5 stocks we are considering into the current market panic & a word on recent performance (BIN, ALL, MQG, OZL, APX)

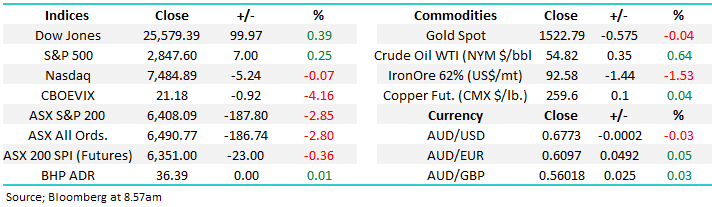

An awful day for the ASX200 which basically mirrored US markets by falling almost 3% yesterday, its worst one day performance in 18-months. The selling was both aggressive and broad-based with only 5% of the ASX200 managing to close in the black while the best performing stock rallied +4.2% compared to 33 socks which fell by over 5%, a very clear but unpleasant picture. Suddenly falling interest rates are being ignored and investors have become fixated with inverting bond yields and the prospect of a recession just around the corner. Central banks have certainly got their work cut out to regain the markets confidence as their tool kit looks relatively bear with interest rates already pretty close to zero.

Interestingly amongst all the “doom & gloom” yesterday we saw the Hong Kong government inject $2.4bn of stimulus in an attempt to offset the huge economic damage being caused by the ongoing massive civil protests. Although the old British colony now expects almost zero growth this year the impact of the stimulus was significant as the Hang Seng rallied 600-point from its intraday lows to actually close up +0.8% on the day. Two things caught my attention:

1 – Global central banks will not roll over without a fight. Before they accept a severe economic downturn we should anticipate further interest rates cuts (where they can) followed by more Quantitative Easing (QE) / fiscal stimulus.

2 – The Australian market was the quasi sell vehicle yesterday as traders bought Asia and US futures, the intensity of Thursdays selling on massive volume had an almost climatic feel to it, time will tell but cashed up fund managers are probably starting to eye the market into current weakness.

Unfortunately we are a logical market to sell if the US is headed into a recession and China’s slowdown persists, we investors should be prepared for continued selling locally until we see some improvement in the economic picture.

Yesterday evening saw amazing volatility as US S&P500 futures dropped like a stone late in the evening only top bounce 1.5% in the next hour as traders attempted to come to grips with ongoing press releases around US – China Trade. This morning as well as the ongoing volatility in overseas markets we again have some major company’s reporting including Newcrest (NCM), Star Entertainment (SGR) and Cochlear (COH), our initial impression of the scorecard so far:

MM remains comfortable adopting a conservative stance towards equities.

Overnight US stocks bounced slightly with the Dow rallying 100-points, regaining over 10% of the previous sessions losses but the tech based NASDAQ still closed down on the day The SPI futures are calling the ASX200 down around 15-points early this morning.

Reporting today: COH, DHG, CQR, HLS, NCM, PCT, SGR, SIQ

Today we are going to look at 5 stocks / positions we are considering into ongoing market capitulation.

ASX200 Chart

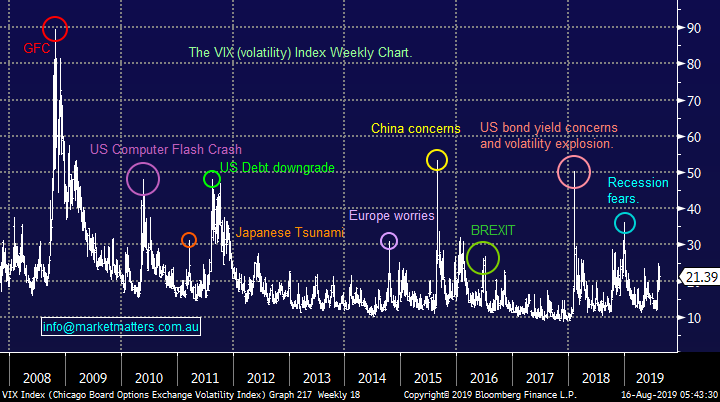

Volatility in equity markets is generally measured by the VIX and as we can see its coming back to life. However it’s more the previous year’s tranquillity that’s out of the ordinary as opposed to the current rally back above 20% which is still well below the panic when recession fears originally surfaced back in Q4 of 2018. With the shorts on the VIX around record volumes further upside squeezes should not surprise.

