An Oil Crisis & COVID-19 mix has smashed markets (CBA, CSL, XRO, PDL, MFG)

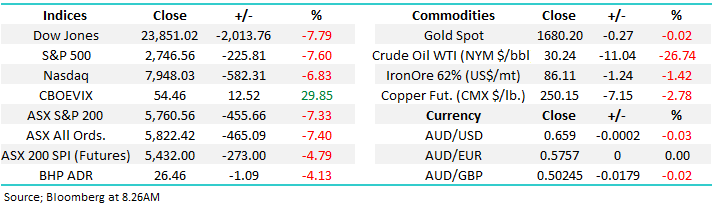

Yesterday the ASX200 endured its worst fall since the GFC and the 2nd largest plunge in 27-years wiping almost $140bn of the ASX in the process, when you combine COVID-19 and an unexpected oil crisis the result was unfortunately Armageddon for stocks. Only a couple of weeks ago global stocks were making fresh all-time highs, on Monday we closed almost 20% lower in what can be best described as a tsunami of selling. Obviously the Energy sector was the focal point of the flight from equities closing down 20% but only 3 stocks in the ASX200 managed to close up while we saw 60 companies decline by 10% or more in an emphatic win for the bears.

At MM we were looking for a low on Monday when only the coronavirus was on the menu but once we saw crude oil plunge by over 25% it was always going to be a very different scenario, although I still thought down 5% in the morning was too rich, I got that totally wrong as we finished the day battered and bruised down a whopping 455-points / 7.3%. Just after lunchtime the US&P500 futures found themselves locked limit down -4.8% meaning any selling of equities had to be targeted elsewhere and we certainly coped some of the attention.

Unfortunately we have clearly been wrong with our expectation of a market bounce to give us the opportunity to position more defensively, the new oil shock has blindsided our view that the market impact from COVID-19 was rapidly approaching its conclusion as it had in China and South Korea. The public sentiment towards coronavirus may have scuppered our view anyway but Saudi and Russia certainly have, importantly we must again reconsider and look forward:

1 – Human behavioural science tells us that we are prone to reacting in the worst ways possible in times of stress hence after a huge +20% shock to equities we are reticent to throw our hands in the air and sell. They say if you are going to panic, panic early and we have clearly not done that which is hurting us across our portfolios at present.

Things will wash through but how long it takes is clearly hard to predict, as have been recent events. We recommend not panicking but ensuring portfolios are solid, containing companies with solid investment fundamentals i.e. invest to sleep, or at least, sleep better. We have been in this position before and although the characteristics of each sell-off is different, they all have one common denominator, the market tends to underestimate our ability to adapt and move beyond the crisis. This is the time to add quality businesses to a portfolio - what feels wrong is often correct with markets.

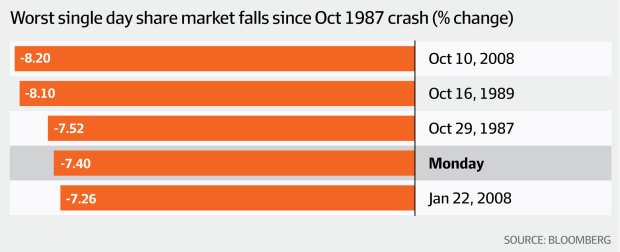

2 – Debt is arguably the new largest / fresh concern for equities and the reason we sold both Boral (BLD) and Pact Group (PGH) yesterday, credit markets are tightening rapidly led by the Energy sector which makes up ~11% of the high debt market i.e. this is a highly leveraged sector. Borrowing money will become harder, central banks will undoubtedly try and alleviate this major issue but “if in doubt keep out” we believe investors should steer well away from stocks that need $$ moving forward.

A bear market is quantified by some when a market falls by 20% over a few months, I wonder what these people call it over just a few weeks! Russia and Saudi Arabia have almost simultaneously thrown their toys out of the cot showing their total disregard for global stability in the process. I find it amazing that 2 countries can act like this in the middle of an unprecedented international pandemic, I guess it clearly illustrates the characters of the respective parties. Some of the higher cost producers with unstable financial positions like Venezuela may be facing major credit issues – if they cannot balance the books their people will unfortunately be the ultimate losers.

