Are the nerves around the Hayne Royal Commission providing a buying opportunity? (WSA, WBC, CBA, NAB)

The ASX200 had a very disappointing day closing down 22-points / 0.4%, totally ignoring the very positive lead from US stocks e.g. the Dow was up 434-points / 1.8%. The US Fed made some extremely market friendly noises yesterday and it’s a definite concern that our market unlike its global peers failed to embrace the rhetoric. The local market weakness yesterday was primarily caused by the banks who appear to have a clear case of the “wobbles” ahead of next weeks release of the Hayne Royal Commission with heavyweights CBA falling -1.9% and Westpac -2.5%.

The Prime Minister has already said he will read the final report before he decides what recommendations to implement but “in principle” he intends to action them all– the report itself will be made public after the market closes on Monday.

The markets are clearly fearing the worst but we feel it’s hard to imagine any huge negative surprises, but this is political football with an election looming in May. However housing prices are falling fast hence any increased pressure on credit restrictions could easily push Australia into its first recession in 27-years – a global record amongst developed countries. How will our PM play this one, support housing or join the populous party and knock the banks? – a tough one given his very little chance of success in the looming election.

We remain bearish the ASX200 short-term targeting a decent break below 5800 – now just over 1% away. However with the current elevated volatility on the stock level we may press the buy trigger on a situation earlier if the opportunity presents itself e.g. ResMed (RMD).

MM is no longer in ‘sell mode’ due to our large cash position with the ideal level to commence buying on an index level below 5800.

Overnight US markets were mixed – as I type this early on Friday morning (I’m out of the office for the first half of the day) the Dow is down 60-points while the NASDAQ was trading up over 1%. The SPI futures are calling the ASX200 to open up around 9-points helped by BHP which is up ~30c and ResMed which was up over 1%.

Today we are not surprisingly going to undertake a succinct review of the banks which have come under renewed pressure ahead of Mondays unveiling of the royal commission report with it’s all important recommendations.

ASX200 Index Chart

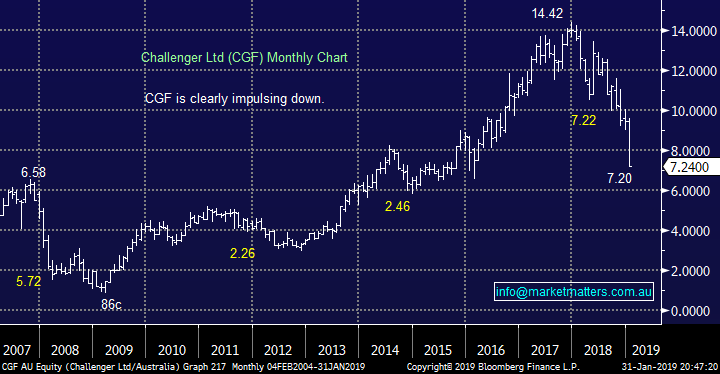

Yesterday MM took a healthy ~26% profit on our Appen (APX) position while also realising a frustrating ~26% loss on our Challenger (CGF) position following the companies painful downgrade last week – the 2 certainly feel like a case of swings and roundabouts!

The important point is we are following our flagged path of discipline for 2019 by cutting our losses and taking profits when stocks hit our target zones.

The MM Growth Portfolio is now holding an elevated cash position of 33%.

Appen Ltd (ASX: APX) Chart

Challenger Ltd (ASX: CGF) Chart

Happily one of our positions in the MM Growth Portfolio Western Areas (WSA) enjoyed a stellar session yesterday rallying well over 7% to trade at its highest levels since November last year. Are we planning to sell I can feel some subscribers say?

MM remains bullish WSA and has elevated our target area to ~$2.80, or almost 20% higher.

We’ve seen recently how strong momentum can be in the resource stocks, and to us, it feels like WSA is just getting started.

Western Areas (ASX: WSA) Chart

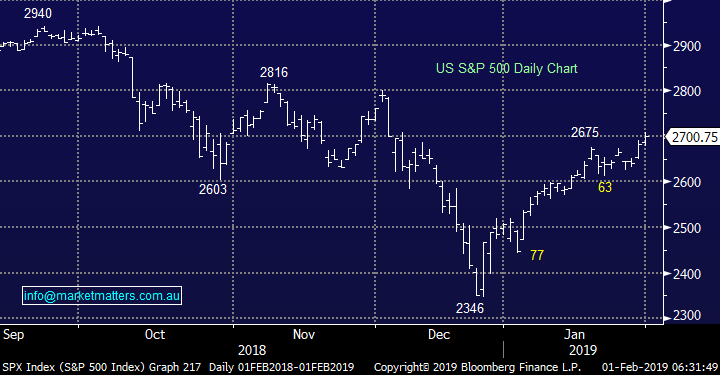

The US markets have reached our targeted psychological 2700 area for the S&P500 following the extremely supportive statement from the Fed.

