6 Non-financials that caught our eye yesterday (ASL, BIN, NHF, VOC, GUD, IVC)

The ASX200 enjoyed an amazing après Hayne banking report reaction, rallying to a 4-month high delivering its strongest day in over 2-years, the reason was simple the outcome wasn’t as bad as many feared. The financial sector led the charge closing up 4.5%, its greatest one day advance since the end of the GFC, with our big banks rallying like “penny dreadfuls” e.g. Westpac (WBC) +7.4% and ANZ Bank (ANZ) +6.5%. To put things in perspective almost 60% of the yesterday’s 114-points gain was courtesy of the banks!

The day felt like an aggressive combination of short covering and outright buying especially in the “big 4” banks, perhaps some underweight fund managers pressed the buy button, conversely investors like ourselves who are overweight the sector didn’t appear to consider taking some profit – more on that later. Also just to add fuel to the fire it appeared that hedge funds / trades were unwinding short Australia – long US positions, another quasi short Australis banks / economy position.

In the middle of all the fallout from the Hayne report we saw the RBA leave interest rates on hold at their record low 1.5% while flagging downgrades to its GDP forecasts acknowledging the downside risks are increasing. Retail sales numbers were very weak just for good measure, while we think the oversold banks remain value, MM does remain concerned how much longer the Australian economy can stretch its run of 27-years without a recession – we continue to believe stock / sector selection is critical in what’s already evolving as an exciting 2019 / 2020.

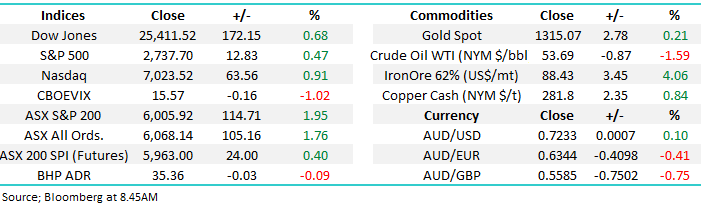

MM has been bearish the ASX200 short-term targeting a break below 5800 – now ~3.5% away. However considering the banks have regained their mojo in a major manner this may prove a tough call. Fortunately we hold 30% of our Growth Portfolio in the big four banks, around 50% overweight, hence we are looking elsewhere to deploy our recently elevated cash levels.

MM is now in “buy mode “due to our relatively large cash position – the current volatile reporting season may provide some value opportunities.

Overnight, US markets were again firm with the broad based US S&P500 gaining +0.5%, the SPI futures are calling the ASX200 to open up around 20-points, regaining half of the afternoons pullback.

We will cover CBA’s first half result that was released this morning in more depth in the Income Note out later, however initial view suggests a slightly weak profit number, a flat dividend but better capital position.

Janus Henderson (ASX:JHG); reported overnight delivering a weaker than expected earnings result however they announced a buy back which the market liked. Shares traded marginally higher in the US.

Today we are going to look at 6 non-financial stocks on the local bourse due to so much action is unfolding under the hood hence we will push our overseas coverage back until Thursdays report.

ASX200 March SPI Futures Chart

The Australian major banks have fallen up to 20% over the last 12-months so a quick 4.5% one day bounce could easily be just the beginning – even after yesterday’s surge CBA is still yielding 5.9% fully franked and over 8.5% for those who hold for the 13-months.

Technically we are bullish the banking sector for at least another ~7% upside into 2019. Remember the comment in Tuesdays report – “we felt fund managers would switch out of resources into banks”. That has not yet started. I was just on the Tele with an Insto Broker who tells me confidently that fundies simply don’t own the banks in aggregate and buying will continue unabated from here. While we’re not that bullish, it’s clearly food for thought.

MM remains comfortable with our long Australian banks position.

Australian Banking Index Chart

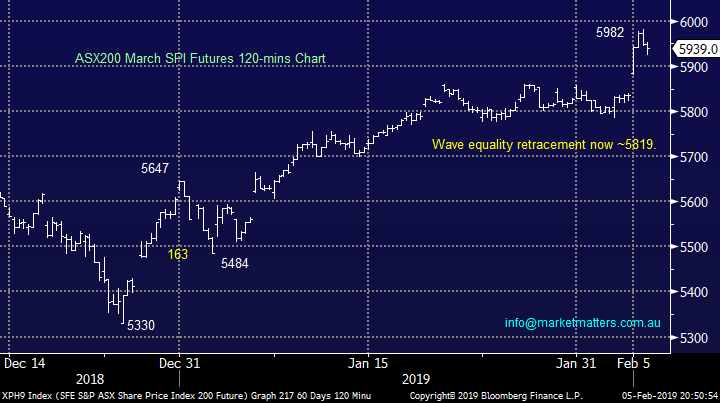

Let’s quickly consider US bank Wells Fargo (WFC US) which was also thrown into the naughty corner in a major way back in September 2016 as millions of fake accounts were uncovered resulting in the firing of 5300 employees and a $US185m fine.

