A mixed overseas & local report after the ASX roars (NST, RRL, BHP, AAPL US, AMZN US, CSCO US, MSFT US, FB US,

Yesterday the local market soared over 100-points to register the markets highest close since late 2007, a combination of buying in both the financials and resources tends to have that impact on our market! So far this month the ASX200 has rallied 231-points from its low, although it feels like more, however Mays equivalent rally was over 300-points so this is nothing out of the recent norm. Also, the average monthly range for our market in 2019 is currently 281-points suggesting that sellers should be patient until the psychological 6600 area, or in other words the current strong rally is actually typical of 2019.

What the shortened week did also throw up was binary like price action that we have witnessed through much of 2019 with yet another takeover announcement for Vocus (VOC) sending the stock up +8.9% while a downgrade for Star Entertainment (SGR) sent the casino operator tumbling well over 15%, that’s huge performance differential.

MM remains confident that low interest rates combined with cashed up fund mangers is the main driver of equities at this point in time but we think its definitely time to be considering what’s either the next hurdle or bullish catalyst for stocks e.g. inflation raises its head taking rate cuts off the table or on the positive side, the US & China resolve their trade issues – as we always say “remain open-minded”.

Under the hood we again saw strength in most sectors with less than 13% of the market closing in the red while 15 names in the ASX200 closed up by 4%, or more. It felt like there were a lot of over the day orders as fund managers were scrambling for somewhere to allocate their cash reserves as the pain of being underinvested during 2019 intensifies for investors i.e. up 900-points and counting.

However we would add that selling into forced buying does generally turn out well in the end hence we are sticking with our overall view to increase cash levels into current strength – after taking a very healthy profit in ResMed (RMD) to kick off the week we are now holding 15% cash in our Growth Portfolio and under 5% in our Income Portfolio, in other words Market Matters still remains “long” this bull market looking to sell into strength.

Overnight the US indices closed marginally lower after rallying strongly for half the session, the Dow closed 200-points below its intra-day high. The SPI futures are still calling the ASX200 to open up around 15-points this morning courtesy of iron ore which rallied over 3% taking BHP along for the ride, the miner closed up 85c / 2.2% compared to its local close yesterday.

MM believed recent weakness in o/s stocks was a buying opportunity however we are slowly becoming cautious into the current strong rally.

Today we are simply going to look at the best 5 performing stocks in the US searching for any for signs of exhaustion following the Dows almost 1600-point, 7-day rally – short-term after last nights lower close we anticipate at least a few days of consolidation.

ASX200 Chart

As stocks soared higher on Tuesday the only standout area of weakness was the gold sector with Northern Star (NST) and Regis Resources (RRL) both closing down over 4%.

At MM we remain keen buyers of this correction in the precious metal sector e.g. NST under $8, RRL ~$4 and SAR ~$2.50 – all are decent distance lower but when stocks are falling 4-5% a day it doesn’t take long.

Northern Star Resources (NST) Chart

Regis Resources (RRL) Chart

In the last 24-hours iron ore regained its “mojo” with a bang rallying over 3% to make fresh 2019 highs, hence BHP’s surge in the US.

MM remains bullish BHP targeting fresh 2019 highs.

BHP Group (BHP) Chart

The 5 strongest US stocks

Today we have simply evaluated the 5 strongest stocks in the US following the markets excellent recovery over the last week. One things very apparent from the list and it’s this rally is being fuelled by the “big end” of town, the 5 top performers contains Apple, Amazon, Facebook and Microsoft no less.

Our feeling is still that the “cashed up” fund managers need to be squeezed further before the market will become primed for a potential correction i.e. markets don’t fall meaningfully when investors are not very long.

