Are Farallon Capital “panicking” at the bottom for coal stocks? (NCM, GDX US, WHC, S32, NHC, SOL)

Firstly our thoughts and prayers go out to all Australians and subscribers caught in the middle of the horrendous bushfires engulfing our great country – stay safe.

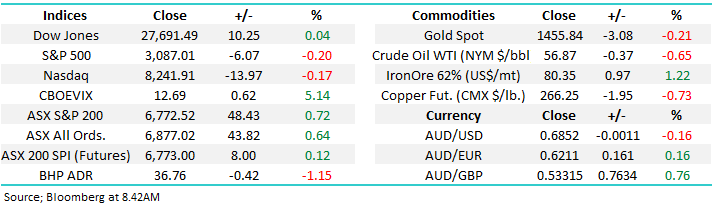

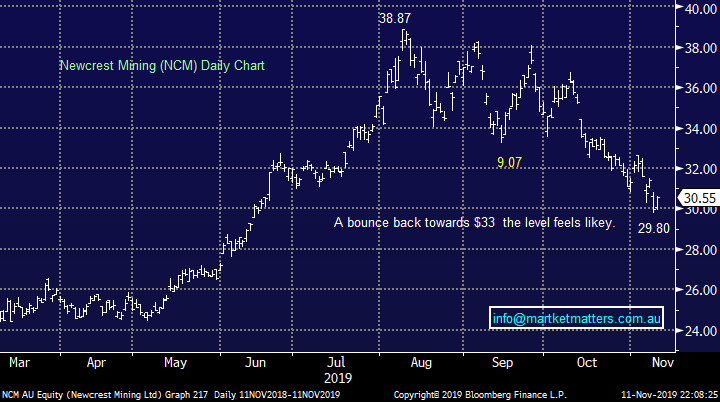

The ASX200 started the second week of November with a loud roar as the market threatens to test its multi-week highs but it was a strange day on a few different levels. The market rallied an impressive +0.7% with the Banks and Healthcare sectors leading from a points perspective while the resources struggled but it was the way we ignored global indices that caught my attention. During our trading session the US futures fell ~0.4% while Asia plummeted following more civil unrest in Hong Kong, the Hang Seng and China fell -2.5% & -1.8% respectively while Australia appeared to enjoy a quasi-safety bid.

The sector rotation that rolled through our stocks on Monday looks set to continue today with BHP falling ~1.4% in the US, on the US market overnight the Energy, Healthcare & Utilities struggled while IT & Real Estate were the best sectors but is was a quiet session both on an index level and under the hood with none of the 11 sectors having moved by more than 0.6% with an hour to go.

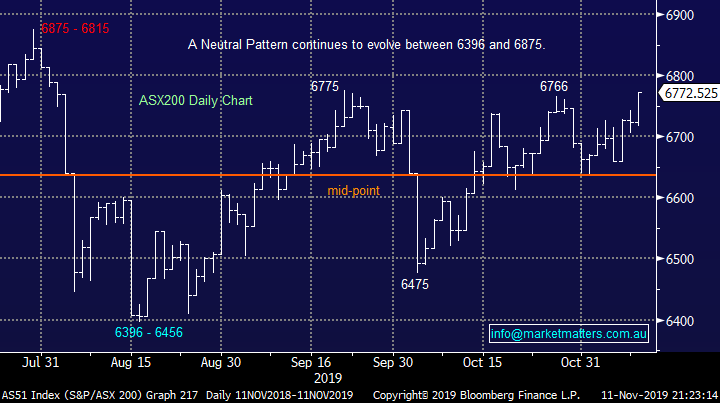

Interestingly if the futures at 10pm last night are anything to go on we still appear to be correlated to the $A when it comes to our intra-day performance, especially when we surprise in either direction – yesterday the $A drifted lower throughout the day and the ASX rallied but after 7.30 pm the local currency staged a recovery and in quick fire time the SPI futures fell -0.5% although perhaps some hedging by UBS on the $300m Whitehaven (WHC) stake discussed today skewed proceedings in this case. However MM’s major takeout from this of course is we’re bullish the $A targeting an initial break above 70c with a rally of ~15% our eventual target, this implies the ASX will struggle relatively speaking in 2020.

Short-term MM remains neutral the ASX200 with a slight positive bias.

Overnight global stocks were very quiet but the SPI futures are implying we will open up 10-points even with BHP down over 1%, the market remains firm.

This morning we have looked at the Australian coal stocks after US investment firm Farallon Capital sold down its stake in Whitehaven Coal (WHC) at a relatively small 4.4% discount to its close but the 95 million shares are worth ~$250m less than they were in 2018, we question if they are selling around the sectors low for the last 12-months – similar to what the Future Fund did with Telstra.

ASX200 Chart

In the short-term for the very active investor / trader we see 2 risk / reward opportunities unfolding in equities:

1 – Be long the ASX200 with stops below 6720 and buy the next ~40-point correction.

2 – Buy the next ~2% correction in US stocks.