The saga has continued unabated but the stock made a major low in the month after the breaking news before rallying ~50% over the following 15-months – admittedly they have since declined more than the underlying market but we are only thinking 6-months ahead for our banks.

The point being when the bad news is finally unveiled the rally, or recovery in the Australian banks case, can often be greater than many imagine.

Wells Fargo (WFC US) Chart

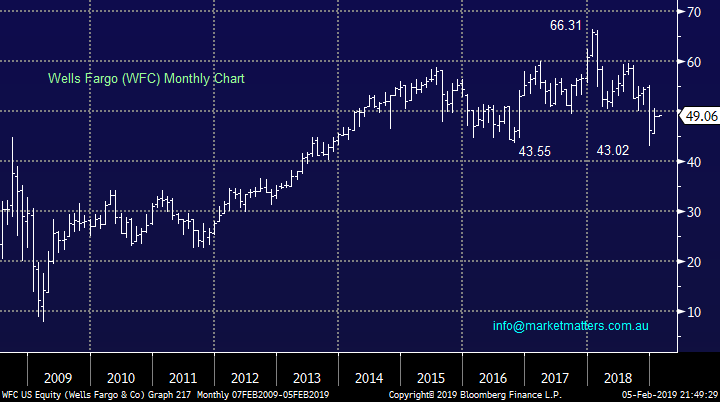

The US markets were firmer overnight as positive expectations grew around a positive US – China trade resolution.

However the small cap Russell 2000 index was down for most of the session and is clearly starting to underperform its peers – we believe the Russell 2000 is regularly the best US index for indicating what lies ahead. Our view on US equities will certainly have an influence on when we start pressing any buy buttons in the weeks ahead:

1 – Short-term we still believe US indices are positioned for a ~5% correction.

2 – We remain bullish stocks in Q1/2 of 2019 and are hence buyers of this weakness if / when it unfolds.

Russell 2000 Index Chart

Looking for opportunities outside of the financials.

MM is sitting on elevated cash positions having locked in some nice profits over the last month. Our plan remains to redeploy these funds into the market as opportunities unfold – we remain bullish into the end of our financial year. As discussed earlier we are comfortable with our large banking exposure and are hence scouring the boards for good risk / reward opportunities moving forward – we are generally looking for more defensive / low beta stocks which ideally do their own thing as opposed to tracking the ASX200 closely.

1 Ausdrill (ASL) $1.39

Specialist drilling business ASL rallied strongly yesterday gaining over 9% yesterday helped by the recent announcement they had secured over $170m in mining services contracts. In our opinion the stock has performed well since the CEO resigned and Norge banks decision to reduce its holding in the company. ASL has now become a major player in the mining services space which we like considering the strength of the underlying sector.

We believe the shares are cheap while the 5% fully franked dividend has unfortunately been unreliable over the last 3-year it looks far better today.

MM likes ASL targeting $1.80 with stops below $1.24 – good risk / reward.

Ausdrill (ASX: ASL) Chart

2 Bingo Industries (BIN) $2.15

Bingo (BIN) has endured a tough 6-months following their announcement to buy “Dial a Dump Industries” last August for close to $600m but we should remember institution’s backed the deal buying stock at $2.54. Since then the company has been in discussion with the ACCC around competition in the rubbish collection space. Effectively, the ACCC raised concerns and the market voted with its feet. We’re now starting to see the market become more hopeful of approval by the ACC on February 21st.

Either way with the stock trading $1 lower than when the purchase was announced (and funds raised) looks decent value. If the deal isn’t approved, they could theoretically buy back stock after selling it at higher levels. If the deal is approved, clearly they will have improved pricing power if the ACCC concerns have any foundation.

MM likes BIN initially targeting $2.50 but stops would be used below $1.95, ok here risk / reward but preferable ~$2.

Bingo Industries (ASX: BIN) Chart

3 NIB Holdings (NHF) $5.50

We have been watching NHF too long in hindsight having previously discussed our interest around $5.15.

The health insurer has had a tough year as Australians have reconsidered the value from private health insurance as the purse strings are being tightened in many households. However some of this headwind should be offset by the recent approval by the Federal Minster for Health to increase insurance premiums by an average of 3.38% across all products – a low increase, but an increase non-the-less.