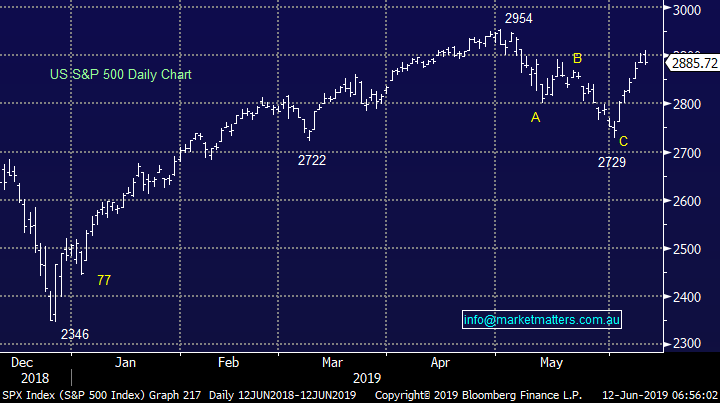

Overall MM remains bullish US stocks targeting the psychological 3000 area, ~4% higher.

US S&P500 Index Chart

1 Apple (AAPL US) $US194.84

Overnight Apple rallied +1.2% and suddenly its regained around half of the recent +20% plunge on fears of deteriorating trade between the US and China. The company’s latest numbers showed they realised US11.58bn profit on $US58bn revenue with services revenue hitting an all-time high although gross margins fell from 38.3% to 37.6% - plus they announced yet another $75bn in share buybacks.

We see deep value in Apple below $US190 with buybacks, large cash balance etc i.e. at this price investors are not paying any premium for growth.

We still acknowledge the current iPhone product cycle is going poorly especially in of course China but the business is looking to allay concerns around life after just selling phones / iPads by increasing its services revenue. Stocks with leverage to China have been sold down aggressively of late but we feel the risk / reward is now attractive with plenty of bad news built into the price.

Technically I can see months of choppy rotation between $US170 & $US210 making the stock neutral at today’s levels.

MM likes Apple below $US190 area.

Apple Inc (AAPL US) Chart

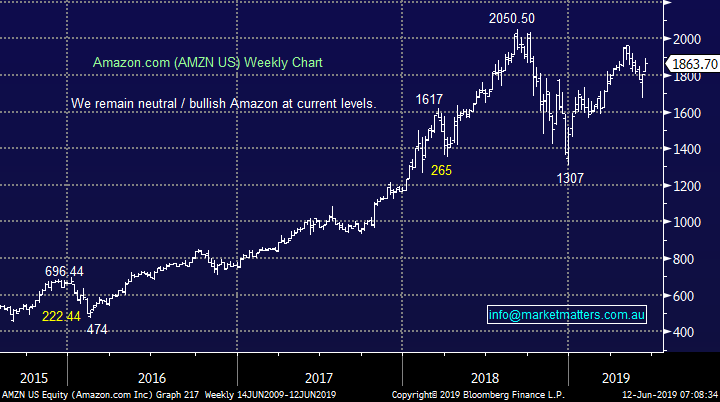

2 Amazon.com (AMZN US) $US183.70.

Overnight Amazon rallied 0.2% as it rapidly shrugs off the rumours around anti-competitive business practices, a classic case of buy the rumour. Recently the on-line retailing goliath produced a huge quarterly profit beat although revenue growth slowed as anticipated.

While we can see Amazon making fresh all-time highs in the coming weeks / months the ”easy money” still appears well behind it. Technically the picture is relatively similar to Apple.

MM is mildly bullish Amazon targeting fresh all-time highs.

Amazon.com (AMZN US) Chart

3 Cisco Systems Inc (CSCO US) $US57.11

This networking giant has made fresh all-time highs this month supported by strong revenue & margins, earnings growth and the usual buybacks. In their 3rd quarter report in May its operating revenue grew by an impressive $US13bn as the company produced another period of double digit earnings growth.

The stocks not too expensive considering its solid proven growth and it reinforces our view that the Australian IT sector is simply too rich on a risk / reward basis compared to its global peers. Technically the stock looks bullish while it can maintain its breakout to fresh all-time highs.

MM is mildly bullish Cisco while it can hold above $US55.