MM is in the short-term bullish camp from a risk / reward perspective.

ASX200 December SPI Futures Chart

US S&P500 Index Chart

US bond yields are hovering above the important 1.9% area. Our opinion is if they fail at current levels we will see strong rotation back from the likes of resources into defensives, a very similar move to the last 24 hours, perhaps stocks are pre-empting bonds this time.

MM expects the defensives to benefit if US bond yields take another leg lower.

US 10-year Bond Yields Chart

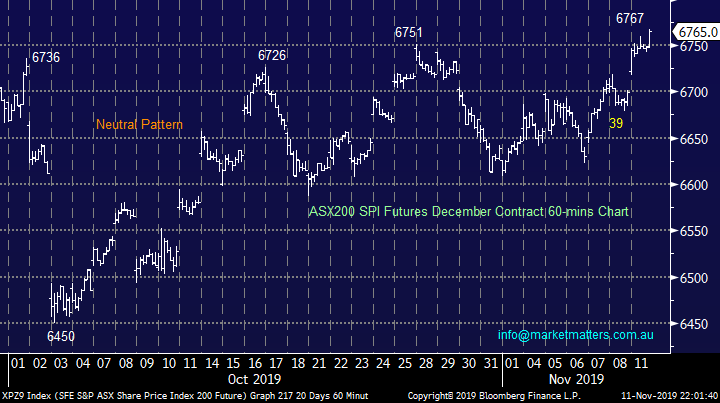

The good news for MM yesterday was the gold stocks reversed up as defensives enjoyed a bid tone, similarly overnight the Gold Miners ETF rallied +0.8% even while the precious metal slipped ~$US5.

MM remains cautious gold at current levels and is considering selling Newcrest (NCM) ~$33.

Newcrest Mining (NCM) Chart

VanEck Gold Miners ETF (GDX US) Chart

As investors capitulate is it time to accumulate coal stocks?

The coal price has almost halved over the last 12-months putting significant pressure on the stocks within the sector – not great news for Australia’s largest energy resource. A recent KPMG coal price consensus forecast report called prices 5-10% higher of the next few years, we believe this result would be bullish the sector which has endured aggressive declining prices over recent times which is illustrated by the Newcastle coal price below.

While the worlds clearly moving towards cleaner energy the transition will take time however investors / money globally is becoming more attuned to their social and environmental responsibilities, leading the investment community has been Norway’s sovereign wealth fund who are the largest globally with over $US1 trillion in assets. The Norwegian fund declared mid this year that they were going to sell off over $10bn worth of fossil fuel stocks while also phasing out oil exploration and coal-related companies from their portfolio i.e. they can no longer invest in companies which mine over 20 million tonnes of coal annually.

Importantly when we see “forced selling” and sectors thrown into the proverbial sin bin opportunities arise like a phoenix from the ashes – as we discussed in the video below coal has now become “interesting” after a very tough period i.e. “coal feels like it’s at a low”. We have briefly looked at 3 local alternatives within the sector this morning.

Recent video with Shaw & Partners Peter O’Connor on resources generally, and coal specifically (Click here or the image below to view)

Coal Price ex-Newcastle ($US/MT) Chart

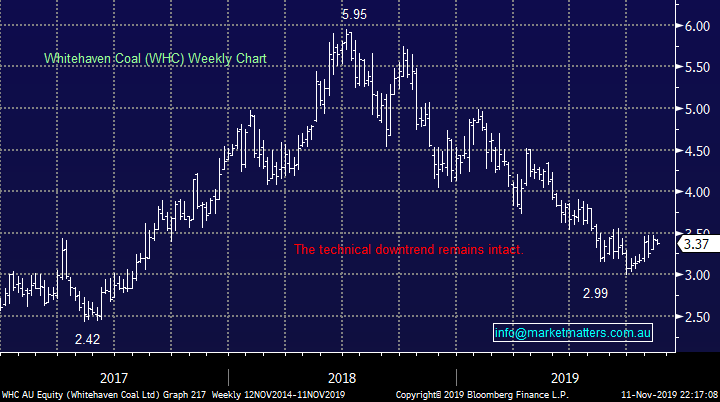

1 Whitehaven Coal (WHC) $3.37

Overnight Farallon’s have sold down over 9% of Whitehaven Coal (WHC) at $3.22 with UBS printing the ticket but they still own 5% of the company which they have been forced to push into escrow for the next 2 months to enable the placement of the $306 million stake i.e. they cannot sell this stake for 60-days. The reason for the sale is the apparent wind up of the fund however I’ve seen all sorts of excuses for selling stock over the years and this is a well-trodden path.

The question now is can WHC rally into Christmas with this overhang in play but its these style of circumstances that can often form a very meaningful low for a stock.

WHC is yielding strongly at present but by definition this remains a function of the underlying coal price. Technically we would be keen buyers below $3 but if fund managers have appetite around $3.22 this feels a big ask.

MM is now cautiously optimistic Whitehaven Coal (WHC).

