Are there opportunities after the huge macro news of the last 24-hours (EHE, PGH, TLS, SYD, QBE, CBA)

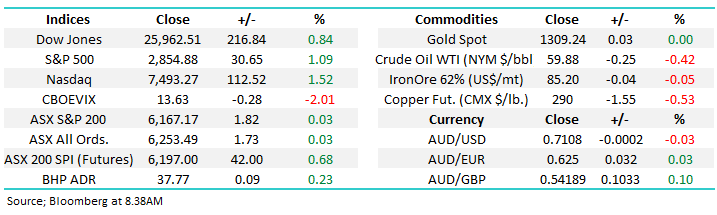

The ASX200 finally managed to close marginally in the green yesterday following a strong rally in the last hour of the day as it felt like a trader, or two, decided the US market would rally following the Fed’s extremely dovish message for 2019 i.e. basically no interest rate hikes in the US this year – they got it right! On the sector level the diversified financials and insurers gave back some recent gains while healthcare and resources rallied, basically netting each other off with the swings generally as you would expect benefitting stocks who like and environment of lower interest rates.

Potentially far more importantly the Fed is now expecting only one hike in 2020 and none in 2021, plus they will maintain rather than reduce their balance sheet which improves liquidity - oh what the difference a quarter makes! Yesterday was actually called “Super Thursday” by many as we saw the US FOMC meeting followed by both Australian employment and New Zealand GDP data. A snapshot of the economic news / releases:

1 – The US Fed is now expecting no rate hikes in 2019, one in 2020 and none in 2021 – they are clearly concerned of a recession looming on the horizon as opposed to inflation.

2 – The Fed is also now planning to end quantitative tightening in September, until further notice, which has sent US 10-year bond yields down towards 2.5% i.e. don’t give up on cheap money just yet.

3 – Even the NZ economy is growing slower than expected with GDP coming in at 0.6% compared to the expected 0.8%, a fairly big miss.

4 – In Australia the unemployment rate hit an 8-year low of 4.9% although nobody I know feels particularly optimistic at the moment, the $A rallied while local 3-year bond yields fell which is slightly confusing.

Hence now it appears we are seeing another macro-economic chapter as central banks led by the US, perform about turns in policy and move back towards a very accommodative stance as global growth struggles. Although the GFC is now more than 10-years behind us central banks continue to basically pirouette on a gymnastic beam with a recession on one side and inflation / higher rates the other – good luck! Australia still has not experienced a recession for 27-years, the current property downturn is certainly going to be a test of the underlying health of our domestic economy with yesterdays jobs numbers helping for now.

Short-term we have sectors like healthcare enjoying the prospect of lower interest rates while the insurers are struggling with the likes of Suncorp, IAG Insurance (IAG) both falling ~3% over the last week. The sector now feels ‘wrong’ as rates stay lower for longer.

MM remains neutral the ASX200 after its strong rally from late December lows but we remain comfortable buying selective stocks.

Overnight US markets were strong embracing the Fed dovish tone with the NASDAQ the standout rallying +1.5%, the SPI futures are calling the ASX200 open strongly and again test the psychological 6200 area.

Today we will look at how MM currently believes we should be positioned moving through 2019 as lower rates appears to be the new norm – for now.

ASX200 Chart

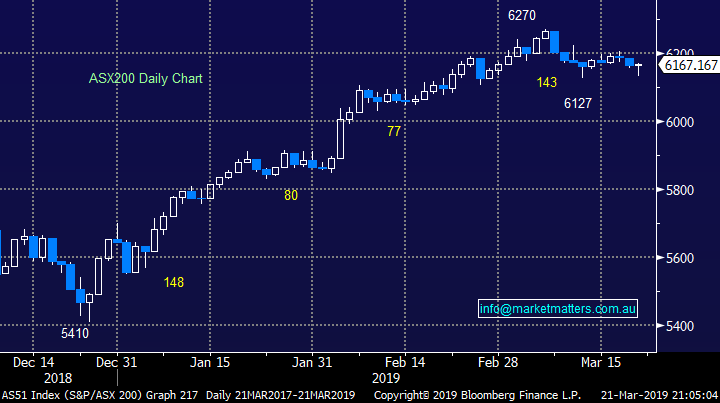

We discussed Estia Health (EHE) on Tuesday when the stock was trading around $2.50 and its certainly received a bid tone from the market this week rallying ~9% in just 2-days, we ask is it too late to now buy EHE?

EHE shares rallied last month following an announcement by the Federal Government that they will provide over $650m in additional funding for aged care / seniors – not an unusual move in an election year. The company’s half year results showed an increase of revenue but occupancy was lower than expected - however the stock has shrugged off any negativity within the result and surged higher.

The shares currently trade on an Est. P/E for 2019 of 16.75x while yielding an appealing 5.9% fully franked. In terms of valuations, it’s traded between a peak of 21x when optimism was high about our aging demographic, and a low of 11.8x when the Royal Commission was announced with an average P/E of 16.9x, making it mid-range today. While we like the stock, we are reluctant to add too much ‘earnings risk’ in the portfolio having recently added a number of beaten down names.

