Are the Resources on track for MM? (WBC, FMG, OZL, WSA, AWC, S32)

A shorter report today after a great work Christmas Party last night and I’m enroute to a friends wedding today!

As the iconic Australian rock band ACDC so eloquently put it the ASX was “Back in Black” yesterday with a bang with over 80% of the stock’s closing up on the day. However while under normal circumstances a 76-points / 1.2% rally would be greeted with bullish euphoria we are still down over -2% for the week coming into Friday illustrating how bad Tuesday and Wednesday were for local stocks. As subscribers know we are looking for areas to increase our market exposure but at this stage maintaining some flexibility via our 15% cash holding feels right.

We are experiencing a news driven period for stocks where any negative leads on trade send stocks sharply lower whereas positive or neutral comments allow stocks to rally as the tailwind of extremely low interest rates regains its front and centre position. At MM we believe President Trump needs a resolution with China which should ultimately be bullish for stocks at least in the short-term but he certainly doesn’t like to make things easy!

MM remains now neutral to bullish the ASX200.

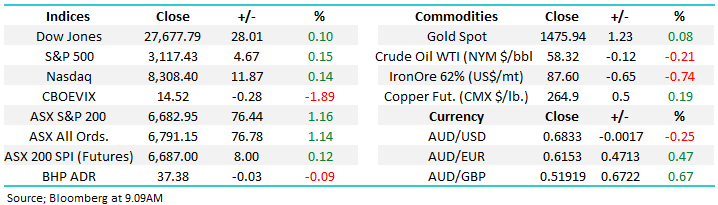

Overnight US markets were quiet with the Dow closing up just 28-points, the SPI futures are pointing to an open up around 10-points for the ASX200.

This morning MM has briefly looked at a few base metals and of course iron ore as this group should enjoy a trade resolution.

ASX200 Chart

We see 2 likely scenarios unfolding this month with the path more than likely determined by President Trumps actions / Tweets into Christmas hence plenty of guesswork here!!

1 – We’ve already seen the worst of the market’s reaction to concerns on trade and stocks are positioned nicely to rally into 2020.

2 – We will see another sharp leg lower by stocks in the next 1-2 weeks into the 6400-6450 region where we would become aggressive buyers.

From an investment perspective it all comes down to money management and risk / reward hence we are comfortable maintaining a degree of flexibility at this point in time.

ASX200 Chart

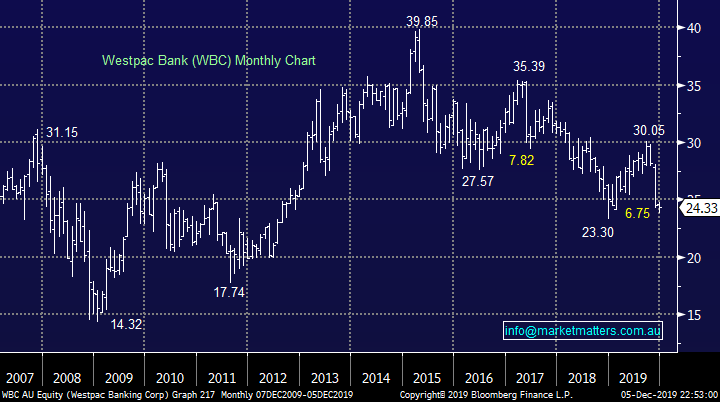

The banks are a huge, although diminishing, influence on our index - the big 4 still make up 19% of the ASX200. As we all know Westpac (WBC) has been front and centre in the sectors recent demise hence it’s the ideal one to monitor carefully. Although WBC feels like its in the eye of a bad storm a further washout cannot be discounted – the current 6.6% fully franked yield we believe is sustainable and will eventually act as significant support for the stock / sector into 2020.

MM likes WBC below $23.

A dip by WBC below $23 is likely to coincide with scenario 2 above which remember we would be aggressive buyers of.

Westpac (WBC) Chart

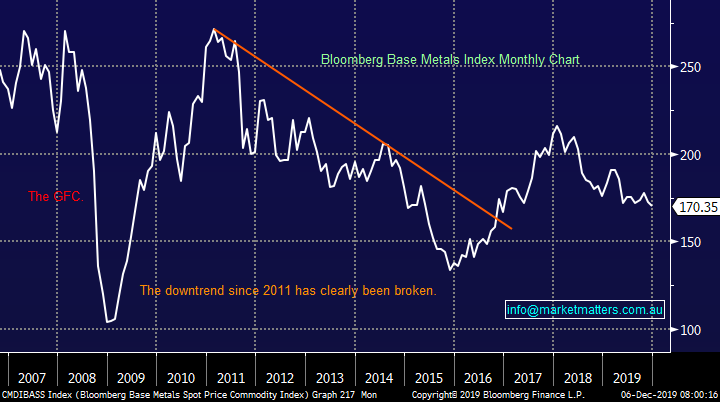

The Metals

At MM we believe the resources sector should have a good 2020 after a relatively subdued 2018/9 after base metals corrected ~20% - never a great back drop for the sector. However if we are correct and 2020 will see a trade resolution plus global government fiscal stimulus the slow steady decline in prices should soon be behind us. Today I have briefly looked at a few industrial metals and our favourite stocks in the sector.

