7 stocks MM are considering selling into strength (CSL, COH, RHC, IEM, SUN, CIM, ALL)

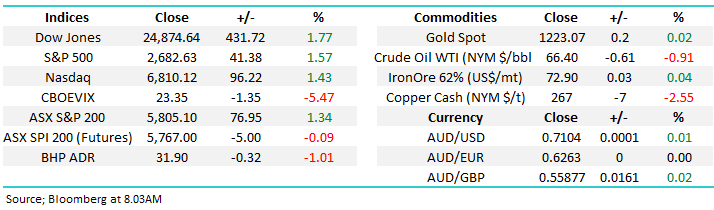

The ASX200 enjoyed an excellent Tuesday gaining +1.3% in the process totally ignoring another steep drop on Wall Street with the exception of the first hour of trading. The banks were a major contributor to the 77-point gain with CBA and Westpac both rallying over 2%, while the growth end of time recovered some of their recent losses assisting the overall positive sentiment.

The breadth and volume behind yesterday’s gains was extremely impressive with 17 members of the ASX200 up by more than 4% while the largest loser was James Hardie (JHX) which only fell -3%.

While we remain positive the ASX200 short-term, ideally targeting the 5900 area, a 181-point / 3.2% sharp rally in 3-days with no major news feels a touch stretched, a pullback / period of consolidation is now feeling overdue i.e. we don’t expect the market to shoot out of the blocks this morning following the Dows 431-point rally overnight.

MM remains mildly bullish the ASX200 short-term targeting the 5900 area.

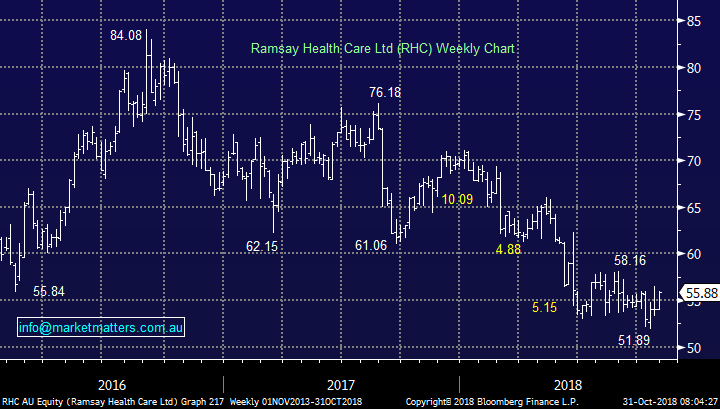

Overnight US indices surged higher again led by the Russell 2000 small cap index which advanced +2%, conversely Europe was slightly lower and this unfortunately is the region Australian stocks are currently more correlated with.

Also, the resources are likely to restrain enthusiasm on our bourse this morning with Crude oil falling -1.3% and copper -2.5%, BHP looks set to open down 1% around $31.90 following weakness on the US ADR market.

Today’s report is going to focus on 7 positions in the MM Growth Portfolio we are considering selling into current strength as MM ideally wants to increase our cash levels around the 5900-area basis the ASX200.

NB as we often say be prepared and as subscribers know we currently believe our cash position of 7% is a touch too low in the current environment – remember, we want to retain flexibility in a market that we think will become more volatile from here.

ASX200 Chart

In yesterday’s report we looked at Macquarie Group (MQG) targeting the $118 area, now only ~2% higher. This morning in a similar vein I have looked at the ASX200 SPI futures which regularly lead the underlying shares both up, and down.

We are bullish the December SPI short-term targeting test towards the 5900 area, again also ~2% higher.

Ideally we will now see some consolidation around the 5800 area but a break back below the 5700 will force us to question our overall view.

ASX200 SPI Futures Chart

A quick look at BHP, the backbone of many a portfolio but still absent from the MM Growth Portfolio even with it representing 6.1% of the ASX200 – we sold the last of our position earlier in the year at $34.

We remain mildly bearish crude oil targeting a decent break below $US65/barrel hence we are comfortable with our patient target to buy BHP around $30 – we are conscious of how popular the “big Australian” is with the market feeling “long” just like CSL was before its sharp correction.

MM likes BHP around $30, around 7% lower.

Crude Oil Chart

We are very conscious that the MM Growth Portfolio is holding a few stocks in the high valuation / growth group and although we bought them into significant weakness they have been hampering our relative performance over the last 2-3 weeks, albeit in a relatively small manner.

Importantly even after the recent correction, the valuations of growth stocks remain on the historically rich side of the fence, so if the re / derating of growth continues there’s more room for many of these shares to fall.

Investors should remember that the growth stocks have largely outperformed for most of the last decade, if the trend is over there’s more to come than just a few weeks!

The healthcare sector remains expensive compared to medium term growth forecasts hence if the current growth derating continues into 2019 this favourite group for retail and professional investors alike may struggle to meaningfully regain recent losses thus they have a large presence in the list below.

Some of these positions we have not held for that long but if they feel wrong sitting in cash for a while is usually the best option.

In short, we’re saying that the correction towards growth globally was more aggressive than we envisaged earlier in the month and we are now more on the sell side than the buy side of this theme.

