Another 4 stocks we are watching carefully in the current choppy market (SUN, MIN, IRE, QAN)

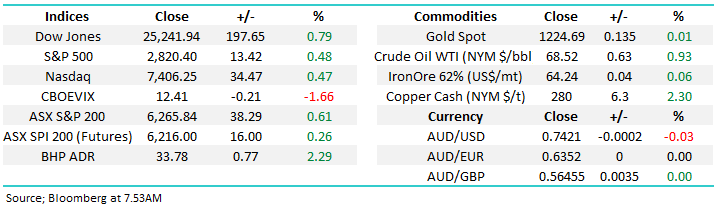

The ASX200 enjoyed a solid recovery yesterday, regaining around 60% of Mondays losses with strength across all sectors, even the “yield play” area held up which was pretty impressive considering the strong gains by US bond yields the prior session. After a month of choppy price action the ASX200 sits up less than 1% with Telco’s and Healthcare the best performing sectors, not 2 groups of stocks that have been in the winner’s circle together often over recent years.

The low volumes were again very noticeable in both stocks and derivatives, the September SPI futures traded in an extremely tight range for virtually all of the day with the discount that we discussed in yesterday’s report hovering around 55-points, mid-range of the last few months i.e. indicating a neutral market.

- Short-term MM remains neutral the ASX200 with a close below 6140 required to switch us to a more bearish stance, however we remain in net “sell but patient mode”.

Overnight stocks were again a mixed bag with the US up around +0.3% while Europe surged closer to 1% plus a solid advance in the likes of oil and copper has BHP set to open up over 2%. The futures are calling the ASX200 to open up around 15-points higher today which feels a touch light considering overnight leads.

Today’s report is going to focus on 4 more stocks we are watching carefully, from both a buy and sell perspective.

ASX200 Chart

Yesterday MM sent out a buy alert on 2 stocks, while neither was unfortunately filled these orders will remain in the market until we instruct otherwise:

- CIMIC (CIM) $47.60 - MM is allocating 3% of the Growth Portfolio into CIM below $47.

- Healthscope (HSO) $2.25 – MM is allocating 3% of the Growth Portfolio into HSO around $2.20 – we will increase the limit on this order to be at $2.25 or better today

CIMIC Group (CIM) Chart

Healthscope (HSO) Chart

As I combed through the stocks in the ASX200 last night another 4 jumped out at me as we constantly evaluate this late cycle bull market.

1 Suncorp (SUN) $15.02

MM has held a large position in SUN for over 3-years and its slowly but surely approaching our $15.5-$16 target area. However we have been watching SUN closely for an important second reason - SUN has been following our technical roadmap very well since the market pullback in 2015/6 and assuming this is maintained a break to our targeted sell area will ring alarm bells for the position of the overall market i.e. 3-4% higher.

Insurance stocks enjoy higher bond rates as they hold their collected premiums in bonds to pay out on any eventual claims, hence the slow but steady increase in bond yields has been a tailwind for SUN as has the recent return to favour of the Australian banking sector.

- MM remains a seller of SUN between $15.50 and $16 but will probably scale out of our position into ongoing strength.

Suncorp (SUN) Chart

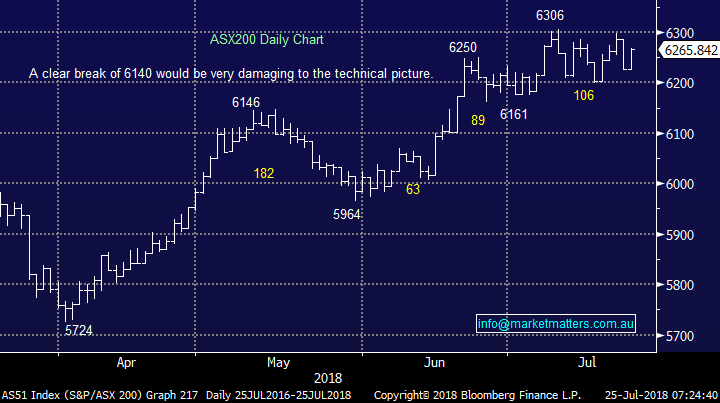

2 Mineral Resources (MIN) $17

After correcting well over 30% in 2018 the mining and mining services business MIN is now looking attractive especially considering where we are in the mining cycle – capex for the mining sector will likely continue to increase in the coming years . In the Morning Meeting today we discussed inflation and the sorts of stocks to be in inflation starts to bite. Commodity companies are certainly a strong hedge against inflation – a topic we’ll build on in coming notes.

