5 stocks to consider if the market sustains further falls (RHC, NCM, CQR, VOC, BEAR)

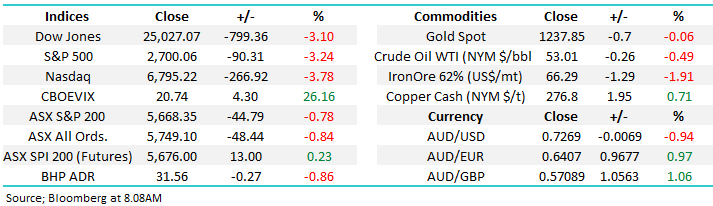

The Dow plummeted 800-points / -3.1%, but the ASX200 only fell 45-points / -0.8% - A pretty good effort as the rollercoaster ride for stocks continues to trundle along. As I mentioned previously, overall not a bad performance locally with some weakness in the banks, courtesy of the yield curve pressures, doing the most damage on a relatively quiet day where the index grinded higher all day after initially plunging ~100-points on the opening bell.

Getting too close to this extreme day to day market volatility / noise is dangerous and likely to derail any well thought out plans. Basically, the ASX200 has now oscillated between 5594 and 5778 since mid-November and until the market moves to a new range of equilibrium, we must remain open-minded but in our case with a positive bias.

MM remains bullish the ASX200 short-term targeting a “Christmas rally” towards the 5900-6000 area.

Overnight US markets were closed for former President George H.W. Bush’s funeral, although the S&P500 futures rallied +0.6% and the SPI futures are indicating the ASX200 will open up slightly in the black.

Today’s report is going to consider 5 stocks which may be worth buying if equity markets continue to struggle into 2019 / 2020 i.e. our medium-term call.

ASX200 Chart

Market sentiment is an amazing beast whether it’s controlled by good old fashioned “Fear & Greed” or just outright Fear which has conducted the orchestra for much of 2018.

For most of the year, investors have been concerned that the US Fed would raise interest rates too fast, but now suddenly worries have made a 360 degree turn and are focused on a potential looming recession. This fresh scenario suggests interest rates increases will be subdued which of course is net negative for the influential financial sector – the bottom line is markets are scarred and “the glass is half empty” mentality is in play whatever different economic scenarios are dominating the press on a week to week basis.

We simply believe US bond yields will have a logical break after more than doubling since 2016.

However, I must add concerns are understandable, ignoring the increase of volatility due to Trump et, al. the only other times there has been a >3% drop in the S&P500, like the last session, in a December was in 1987, 2000 and 2008 – most certainly not good times for equity investors.

US 10-year Bond Yields Chart

5 Defensive potential stocks/ positions

As you know. MM is short-term bullish the ASX200 while being overall concerned around what comes next in 2019 /2020.

When we stand back and look at the ASX200 Accumulation Index (including dividends) the current pullback remains relatively small compared to what’s been experienced over the last decade, in other words investors should not be surprised to see stocks a lot lower in the next 1-2 years.

Hence today’s report is going to consider 5-defensive ideas which by definition need to have performed well since the market rolled over this August.

ASX200 Accumulation Index Chart

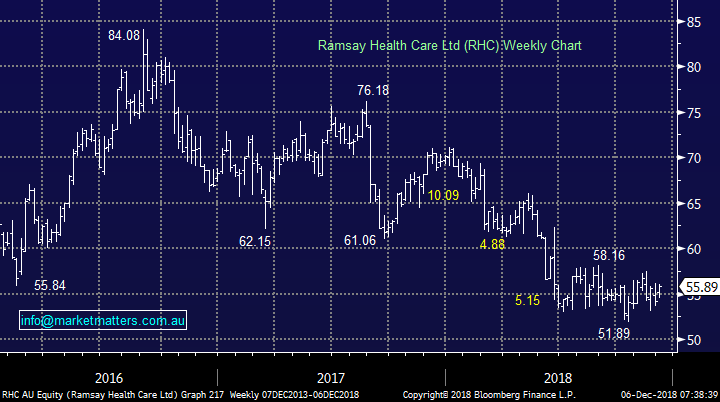

1 Ramsay Healthcare (ASX: RHC) $55.89

Over the last 3-months the ASX200 has fallen 9% while Ramsay Healthcare (ASX: RHC) is up 1.8% - MM has owned RHC for almost 6-months from around current levels.

However much of the Healthcare Sector like heavyweights Cochlear and CSL are down by over 20%, which is a clear alarm bell for RHC moving forward.

We believe RHC has outperformed the market by over 10% recently, primarily because it had already declined almost 40% from its early 2016 high, not because it’s a prime defensive candidate.

This illustrates to us that some the most previously “battered” stocks may outperform if we experience a prolonged bear market over the next 1-2 years.

MM still plans / hopes to take profit on our RHC position around 4 to 5% higher.

Ramsay Healthcare (ASX: RHC) Chart

2 Newcrest Mining (ASX: NCM) $20.73

NCM is up over 9% over the last 3-months, enjoying a strong performance by much of the gold sector e.g. Evolution Mining (ASX: EVN) +12.7% and St Barbara (ASX: SBM) +14.1%.

In other words many of the quality gold names have outperformed the market by around 20% in recent months.

MM has held 3% of our Growth Portfolio in NCM since July, also from around current levels, we may even take profit on this position if the opportunity arises over the coming weeks around $1 higher.

However, we believe the gold sector will outperform in 2019 / 2020 and envisage increasing our exposure in a selective manner into 2019.

