and broader S&P 500 ending its session in positive territory, while the tech. heavy Nasdaq 100 was weaker.

• US-China trade talk optimism arose as they seek to meet, while crude oil posted its biggest 2-day gain since June following a hurricane on route to the US shores.

• BHP is expected to outperform the broader market after ending its US session up and equivalent of 0.2% from Australia’s previous close.

• The September SPI Futures is indicating the ASX 200 to open marginally lower towards the 6160 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here