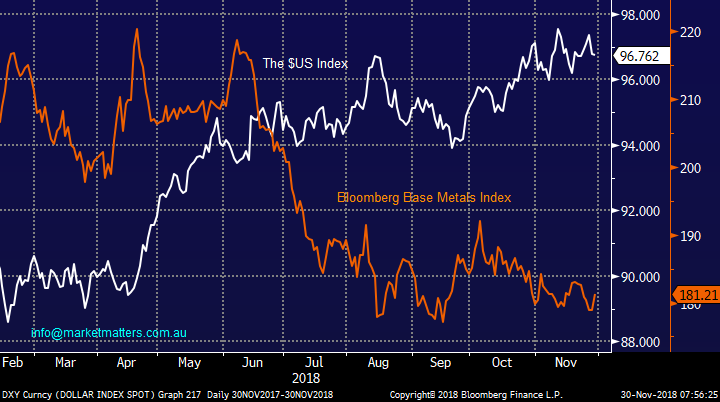

A weaker $US looks to be on the cards (SUN, QBE)

**Technical issues yesterday has resulted in some subscribers not receiving the afternoon report - click here to read**

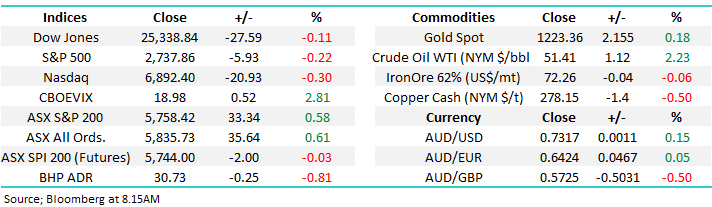

The ASX200 was up a solid 33-points yesterday which usually would be regarded as a good performance but after watching the Dow surge up over 600-points into the close the majority of us expected more. Unfortunately, it was not to be a day of celebration in Asia with much of the region struggling led by China which closed down over 1% as concerns around an escalating US – China trade war took centre stage.

Under the hood on the ASX the Banking and IT sectors remained firm while the resources enjoyed a much-needed bounce. What comes next looks likely to hinge on a much-awaited dinner between US President Donald Trump and China’s Xi Jinping! Hopefully a deal can be etched out as they share an Empanada or two washed down with bold Argentinian Malbec!

At about 5am this morning President Trump actually hinted at a China trade deal ahead of the G20 when he said he was very close to “doing something” with China but this came on the same day he also cancelled a meeting with Russia’s President Putin and his former lawyer Michael Cohen pleaded guilty to lying to Congress about work he did on an aborted project to build a Trump Tower in Russia – the Presidents juggling more balls than a circus clown!

As we commence the last day of a choppy November it may surprise many to know that we start the day only down -1.2% for the month, an okay performance considering the average of the last decade is -1.8% primarily due to a number of large cap stocks trade ex-dividend including ANZ, NAB and Westpac. If MM is correct and December is a strong month we must remember the top of the traditional “Christmas rally” is usually in the last 48-hours of the month.

MM remains bullish the ASX200 short-term targeting a “Christmas rally” towards the 5900-6000 area.

Overnight US / Europe were choppy but both closed with little change, the SPI futures are pointing to the ASX200 falling ~10-points early not helped by BHP Billiton (ASX: BHP) which slipped 0.8% in the US.

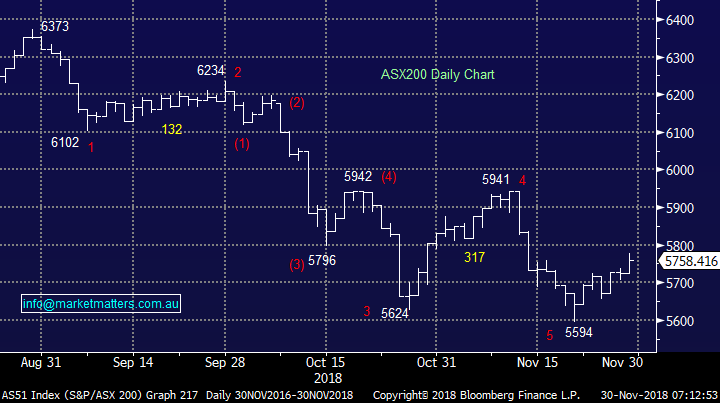

Today’s report is going to revisit or thoughts around a weaker $US following Fed Chair Jerome Powell’s dovish speech yesterday i.e. he implied US interest rates may not rally as fast as previously thought which is fundamentally bearish for the $US.

