Are Australian China facing stocks representing decent risk / reward? (BHP, QUB, A2M, TWE, SGR)

The market was weaker than I anticipated yesterday but when the US futures plunge another -1.5% during our trading session it’s no surprise that buyers again ran for the hills. The consistent coronavirus news across our trading screens seems relentless and that’s curbing any real appetite to buy the dip. I was watching an interview in the US very early this morning with a guest reiterating that buying stocks into panicked price action has a very good track record of success, certainly seems like panic has now taken hold.

The US has confirmed its first case of unknown origin, Italy’s death toll rapidly hits 17 and Japans shutting all schools from March 2nd. Both Scott Morrison and equity markets are now fully expecting a pandemic outbreak, hardly a bold call with the virus already reaching 47 countries. Amazingly it’s just a week ago that stocks were dismissing the virus as purely a China based problem, the ASX likely to be down ~10% in a week considering where futures are trading this morning.

The ease at which stocks are retreating is unnerving, and without getting too dramatic the intra-day trading action reminds me of what we saw in the GFC. Markets are de-risking fast with the Australian IT stocks again the worst performers, we’ve flagged the risks of momentum traders all sitting complacently long the sector and as we saw in late 2018 when the music stops playing there’s not enough chairs i.e. in H2 of 2018 the local IT sector fell almost 20%, this Februarys correction is already 15.8% and counting, as we said yesterday when markets endure tough times it’s the high valuation / growth names that usually suffer some of the deepest corrections.

At this stage with the ASX200 almost 8% below last week’s all-time high it’s a tough decision to say let’s become defensive / increase cash positions but we’re not dismissing the idea with our Growth Portfolios cash position of ~5% feeling too low after the last 4-days trading. We regularly say investors must remain open-minded and flexible hence we may move to reduce our market exposure, preferably into the next decent bounce – remember our analogy of a bear market & a ping-pong ball going down a staircase, they’re both ultimately going to reach the bottom but both will sometimes bounce sharply along their journey.

MM is now neutral equities wanting to see how the next few days evolve before jumping on either bandwagon.

Overnight US stocks were yet again extremely volatile, particularly in the last 3 hours of trade. We saw some aggressive buying of an intra-day dip early on however it simply felt no trader wanted to go home long equities, and the sell-off gained momentum into the close. The ASX200 is bracing for another sharp decline at the open with SPI Futures down 164pts / 2.48%

Intra-day chart of the S&P 500

Today we’ve obviously maintained a vigilant eye on the current volatile markets while looking at 5 Chinese influenced stocks to see if they are providing some value after recent market volatility. The Chinese market was actually up yesterday while most global indices continued their downward spiral raising the question: is the country that led us into the outbreak showing signs that it may be the first to recover?

ASX200 Chart

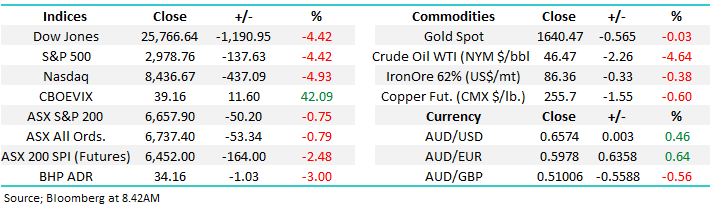

Global Markets

US equities continue to test the downside with the broad-based S&P500 already down 11.4% from this month’s high making it an official correction. The S&P500 bounced strongly this morning from the 3000-support area, before rolling over and closing on the lows. I wouldn’t be surprised to see a decent bounce close at hand, however ultimately, I think equities have now seen a high for a while, and bounces will be sold.

MM is now neutral US equities although I feel a bounce is close at hand.

US S&P500 Index Chart

US bond yields have again made fresh all-time lows overnight, a move we had been forecasting throughout 2020. MM has been calling the current spike lower in bond yields to represent a major swing low, obviously time will tell here but Part A of the outlook remains on track, the flight to the safety of bonds is moving in a clear inverse correlation to stocks i.e. stock and bond yields are likely to bottom at similar times. No change to our thoughts on bonds:

We can see the Fed cutting interest rates by up to 0.5% and the government adding major fiscal stimulus to kick start their economy assuming it slows with the coronavirus.

MM is still expecting bond yields to bottom during this crisis.

US 10-year bond yields Chart

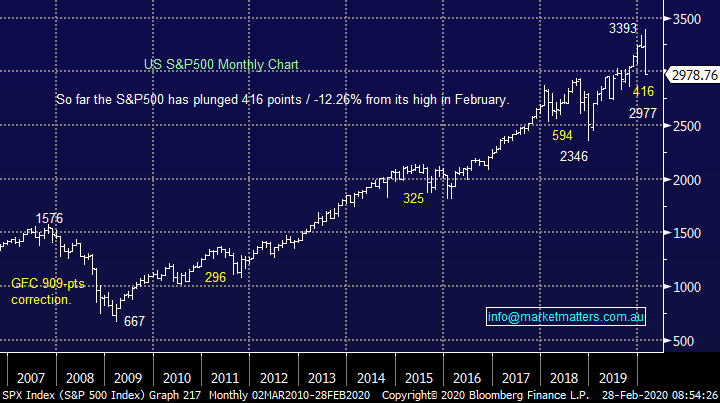

The flight away from risk assets (shares) into safe havens such as gold, bonds has not flowed through to the $US, the $US has encountered some selling over the last fortnight, this is another market where MM sees a major change in trend and its already started to fail.