The stock is trading on an undemanding valuation of 12.4x 2018 earnings while paying a healthy 3.4% fully franked dividend – meaning it’s about ~11% cheap relative to its 5 year average. Our target is $22.50 while we can run stops below $16, very compelling risk / reward.

- MM likes MIN around the current $17 area.

Mineral Resources (MIN) Chart

3 IRESS Ltd (IRE) $11.74

IRESS is a stock we don’t often mention but its technical position caught my eye last night. The information provider for financial markets has been on a rollercoaster ride over the last 18-months as investors have juggled the impact of its foray into the UK market. IRE has also invested heavily in artificial intelligence (AI) which as we all know is a “hot topic” at present with amazingly 50% of its 1800 staff now working in the area.

Technically we like IRE around $11.74 targeting $13 and potentially beyond, if we are correct the $11 area should not be breached.

- MM likes IRE around $11.74 with stops below $11.

IRESS Ltd (IRE) Chart

4 QANTAS (QAN) $6.72

MM has been watching QAN from a distance for most of 2018 – in hindsight we should have had a speculative dabble.

Our long-term $7 target remains firmly both intact and now close at hand. Although the companies valuation is not scary at 10.35x estimated 2018 earnings we remain on balance negative into further strength.

- Technically MM remains bearish QAN ~$7, or less than 1% away.

QANTAS (QAN) Chart

Conclusion

Of the 4 stocks we looked at today 2 are in the sell basket and 2 the buy:

Buy – we are bullish both MIN and IRE around current levels – we like both of these stocks as they have a low correlation to the ASX200.

Sell – we are sellers of SUN between $15.50 and $16 and negative QAN around $7.

Overseas Indices

The tech-based NASDAQ continues to trade around its all-time high although its slowly starting to under form the broad based S&P500 which now sits less than 2% below its all-time high – ideally we are looking for failure into fresh all-time highs as we’ve alluded to many times in 2018.

Europe continues to try and rally although it’s not been particularly exciting over recent weeks – technically we much prefer European stocks compared to the US in the second half of 2018.

US S&P500 Index Chart

European EUROSTOXX 50 Chart

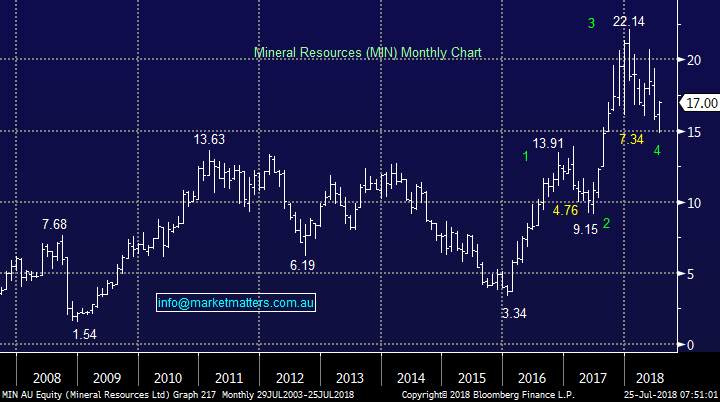

Overnight Market Matters Wrap

· The US majors ended higher overnight, led by the telcos, energy and material sector as US companies continue to post stronger than expected earnings. On the economic data front, US Flash Manufacturing PMI was better than expected.

· We expect the material and energy sector to outperform the broader market as BHP in the US ended its session up an equivalent of 2.29% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 11 points higher, testing the 6280 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here