While MM likes EHE at current levels, we are unlikely to pull the trigger in the Growth Portfolio, more an income play and we would run stops below $2.50.

Estia Health (EHE) Chart

The Pact Group (PGH) is a stock we own in the MM Growth Portfolio and it was hit hard yesterday trading to a low of $2.39 before closing at $2.56. UBS handled the sell down of 26 million shares at a ~9% discount to market – about 7.5% of the company. This stock is controlled by Raphael Geminder and there’s been continued talk about a privatisation and this is a another sign that it could be on the cards. Presumably, any privatisation would need to be at a higher level, and Thursdays low feels like a good one.

We are now in the red on our position but our initial feeling is we are seeing an opportunity as opposed reason to panic – The Australian is reporting that “Hedge funds have piled into Pact Group” which is often a positive sign.

MM is considering increasing our current small ~2% position in PGH.

Pact Group (PGH) Chart

Investing in the evolving economic landscape.

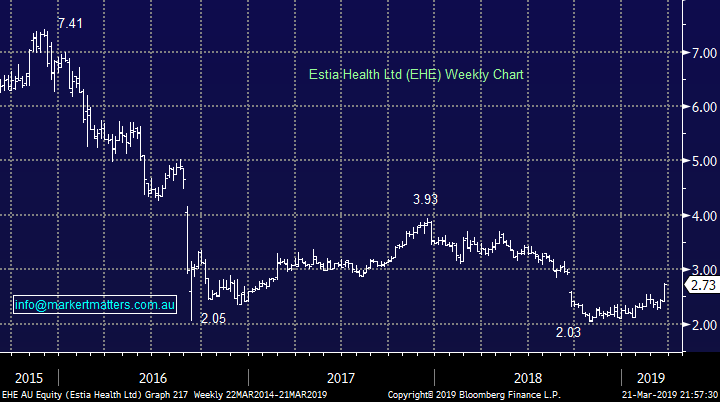

As discussed the Fed have just thrown fresh fuel on the decade old equities bull market by implying US interest rates will remain extremely low / accommodative for at least another 2-3 years. This dramatic change in stance will make it easier for the RBA to cut rates from todays all-time low 1.5% if they deem necessary.

MM believes the RBA will cut once this year with Melbourne Cup Day our best guess – the general market is looking for 2 rate cuts.

Low interest rates, or free money as we often call it, has arguably been the main contributor to the impressive bull market for US stocks post the GFC with it almost raining buybacks i.e. companies using money, often borrowed at low interest rates, to buy the companies own stock sending the shares higher. In 2018 over $US1.1 trillion was spent on buybacks with many predicting the number will be higher in 2019. My concern when I look at the chart of the Dow below is company directors are buying back their stock today saying its cheap after the markets already rallied ~400%.

Dow Jones Chart

Perhaps lower rates will help stabilise the property market and enable the indebted Australian consumer to reduce their liabilities, both being very important local issues over the years ahead. Less debt by the average person and an improvement in consumer confidence if / when housing prices stop falling should help the retail / auto sectors where share prices in some cases have literally collapsed.

The hardest question to answer is are we seeing the last chapter of the free money trade or will it last for years to come, as the Fed has implied. At MM we believe any answer to that is guesswork but nimble investing and being prepared to switch stocks / sectors as the picture evolves will yield the best returns i.e. not trading just being open-minded to an ever changing economic picture.

Today we have quickly looked at the 3 beneficiaries and 2 losers from the Feds strong dovish stance.

Winners from lower rates

We could have included a few other sectors like resources, golds and the tech space but we have stuck with the more commonly acknowledged stocks / sectors that historically enjoy low rates.

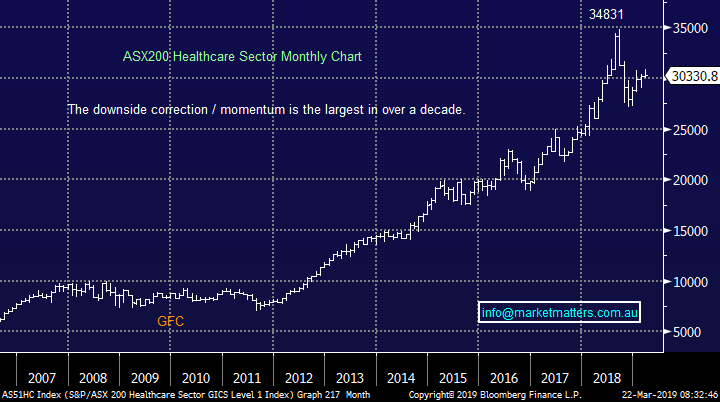

Healthcare stocks

The healthcare sector has endured a meaningful correction in 2018 /9 and while a lower interest rate environment will help we would be adopting a sell into strength attitude as opposed to buying the recent sharp correction.

MM is long ResMed (RMD) & Healius (HLS) in the sector with current target prices around $15.50 and $3.20 respectively

ASX200 healthcare sector Chart

Telcos

No change here, we like Telstra even though its dividend may not be what it once was it’s probably now sustainable at 5.8% fully franked + they are reinvesting back into the business for future growth. A stock that many continue to dislike however worth noting that it has rallied ~26% from the $2.60 low.