MM believes the VIX will eventually challenge late 2018 levels this year i.e. ~35.

However the Put / Call ratio has become pretty exaggerated over recent weeks as the bears have come out to play which is a solid indicator that a bottoming process is could now be unfolding, or in other words the pessimism has simply gone too far in the short-term.

The VIX Index (Fear Gauge) Chart

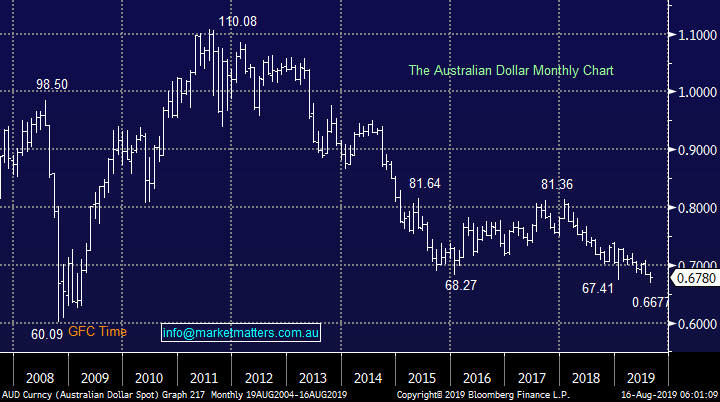

The Australian dollar is having a relatively quiet month considering all the fun and games unfolding in bonds and equities. At 11.30pm yesterday we saw stronger than expected employment data for Australia, better data (particularly employment) implies less chance for rate cuts domestically, and the market clearly didn’t like it.

In todays AFR comments from the Reserve Bank Deputy governor were less dovish than many were hoping for but following the solid data it made sense. Australian 10-year bonds have made yet another all-time low at 0.888% but Mr Debelle even questioned the ability of bond markets / yield curves to forecast a recession, while at the same time talking up the local economy – not the talk of a man wanting to slash the RBA Cash rate from 1% towards zero.

MM is bullish the $A at current levels - perhaps our interest rates will now fall less than our US counterparts.

The Australian Dollar ($A) Chart

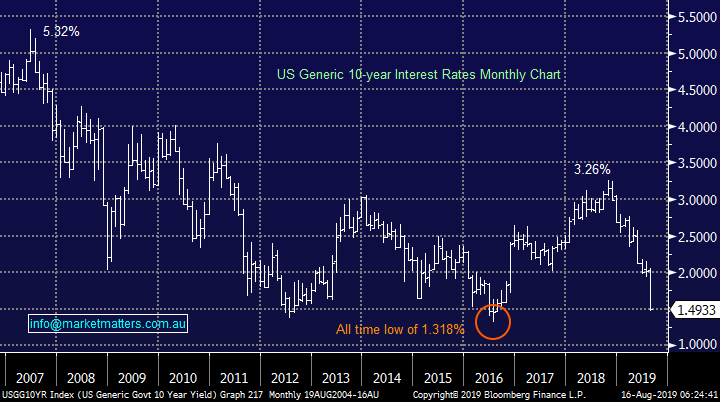

Overnight the US 10-year yield plunged under 1.5% as a recession is being priced in as an almost forgone conclusion. While a period of consolidation is overdue the downtrend is clearly entrenched.

We remain bearish US bond yields targeting fresh all-time lows.