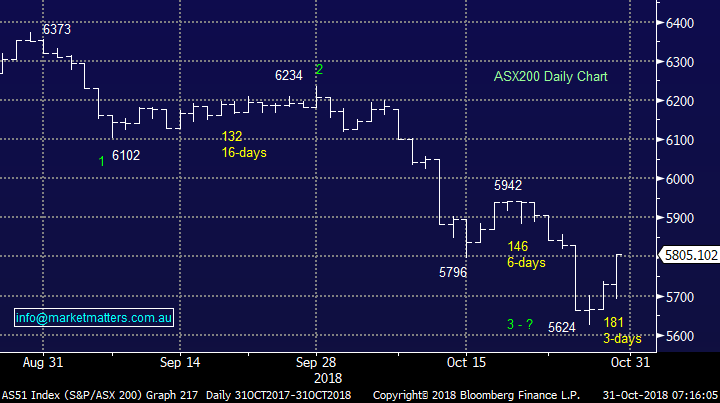

1 CSL Ltd (CSL) $187.44

Following its almost 25% correction CSL is trading almost smack on its average 12-month forward P/E of the last 3-years but this still may prove expensive if growth gets further re-rated.

We allocated 3% of our Growth Portfolio into CSL around $188 earlier in the month and with the exception of a brief rally the position has been in the red since.

MM is now considering taking a small profit from this position between $190 & $195 region should it get there.

CSL Ltd (CSL) Chart

2 Cochlear (COH) $175

Similar to CSL following its recent correction COH is now trading almost smack on its average 12-month forward P/E of the last 3-years but we are wary of further growth rerating into further market volatility.

We allocated 3% of our Growth Portfolio into COH just below $190 on the same day we bought CSL earlier in the month and the positions basically been in the red since.

MM is now considering taking a small loss on from this position around $180 should it get there

Cochlear (COH) Chart

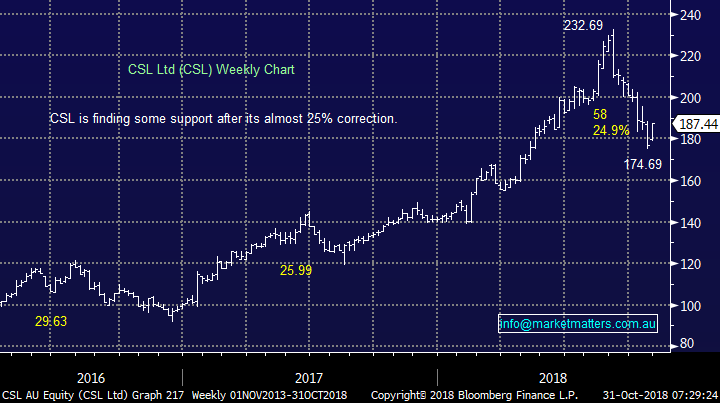

3 Ramsay Healthcare (RHC) $55.88

RHC is trading ~20% below its average 3-year PE and because of this and their recent positive corporate activity in Europe we are going to be more fussy with exit levels.

We’ve held RHC for just over 4-months and have remained patient due to the valuation but it can easily become tarred with the same healthcare / growth sector brush as we saw 2-weeks ago.

MM is now considering taking a small profit on this position around $58.

Ramsay Healthcare (RHC) Chart

4 Emerging Markets (IEM) ETF 54.67

Having taken profit on our BBUS ETF (short US stocks) this small offsetting position in the emerging markets should be feeling a little lonesome i.e. we have “lifted a leg in the air” of the spread.

MM is considering cutting this position around breakeven between 57 and 58 should it get there.

Emerging Markets (IEM) ETF Chart

5 Suncorp (SUN) $13.99

SUN has been sitting in our Growth Portfolio for 3-years but the time feels close for MM to take our last profits from the table – it was also our largest holding for most of this time.

MM is now considering taking a profit on this position around $14.40 i.e. over 30%.

Suncorp (SUN) Chart

6 CIMIC Group (CIM) $47.27

Following its 12% correction the mining services business is trading slightly on the cheap side but nothing major.

This is another stock that we bought into early month weakness that has slipped further than we expected as our overall view of the market has moved to the slightly more bearish stance medium term.

MM is now considering closing out this position around $48 i.e. breakeven.

CIMIC Group (CIM) Chart

7 Aristocrat (ALL) $26.71

Following its 22% correction ALL is trading ~10% below its average 12-month forward P/E of the last 3-years i.e. confidence is diminishing that it can maintain the growth, a recent thematic.

We like the business of ALL but it’s a matter of at what price, as is so often the case. We feel it makes sense to take profit if the stock trades back towards its average valuation of recent years.

MM is now considering taking a small profit on this position above $29.

Aristocrat (ALL) Chart

Conclusion

MM has 7 positions / stocks that we are considering cutting into the current market strength, ideally we will increase our cash position closer to 20% than its current 7%.

1 – CSL between $190 and $195.

2 – Cochlear (COH) around $180.

3 – Ramsay Healthcare (RHC) around $58.

4 – IEM ETF between 57 and 58.

5 – Suncorp (SUN) around $14.40.

6 – CIMIC Group (CIM) around $48.

7 – Aristocrat (ALL) above $29.

Overseas Indices

The US Russell 2000 has now satisfied our downside bearish targets switching us to neutral / bullish, ideally we will see a corrective bounce towards the 1575 area, around 4-5% higher.

US Russell 2000 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January.

German DAX Chart

Overnight Market Matters Wrap

· Choppy sessions in the US overnight, as investors digest corporate earnings, while trying to juggle with the US-China tensions at the same time.

· Metals on the LME were mainly weaker once again, while oil fell and iron ore eked out a small gain.

· BHP however is expected to underperform the broader market after ending its US session down an equivalent of 1.01% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 17 points lower this morning, testing the 5790 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.