Are there any more dogs for MM’s basket? (CYB, EHL, SGR, GEM, CGC, EVN, RIO)

The ASX200 enjoyed a strong “Hump Day” rallying over 20-points while US stocks wobbled and Telstra (ASX: TLS) traded ex-dividend. The “Big 4” banks remained firm which combined with an abundance of green on the screen was enough to quickly lay to rest any early morning jitters. Volatility on the stock level is rapidly drifting back to normality with only 5 stocks in the ASX200 moving by over 5% on the day i.e Vocus (ASX: VOC), Seek (ASX: SEK), Bingo (ASX: BIN), NEXTDC (ASX: NXT) and Reliance Worldwide (ASX: RWC).

The upside momentum of the local index is slowly waning and our ideal short-term scenario is a pullback towards the psychological 6000 area, hence we are comfortable with decent cash levels in both our Platinum and Income Portfolios.

MM remains in a patient “buy mode”, importantly we are not chasing the market in general at current levels.

Overnight US markets were relatively quiet with the Dow slipping 72-points but the broader index was basically unchanged. The SPI is pointing to an unchanged open by the ASX200.

Today we are going to review 6 stocks who have recently endured some tough times. Following our forays into Bingo (ASX: BIN) and Pact Group (ASX: PGH) we are considering whether to add to this duo – in a number of reports in 2019 we have considered a “dogs” basket of 3-5 stocks but with only a 2% exposure to each i.e. up to 10% in a selected group of previous underperformers.

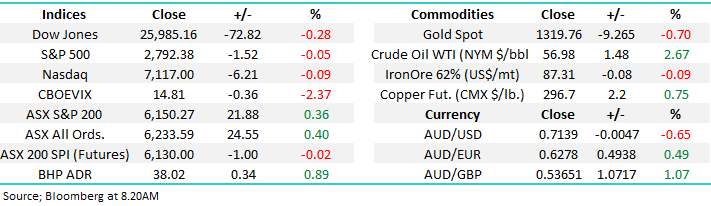

ASX200 March SPI Futures Chart

The local comparatively high yielding stock market continues to deliver for the patient investor and as we pointed out in a recent report the Accumulation Index is only 1% below its all-time high i.e. calculated if all the markets dividends were immediately reinvested on their paid date.

If / when we see a retest of the clear overhead trendline illustrated below MM is likely to be tempted to take some $$ off the table & / or hedge part of our portfolio (s) with a bearish ETF – currently around 4-5% higher.

MM can see ourselves buying the geared BetaShares bearish ETF (ASX: BBOZ) in the weeks / months ahead.

ASX200 Accumulation Index Chart

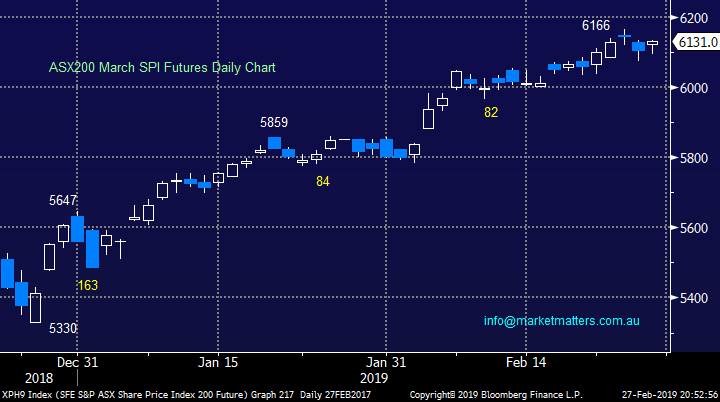

Our gold sector continues to come off the boil with Evolution (ASX:EVN), St Barbara (ASX: SBM) and Saracen Minerals (ASX: SAR) all ~10%, or more below, their recent highs. Rising global inflation is the common catalyst to set this sector alight but it’s been noticeably absent since the GFC.

MM is expecting to establish a decent gold position in the months ahead, but not yet.

Evolution Mining (ASX: EVN) Chart

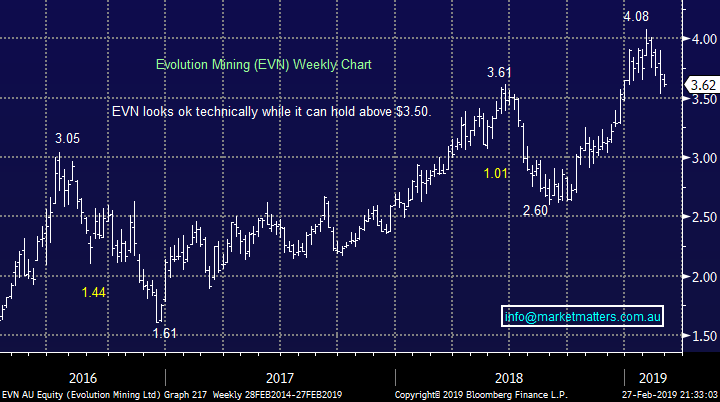

After market yesterday RIO Tinto (ASX:RIO) reported FY18 earnings and most hype was around their US$4bn special dividend, which is big but not unexpected. The result itself was a beat at the earnings line by around 3%, with the company reporting profit of US$8.81B v US$8.54bn expected. They also announced an ordinary dividend of US$3.07 for the year, above the US$3.03 expected by the market, up from US$2.90 in 2017. That means the second half dividend was US$1.80 per share while the special dividend equates to US$2.43. The stock traded marginally higher in London, but was down a touch in the US.