US 10-year bond yields Chart

No change with the volatile US market, “MM believes we have entered a new short-term cycle for US stocks where bounces should be sold for the active trader” this continues to feel on the money:

1 - Our initial target for this aggressive market correction is ~2750, now around 3.5% lower – another night like we just saw will probably do it!

2 – However this may only be the initial leg lower, our ultimate target for this market pullback is potentially ~2350, a retest of Decembers panic low – we are certainly getting increasing fundamental “alarm bells to test these levels.

We are in exciting times, not ones to panic and runaway but its essential investors have a plan otherwise these dominant human emotions of “Fear & Greed” will wreak havoc with returns. The MM Growth Portfolio is holding 21% in cash, relatively defensive but with US stocks approaching our original target we are considering putting some more equity to work.

Our initial target for this down leg in the S&P500 remains 2750, or ~3.5% lower.

US S&P500 Chart

5 stocks on the MM radar.

MM is sitting on 21% cash in our Growth Portfolio and we believe the current negative sentiment around a looming global recession will again be replaced by optimism around historically low interest rates i.e. Yield will raise its flag again

The number of global bonds providing a negative yield keeps inching higher by the “occasional trillion dollars”, today its estimated to be ~25% of the global bond market or $US16 trillion - Sweden has just sold 10-year debt with a negative yield for the first time. These are unprecedented times and if governments can borrow money for infrastructure at or below zero % why wouldn’t they when their economies need a shot in the arm?

MM believes the hunt for yield will resurface soon.

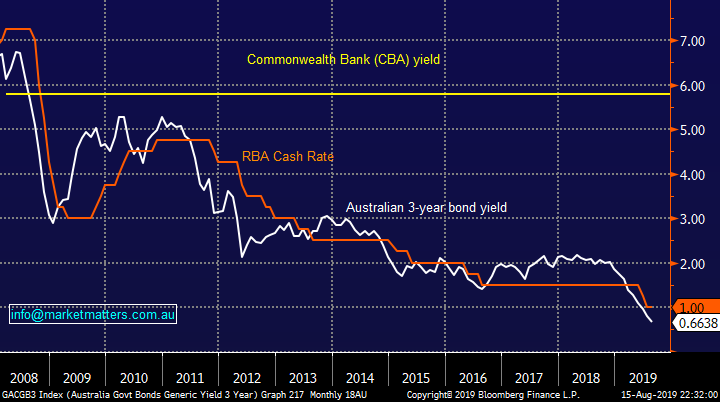

Major Australian interest rates Chart

Today we have briefly looked at 5 Australian stocks MM likes into current weakness but we stress we see no reason yet to chase stocks. Also remember we are expecting the markets choppy nature to continue over the next 12-18 months hence if we increase our market exposure into current ongoing weakness the plan will be to trim it back into a decent rally.

1 Bingo Industries (BIN) $2.39.

MM has been watching BIN closely since we realised a great 55% profit from the waste business back in June. Both Bingo (BIN) and Cleanaway (CWY) are in the same waste management sector and history tells us it’s a relatively recession proof space but both stocks appear to have got way ahead of themselves in 2019 as we saw when CWY tumbled almost 14% yesterday following its report.

BIN steps up to the plate on the 22nd, obviously the contents will determine any action by MM but technically the stock looks good ~$2 and we do like the sector into weakness.

MM likes BIN around $2.

Bingo Industries (BIN) Chart

2 Aristocrat (ALL) $28.01.

Aristocrat has evolved into a world class global gaming business which produced an excellent result back in March when it showed 35% revenue increase to $US2.1bn. This is clearly a constantly evolving industry but ALL are pressing all of the correct buttons.

We took a nice profit on ALL above $31 for valuation reasons but back under $28 the risk / reward is far more appealing.

MM likes ALL below $28.

Aristocrat (ALL) Chart

3 Macquarie Group (MQG) $118.

MQG needs no introductions, it’s a quality business which can regularly provide opportunities courtesy of its high correlation to US indices. We have previously flagged our interest in the stock below $110 and as US indices unravel our targets coming into view, we will be keen buyers ~6% lower – easily achievable in such a volatile beast.