For those who missed it below is a recent video I did with highly regarded resources analyst Peter O’Connor as we look for areas to increase our Resources Sector exposure. CLICK HERE

Bloomberg Base Metals Index Chart

1 Iron Ore

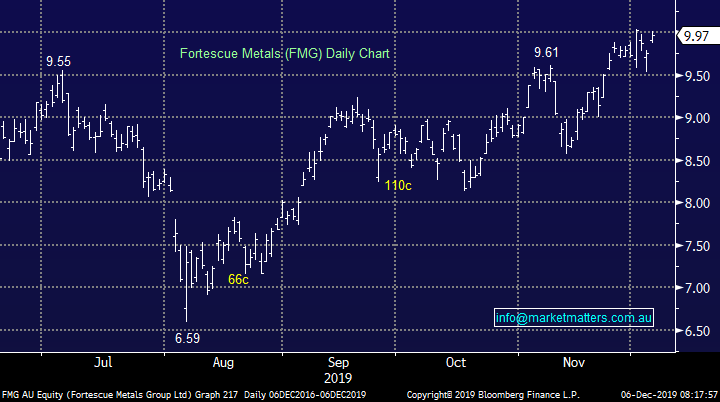

The iron ore price has corrected over 15% from its highs of 2019 leaving us neutral the bulk commodity – we are buyers under 550 and sellers ~650. In hindsight when we took profit a few weeks ago on our Fortescue (FMG) position it was too soon but we still believe the disconnect with the underlying bulk commodity is dangerous on a risk / reward basis.

MM likes FMG into weakness.

Iron Ore Chart

Fortescue Metals (FMG) Chart

2 Copper

We find it very encouraging that copper has remained resilient over recent months, even when President Trump throws his hand grenades into the ring – our initial target for “Dr Copper” remains ~10% higher.

MM remains bullish Copper & OZ Minerals (OZL).

Copper Chart

OZ Minerals (OZL) Chart

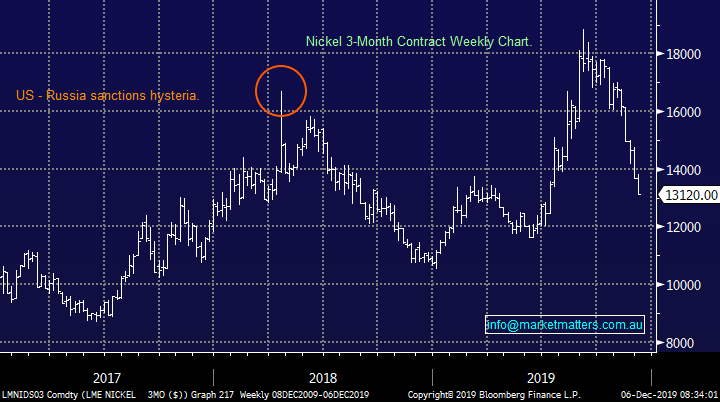

3 Nickel

Nickel has plunged almost 30% in the last 6-months which takes the metal back to the fair value / cheap end of the spectrum in our opinion.

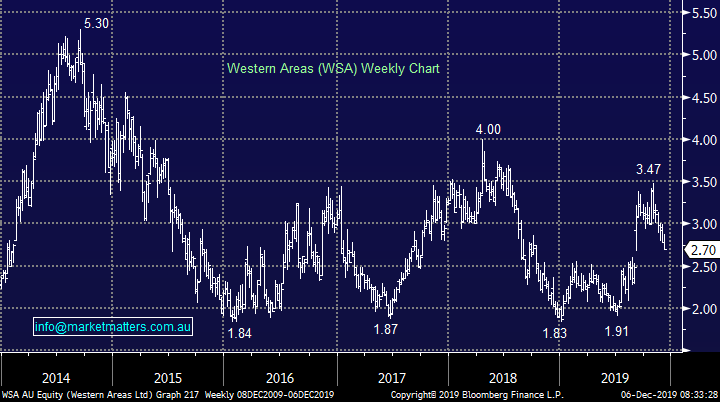

As subscribers know following its ~25% correction MM is considering averaging its position in Perth based nickel producer Western Areas (WSA). This clearly would be a move supporting our view that a US – China trade resolution will occur sooner rather than later and that value stocks / resources are set to outperform in 2020.

MM is bullish WSA at current levels.