ASX200 Chart

The falls in Asia yesterday showed how nervous markets have become around escalating trade tensions between the 2 economic superpowers just when investors are concerned about a potential recession in the US in 2019 /2020.

As we touched on Thursday morning (AEST), Fed Chair Jerome Powell was far more dovish than expected in his latest speech suggesting the rate of increase of US interest rates will moderate from its current rapid ascent – a clear indication he is seeing some chinks in the US economic armour.

As Buenos Aries goes into almost lockdown this weekend for the G20 meeting, hurting local small business in its wake, its clues around the future for US – China trade that most commentators will be scrutinizing. Two of the main beneficiaries from a positive outcome should be the Emerging Markets and Australian Resources Sector and we will look at both later.

Remember we are looking to exit our iShares Emerging Markets ETF (IEM) position around 4-5% higher using the proceeds to increase our resources exposure.

iShares Emerging Markets ETF (EEM) Chart

A weaker $US and its implications

As we know the $US was sold off aggressively following Jerome Powell’s dovish speech which also sent US bond yields lower and the Dow soaring over 600-points. The $A is back well above 73c and we can see this current bounce comfortably reaching the 74-75c region.

MM has been bearish the $US for a few weeks, a view we believe has supported our bullish short-term outlook for global stocks. This certainly felt correct yesterday although for this opinion to fully unfold its likely “that dinner” will need to finish amicably – from what I read Trump almost lives on McDonalds which may be an initial stumbling block!

Interestingly yesterday even though Jerome Powell implied interest rates may not rise as fast as many feared the obvious stocks to benefit actually fell i.e. the “yield play” group such as the Utilities and Transurban (ASX: TCL) – the reaction was initially more of a “risk on” & “sell defensives” as opposed to focusing into what lower rates / $US means for companies.

The $US Dollar Index Chart

The $US has been one of our good calls of 2018 and we believe Jerome Powell has helped clarify the picture further – we are now bearish the $US targeting a minimum ~3% decline in the short-term i.e. back to its late September lows. Initially this suggests:

The $US received a “safe haven” bid when stocks tumbled in October, a weaker $US implies equities will recover, or at least not fall aggressively, into 2019.

Over recent weeks economists had been questioning if the Fed can / will tighten rates once in December and 4 times in 2019, as they had previously targeted, it now appears they won’t. Assuming they are forced to take their foot off the gas it should be negative for the $US and the subsequent implications are important from an investment perspective:

Theoretically the following 3 correlations should play out if / when the $US pulls back:

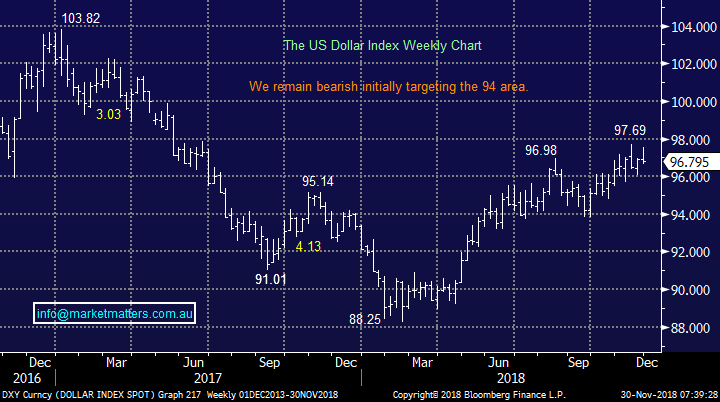

1 $US v Base Metals

If the $US Index corrects it should be good news for our resources holdings as the Bloomberg Base Metals Index is inversely correlated to the $US – doesn’t feel right just yet but we are watching very closely.

RIO which we hold is still 15% below its 2018 high and noticeably underperforming the ASX200.

MM has been watching a few stocks with a view to increasing our resources exposure but the prices have not felt compelling so far.

$US Index v Base Metals Chart

2 $US v Gold

If the $US Index corrects it should be good news for our Newcrest Mining (ASX: NCM) position as gold is inversely correlated to the $US – our current target for NCM is ~$21.80, around 5% higher.

Seasonally December is usually a good time for NCM with an average gain of +3.7% over the last decade, not far off our target.

We are mildly bullish golds / NCM into 2019.

$US Index v Gold Chart

3 $US v Emerging Markets

If the $US Index corrects it should be good news for the Emerging Markets (EEM) which are inversely correlated to the $US and especially so in 2018 due to the escalation of fears around serviceability of EEM debt domiciled in $US. This correlation makes both technical and fundamental sense to MM and at this stage we are very comfortable with our IEM ETF position.