MM likes MQG below $110.

Macquarie Group (MQG) Chart

4 OZ Minerals (OZL) $9.25.

OZL is another quality business which is being dragged lower by weak copper prices and concerns around the Chinese economy – very real issues. The volatility in this stock / sector should not be underestimated and while our buy zone is ~8% below yesterdays close in todays market this can be achieved in 24-hours!

MM currently likes OZL below $8.50.

OZ Minerals (OZL) Chart

5 Appen Ltd (APX) $23.90.

APX is a very in vogue artificial intelligence (AI) business that’s now corrected over 25% as the momentum traders have been stopped out – no great surprise.

The company reports on the 29th but the recent correction has clearly removed some of the “frothiness” from the share price, as Clint Eastwood said in Dirty Harry “Do you feel lucky?” We often here a lot of talk about valuations in this area of the market however realistically, this is a momentum stock and using technical’ s makes sense. This is a great sector for relatively short term investment, assuming of course our timing is again as good as it was last November.

With our target for US indices still a few percent lower the Software & Services stocks may continue to underperform but we now believe they are well over half way in their pullback, potentially time to accumulate.

MM currently likes APX around the $23 area.

Also in the sector we like Xero (XRO) below $55 but that is ~8% lower.

Appen Ltd (APX) Chart

Xero (XRO) Chart

Conclusion (s)

MM is dusting off our buying hats as markets correct, above are 5 / 6 stocks we currently have firmly in our sights.

A word on recent performance

There are a number of positions in the Growth Portfolio that are in the red, never great to see however understandable in the current market. We added a number of value orientated companies into weakness and some of these have struggled in recent times – Pact Group, Costa & Adelaide Brighton are three obvious candidates.

Using the SMA that is aligned with the Growth Portfolio as a proxy on performance, the portfolio has now pulled back in line with the market, down -2.83% financial year to date versus the ASX 200 which is off by -3.13% and the accumulation index which is also down -2.83%. This follows a +12.94% return last year. While we are not about delivering market returns, and tracking the market is certainly not our mantra, I think it’s important to always consider returns at the portfolio level while also recognising that short term performance is fairly irrelevant – consistency over time in an approach that works is the key.

Managing money / writing newsletters can at times be tough, but I don’t get that feeling at the moment. Markets are becoming interesting again on a number of levels, and we’re once again starting to see value emerge. Hold onto your seats, volatility is here and that’s when an active approach will shine through.

Enjoy the weekend & keep an eye out for the weekend report on Sunday morning

James

Global Indices

We believe US stocks are now bearish short-term as we touched on earlier, the tech based NASDAQ’s initial target is ~6% lower.

US stocks have generated technical sell signals.

US NASDAQ Index Chart

No change again with European indices, we remain very cautious European stocks as their tone has becoming more bearish over the last few weeks however we had been targeting a correction of at least 5% for the broad European indices, this has now been achieved.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· A more subdued session was experienced overnight in the US, with the Dow up 0.39%, while the broad based S&P 500 closed 0.25% in the black. The Nasdaq 100 however, underperformed after Cisco fell 8% on a revenue miss and a poor sales forecast.

· US retail sales rose 0.7% in July, ahead of analyst expectations. This was the biggest jump in four months and comes after a gain of 0.3% in June.

· The US 10-year bond is currently yielding 1.53% vs 1.50% on the 2 year. There is a lot of debate around the ability of the yield curve to predict a recession. Even former Fed Chair Yellen commented that, on this occasion, it may not be a reliable indicator.

· Copper fell on the LME, while aluminium made a small gain and nickel jumped 2%. Iron ore fell lost ground while gold is currently trading at $US1522.79/oz.

· A quieter day is expected, while investors turn their short term focus on the current earnings season, with the September SPI Futures is indicating the ASX 200 to open with little change, testing the 6400 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.