I’ve always been told to buy miners and high P/E’s and sell them on low P/E’s which sounds counterintuitive, however mining companies are bought for growth, and that growth potential is at its highest when money is going into the ground for exploration and mine development / optimisation. Rio is now trading on a P/E of 10.6x which is cheap, and they’ve clearly done an exceptional job in recent years, however earnings are now likely to track backwards for the next few years. Effectively, RIO needs to plug ~US$1bn per year of earnings, or ~US$2bn of EBITDA, suggesting that any developments/acquisition will be in the ~US$10bn range in aggregate. The other aspect is that the company needs to add options that deliver earnings now not in another longer dated time frame. MM are not buyers of RIO, BHP or FMG at current levels.

Rio Tinto (ASX: RIO) Chart

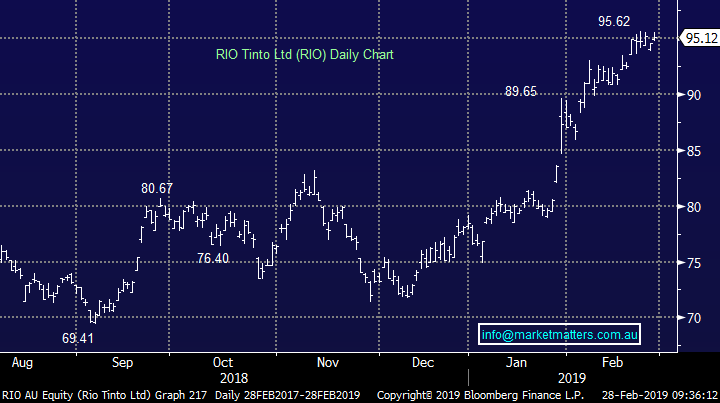

Overseas indices

No change with US markets, we still believe they have a strong risk to the downside with our target ~5% lower but we should a remember that tops, even short-term ones, generally take longer to evolve as opposed to bottom which usually react like a tensioned spring board.

US Russell 2000 Chart

No change with European indices who have reached major resistance and our target area following their ~12% bounce, we are now neutral to bearish from a simple risk / reward basis.

This reaffirms our believe that patience is likely to be rewarded with buying of the market in general – clearly not necessarily on a stock by stock basis.

German DAX Index Chart

Review dogs

Today we have reviewed and updated the “dogs” we are watching carefully, some have dropped out while new ones have taken their place but the logic remains the same, we are looking for opportunities where the pessimism elastic band has stretched too far.

1 CYBG Plc (CYB) $3.52

UK based bank CYB was spun off by NAB – looks like good timing by the “More than money” bank so far with this spin-off.

A few weeks ago the stock rallied on a better than expected 1st quarter update. The market’s reaction was driven by two major pieces of the update with the net interest margin (NIM) reporting better than expected, while further increases to the expected synergies of the merger with Virgin Money were also announced. After seeing sliding margins over the last 12 months, Clydesdale’s NIM remained steady at 172bps driven by better mortgage loan growth and liquidity in institutional funding which offset the slow deposit growth. The company updated NIM guidance for the full year to the higher end of the previous range, now 165bps-170bps

The bank also increased the minimum level of cost synergies it expects to achieve, upgrading it from £120m/year to £150m/year from FY21 onwards. A nice 25% increase to the synergies which continue to validate the merger with Virgin Money. There are some underlying issues within the report – namely a lack of deposit growth which grew only 10% of that of the loan book. NIM will continue to slide, and it looks as though this result is masking the problem. The UK economy continues to face challenges as well which may see the impairments rise and loan growth slow. The upside remains around the merger as the combined entity will produce a better product on a more cost efficient rate.

Some of the above is straight from our report on the 7th with the highlighted issues around the UK looking to come through in the share price with CYB now trading around 10% below the immediate excitement following the report. Uncertainty around BREXIT remains and while we see value in CYB at lower levels we still have no interest “paying up”.

We are interested in CYB into fresh all-time lows.