Remember fear usually has a different appearance to greed, the later builds slowly over time but fear is more powerful as we have witnessed over the last fortnight, it usually manifests itself in a more aggressive and sharper manner. We already have plenty of blood on the streets and headlines in the press, I don’t want to sound eternally optimistic but after falling over 20% in such a short period of time and looking destined to hit 2018 / 2019 support illustrated below I am reticent to be aggressively pushing the sell button, but we must acknowledge the downside momentum is huge – I believe that’s why central banks are sitting on their hands for now, the last thing they want to do is press further stimulus button without being able to at least reinstate some order to financial markets.

Today we have attempted to add some calming logic to the recent panic while importantly guiding to how we want to be positioned.

ASX200 Chart

I can imagine some subscribers are wondering why equities get hammered when the oil price collapses, after all the Energy Sector is well under 5% of the ASX200 plus a number of other companies benefit from lower prices hence why all the panic? The main issues is investors believe that the crude oil stoush within OPEC will tighten up bond markets / credit pushing the whole economy into recession i.e. if you cannot borrow it’s hard to do business - we already know many people believe that COVID-19 will push us into a recession, this is like 10 nails in the coffin all at once.

Investors are now pricing in a recession due to the combination of COVID-19 and the current “Oil Shock”.

The S&P500 and crude oil have been strongly positively correlated over recent years sending warning shots to many fund managers and traders alike i.e. if oil crisis continues or deepens stocks may go lower still, the chart below suggests another 10% is not out of the question.

Crude Oil v S&P500 Chart

A snapshot of Global Markets

US stocks were clobbered overnight, with the Dow trading down over 2000-points by the close after hitting the circuit breakers early on which pause the market for 15 mins it’s down 7%.

The chart below illustrates the current correction by the tech based NASDAQ is very similar to that in 2018.

MM believes accumulating quality US tech names after this 18% correction makes sense.

US NASDAQ Index Chart

MM still believes we are approaching a major inflection point for bond yields but while stocks panic and COVID-19 / Crude Oil dominates the news the current bear trend for yields could easily have still further to unfold. Bonds are now priced for a recession with US paper dipping below 0.5% overnight, significantly below the Fed Funds Rate illustrating where markets believe interest rates are headed – much lower!

MM is still expecting bond yields to bottom during this current market turmoil.

US 10-year Bond yields Chart

Concerns around debt has now become a clear issue in the market. Unprofitable US shale energy companies hold a significant amount of debt which has just become a lot more expensive as credit spreads have blown out.

The below move tracks the price of the iShares High Yield ETF which has declined ~10%

iShares High Yield ETF Chart

3 quality stocks we like medium-term into the current market panic.

Ideally, we would have liked to be buying stocks into this weakness from higher cash reserves in our Growth Portfolio, however in our view that ship has now sailed. Yesterday we added to our holdings in Bingo (BIN), BHP Group (BHP) and Macquarie Bank (MQG) in our Growth Portfolio as they tumbled lower while selling Pact Group (PGH) and Boral (BLD) to fund the purchases – as we said yesterday tightening our portfolio in the process, simply lightening our exposure to companies carrying debt.

This realigning of our Portfolios away from debt is likely to remain a focus in the coming week – we want to own stocks which don’t have us feeling uncomfortable in these turbulent times and beyond. We are currently considering additional holdings in the MM Growth Portfolio which could be sold to move “up the quality” curve i.e. Emeco Holdings (EHL) and Costa Group (CGC), which both have reasonably high net debt positions.

The rationale being:

- Reduce balance sheet risk if credit markets deteriorate further

- Improve the quality of our holdings

- Position for a bounce when it arrives

The 3 stocks we are considering adding to our portfolio are solid businesses which have been dragged lower by the plunging market – quality businesses are on sale as well as companies facing an uphill battle moving forward.

