Are the Casinos a Good Bet here? – (FMG, CWN, SGR, SKC)

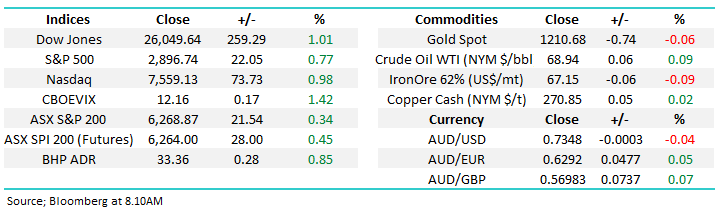

The ASX200 finally found some strength yesterday afternoon, with the banks in particular reversing earlier losses to close up +0.5% on the day. The market has corrected 138-points / 2.2% over the last 6-days and it now feels like the recent politically inspired correction is behind us and local stocks are poised to move back into step with global markets.

Donald Trump has kicked an impressive goal overnight rewriting parts of the North American Trade Agreement in a bilateral deal between the US and Mexico, the pressure is now on Canada to complete a totally fresh start for NAFTA. Undoubtedly Donald Trump has proven to be an impressive president from a stock market perspective with the S&P500 now up +39% since its low around election day back in November 2016. Market concerns around a US – China trade war have continued to diminish and this recent success by Trump adds confidence to many that he will also get a good result between the world’s two largest economies.

· We are still neutral / negative the ASX200 following the close below 6300 and remain in careful “sell mode”.

Overnight stocks were strong, courtesy of the US-Mexico trade deal with the S&P500 closing up 1%, making another fresh all-time high. The SPI futures are pointing to an open up around 25-points / 0.5%.

Today’s report is going to focus on the gaming stocks following strong results by both Crown (CWN) and Star (SGR) – both stocks have rallied over 11% over the last month and we question whether MM has missed the bus on this one.

ASX200 Chart

Yesterday we dipped our toe back into the resources sector allocating 3% of our MM Growth Portfolio into RIO around the $72.60 area.

We previously took profit back in April on our holding in the large diversified miner above $80, a move which certainly felt premature when the stock spiked above $87, but the recent -18.2% correction has vindicated our action if not perfect timing – the last few % is often luck.

· MM is bullish RIO around the $70 area and may consider averaging into further weakness in RIO, or elsewhere within the sector.

RIO Tinto (RIO) Chart

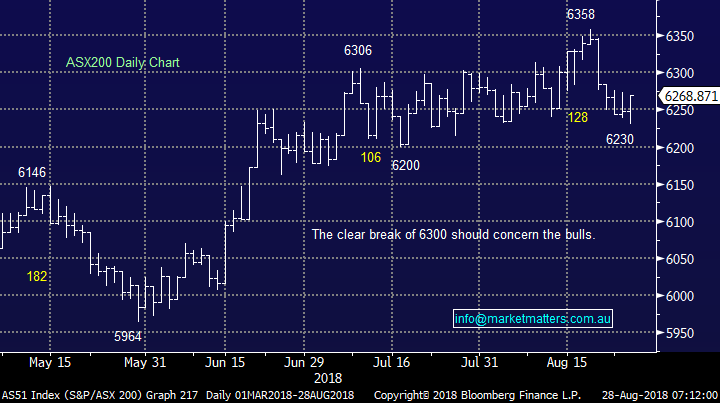

One of the reasons we chose to pull the trigger on the RIO trade was the relative performance of our iron ore stocks compared to the underlying bulk commodity:

- Iron Ore has corrected 8.5% from its August high.

- However, RIO & FMG have fallen -18.2% and -27.7% from their respective 2018 highs.

Our feeling was clearly that things were “overly optimistic” earlier in the year when we liquidated our resources exposure, but the pendulum has swung back the other way as the below iron ore – FMG chart illustrates i.e. investors have been chasing growth stocks and selling resources after their stellar 2-year gains.

Fortescue Metals (FMG) v Iron Ore Chart

Australian & global casinos

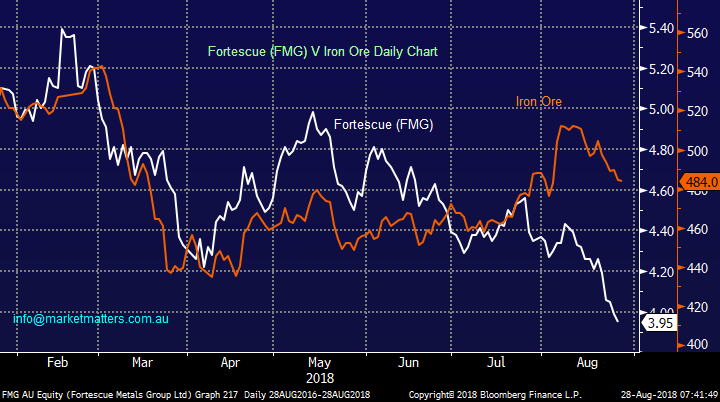

The sector we have deliberated around the most over the last 1-2 weeks is the gaming / casino stocks following particularly solid results from both Crown (CWN) and Star (SGR). Firstly let’s consider the local 2 options from a global perspective:

- The average P/E of the global casinos globally is 20.1x while CWN trades on 22.5x and SGR 18.4x – obviously not as cheap as they were a few weeks ago.