MM is bullish TLS initially targeting ~$3.50.

Telstra (TLS) Chart

The Yield Play

The classic “yield play” stocks like Sydney Airports (SYD) and Transurban (TCL) feel fully priced as they remain around their all-time highs but until the central banks tailwind is removed it feels unlikely that any meaningful pullback will unfold.

We believe portfolios should contain a strong yield focus but an open-minded outlook on stocks may lead to better returns e.g. Estia Health (EHE) mentioned earlier.

Sydney Airport (SYD) Chart

Losers from lower rates

Insurance stocks

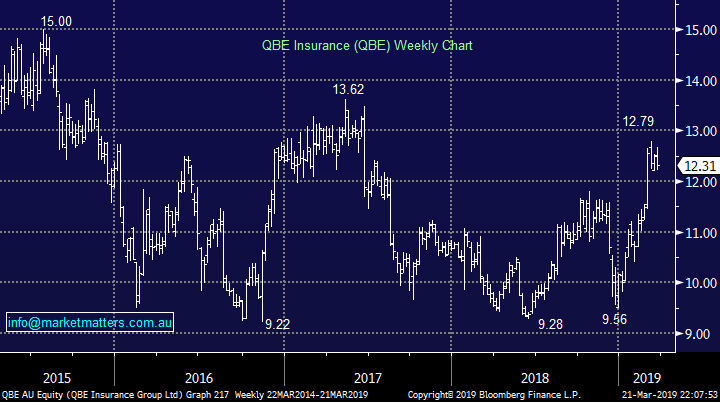

Insurance companies benefit from higher rates because they earn interest on the premiums they receive before having to pay out any claims that materialise over time. We continue to watch our QBE holding closely, especially as we see potential upside for the $A which would be an earnings headwind for the business which holds monies in US interest bearing bonds i.e. a $US earner.

MM has no interest in adding insurance stocks to the MM portfolios at this point in time – we are now on the sell side looking for an optimum time to cut the position.

QBE Insurance (QBE) Chart

Banking stocks

Banking stocks are a tricky one here because they pay good dividends but their margins usually increase when rates rise, not fall. On balance we feel they are neutral here but we wanted to include them because of both our and most subscribers large exposure to the sector. However we will switch to a more bullish stance once the local property declines stabilise.

MM is neutral banks but their dividends remain attractive.

Commonwealth Bank (CBA) Chart

Conclusion

Of the stock / sectors looked at today when considering the new dovish stance from central banks Telstra is our favourite play – it’s been a while since people wrote that.

Also, while we believe portfolios should contain a strong yield focus at this point in time an open-minded outlook on stocks may lead to better returns e.g. Estia Health (EHE) mentioned earlier today and on Tuesday.

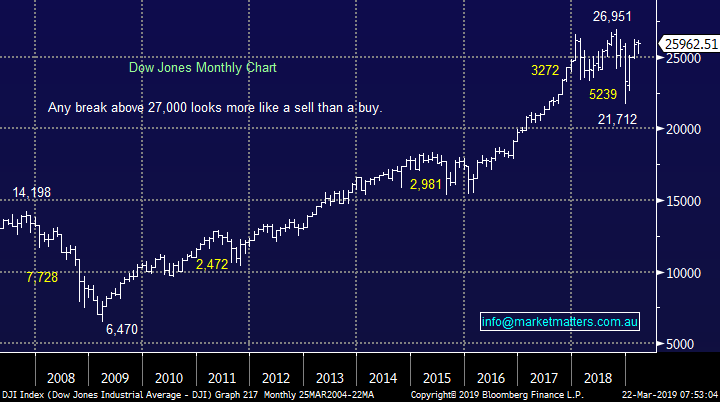

Global Indices

US stocks love “free money” and the catchphrase don’t fight the Fed definitely rang true last night with the NASDAQ leading the charge to fresh 2019 highs led by APPLE which surged almost 4%. Interestingly the small cap Russell 2000 continues to struggle from a relative perspective.

Following the market’s positive reaction to the dovish Fed we believe investors should be long, or square i.e. the Fed appear to want stocks higher and their power should not be underestimated.

US NASDAQ Chart

Also no change, European indices are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage.

Any significant Increase in our equities exposure moving forward may be accompanied by purchasing a negative facing ETF.

German DAX Chart

Overnight Market Matters Wrap

· The US rallied overnight, led by the tech sector as investors digested the Fed’s dovish comments yesterday on future interest rates.

· European markets were mixed, with the UK higher and German market lower, as the EU looked set to give the UK a conditional extension to its Brexit deadline, which is due next Friday. But to gain the likely extension to May 22nd, the UK parliament will have to first approve the current exit proposal, one which has already been overwhelmingly twice rejected!

· Commodities were generally easier overnight as was the A$, which is holding just above US71c.

· The March SPI Futures is indicating the ASX 200 to open 45 points higher, testing the 6215 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.