A mixture of reports & questions (BHP, HSO, APT, MIN, ECX, ANN, BPT, PDL, WSA)

BHP Result; I’m about to jump on the BHP conference call however first thoughts;

On first glance the numbers look OK;

· NPAT – Headline $8.933bn vs. street at $9.18bn

· Looks like a $333m impairment in result … if adjusted for this result it would be about inline

· Dividend – US$1.18 vs. street $1.16, so a good number however there were a few outliers on the top side. Shaw was at $1.27 and UBS at $1.30

· No specific detail on capital management other than in a foot note saying that the $10.8b received from Shale will flow through to shareholders once the transaction completes.

Healthscope Result - The numbers look good;

· EBITDA coming in at the top end of company guidance set in May

· Guidance of +10% growth in FY19 maintained

· The market was concerned that the new Northern Beaches hospital would be a drag – it hasn’t

· Spin out of property assets a positive

The ASX200 was extremely quiet yesterday, trading in less than a 20-point range and finally closing up just over 5-points. For a slight change to the recent role play the banks were the main drag on the market while the heavyweight energy plays rallied strongly i.e. Woodside (WPL) +2% and BHP Billiton (BHP) +1.3%.

Locally we are enjoying a net positive reporting season which is clearly helping the ASX200 make fresh decade highs currently up +4.6% for the year, a pretty good effort considering the panic that hit stocks in January / February. All eyes will be on BHP today which reports at 830am.

· We are neutral the ASX200 while the index holds above 6240 but we remain in “sell mode” albeit in a patient manner.

Overseas markets were quiet like our own with the US S&P500 gaining +0.24% but the SPI futures are pointing to a slight fall but the BHP result is likely to change that one way, or another.

Today’s report will be larger than usual being split in 2 halves:

1. We are going to provide a brief opinion on 5 stocks that caught our eye yesterday.

2. We are going to answer 7 questions that were outside our coverage yesterday of our bigger picture views

ASX200 Chart

1 The 5 stocks that caught MM’s eye yesterday.

Winners

Happily, MM owns 2 of the 3 across our MM Platinum and Income Portfolio’s.

1 Afterpay Touch Group (APT) $17.50

Yesterday APT rallied another +5.4% to fresh all-time highs. This has proven to be a great Australian success story, a company that has disrupted the payments space here (and now overseas) in a few short years. While it’s hard to be negative with such an obvious positive trend, we do question whether this is rapidly becoming a “GARP” play – Growth at any price, although perhaps the foundation of that view stems from us not owning it!

We could not chase APT at current prices but we have to admit it’s a stock we have clearly underestimated in 2018.

· MM is neutral APT here but we can easily see a 15-20% fall from current levels.

Afterpay Touch Group (APT) Chart

2 Eclipx Group (ECX) $2.49

ECX bounced strongly yesterday gaining over 16% after confirming an approach from its main competitor SG Fleet (SGF). The highly conditional bid equates to ~$2.55, this feels like an opportunistic approach following ECX’s recent troubles. We remain keen on ECX despite its recent woes taking a similar view on its relative value that SGF does, our only concern with the position was our inability to average down into weakness given the Income Portfolio was low on cash.

· We remain keen on EC, expecting resistance from the ECX board to the takeover which may ultimately lead to a higher bid

Eclipx Group (ECX) Chart

3 Mineral Resources (MIN) $14.80

MIN bounced +4.2% yesterday after releasing more information around the business in a “presentation pack” than it did within its results last week – as we say markets hate uncertainty, what were management thinking!

MIN is trading on a relatively cheap P/E of 10.4x Est 2019 earnings while yielding 3.9% fully franked. We took our medicine on ORE last week so we could give the correlated MIN more space and so far, this feels correct.

· MM remains mildly optimistic MIN

Mineral Resources (MIN) Chart

Losers

Fortunately, MM owns neither of these two.