MM maintains its contrarian bearish view on the $US.

The $US Index Chart

Is it time to buy China and Australian stocks influenced by the world’s second largest economy?

Chinese stocks have rallied over the last few weeks as a combination of stimulus and apparent relatively successful containment of the virus has investors donning a very different cap to the rest of the world – perhaps the government is simply buying the market in an attempt to maintain some level of confidence in China, whatever the reason the Shenzhen CSI 300 Index looks poised to punch through to fresh 2-year highs, pretty amazing stuff under the circumstances.

This strength in the Chinese market has seen fears increase of an eventual market crash similar to 2015 but we believe it’s premature to be anticipating this outcome, the PBOC have only just got started injecting funds into the economy, cutting interest rates and encouraging lenders to offer “cheap” loans to limit the impact of the economically depilating virus.

Don’t forget the catchphrase that has worked so successfully over the last decade “don’t fight the Fed”, we believe it’s equally applicable to the PBOC (Peoples Bank of China). So far most major central banks have been very quiet as they probably attempt to gauge exactly how bad things will unfold as the coronavirus spreads across the globe, a move that was getting almost zero airtime a week ago.

MM is actually technically bullish Chinese stocks but believes central banks / governments will need to act before stability can return to global indices – unless of course a vaccine is found asap.

China’s Shenzhen CSI 300 Index Chart

Hence, we ask the question today that if the PBOC is already pressing the stimulus button will China facing stocks be the first to recover, or is it purely a case of the PBOC buying stocks and we should ignore the phenomenon i.e. Italy is seeing the country enter lockdown while China is looking to slowly relax conditions.

1 BHP Group (BHP) $35.19

The performance of BHP, like the rest of the resources, is very correlated to the health of the Chinese economic engine, it simply needs the world’s second largest economy to drive up demand and prices of the resources its selling. We believe China is commencing a huge stimulus program to kick start its economy which should assist the old ”Big Australian” – the iron price remains strong implying this cash cow will continue to deliver, BHP is trading ex-dividend 65c fully franked in a few days’ time putting it on an attractive 5.5% yield before franking.

MM likes BHP into weakness with the $34 area an initial technical target.

NB Our outlook is similar for other large cap resource stocks.

BHP Group (BHP) Chart

Iron Ore Chart

2 Qube Logistics (QUB) $3.01

The movement of freight is influenced heavily by broader economic conditions of which China is a major driver and Qube Logistic has unsurprisingly had a tough week, it’s now trading down ~20% from recent highs. They recently reported 1H results and while they met 1H numbers they poured cold water on full year guidance, saying that because of the prevailing market conditions they could see a reduction in volumes and therefore earnings in the 2nd half.

Identifying stocks that will be remain solid in the longer term despite short term headwinds was the premise of this report, and QUB fits that bill.

MM is bullish QUB ~$2.80

Qube Logistics (QUB) chart

3 a2 Milk (A2M) $15.75

A2 Milk again delivered with its profit report this week showing well over 20% net profit growth aided by an impressive 31.6% lift in revenue. MM remains very optimistic Australian and NZ food products being sold in China; we are perceived as clean / healthy regions which is exactly what the growing Chinese middle class crave.

MM remains bullish A2M with entry levels the only tricky issue.

A2 Milk (A2M) Chart

4 Treasury Wines (TWE) $11.29

TWE has been struggling with both China and US sales and the selling pressure didn’t subside following an update to its FY 2020 guidance – not surprisingly their sales have been significantly impacted in China this month however there are also a number of other short term ssues at play. There have been some rumblings about TWE becoming a take-over target and at this stage this is the only way we can see outperformance in 2020.

MM is in no hurry to buy TWE.

Treasury Wines (TWE) Chart

5 Star Entertainment Group (SGR) $3.71

We have 2 large concerns with this Australian casino operator, especially in the short term:

1 - The Chinese gamblers are unlikely to be pouring through its doors anytime soon.

2 – The growing swell of ethical funds are likely to give the stock a wide berth.

MM is bearish SGR anticipating the next 10-15% is still down.

Star Entertainment Group (SGR) Chart

Conclusion

MM believes China will aggressively stimulate its economy and probably continue to support its share market making us net positive Chinese stocks.

On the domestic front we like BHP, QUB & A2M into weakness, are neutral TWE but are bearish SGR.

Overnight Market Matters Wrap

- Global growth concerns remain as investors see the threat of the coronavirus to evolve to be a global pandemic, helping the 3 key US indices to lose over 4.4% in a session.

- Airline, technology, energy and material stocks were among the hardest hit sectors. European markets fared little better, dropping around 3.5%. Bond yields once again hit record low levels, as investors rushed to defensive assets, with US ten-year bonds at one stage below 1.25% before easing back to 1.30%. It was a night of record levels for the bond market, with US 30-year treasuries hitting 1.77% and Australian 10 years at 0.85%.

- Commodities and metals were weak with BHP expected to underperform the broader market, after ending its US session off an equivalent of -3% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 extend its decline and open 169 points lower, testing the 6490 level this morning.

Brace for another difficult day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.