Newcrest Mining (ASX: NCM) Chart

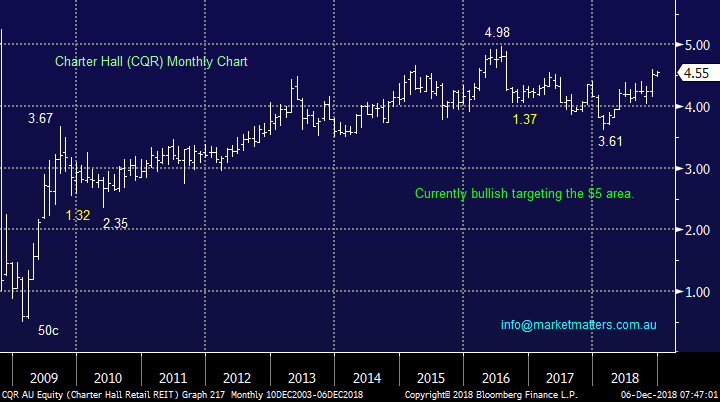

3 Charter Hall Retail (ASX: CQR) $4.55

CQR is up +6.3% over the last 3-months enjoying the tough market times like over 30% of the real estate sector – some good stock selection has been required.

We remain bullish CQR into 2019 targeting another 10% upside.

The real estate sector may offer some value in a bear market but it also depends on why stocks are falling e.g. rising interest rates is bad for real estate.

MM may add some real estate to its Growth Portfolio but my “Gut Feel” is probably not.

Charter Hall Retail (ASX: CQR) Chart

4 Vocus (ASX: VOC) $3.49

VOC is up almost 18% over the last 3-months while sector bell weather Telstra is unchanged even after trading ex-dividend 11c fully franked at the end of August.

MM likes the battered Telcos into 2019/20 believing they can definitely continue to outperform, just as they have since August.

MM anticipates holding a decent exposure to 1 or 2 Telcos into 2019 – we currently have 7% of the Growth Portfolio in Telstra (ASX: TLS).

Vocus (ASX: VOC) Chart

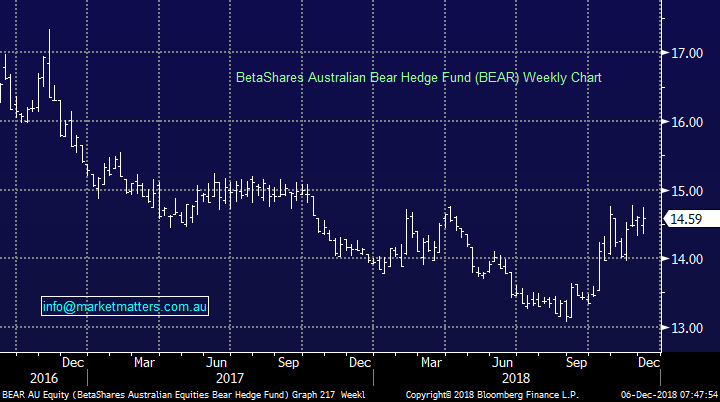

5 Bearish ETF’s

Long bearish ETF’s has clearly been a winner since August as they are inversely correlated to the underlying ASX200.

MM definitely expects to buy negative ETF’s at different stages during 2019/20 e.g. The BEAR and the BBOZ (leveraged bear).

This is of course assuming we maintain our medium-term negative outlook towards equities.

BetaShares Bear ETF (ASX: BEAR) Chart

Conclusion

We like gold stocks, Telcos and bearish ETF’s as the ideal plays for a bear market into 2019/20.

RHC is a definite no while CQR is a probably not.

We also do believe that many “battered” stocks may often outperform if we experience a prolonged bear market over the next 1-2 years i.e. the damage has already been done but I stress not in all cases.

Overseas Indices

The US S&P500 has satisfied our downside bearish targets switching us to neutral / bullish but its clearly not out of the woods yet.

US S&P500 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January.

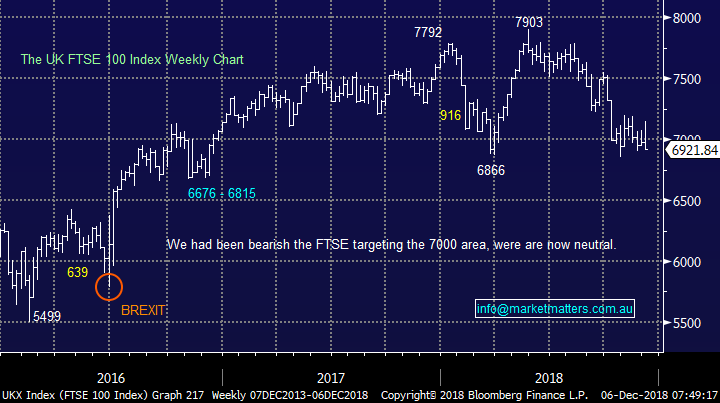

The UK FTSE feels likely to make fresh 2018 lows before being able to bounce.

UK FTSE Chart

Overnight Market Matters Wrap

· With the US equity and bond markets closed overnight for the funeral of former President George H.W. Bush, the Australian market is set to open a little higher this morning after European markets put in a less volatile performance in the wake of the previous day’s US market hit.

· The UK FTSE was 1.4% weaker ahead of next week’s Brexit vote which is on a knife edge, as uncertainty remains about the next step towards the country exit from Europe early next year. UK growth numbers are already under pressure, as highlighted by a drop in the latest Services PMI data to 50.4 from 52.2 in October.

· Commodities were mixed, with gold, iron ore and oil prices mostly slightly weaker while copper was a touch firmer. All eyes on the OPEC meeting which begins in Vienna tonight with investor expectations of production cuts of around 1.3mb/d in order to rebalance markets and steady prices after the recent 25% selloff from their highs.

· The December SPI Futures is indicating the ASX 200 to open marginally higher, testing the 5675 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.