We are bullish Emerging Markets into 2019.

$US Index v Emerging Markets Chart

This is good news for our portfolios but it’s rare that there’s not a “but” in the scenario, in this case for us it’s the insurance stocks and in particular Suncorp (ASX: SUN) which we hold in both our Platinum and Income Portfolio’s plus QBE Insurance (ASX: QBE) which has been in our Growth Portfolio since late 2016 - QBE is showing a decent profit unlike many investors foray into the stock but we are now watching carefully.

The insurance sectors revenue is largely assisted by monies sitting in fixed interest i.e. they prefer higher interest rates so when bond yields fall it’s not a bed of roses for the likes of SUN and QBE both of whom slipped lower yesterday. We question if there’s now a better place for these funds.

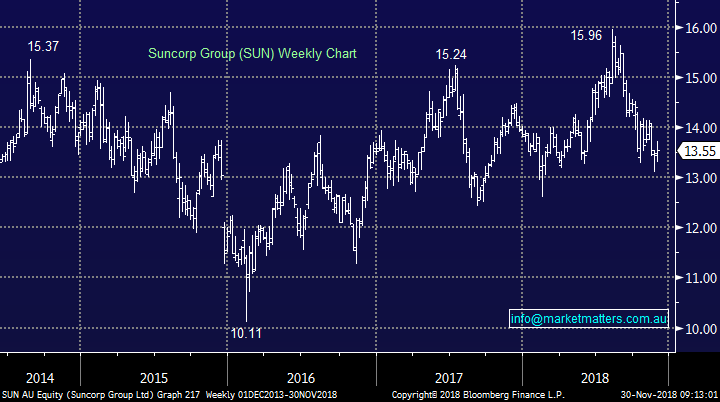

Suncorp (ASX: SUN) $13.55

For a long time SUN was our largest holding in the Growth Portfolio but after trimming our position into recent strength which took the stock close to $16 we now only hold a 4% allocation.

Technically SUN fits our overall market view – short-term bullish targeting over $14 but then bearish targeting a test of $10.

MM is looking to sell our SUN position ideally above $14 into a Christmas rally.

Suncorp (ASX: SUN) Chart

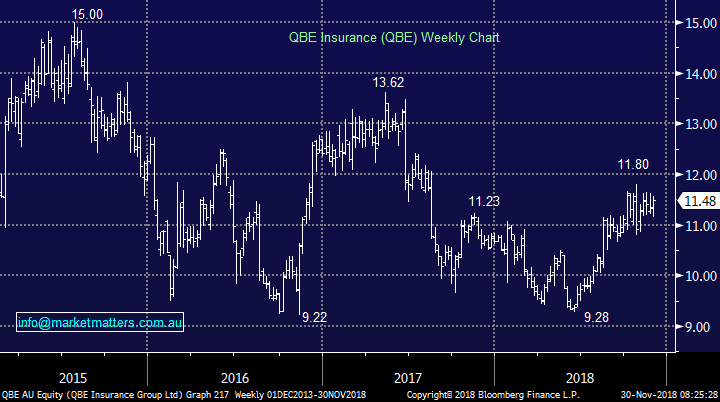

QBE Insurance (ASX: QBE) $11.48

MM holds a 4% allocation to QBE in our Growth Portfolio. Unfortunately QBE also has significant revenue in $US plus a large ’float’ exposed to US fixed interest holdings hence a lower $US compounds the damage of a delay in rising interest rates.

Technically QBE is neutral medium-term.

MM is looking to sell our QBE at an opportune time, it’s another potential funding vehicle if / when we increase our exposure to the resources sector.

QBE Insurance (ASX: QBE) Chart

Conclusion

We remain bearish the $US into 2019.

The insurance sector is not looking as exciting as it did a few months ago and MM can see ourselves lighten this exposure in the coming weeks.

Overseas Indices

The US S&P500 has now satisfied our downside bearish targets switching us to neutral / bullish with an ideal initial target ~2850, or 4% higher.

US S&P500 Chart

European indices remain neutral with the German DAX hitting our target area which has been in play since January.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets closed marginally lower in the final 15 minutes of trade overnight as minutes from the recent US Fed meeting disclosed officials are more tentative about the pace of rate rises.

· All eyes will be on the G-20 summit over the weekend as investors wait for an update with the current US-China trade talks.

· BHP is expected to underperform the broader market today after ending its US session down an equivalent of -0.81% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 20 points lower towards the 5740 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.