However our preferred scenario now remains a correction to the 15% impressive rally from late Decembers low will soon unfold – one of the reasons for the elevated cash positions in both the MM Portfolios.

US S&P500 Chart

Are the banks becoming too scared by Hayne et al?

There’s a very common saying in markets “buy on rumour & sell on fact”, in the ASX200 today the banks are potentially following the reverse of this saying perfectly. With only 2 trading days remaining until the release of the final banking report, nerves are clearly increasing rapidly which makes sense when we consider Mr Hayne’s scathing interim report released back in September 2018.

The simple dichotomy MM faces is we are already overweight the banks ahead of some major news, do we want to push the proverbial boat out? In our Growth Portfolio we hold 30% across CBA, NAB and Westpac compared to a banking sector weighting of ~25% i.e. we are already positioned mildly bullish the sector which importantly fits our view for 2019.We’re less so in the Income Portfolio however that’s largely a result of our skew towards Hybrids.

Let’s take a look at 3 of the majors and consider if we want to add, or reduce for that matter.

This is an interesting time to remember the poker analogy we used in a recent MM report where most successful players tend to raise or fold as opposed to checking.

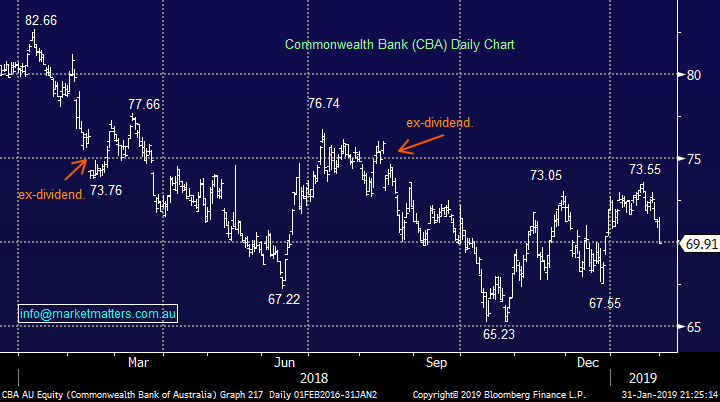

1 Commonwealth Bank (CBA) $69.91

CBA has fallen almost 5% over the last few days with the clear price action of a market that is scarred, or has a sniff of bad news looming on the horizon.

CBA currently yields 6.17% fully franked and is due to trade ex-dividend ~$2.01 in mid-February – only 2 weeks until a very attractive dividend.

Technically we are now neutral with a test of $68 feeling a strong possibility.

MM likes CBA into weakness below $70 but would be accumulating, not buying full exposure if we had no position.

Commonwealth Bank (ASX: CBA) Chart

2 National Australia Bank (NAB) $23.86

Over the last 5-days NAB has been one of the better performing banks only falling -2.65%.

NAB currently yields 8.3% fully franked but doesn’t trade ex-dividend again until May.

Technically we are neutral NAB here but would be keen buyers into weakness below the recent $22.52 low.

MM likes NAB into panic weakness below $22.50.

National Australia Bank (ASX: NAB) Chart

3 Westpac Bank (WBC) $24.55

WBC has been the worst performer of the “Big Four” banks over the last 5 trading days falling -4.1% following a nice 13% rally from its recent low.

WBC currently yields ~7.66% fully franked but like NAB doesn’t trade ex-dividend again until May.

MM likes WBC into panic weakness below $23.

Westpac bank (ASX: WBC) Chart

The theme is relatively constant across the 3 stocks – no compelling reason to buy into current weakness but be prepared to buy any spike lower if we see panic after the Monday nights release of the Hayne Report.

In this case we are going to “check” our already overweight position as opposed adding / reducing due to our medium-term outlook.

Conclusion

We’re comfortable with our current banking exposures and would likely increase it if we get an aggressive sell off after the release of the Hayne Report.

Overnight Market Matters Wrap

· A mixed session in the US overnight, with the Dow down marginally, whilst the broader S&P 500 and Nasdaq 100 in positive territory.

· Chinese factory output fell for a second straight month. This may play into Trump’s hands as he announced that he is optimistic that a trade deal with China can be made by the March 1 deadline. Trump is also planning a summit with Kim Jong Un.

· All metals on the LME were slightly better, with nickel the standout, +1%. Iron ore continues to rally, while oil and gold were slightly lower.

· The March SPI Futures is indicating the ASX 200 to open 15 points higher towards the 5880 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.