Are Healthcare stocks bracing for a correction? (MSFT US, FMG, WTC, CSL, RHC, COH, PNV, AVH)

Yesterday the ASX200 reached and closed at fresh all-time highs as February lives up to its seasonal reputation as the 2nd strongest month for Australian equities. While the market finally finished the day up +0.25% the real action was under the hood where we saw 19 members of the ASX200 rally by more than 4% and 8 stocks retreat to the same degree – reporting season is living up to its volatile reputation. The only 2 sectors to drag on the index were the Healthcare and IT sectors, 2 of the strongest over the last year implying a little profit taking maybe creeping into the market.

Things remains uncertain on the local interest rate front after we saw Unemployment tick up to 5.3% but the underlying breakdown of the data was mixed, following the release we saw the $A fall to fresh decade lows however the coronavirus is playing a significant part in its current leg lower. I feel we summed the employment data up well in the yesterday’s Afternoon note:

“While the headline was soft, the actual composition wasn’t. A higher participation rate implies strength, so does the number of full-time jobs being added v part-times, overall, not such a weak print in our opinion. “.

Australian bond yields remain above last April’s all-time lows as uncertainty creeps into many economists view on how the RBA will act through 2020 / 2021. Our opinion is the RBA does not want to cut rates and will be on hold for at least a year unless we see a significant economic impact from the coronavirus outbreak. I actually wouldn’t be surprised if the next move by the RBA was an interest rate hike in late 2021, undoubtedly a contrarian thought at this point in time.

MM has increased our cash holding to 12%, we may do a little more if a suitable opportunity arises into strength.

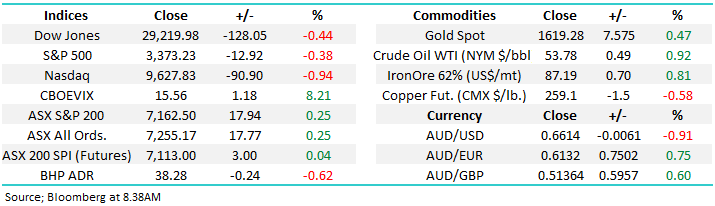

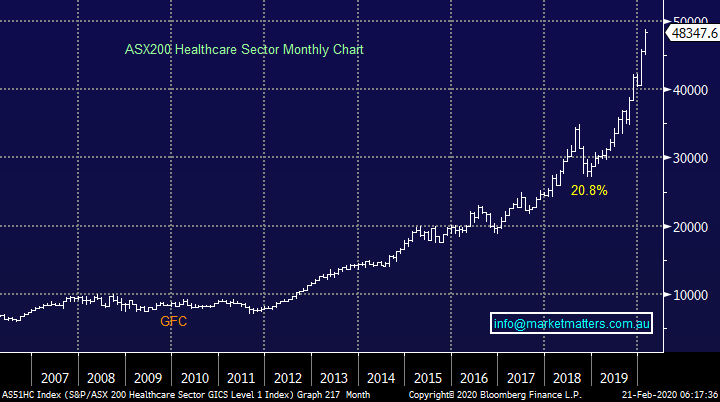

Overnight US stocks were weaker, although some buying late in the session saw stocks finish off their daily lows, the Dow Jones down 128 points by the close while the Nasdaq finished weaker by -0.94%. Domino’s Pizza (DPZ US) in the US rallied ~25% after showing very strong quarterly sales. While a different entity to the listed Dominoes in Australia, they are impacted by similar trends. The concern around meal deliveries from Uber Eats and the like reducing demand for pizza’s has proven to be overblown and a strategy called ‘fortressing’ is working - we’ll look at this in an international note shortly.

This morning the SPI is pointing to a modest 5-point gain as reporting winds down for the week. Ingham’s (ING) result today will be interesting.