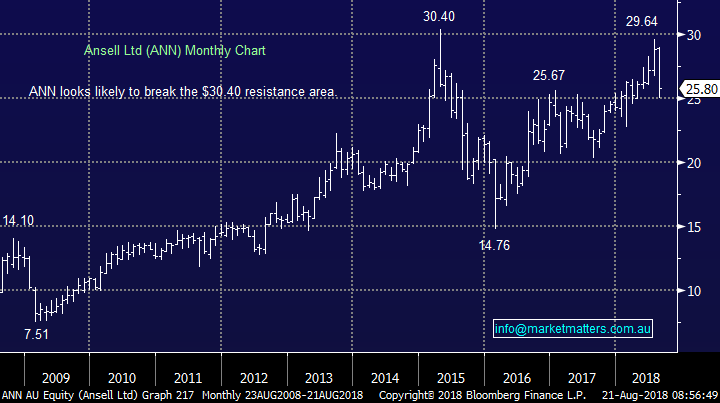

1 Ansell Ltd (ANN) $25.80

Health & Safety product provider ANN tumbled -7.2% following a report on the slightly messy side with concerns raised around rubber prices plus a potential USD-China trade war and subsequent tariffs.

It will be interesting to see if the trend of reporting season follow through, both up and down, impacts ANN today.

ANN trades on an Est P/E of 17.8x while yielding 2.4% grossed up.

· MM is now neutral just here.

Ansell Ltd (ANN) Chart

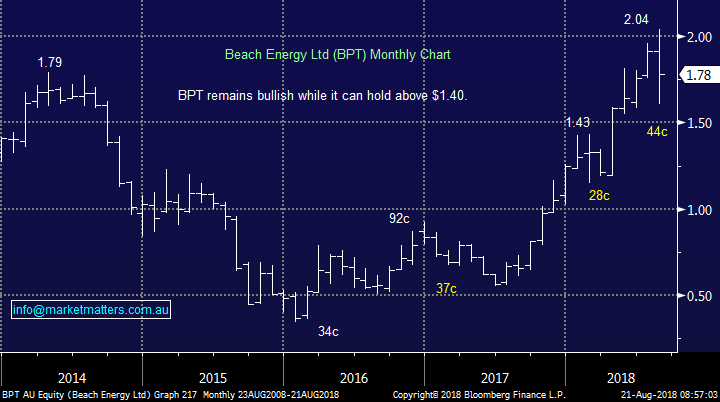

2 Beach Energy Ltd (BPT) $1.78

BPT feel almost 5% yesterday as their results feel a little short of expectations. The company delivered a NPAT (net profit after tax) of $302m while the market was looking for $307m.

BPT is trading on a cheap Est P/E for 2019 of 8.9x while yielding 1.6% grossed up.

· MM likes BPT while it can hold above $1.40.

Beach Energy Ltd (BPT) Chart

7 quick questions delayed from Monday.

We’ve obviously touched a nerve with our reports on corrections but we do appreciate all feedback flattering or not!

Question 1

“Good afternoon James and MM team, firstly – great call on NCK prior to release of full year results, I got in the session before at $6 now turned out to be an excellent trade both terms of capital gains and the looming $0.24 (fully franked) dividend in early October. Secondly – as MM always say addressing losers is just as important as mentioning winners which bring my question on MIN which your position is underwater (even if you include the $0.40 fully franked dividend looming). What’s MM view on this current position and if the stock continues to linger around this $14 level, would MM consider averaging down prior to AGM when forward guidance will be provided.” - Thanks & regards, Tianlei J.

Hi Tianlei,

Obviously, we have touched on MIN earlier in today’s report but I would make 2 quick points here:

1. We very rarely average positions at MM unless that was the plan at the beginning of the investment.

2. I reiterate one of the reasons we cut our ORE position was to give the preferred MIN position more room i.e. invest / trade to sleep well.

3. We manage a portfolio, and make calls in the context of a portfolio rather than making calls on individual positions in isolation

Question 2

“Hi James, thanks yet again for all your help. Could you please shed some light on the future of the trade war and how that affects the resources and other export sectors. (This might be a good opportunity for a directional follow up with Peter O’Connor.). Many of us have no experience with an instant trade war and what this is likely to achieve for the USA economy, hence it appears to be having a much greater effect (on growth stocks) than what we first imagined.

You might have access to historic and present numeric values which could allow a comparison and hence be of assistance to us in understanding the bigger picture. (For example, the reduction in Nickel price sees it sit on the verge of breaking below its 12-month positive trend line, and has surprised us.) For Australia, whilst the value of some commodities has fallen, so too has the AUD value and in the longer term that should make our exports more competitive.” – Thanks Phil B.