- Both CWN and SGR are trading well above their historical discount to the sector, driven in all likelihood by the growth of tourism from Asia.

Global Peer Comparison – Casinos

Hence the global picture is not particularly exciting from a historical perspective but we must consider if the dynamics are changing as the Chinese middle class grows significantly and overseas travel is definitely on the menu.

We have a couple of factors pulling us in different directions from the macro perspective:

1. Concerns that the large debt burden of the average Australian

2. US bond yields are currently implying a recession is ~2-years away - gaming stocks usually struggle during tough times.

Conversely, we are very bullish the growth of the Chinese “middle class” which is obviously supportive of both CWN and SGR – a record 226,900 Chinese tourists visited Australia alone last February.

We have more confidence with the Chinese tourist than a US recession is looming in ~2-years.

US 10-2-year bond spread

1 Crown Resorts (CWN) $14.34

Earlier in the month CWN announced a strong result including a 1.5% rise in main floor gaming revenue, while VIP turnover soared by over 50%. The market welcomed the result and the stock has rallied above its recent $14 barrier assisted by a $400m buyback due to commence on the 30th of this month.

Technically, CWN looks strong - initially targeting the $16 area while it can hold above $13.80.

· MM is bullish CWN at current levels.

Crown Resorts (CWN) Chart

2 Star Entertainment (SGR) $5.55

SGR has performed strongly following the release of its full year results showing an increase in normalised profit of over 20% year on year. Sydney was the standout for SGR helping prop up a soft performance out of Queensland. The main variable for SGR is whether how the picture will evolve once Barangaroo opens its doors in 2021.

Technically SGR looks good while it can hold above $5.10 with ideal buying currently ~$5.40, just above yesterday’s low.

· MM likes SGR while it can trade above $5.10.

Star Entertainment (SGR) Chart

3 SkyCity Entertainment (SKC) $3.88

SKC’s shares also rallied following the release of its full year results earlier in the month which showed net profit after tax up +10.4% on the year. SKC is now trading on a P/E of 17.3x Est 2019 earnings, a clear discount to both SGR and CWN but we feel its warranted especially considering the growth potential for CWN moving forward.

Technically we are neutral SKC.

· MM is neutral SKC.

SkyCity Entertainment (SKC) Chart

Conclusion

Overall we like the gaming sector with a couple of macro reservations but the dominant factor is the positive influence from growing Chinese tourism.

· MM likes CWN, SGR and SKC in that order at today’s prices.

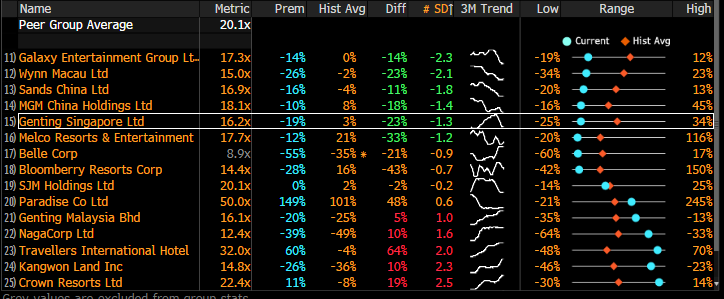

Overseas Indices

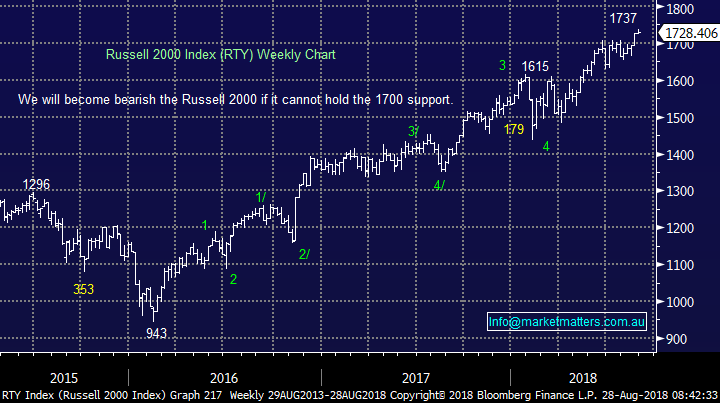

US indices rallied to fresh all-time highs last night but we note the Russell 2000 which we have been watching for a few weeks closed almost on its low, but still ~2% away from generating a sell signal.

US Russell 2000 Chart

During 2018 we have seen huge divergence between US indices and the Emerging Markets as investors have been rattled by both Turkey and a potential US-China trade war.

· We believe this elastic band has become stretched too far and expect relative catch up by the Emerging Markets.

S&P500 v Emerging Markets Chart

Overnight Market Matters Wrap

· The US started the week on a positive note, with the broader S&P 500 and Nasdaq hitting fresh highs as investors welcomed the US-Mexican trade agreement.

· The automobile sector outperformed the market, on the back of the trade agreement, while the department stores were the laggard.

· Domestic earnings expected to report today are APX, BKL, CTX, ORE & SDA.

· The September SPI Futures is indicating the ASX 200 to open 25 points higher, testing the 6295 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here