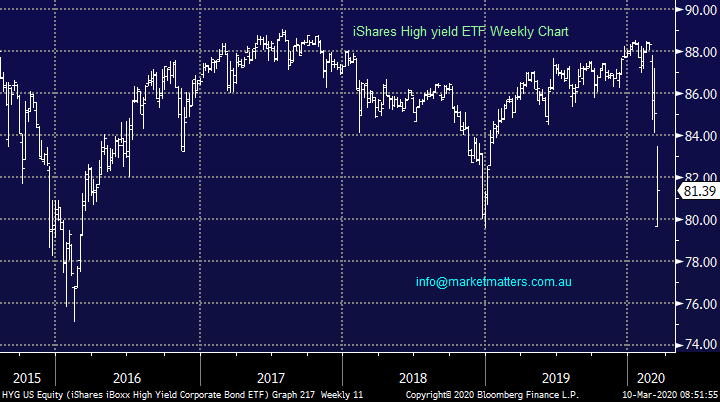

1 Commonwealth Bank (CBA) $69.15

CBA has already fallen 24% from its 2020 high although it has paid a healthy dividend along the way.

MM likes CBA into current weakness.

Commonwealth Bank (CBA) Chart

2 CSL Ltd (CSL) $295.96

CSL has corrected 13% from its 2020 high, not as much as many but we believe value now is starting to emerge in the quality stock.

MM likes CSL into current weakness.

CSL Ltd (CSL) Chart

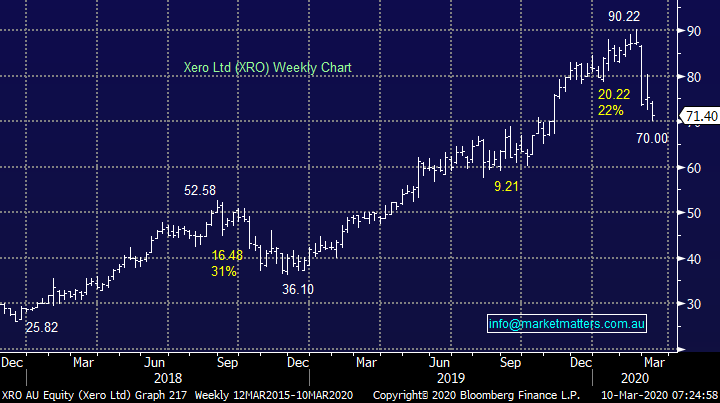

3 Xero (XRO) $71.40

XRO is our “token consideration” for the growth sector but sub $70 it looks great especially considering the current position of the highly correlated tech based US NASDAQ.

MM likes XRO into current sell-off.

Xero (XRO) Chart

Lastly we are considering switching from Pendal (PDL) to Magellan (MFG) as the latter is a higher quality business, in our opinion, which has started to get sold off to the same degree as PDL – another example of what stock MM believes will outperform in years to come.

Magellan (MFG) v Pendal Group (PDL) Chart

Conclusion

MM believes investors should be moving further up the “quality curve” as the combination of COVID-19 and the fresh Oil shock / increasing debt concerns has us wanting to hold stocks we feel will be on a solid footing in years to come.

Potential Sells: Emeco Holdings (EHL) and Costa Group (CGC).

NB The goal posts have clearly moved over the last 48-hours changing our view on a number of stocks.

Potential Buys: Commonwealth Bank (CBA) / CSL Ltd (CSL) or Xero (XRO).

Lastly we are also considering switching from PDL to MFG.

Watch for alerts.

Overnight Market Matters Wrap

- The global selloff continued and accelerated overnight in the US, with the Dow and broader S&P 500 plunging ~7.60% , its worse day since the GFC with all but 9 of the S&P 500 companies were in the red.

- Concerns remain with the ever mounting coronavirus and crude Oil losing 24.59%, its most since 1991, while the VIX (Volatility / Fear Index) rose as high as 62.12, the second highest before the GFC peak of 89.53.

- The March SPI Futures is indicating the ASX 200 drop another 325 points, testing the 5435 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.