Reporting schedule available here: CLICK HERE

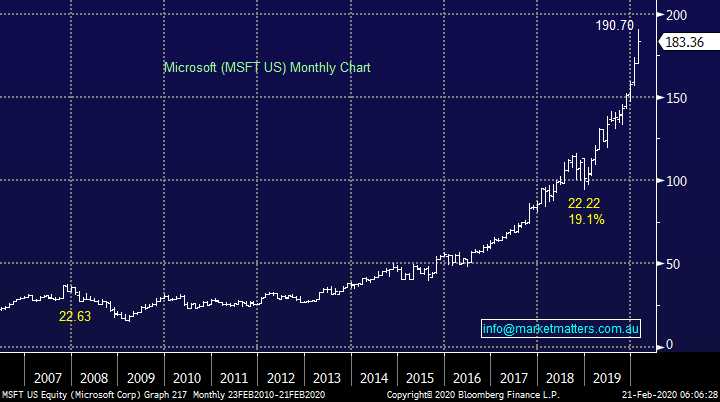

Today we have looked at the HealthCare Sector which has been the top performer in Australia over the last year rallying an extraordinary +66%, double the return of its nearest rival. The almost exponential advance has taken the sectors weighting up to 11.5% of the ASX200 making it the 3rd most important group of stocks in the ASX200. However, at the sector level at least it’s been spluttering of late, highlighted by its decline yesterday while the index made all-time highs, one day doesn’t change a summer but it did catch our eye.

Our gut feel at MM is we will see another bout of selling on fears around the coronavirus in the coming few weeks, it’s not going away anytime soon.

ASX200 Chart

Global Indices

US equities retreated last night in what many technical analysts would identify as the potential start to a correction of the recent “classic 3rd wave / acceleration phase”. Assuming this interpretation is correct there are 2 important points to bear in mind:

1 – the NASDAQ should soon experience a fairly sharp 6-8% correction, potentially back towards the 9000 area.

2 – The trend is up, and such a pullback is another buying opportunity, not a time to panic.

MM is short-term neutral to negative US stocks as they’ve hit our Q1 target area.

US NASDAQ Index Chart

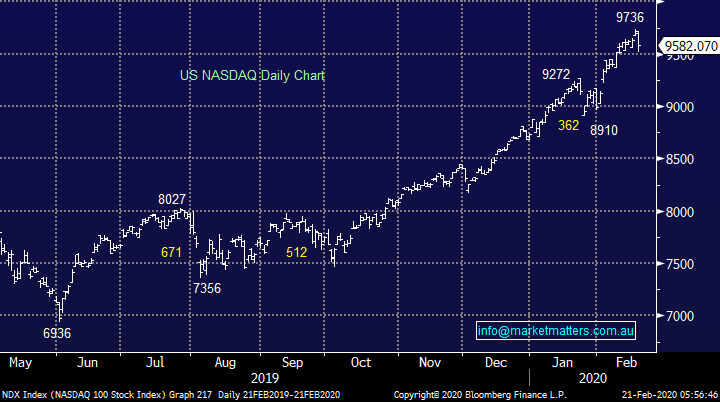

Household name Microsoft has rallied like a runaway train over the last few years as the company has continued to go from strength to strength. Picking tops / turning points when stocks rally with this degree of momentum is a mugs game in our opinion, but we are very comfortable identifying areas where MM would be keen to buy retracements, a characteristic of all bull markets. At this stage our optimum entry level is ~$US170, or 7% lower i.e. only where we were around 4-weeks ago.

MM is bullish Microsoft medium term regarding pullbacks as buying opportunities.

Microsoft (MSFT US) Chart

The Australian investor remains a yield hungry beast and I feel assuming that we’ve seen the greatest impact of the coronavirus led sell off in iron ore it won’t be long until we see some accumulation of Fortescue Metals (FMG) – the company pays a whopping 76c fully franked dividend on March 2nd. Definitely one for the watchlist especially if we see another leg down in resources, a good possibility in our opinion.

MM likes FMG into current weakness.