Whitehaven Coal (WHC) Chart

2 South32 (S32) $2.75

South32 (S32) is a diversified miner with a large coal exposure and like WHC it’s endured a tough 2018 / 2019 correcting almost 45% but it’s now turned the risk / reward towards the buyers / accumulators in our opinion – the stocks anticipated 4.9% fully franked dividend is also attractive to most local investors.

The downtrend is clearly entrenched for the stock and sector but we feel patient buying into weakness is likely to be rewarded into 2020.

MM is slowly becoming interested in S32 below $3.

South32 (S32) Chart

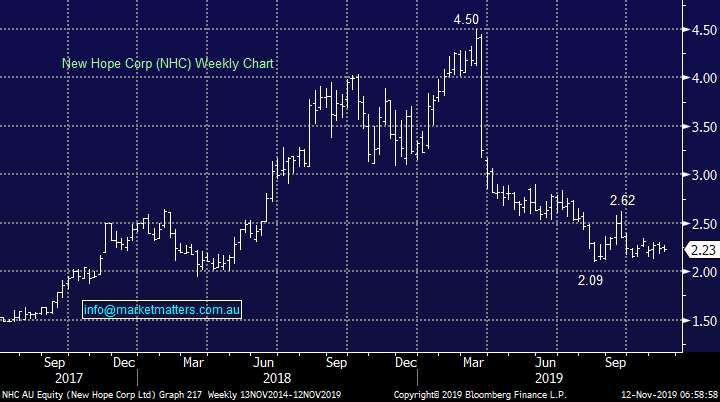

3 New Hope Corp (NHC) $2.23

NHC crashed back in March after posting its first-half results for 2019, the company cited headwinds arising from an uncertain energy policy and ongoing environmental concerns facing the coal industry- no surprises surely! In September when they delivered their full year numbers there were no major surprises, the stock has continued to track sideways – revenue came in at $1,306m while net profits rose 3% to $268m.

At this stage we feel that NHC remains a buy arounds $2 and sell above $2.50 – a very micro view, however there are more question marks over the demand for Thermal Coal used for energy versus Coking Coal which is used in steel making. NHC is skewed towards Thermal Coal.

MM is neutral NHC at current prices.

New Hope Corp (NHC) Chart

4 Washington H Soul Pattinson & Company (SOL) $23.06

While SOL is an investment company with a broad suit of investments rather than a specific coal stock, it does own 50% of New Hope Coal (NHC) worth around $1bn and is therefore influenced by what happens in the coal market. They also own 25% of TPG Telecom (TPM) and 43% of Brickworks (BKW) along with a bunch of other diverse assets including pharma & property – a lot going on with coal of those influences. They have a counter cyclical style of investment with a value focus.

We feel SOL has bottomed well however a break of ~$23.50 needs to occur to confirm upside momentum.

MM is neutral SOL at current prices.

Washington H Soul Pattinson & Company (SOL Chart)

Conclusion (s)

MM is looking to build a small position in coal stocks but this view will be under pressure if a US – China trade deal is not completed relatively soon. However we feel the optimum strategy is to accumulate into weakness hence the impact of Farallon’s sell down will be interesting when WHC recommences trading.

In order of preference we like S32, WHC, SOL and NHC.

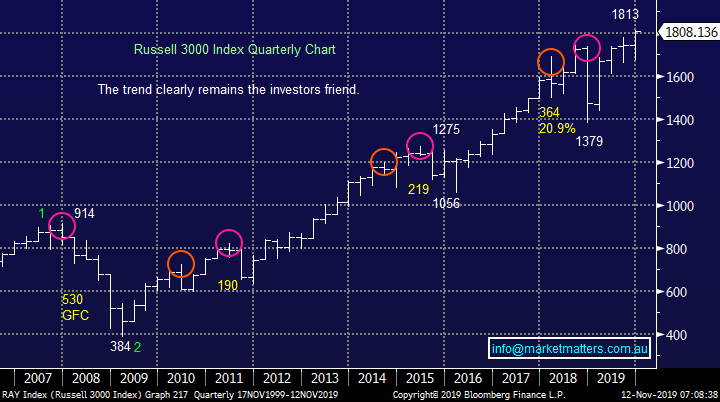

Global Indices

No major change, we had given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated, a close well under 1750 for the Russell 3000 is required to switch us to a bearish short-term stance.

MM is now neutral / positive US stocks.

US Russell 3000 Index Chart

European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

- US equity markets gave back its early gains as concerns of the trade deal between China and US re-ignighted when President Trump, trumped previous optimistic tariff comments from its Chinese constituents.

- With doubts of the on again, off again trade deal, the Dollar index started the week on a low note, while the emerging markets are set to trade weaker today.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of 1.15% from Australia’s previous close.

- The December SPI Futures is indicating the ASX 200 to open marginally higher, testing the 6780 level this morning with Westpac (WBC) trading ex-dividend at $0.80/share and Orica Ltd (ORI) at $0.33/share..

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.