CYBG Plc (ASX: CYB) Chart

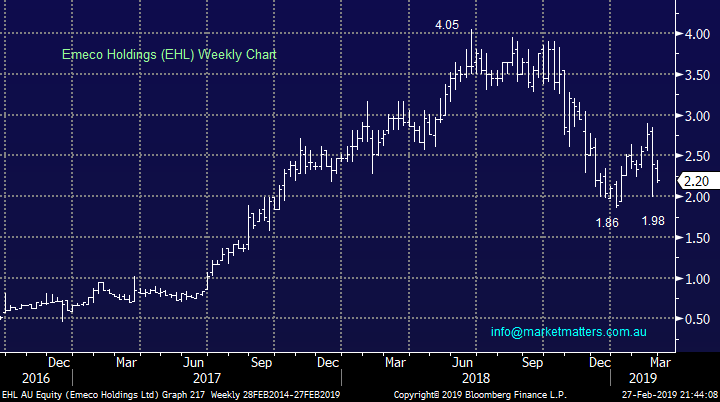

2 Emeco Holdings (EHL) $2.20

Earthmoving equipment hire business Emeco (EHL) dived following the release of its interim results which showed a slight miss on the profit line however the market got concerned about increased debt from higher expenditure (for growth), and the potential for a capital raise. The rhetoric from the MD was solid and he’s got plenty of skin in the game however the market certainly did not embrace his comments on the day.

That, top line growth was good, margins are expanding and they have better utilisation of their fleet which is growing, hence this is a business we are considering moving forward.

MM is neutral EHL at present but will become more interested into fresh multi-month lows.

Emeco Holdings (ASX: EHL) Chart

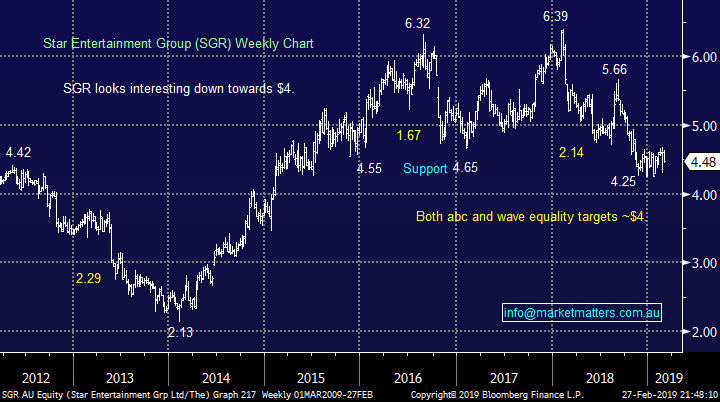

3 Star Entertainment (SGR) $4.48

Casino & hotel operator SGR has been on our radar for months but not much has changed in 2019 and even their recent result hardly had an impact on the share price.

SGR is suffering a few headwinds at present with a declining growth in Chinese tourism and a local economy spluttering due to declining house prices.

MM is neutral here but likely to put our hands up into new 2019 lows.

Star Entertainment (ASX: SGR) Chart

4 G8 Education (GEM) $3.13

Not a classic dog but G8 education (GEM) has had a tough week following its latest report.

After the childcare operator GEM reported its full year numbers the stock was sold off hard. GEM had rallied strongly into the result so the market was clearly looking for a better set of numbers. Earnings were a slight miss but it was occupancy levels that were the main concern. The company does see some improving dynamics here which has also been shown through other industry data. The main question being asked is whether or not 2018 was trough occupancy in Australian childcare?

MM likes GEM around $3.10. The stock is reasonably cheap (15x) and they’ve got a turnaround under way.

NB a break of $2.85 would concern technically.

G8 Education (ASX: GEM) Chart

5 Costa Group (CGC) $5.43

CGC has been on our radar since the start if the year and its starting to feel that our optimistic entry target of ~$4 was unrealistic.

Since the release of their 1H results the stock has been strong - they booked NPAT of $8.5m, which was low relative to this time last year but in line with expectations – remember they downgraded in early January and were whacked from ~$7 to ~$4.50 on what we thought were seasonal factors. Other metrics were on the softer side but importantly, guidance was strong and they expect profit growth of ‘at least’ 30% for CY19 which was up from previous guidance of 30%, plus they said crop performance and weather conditions have been generally positive in the early part of the year. As I said above we have been targeting a buy in CGC nearer $4.00 and the stock has rallied today to close at $5.43.

Technically CGC looks a buy with stops below $5.10, or around 6% risk.

MM now likes CGC at current levels – watch for alerts

Costa Group (ASX: CGC) Chart

Conclusion

Of the 5 stocks looked at today we are now considering CGC at current levels while the others all need to fall further to trigger our buying – although we remain open minded & flexible!

Overnight Market Matters Wrap

· The US equity markets closed marginally lower overnight, as investors continue to decipher what actions to take following the US Fed announcing they are close to announcing plans to end the run-off of its US$4 trillion portfolio this year.

· US Fed Chairman, Powell spoke of raising productivity, but said the Fed isn’t looking at a higher inflation target. On the global macroeconomic front, US trade representative Robert Lighthizer said the US is pushing for a deal with China that includes significant structural changes to the Chinese economic model. Lighthizer is being encouraged to stay strong on negotiations so it seems a deal isn’t imminent.

· Metals on the LME bounced while iron ore was down a touch. Oil bounced after US crude supplies fell more than anticipated and shipments from the Saudis hit a record low.

· The March SPI Futures is indicating the ASX 200 to open marginally higher towards the 6155 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.