Fortescue Metals (FMG) Chart

Iron Ore Chart

Logistics solution business WiseTech (WTC) remains under the pump crashing 35% this week after the company downgraded its half-year results / earnings guidance. Remember it was only 4-months ago when US hedge fund J Capital accused the company of accounting trickery sending the stock plunging ~$10, perhaps a touch of déjà vu. Our conclusion back in mid-October was on the money and our thoughts haven’t really changed:

“While WTC is a stock we’ve only ever been spectators in, after reading the report today we’re happy to be on the sidelines here – a lot more to play out with this one.”

MM still has no interest in WTC.

WiseTech (WTC) Chart

Is Healthcare Sector ready for a correction?

The Australian Healthcare Sector looks to have boarded the same runaway train as Microsoft with our own star CSL Ltd driving this particular locomotive. While interest rates remain low and investors are forced up the risk spectrum to chase both yield and growth we expect P/E expansion (increased valuations) will continue to be an underlying theme in equity markets although it might have another snooze like it did in late 2018 i.e. all bull markets experience a pull back at some stage.

Today I have briefly looked at 5 stocks in the sector with the primary objective to identify buying areas.

ASX200 Healthcare Sector Chart

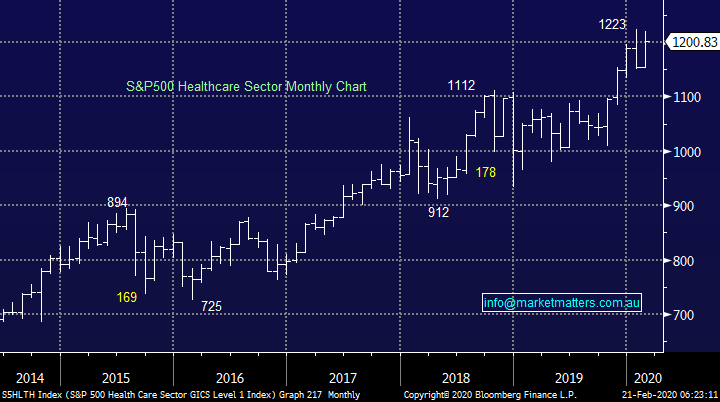

Interestingly the US Healthcare Sector hasn’t enjoyed such an explosive few years, in our opinion probably because of 2 driving factors:

1 – The US sector isn’t dominated by one extremely successful business like our own with CSL Ltd (CSL).

2 – The US has a far greater degree of depth where relatively nervous investors can buy perceived quality / lower risk stocks like Apple, Google and Microsoft.

US S&P500 Healthcare Sector Chart

1 CSL Ltd (CSL) $338.68

Blood plasma business CSL has been an unprecedented success on the Australian bourse becoming the second largest stock in the ASX200 with a huge market weighting of 6.4%. The company delivered an impressive 11% growth in revenue this month to $US4980m which dropped down to NPAT of $US1248m.

We have zero doubt that this is a top quality business the only issue is the valuation with the stock trading on an Est P/E for 2020 of 47.8x however we have missed out on some of the recent gains by underestimating how much of a premium investors would be prepared to pay for this quality business. If MM was to play devil’s advocate, we would also point out its now a very owned stock and the momentum traders are all over it, and so too are the value managers. I did a video with a well-known value manager recently who in the lift was talking about their position in CSL. Clearly a winner however it seems value manager, growth managers and everything in between now has CSL in their portfolio.

The stock is statistically due for another ~$20-30 pullback and at this stage from a risk / reward perspective I would rather be sitting on the sideline waiting to pounce next time it gets the “valuation jitters”.

MM currently likes CSL around $300.

CSL Ltd (CSL) Chart

2 Ramsay Healthcare (RHC) $79.37

RHC is the second largest stock in the Healthcare stocks and it represents well under 1% of the ASX200 illustrating CSL’s dominance of the sector and why we don’t pay too much attention to the sectors index. Australia’s largest private health operator recovered strongly in 2019 a move we considered a few times but unfortunately ultimately missed.