Cisco Systems Inc (CSCO US) Chart

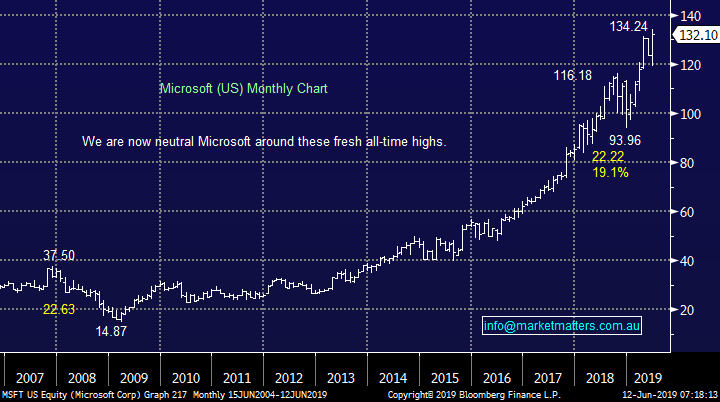

4 Microsoft (MSFT US) $US132.10

Microsoft has also made fresh all-time highs this week to regain its trillion dollar status, very impressive for a business still growing at ~16% pa. While the company is sitting on $50bn in cash and performing healthy stock buybacks we are conscious that the stock has run very hard, not a sell fundamentally but perhaps a dangerous one to chase into strength.

We remain keen buyers into weakness but at this stage of the stock / economic cycle we will be patient for now.

MM likes MSFT as a business but we are neutral around current levels.

Microsoft (MSFT US) Chart

5 Facebook (FB US) $US178.10

Facebook know everything about anybody and they’re using that information to generate advertising dollars. While the power of their platform is undeniable there is almost certainly going to be ongoing concerns around privacy and that remains a worry to us.

Technically we can still see fresh all-time highs by FB but the risk / reward is not too exciting as the stock’s struggled in June compared to the others in today’s group.

MM is neutral / positive Facebook at current levels.

Facebook (FB US) Chart

Conclusion

Of the 5 stocks we looked at today none give us any reason just yet to throw in the towel on the current post GFC bull market.

Global Indices

US stocks finally had a rest after the last weeks strong gains but we still anticipate the market will be higher over the next few weeks.

We still see fresh all-time highs by US stocks in 2019.

US NASDAQ Index Chart

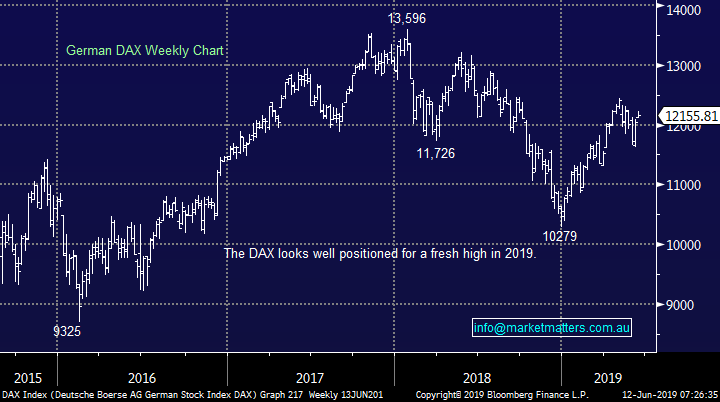

No change with European indices, we remain cautious in this region although we are slowly becoming more optimistic.

German DAX Chart

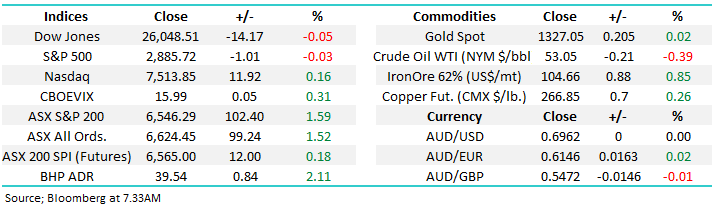

Overnight Market Matters Wrap

· The US had a breather from its recent run, with its respective indices ending mixed with little change.

· Trade talks between US and China, along with anticipation for a Fed interest rate cut, now being the focus for investors.

· Crude oil fell, off 0.39% to US$53.05/bbl. however we expect the resources to outperform the broader market, with BHP ending its US session up an equivalent of 2.11% from Australia’s previous close to $39.54.

· The June SPI Futures is indicating the ASX 200 to continue to make fresh 12-year highs and open 15 points higher, towards the 6560 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.