5 Stocks / Positions to Consider with this week’s Dividends (IEM, ALL, RIO, OSH, BPT, ORG)

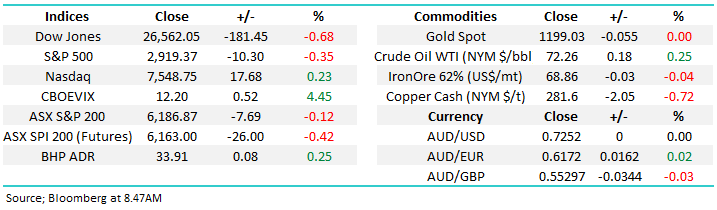

The ASX200 put in a stellar performance yesterday to close only marginally in the red, as the trend of the past few weeks continued in earnest i.e. the “market” remains, for now at least, a buyer of weakness but a seller of strength. The volume and price action were very quiet for a Monday, especially considering the news flow that hit some Asian indices e.g. Hong Kong fell -1.6%.

The only action that caught our eye on a more granular level was obviously continued strength in the energy stocks but weakness in both the gold names. Interestingly overnight, we saw corporate activity heat up with a merger of Barrick Gold and Randgold which values the latter at around $5.4b. Gold has obviously been weak however consolidation in a sector can often be a sign of a low.

Asian equities have been the big loser from a prolonged US-China trade war. Since mid-May, the Hang Seng is down -17%, while the US S&P500 is up +7.3%. We believe either a full-scale trade war will blow up or the economic super powers will find some middle ground, but either way the relative performance between the US and Asia will reverse at some point.

· MM remains short term negative the ASX200 with an initial target sub 6000.

Overnight stocks were mildly weaker with the US S&P500 down -0.35% and Europe slipping ~0.6%. The SPI futures are picking the local market to open marginally lower.

Today’s report is going to look at 5 stocks / positions we like in the current market as almost $19bn is paid to investors this week in dividends with heavyweights BHP, CBA and Telstra the main contributors.

NB Our view of the market is it’s on the expensive side trading on a P/E of ~16x, compared to the decade average between 14-15x hence careful stock selection and entry levels are warranted.

ASX200 Chart

A number of today’s selection will be a reiteration of recent reports but after an extremely quiet period in the market MM can see a likely increase in activity moving forward.

1 Buy emerging markets v US stocks.

As we discussed a few times recently, MM believes the recent underperformance of the emerging market compared to the US S&P is rapidly becoming too stretched, especially since we read the latest Bank of America’s fund manager survey:

· Fund managers are now 21% overweight US stocks, the largest level since January 2015 while their allocation to global stocks fell to an 18-month low.

Overall when the elevated 5.1% cash levels are put back to work by fund managers our opinion is the divergence will again narrow – see below chart.

Emerging markets iShares emerging markets ETF (IEM) Chart

Yesterday MM dipped its toe in the water of the emerging markets ETF (IEM) which we have discussed for the last few weeks.

· We located 3% of the Growth Portfolio into the IEM but importantly intend to average this position if the opportunity arises into fresh lows around the 56 area.

When we look at both IEM and highly correlated Hang Seng fresh 2018 lows would not surprise but as we said above we will average into this move – especially if its occurs around further negative news on US – China trade.

iShares Emerging Markets ETF (IEM) Chart

Hong Kong’s Hang Seng Chart

2 Aristocrat (ALL) $28.13

ALL is best known for being one of the world’s leading gaming technology companies, but it’s not just all about “the pokies” it’s also become a successful digital company i.e. first half of FY 2018 the digital part of the business delivered a huge ~230% increase in revenue to almost $430 million, taking it over 25% of the ALL’s total revenue.

The appeal of this business is its scalability with well over 8 million daily active users the growth remains exciting. We are attracted to the stock which following the recent correction now has the shares trading on an Est P/E of 23.7x for 2018 – a reasonable multiple for a growth business. MM has been patient with our ambitions to buy ALL pulling the entry level back from $29 to around $28, or 3.5% lower.

ALL has now corrected over 15% from its July high.

· MM is currently a buyer of ALL around $28.

Watch out for alerts

Aristocrat (ALL) Chart

3 RIO Tinto (RIO) $78.52

MM has a 3% exposure to RIO in the Growth Portfolio from attractive levels, but following last weeks announced US$3.2bn return to shareholders via an off market buyback allowing shareholders to enjoy franking credits before a potential change in government – great to see a company thinking of its shareholders!

Yesterday was the last opportunity to take up RIO’s off market buyback offer so we can envisage some potential weakness in the stock today.

· MM likes RIO into weakness around $77.50, we are still targeting the ~$90 area.

NB RIO is unlikely to be the only resource goliath returning capital to shareholders, BHP is expected to announce its own bigger share buyback very soon and it’s likely that it too will be using an off-market buyback given its franking balance (and the risk of the franking rule change) – this, along with its energy exposure explains why BHP has outperformed many rivals over recent months.

Watch out for alerts

RIO Tinto (RIO) Chart

4 Oil Search (OSH) $8.74 & Beach Energy (BPT) $1.92

We like both the resources and oil sectors from a macro perspective of rising interest rates and inflation. While the sector has enjoyed a great year MM believes it still has further upside.

We have no oil exposure in our MM Portfolios’ at present, but 2 stocks in the sector are presently on our radar:

Oil Search – a more conservative play to-date OSH has been far less volatile over the years than many of its sector friends.

· MM is bullish Oil Search (OSH) initially targeting the $10 area, around 15% higher.

Oil Search (OSH) Chart

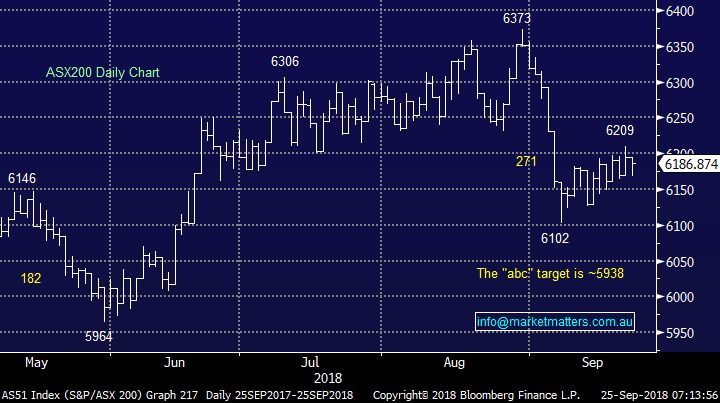

Beach (BPT) has been a far more volatile play than OSH over recent years, but short-term remains positive.

We like BPT as a short-term play targeting ~$2.10, but the risk / reward will only become attractive if / when we see another test of the $1.60 area.

Beach Energy (BPT) Chart

5 Origin Energy (ORG) $8.02

Energy retailer ORG has followed the MM forecasted path extremely well in 2018 and we cannot ignore what’s unfolding at present.

The stock has been a volatile beast this year hence a plan is required for spikes in either direction.

· MM is a buyer of ORG ~$7.25, initially targeting 15-20% upside.

Origin Energy (ORG) $8.02 Chart

Conclusion

Moving forward, we are considering the below 5 positions / stocks:

- Buy Emerging Markets, Sell the US.

- Buy Aristocrat (ALL) around the $28 area.

- Add to RIO around $77.50.

- Buy Oil Search (OSH) around current levels.

- Buy origin Energy (ORG) around the $7.25 area.

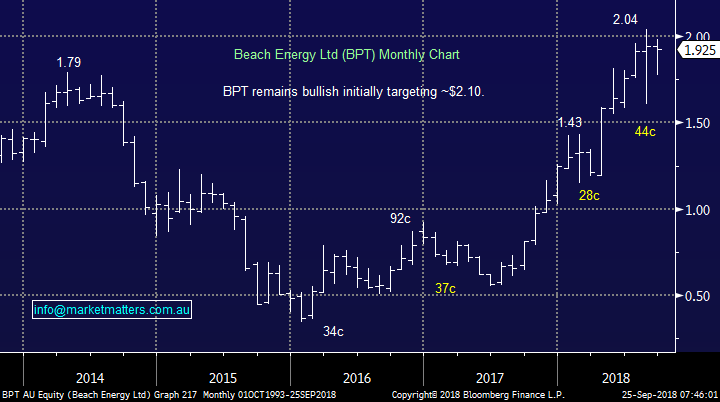

Overseas Indices

The US Russell 2000 feels attracted to the 1700 area like iron fillings to a magnet.

We remain short-term bearish looking for a ~5% correction.

US Russell 2000 Chart

European indices remain mildly negative, but also very choppy day to day and week to week.

German DAX Chart

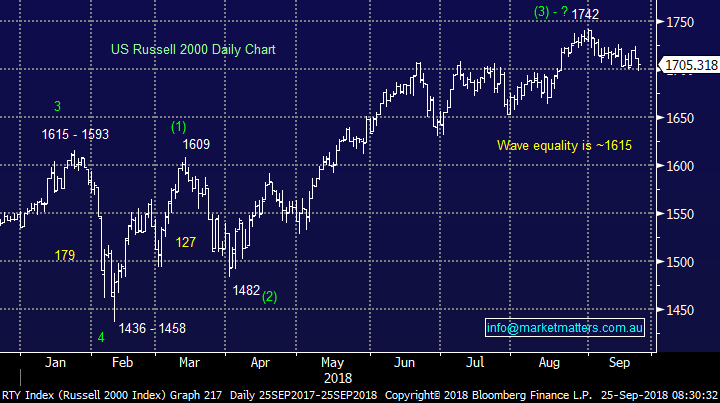

Overnight Market Matters Wrap

· A mixed session overnight in the US, with both the Dow and broader S&P 500 ending their day in negative territory, while the tech. heavy, Nasdaq 100 closed marginally higher.

· Energy shares also firmed in the wake of a stronger oil price, after crude oil edged higher towards US$72.26/bbl., as OPEC talks failed to result in any supply increases to offset the impact on Iranian supply of US-Iranian sanctions.

· The broader commodity market was mixed with base metals losing some of their recent gains, while gold and iron ore prices were steady. The A$ is slightly weaker this morning at US72.52c.

· The December SPI Futures is indicating the ASX 200 to open 4 points higher, still testing the 6190 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.