We feel the companies rate of growth the stock doesn’t feel cheap trading on a P/E of 27.6x and MM doesn’t want to be suckered into a FOMO (Fear of missing out) scenario in a year where we anticipate elevated volatility.

MM is neutral RHC at present.

Ramsay Healthcare (RHC) Chart

3 Cochlear (COH) $242.35

Hearing implant leader COH has rallied solidly of late although not to the same degree as heavyweight CSL. The company received a strong broker upgrade this week which interestingly hasn’t particularly flowed through to the underlying share price – it simply feels tried to MM. Rivals have been struggling of late although we feel this is probably a short-term phenomenon conversely the negative impact from the coronavirus, which has led to a major slowdown in implants in China, this is hopefully going to dissipate in H2 of this year.

MM is neutral COH at current levels.

Cochlear (COH) Chart

4 PolyNovo (Ltd (PNV) $3.12

PNV has enjoyed a strong 2019 primarily because of the success of its synthetic polymer Novosorb to treat serious burns victims which is gaining use across the globe. December was the first month when sales exceeded $2m which is not a big number but it was only back in April 2019 that it passed the $1m milestone illustrating clear growth but with a market cap of over $2bn, there’s a lot more water required under this particular bridge to vaguely justify this valuation.

We like the company and especially its products, but investors must understand its priced on blue sky and risks are high if growth vaguely slows.

MM likes PNV ~10% lower from a risk / reward perspective.

PolNovo Ltd (PNV) Chart

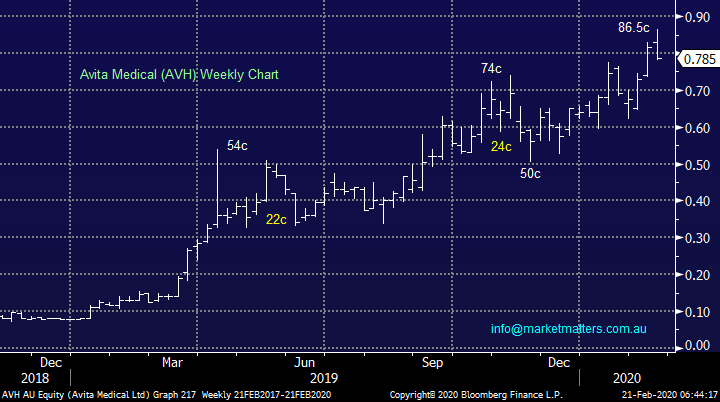

5 Avita Medical (AVH) 78.5c

Biotech AVH develops and distributes tissue-engineered cellular products with its RECELL technology getting the headlines for its use to treat 2nd and 3rd degree burns. This is a stock in relatively early days with RECELL only having been used on ~8000 times commercially but the results have been good and with approval to operate in the US, Europe and China the future looks fairly rosy. The latest years revenue was just shy of $10m with a more than 50% increase in sales from Q2 to Q3 i.e. solid growth, they have over $12m cash in the bank and low debt which means the foundations are solid.

Again, this is a $1.66bn company and will need to continue delivering to justify its valuation. We like the company but are nervous at current levels.

MM is neutral AVH around 80c.

Avita Medical (AVH) Chart

Conclusion (s)

MM is underlying neutral the Australian Healthcare Sector but a keen buyer into weakness, sounds like a lot of investors towards the whole market – I rarely like being with the crowd.

Overnight Market Matters Wrap

- The case of the Coronavirus / COVID-19 was back on the spotlight as fears the vires can spread more easily than thought. This overshadowed strong US economic data being released, with the Philadelphia Fed noting its business conditions index soared to 36.7 from 17, the highest level in two years.

- Metals on the LME were weak again, with nickel down more than 1%. Iron ore however, rallied along with Crude oil back testing the US$54/bbl. Level.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of -0.62% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open marginally higher, testing the 7168 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.