Nickel Chart

Western Areas (WSA) Chart

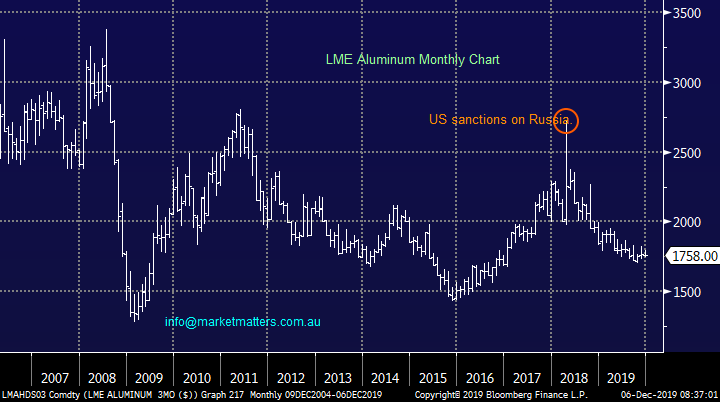

4 Aluminium

Aluminium has had a relatively quiet 2019, just drifting steadily lower. At this stage there is no obvious catalyst outside of trade talks to turn the metal higher although it’s clearly getting close to support / value.

Hence I’ve focused more on our preferred stock in the space, Alumina (AWC) which has held up reasonably well while the metal drifted lower, at this stage we would like to see a spike towards $2 to become keen from a risk reward viewpoint.

MM likes AWC into weakness.

Aluminium Chart

Alumina (AWC) Chart

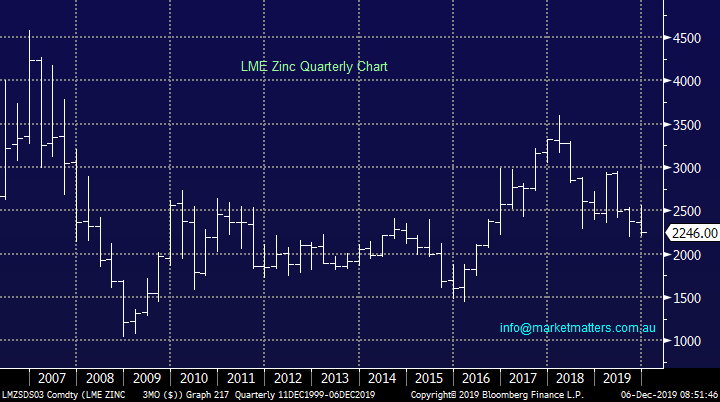

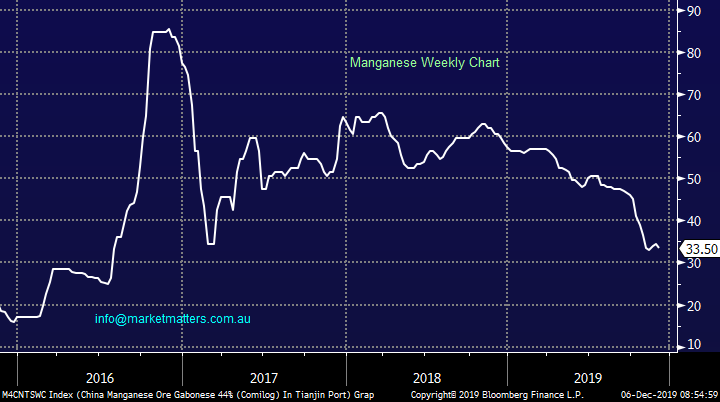

5 Manganese & Zinc

We’ve bracketed these 2 metals together because they are both mined by South32 who we wanted to consider. Both metals have followed their peers lower in 2018/9, it feels basically like now or never for zinc in particularly otherwise the post GFC lows will be looming fast. Hence we like the idea of buying weakness but like always not becoming married to the position.

MM likes S32 into further weakness.

Zinc Chart

Manganese Chart

South32 Chart

Conclusion

MM likes the 5 stocks briefly touched on in today’s report with OZ Minerals (OZL) and Western Areas (WSA) our preference at today’s levels.

Global Indices

No change, previously we have given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated, a close well under 3025 is required for the S&P500 to switch us to a bearish short-term stance.

MM remains now neutral / positive US stocks.

US S&P500 Index Chart

No change, European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias with a target ~5% higher looking realistic.

German DAX Chart

Overnight Market Matters Wrap

· The SPI is up 8 points after a mildly positive move in US equities overnight. The Dow closed 0.1% higher, the S&P 500 rose 0.2% and the NASDAQ eked out a very small gain.

· Markets are taking a wait and see approach to the US-China trade conflict. With a deadline of December 15, many are sitting on the sidelines rather than jump at each sound bite from President Trump. US Treasury Secretary Mnuchin said talks were on track without mentioning a timeline.

· US imports of Chinese goods dropped to a three year low, while the US trade deficit declined to its smallest level in one and a half years, as both imports and exports fell. Chinese trade balance data will be released on Sunday.

· Nickel rose more than 1%, iron ore fell 0.5% and gold crept up to $US1482/oz. Copper was flat and brent crude oil made a small gain. US 10 year government bonds are currently yielding 1.79%.

· The September SPI Futures is indicating the ASX 200 to marginally higher towards 6685

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence