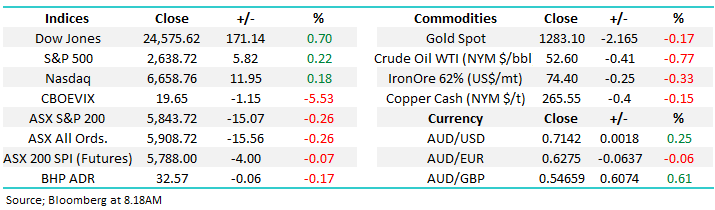

5 stocks that we will avoid as downgrades wash over the ASX200 (CGF, WSA, SEK, REA, DMP, CWN, CCL)

The ASX200 enjoyed a far better day only falling 15-points largely ignoring a poor lead from Wall Street where the Dow was “hit for six” dropping over 300-points. If you remove the dramatic falls on stock specific bad news the local market was actually fairly boring both on an index level and under the hood i.e. Challenger (CGF) -17.2%, IOOF (IFL) -8.2% and Northern Star (NST) –5.7%.

The markets continues to behave itself rejecting / stalling at the 5900 technical resistance level, our ideal target for a pullback remains around the 5750-5775 area but we must remain open-minded following the volatility that hit stocks in December and early this month.

MM remains just in “sell mode” but with cash levels now sitting at a comfortable 20% we will become far more fussy moving forward and are definitely not ruling out buying decent weakness for a short-term play.

Overnight US markets stabilised with the broad based S&P500 closing up 0.2% while the futures are calling the ASX200 to open unchanged.

Today we are going to cast our eyes over some local stocks we intend to avoid over the next few months and potentially throughout 2019 as yesterday we again saw the impact of company misses / downgrades yesterday.

ASX200 Index Chart

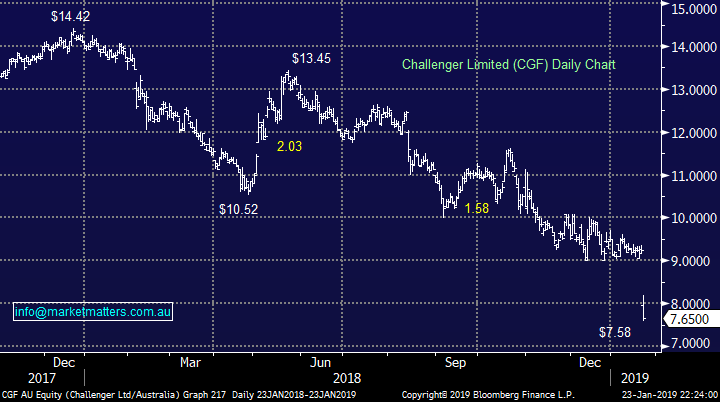

On a day when the MM Growth Portfolio should have been outperforming we struggled courtesy of a second downgrade from previous market favourite Challenger (ASX:CGF) where we fortunately only have a 3% holding – the drop took about 0.5% off portfolio performance.

Things felt pretty good after taking profit on our previous CGF position just below $14 in late 2017 followed by a rebuy ~$9.84 into the recent market weakness in November, an almost 30% value add but alas yesterday’s fall negated all the “feel good” factor.

In a nutshell our thoughts on CGF moving forward:

1 – A second downgrade but they often come in 3’s however this may have been the new boss clearing the slate when blame can be laid at his predecessor’s door.

2 – We feel It’s highly unlikely that CGF can bounce far without any fresh news and a trading range of $7 to $8 is probably the best we can hope for in the months ahead.

3 – Market concerns about falling margins and the impact of volatile markets will linger, while their capital position is weak therefore the concern of a potential capital raising will also weigh on this stock.

4 - Many fund managers had it in their overweight basket and therefore overhang on the sell side will be high implying risks are still on the downside short-term.

5 – The shorts have been “all over” CGF of late taking their exposure to around 7% from only 2% over the last 6-months, we will watch this carefully but it doesn’t add confidence that short covering will lead to a bounce, which we can use to exit the holding.

At this stage we have no interest in averaging CGF and may cut and run into any reasonable bounce.

Challenger (ASX: CGF) Chart

Western Areas (ASX:WSA) was another stock that was sold yesterday after they posted December quarter production/sales scorecard and Harry didn’t get a chance to cover the update in the afternoon note yesterday. The production metrics were all okay, however there was a clear trend of higher costs. This is the 5th straight quarter that saw higher costs from WSA, and although the numbers were within guidance, the trend is up – and the market didn’t like it.

While there were a number of one off developments that hurt the cost figure yesterday that theoretically should be beneficial in the future, the market’s reaction can’t be ignored and stocks that disappoint tend to stay in the sin-bin for period.

Western Areas (WSA:ASX) Chart

Overseas last night, US stocks were quiet and if we are correct they should be in the early throws of a correction of the late December rally. Our preferred scenario for Q1 / Q2 is a choppy advance towards 2870, or around 8% higher after a short term pullback

S&P500 Chart

5 stocks we are likely to avoid in 2019.

Successful investing can at times be compared to the consistent winner on the poker tables – profitable players usually raise or fold with “check” being their least common action. We believe there are definite parallels with effective investing:

1 - Most people spend the majority of their thoughts / efforts on buying (raise in poker).

2 – Selling certainly gets the least attention but in our opinion its equally important as buying (the fold in poker).

3 – The hold and hope is a very common path for investors which often ends badly (in poker winners rarely check).

We evaluated the MM performance in 2018 with the standout need for improvement being the need to cut losses faster - in our case for 2018 Janus Henderson (JHG).

At MM we believe if you wouldn’t buy / average a stock today the question must be asked loud and clear why hold it? I’m sure you know where I’m going with this….we are pondering CGF as I type!

1 Seek (SEK) $17.67

While we remained bearish the jobs listing goliath SEK for most of 2018 it remains a popular stock with many hence this report felt an ideal opportunity to update our thoughts. SEK has struggled since its latest results primarily on the back of disappointing guidance for the year ahead. The business is investing for the future which we like but further short-term setbacks in today’s fickle market could easily send this stock significantly lower.

The stock has fallen almost 30% from its 2018 high hence a bounce would not surprise but we believe the main risk remains to the downside.

In 2018 earnings fell a touch while the market is positioned for +3% growth in FY 19. On a P/E of 30x those estimated 2019 earnings while yielding 2.6% fully franked, the market is clearly paying for growth beyond 2019, which can be a risky proposition in this type of environment.

We are bearish SEK targeting a further ~20% downside.

Seek (ASX: SEK) Chart

2 Domino’s Pizza (DMP) $45.17

DMP is a stock and business MM has not liked for a few years and we remain in no hurry to change this view. As can be seen below its been a rollercoaster ride for shareholders over the last 7-years with some major winners and losers depending on the timing of investment.

The Australian franchise business still concerns us as does the European growth story. The technical picture is not clear for a downside target but the trend remains clearly down.

The market is pricing in 16% growth in earnings consistently for the next 3 years and the stock is trading on a P/E for 2019 of 25.5x while yielding under 3%. Considering the growth rate, and the P/E, the valuation looks okay however we’re sceptical that the business (given recent trends) can turn into such a consistent growth play as consensus implies.

MM has no interest in DMP above $35.

Domino’s Pizza (ASX: DMP) Chart

3 REA Group $76.21

We all know both the business REA (Realestate.com.au) and the concerns around the Australian housing market. REA actually doesn’t suffer directly from falling house prices and according to the CEO, they benefit from the need for higher marketing spend and longer listing times. That said, volumes are important and lower prices without the impetus from forced selling can mean volumes contract substantially.

Again, the market is currently factoring in strong, consistent earnings over the next 3 years as shown below, in an environment that we believe gets tougher from here.

We simply question whether the market is too optimistic paying 30x FY19 earnings for a business facing a more challenging couple of years ahead.

MM has no interest in REA until we establish a firm opinion of when the housing market will stabilise.

REA Group (ASX: REA) Chart

4 Crown Resorts (CWN) $12.10

CWN has positioned itself through its Barangaroo development for high rolling Chinese gamblers just as we have slipped down the rankings as a desirable destination for the Chinese traveller. However Macau’s gambling revenue still managed to grow 14% in 2018 showing there clearly remains plenty of gold in the gambling hills although we note the former Portuguese colony has started appealing more to the mass market visitors by providing broader entertainment i.e. tourism Australia needs to get a wriggle on!

While we believe the Barangaroo development will ultimately prove the jewel in CWN’s crown so to speak, it may become a drag in the short-term especially as they look to sell the luxury apartments on top of the casino into a weak market.

The stock is currently trading on 19.9x while yielding 6.2%, compared to Star (ASX: SGR) on only 15.1x and yielding 6.6% without the execution risk of a big new Sydney development.

Technically CWN also looks average with a target close to $10.

MM has no interest in CWN much preferring Star Entertainment into further weakness.

Crown Resorts (ASX: CWN) Chart

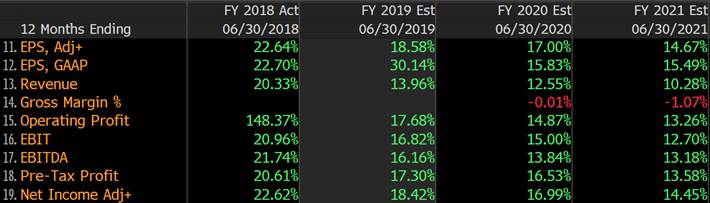

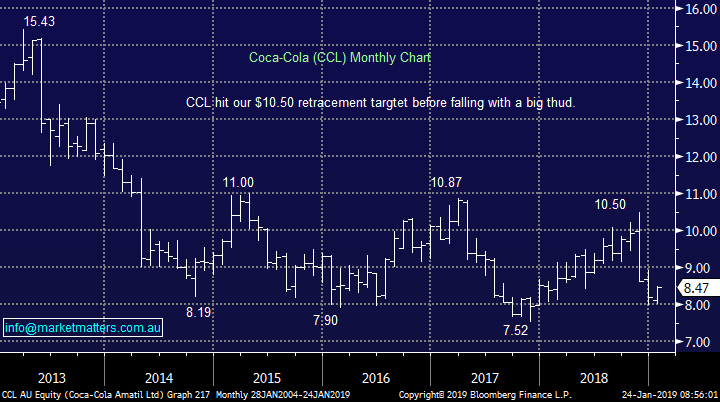

5 Coca-Cola (CCL) $8.47

We have been net bearish CCL for a number of years although we did pick the technical bounce to $10.50 in 2018.

While around todays $8.50 we regard the stock as more neutral / bearish bet it’s not one for us as we perceive the world will continue to move away from sugary drinks – Australia will follow more advanced countries with a sugar tax - it’s a matter of when in my opinion, probably when the diabetes bills get too large.

MM has no interest in CCL for the foreseeable future.

Coca-Cola (ASX: CCL) Chart

Conclusion

MM will likely be avoiding SEK, DMP, REA, CWN and CCL in 2019.

We could have added more to this list if time allowed hence we may run a Part 2 report in the coming weeks.

Overnight Market Matters Wrap

· The US majors all closed in positive territory overnight, on the back of positive quarterly earnings, with the Dow ending its session up 0.70%.

· However, concerns about near term US growth were fuelled by comments from a White House economic spokesman that if the government shutdown continued for the rest of the quarter (currently entering its second month), it could result in zero growth in the first quarter, although he expected a strong bounce back in the second quarter.

· Most key commodities were little changed overnight with oil and gold a little weaker and the A$ is steady around US71.4c.

· BHP is expected to underperform the broader market, after ending its US session down and equivalent of -0.17% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open marginally higher, testing the 5850 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.