Hi Phil,

Clearly a large question and beyond the scope of today’s report but I will tap “Rocky” on the shoulder when the dust settles after reporting season for another interview.

However, a quick comment on nickel, we have been looking for this pullback hence our extremely small exposure to the resources sector, we are considering nickel stocks into this current pullback e.g. western Area (WSA) and Independence Group (IGO).

Nickel Chart

Question 3

“As a new entry into the investment market, thank you to MM, it has been extremely educational and beneficial, well worth the investment. If possible, I would like your thoughts on the two shares recently added to your portfolio, (HSO and MIN), both have dropped significantly since, ~5% and ~18% respectively, at time of writing. Where do you see the price target being for these and in what timeframe? Secondly, I am happy with my overall portfolio at present, however my one concern is PDL, which I bought on emotion rather that data. Can you please advise your thoughts on PDL and where you see it in the mid-term, or should I 'take my medicine' at ~-8%?” - Thanks again. Glenn J.

Hi Glenn,

Welcome on board and thanks for the question (s):

1. Healthscope (HSO) – reports today but we are ultimately looking for the $2.75 region all things being equal, perhaps with a revised takeover in 2018/9.

2. Mineral Resources (MIN) – discussed earlier, if the stock can get itself back above $16.50 technically we expect over $20 while fundamentally we are also keen, post reporting this is likely to take many months unless lithium has a resurgence.

As for PDL we put it in a similar basket to our own holding in Janus Henderson (JHG). We believe that the fund managers are the cheapest market sector and not a sell here

Pendal Group (PDL) Chart

Question 4

"Sir, In the current market there are a few high flyers that are volatile but basically keep rising.

I am referring to stocks such as A1X, CTD, NXT, WEB and others. Is your policy to hold onto stocks such as these and hope that will keep rising or at least hold their value, or to take the profits? The dividend of most of these types of stocks is irrelevant.” - With thanks Richard R.

Morning Richard,

At this stage of the market cycle we believe it’s certainly time to take some $$ off the table from the high growth / valuation stocks although they clearly remain strong.

We have taken profit in Webjet (WEB) and half of our A2 Milk (A2M) leaving the second half of our A2M position our main exposure to this group of stocks.

Question 5

“Happy Sunday James and Team, the market seems to be doing really well since the Trump victory in particular, before that our ASX200 ranged between 4900 and 5400 briefly getting close to 6000 in the period of 2014 and 2016. I keep on hearing about a correction and not just from you guys over the last 12 months but from other experts.

Keep in mind 1 thing please, Peter Lynch averaged 29% over a 13-year period at Fidelity which included the major crash of 1987 and from memory in that period he saw 3 corrections yet he was always fully invested. One great point in his book was "time in the market as opposed to timing the market". So thankfully I have Peter Lynch's model and have managed to double my portfolio value in the last 12 months. Good luck all and enjoy the rest of your weekend.” - Frank M

Hi Frank,

A very fair point but why not add some value / alpha if and when you can. As you know we went to ~50% cash before the market fell 20% in 2015/6 enabling us to improve performance significantly.

We clearly agree in part with Peter Lynch’s model otherwise we would move to 100% cash when we felt markets were due a correction.

· As active investors we do believe in adding value through both sector rotation and increasing / decreasing our cash position.

Let’s see how we travel over 2018/9.

Question 6

‘Hi James, you're right about the broken record for the correction. Although I don't mind reading your material it's become a bit of a standing joke amongst my friends that do a bit of investing in the share market. We think if you just keep reminding us that there is a correction looming, one day you'll be right. I reckon the market will be at 7000 pts sometime in the future...... how's that for a forecast!!!!!” – Steve S.

Hi Steve, thanks for the feedback – we certainly do take it on board.

In terms of predictions and forecasting, it depends what they are based on. If they have a basis built on research - of time spent developing them, of diligent consideration, then they should be considered / given credibility even if they don’t play out. If on the other hand, predictions are simply thrown around without a foundation of research, of diligence in forming them, then they serve little purpose for anyone, irrespective of whether they eventuate or not.

Of course you’re right, predict a correction and one day it will happen, however what we’re attempting to do our my notes is simply acknowledge that we’re long overdue for one now, as we are, and ensure we’re giving enough weight to that potential outcome while still investing in stocks along the way. Too many simply focus on the upside without enough focus on the downside.