MM still likes NHF but back around the mid-January $5.20 area.

NIB Holdings (ASX: NHF) Chart

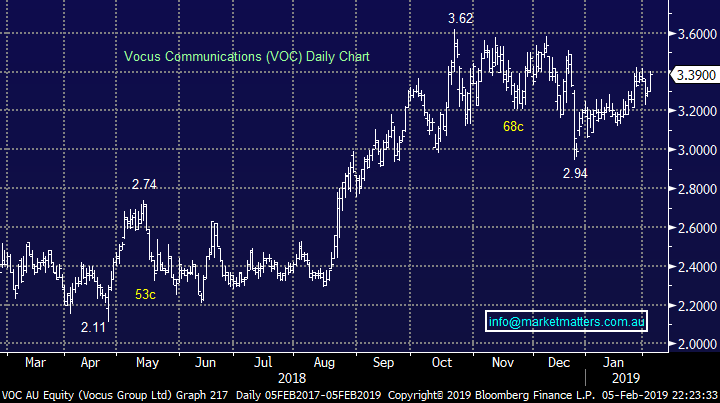

4 Vocus (VOC) $3.39

Vocus (VOC) has been discussed in a number of our reports over recent weeks and caught our eye again yesterday with it testing its 2019 high.

The telco sector remains one we like in 2019/2020 and it’s performed well over the last 6-months. Vertically integrated VOC is arguably now the growth option amongst the Telcos after its tough few years in the wilderness.

MM likes VOC in the $3.30 region initially targeting 15-20% upside but stops are needed in this volatile beast below $3.20.

Vocus (ASX: VOC) Chart

5 GUD Holdings (GUD) $11.56

GUD is another stock we have looked at over the last few weeks following its sharp correction in late 2018. The stock slumped last month after its $29m profit disappointed analysts. The consumer products business has a number of moving parts with many obviously facing the headwind of a weakening economy, hence this is not one to chase higher in our opinion.

We feel the shares are good value closer to $11 where it’s 4.5% fully franked dividend would obviously become more attractive.

MM likes GUD around the $11 region.

GUD Holdings (ASX: GUD) Chart

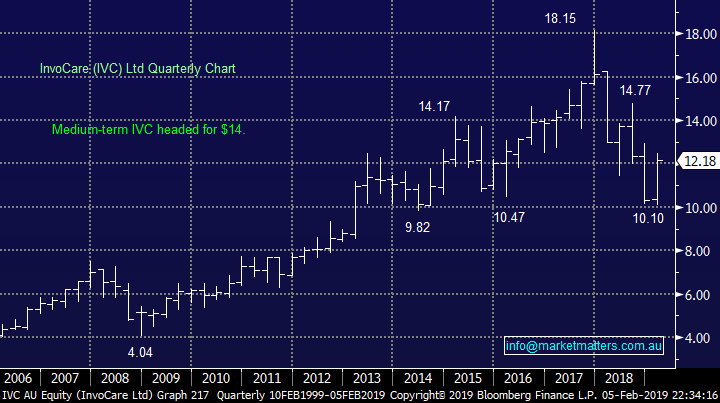

6 Invocare (IVC) $12.18

Funeral business IVC is clearly exposed to the tailwinds of an ageing and growing population – the morbid statistics for annually increasing deaths are steady and upward, although a weak patch more recently had hurt the well owned stock.

We believe the recent pullback in the share price is providing a good long-term opportunity.

MM is bullish IVC with our ideal buy level ~$11.80 targeting over $14.

Invocare (ASX: IVC) Chart

Conclusion

The summary of the 6 stocks we covered today are as follows:

Bullish / consider at current levels – Ausdrill (ASL) and Vocus (VOC).

Bullish / consider at lower levels – Bingo (BIN), NIB Holdings (NHF), GUD Holdings (GUD) and Invocare (IVC).

Overnight Market Matters Wrap

· The US continues its current streak in positive territory overnight, supported by an overall positive earnings season with ~50% of the broader S&P 500 reported and 70% of it beating consensus.

· European markets also had a strong night, continuing to shake off Brexit concerns and hitting 2 month highs, with the UK market leading the way, up 2%, boosted by gains in construction and material companies.

· CBA reported this morning and is likely to be welcomed by investors and outperform the broader market, while BHP is expected to underperform after ending its US session down an equivalent of 0.09% following weakness from crude oil.

· The March SPI Futures is indicating the ASX 200 to open 20 points higher, testing the 6030 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.