Question 7

“Hi James, reading your weekend report made me smile after reading a quote from "Livewire" today and it is discussing "Is a recession around the corner?". We have a quote "Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves." Peter Lynch. For a year or more you have become fixated on there being a recession sooner rather than later and today using Elliot Wave Theory trying to determine when position 5 is reached. Although I use technical analysis for buying and selling I am not really convinced about EW theory. Personally, I can't see a recession yet especially as the US economy is going gang busters and no sign if significance inflation or unemployment. However, we do usually get a turn down over the next few months but I am not pressing the sell button, it will be a chance to buy.” – Chris B.

Hi Chris,

We agree the likely better action is to buy the next pullback if / when it unfolds but we don’t have an infinite amount of $$, and allocating available funds while maintaining flexibility remains key

Hence to buy at attractive levels we must first indeed press the sell button, to a greater or lesser degree.

I’m glad this subject has garnered so much attention, subscribers are obviously reading and understanding our thoughts although as would be expected they’re not always fully aligned with them!

This sort of discussion reminds us of the attention we received in both 2015 when we aggressively sold strength and in 2016 when we aggressively bought panic!. Remain open minded is the key here.

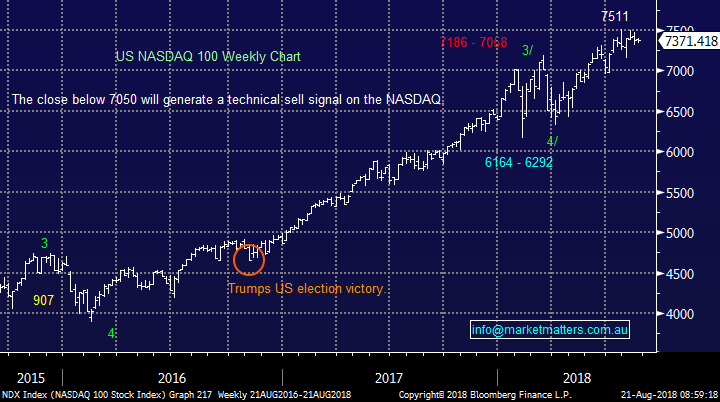

Overseas Indices

No change, the S&P500 still looks destined to make fresh all-time highs in the next few weeks, this has been our preferred scenario for months with the big question “will it fail around 2900?”.

Last nights continued outperformance by the Dow finally suggests it may follow the broader indices higher but interestingly the NASDAQ that led the bull market continues to lag, closing negative.

· MM intends to increase our BBUS short US ETF position into further strength.

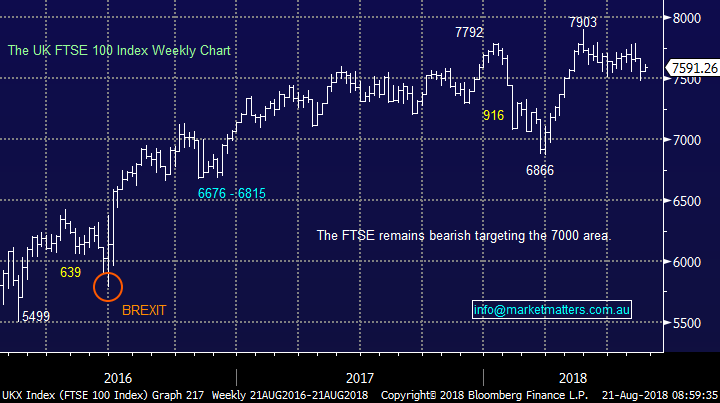

European indices were stronger overnight, perhaps we are witnessing some market rotation.

US NASDAQ Chart

UK FTSE Chart

Overnight Market Matters Wrap

· A mixed session was experienced overnight in the US, with the Dow and broader S&P 500 ending slightly higher, while the tech. heavy Nasdaq 100 closed smalls in the red.

· This week, the US Fed will release minutes from the August policy meeting and the chairman, Jerome Powell, will be speaking on Friday at the Jackson Hole economic symposium.

· Domestically, the focus remains on corporate earnings, with BHP being the main topic today, releasing earnings well below average consensus, however dividend slightly above consensus.

· The September SPI Futures is indicating the ASX 200 to open marginally higher, testing the 6350 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here